Features

Banking scandals and regulatory failures: lessons from Kiwibank

The Commerce Commission has filed criminal charges against Kiwibank Limited (Kiwibank), alleging “longstanding, systematic” breaches of the Fair Trading Act.

The Commerce Commission has filed criminal charges against Kiwibank Limited (Kiwibank), alleging “longstanding, systematic” breaches of the Fair Trading Act.

In a statement, the Commission said the breaches relate to issues that resulted in more than $7 million being incorrectly charged to over 36,000 customers for fees and interest rates in relation to home loans, credit cards and overdrafts, over a period of several years.

Last month, the Commerce Commission filed 21 criminal charges against the bank for errors. According to the Commerce Commission, these issues have been present since Kiwibank’s inception in 2002. Kiwibank’s CEO, Steve Jurkovich, stated that the bank proactively identified the problems and fully cooperated with the investigation. Jurkovich expressed disappointment over past mistakes but commended the team’s efforts to rectify the issues and ensure fairness for customers.

Furthermore, Kiwibank has been fined $812,500 by the High Court in Wellington for making false or misleading representations to customers. The Financial Markets Authority (FMA) revealed that from 2005 to 2020, 35,000 home loan customers were overcharged transaction fees totaling $1,172,639.94. The FMA’s proceedings, limited to conduct from April 1, 2014, covered 19,000 affected customers and overcharges amounting to $576,809.66. Kiwibank admitted to breaching the Fair Dealing provisions of the Financial Markets Conduct Act 2013 earlier this year, and the penalty reflects the seriousness of these breaches.

Justice Francis Cooke, delivering the verdict, highlighted the importance of accurate financial systems in maintaining customer trust and market integrity. She noted that while the overcharges were not intentional, Kiwibank’s negligence had significant implications. Kiwibank has since taken steps to address the systemic failures and remedy the overcharges, including compensating customers with interest.

The FMA noted that Kiwibank began efforts to remediate all affected customers in May 2021, ensuring refunds included the overcharged amounts plus use-of-money interest.

Source:

Kiwibank pleads guilty to Fair Trading Act breaches (1news.co.nz)

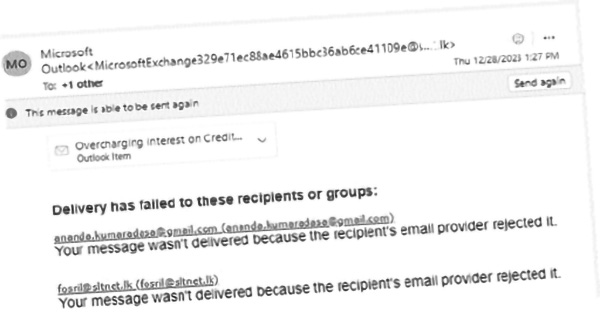

In December 2023, I reported such an incident, related to a private commercial bank listed in the Colombo Stock Exchange, to the Ombudsman Ananda Kumaradasa, but he never replied to my mail, instead I got the following automatic reply. (See figure 1)

One of the secretaries called me on my landline and mentioned that my complaint would be addressed, but it might take 3-4 months. However, I have not received any response until today. I had also requested a confirmation via email, which I have not received.

The recent legal issues faced by Kiwibank in New Zealand resonate strongly with similar banking challenges in Sri Lanka, particularly concerning transparency and fair treatment of customers. Kiwibank’s case, where systemic errors led to overcharging customers, highlights the importance of robust financial systems and transparent communication. This is especially relevant to the issues reported regarding credit card interest calculations by private commercial banks listed on the Colombo Stock Exchange.

In Sri Lanka, there have been complaints about how certain banks calculate interest on credit card balances. For example, one concerned individual wrote to the Ombudsman highlighting several issues:

Misleading Marketing:

Banks offer 51 days of interest-free credit. However, it depends on the transaction day and the settlement date.

Interest Calculation from Transaction Date:

If the settlement does not occur by the due date, interest is applied from the transaction date until the actual settlement date. This practice is misleading because it effectively negates the interest-free period if the payment is late by even one day.

Unfair Penalization:

If the settlement is delayed by just one day, the entire “credit” entitlement is withdrawn, penalizing the customer excessively. A fairer approach would be to apply interest only for the days the payment is overdue.

Comparative Practices:

While some banks charge interest only for the actual days overdue, many banks charge for the entire month if the payment is delayed by even one day, as confirmed by their statements.

This situation mirrors the Kiwibank scenario in terms of the need for better transparency and fairness in banking practices. Just as Kiwibank has taken steps to rectify its systemic issues and compensate affected customers, Sri Lankan banks should also consider revising their practices to ensure they are fair and transparent. Customers should be clearly informed about how interest is calculated and under what conditions, ensuring they are not misled by marketing claims.

Institutions such as the Central Bank and the Commission of Internal Trade also have a role to play in preventing such unfair exploitation of customers.

Misleading Discounts by Banks: The Case of Unclaimed Vouchers

The issue of misleading customers through deceptive practices is not limited to overcharging and unfair interest calculations but extends to the way discounts are offered and applied. This problem is exemplified by a recent situation involving a Sri Lankan bank credit card and a partnership with an online shopping platform.

The Situation

When credit cards offer discounts, it is generally expected that these discounts are automatically applied at the point of purchase. However, in this case, the process was far from straightforward:

Misleading Discount Offers:

Customers using the aforesaid credit card were promised discounts on purchases made through the online shopping platform However, instead of automatically applying the discount at the time of purchase, customers were required to claim a discount voucher separately.

Lack of Guidance:

No clear link or guidelines were provided to customers on how to claim the discount voucher. This left many customers unaware of the additional steps needed to receive their discount, which can be seen as a manipulative tactic to minimize the actual usage of the discount.

Misplaced Trust:

The bank concerned garnered trust from its customers. Customers naturally assumed that when they used their credit card, the discount would be automatically applied to their transaction. That assumption was reasonable given the standard practices of discount application in the industry.

Failure to Deliver Promised Discounts:

Customers completed transactions believing they would receive the discount, only to find the full amount charged to their accounts. This discrepancy between expectation and reality is a clear example of a misleading marketing gimmick.

Passing the Blame:

When customers raised concerns, both BOC and Daraz failed to provide satisfactory solutions. Instead of resolving the issue, the responsibility was shifted back to the customers, creating frustration and distrust.

The Core Issue

The core issue here is the unethical practice of offering discounts that are not straightforward to claim, thereby misleading customers. This not only damages the bank’s reputation but also erodes customer trust.

Recommendations for Improvement

Clear Communication:

Banks should provide explicit instructions on how to claim discounts. This information should be easily accessible and prominently displayed in all marketing materials.

Automatic Application:

Whenever possible, discounts should be applied automatically at the point of sale to avoid confusion and ensure customers receive the benefits they are promised.

Customer Support:

In cases where manual claiming is unavoidable, robust customer support should be available to assist customers in navigating the process.

Regular Audits:

Financial institutions should conduct regular audits of their promotional campaigns to ensure that all offers are transparent and that customers are not being misled.

Regulatory Oversight:

Regulatory bodies should oversee such promotional practices and impose penalties on institutions that fail to meet fair trading standards.

Conclusion

The Kiwibank case underscores the importance of financial institutions maintaining rigorous standards and accurate systems to uphold consumer trust. It also highlights the role of regulatory bodies in ensuring compliance and protecting consumer interests. In Sri Lanka, banks and regulatory authorities should take similar steps to review and improve their practices, ensuring that customers are treated fairly and transparently.

The issue of misleading discounts by banks highlights a broader concern about transparency and fair treatment in the banking industry. To maintain trust and ensure customer satisfaction, banks must prioritize clear communication and straightforward practices. Regulatory oversight and stringent internal audits are essential to uphold these standards and protect consumer rights.

(The writer, a senior Chartered Accountant and professional banker, is a professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)

Features

Crucial test for religious and ethnic harmony in Bangladesh

Will the Bangladesh parliamentary election bring into being a government that will ensure ethnic and religious harmony in the country? This is the poser on the lips of peace-loving sections in Bangladesh and a principal concern of those outside who mean the country well.

Will the Bangladesh parliamentary election bring into being a government that will ensure ethnic and religious harmony in the country? This is the poser on the lips of peace-loving sections in Bangladesh and a principal concern of those outside who mean the country well.

The apprehensions are mainly on the part of religious and ethnic minorities. The parliamentary poll of February 12th is expected to bring into existence a government headed by the Bangladesh Nationalist Party (BNP) and the Islamist oriented Jamaat-e-Islami party and this is where the rub is. If these parties win, will it be a case of Bangladesh sliding in the direction of a theocracy or a state where majoritarian chauvinism thrives?

Chief of the Jamaat, Shafiqur Rahman, who was interviewed by sections of the international media recently said that there is no need for minority groups in Bangladesh to have the above fears. He assured, essentially, that the state that will come into being will be equable and inclusive. May it be so, is likely to be the wish of those who cherish a tension-free Bangladesh.

The party that could have posed a challenge to the above parties, the Awami League Party of former Prime Minister Hasina Wased, is out of the running on account of a suspension that was imposed on it by the authorities and the mentioned majoritarian-oriented parties are expected to have it easy at the polls.

A positive that has emerged against the backdrop of the poll is that most ordinary people in Bangladesh, be they Muslim or Hindu, are for communal and religious harmony and it is hoped that this sentiment will strongly prevail, going ahead. Interestingly, most of them were of the view, when interviewed, that it was the politicians who sowed the seeds of discord in the country and this viewpoint is widely shared by publics all over the region in respect of the politicians of their countries.

Some sections of the Jamaat party were of the view that matters with regard to the orientation of governance are best left to the incoming parliament to decide on but such opinions will be cold comfort for minority groups. If the parliamentary majority comes to consist of hard line Islamists, for instance, there is nothing to prevent the country from going in for theocratic governance. Consequently, minority group fears over their safety and protection cannot be prevented from spreading.

Therefore, we come back to the question of just and fair governance and whether Bangladesh’s future rulers could ensure these essential conditions of democratic rule. The latter, it is hoped, will be sufficiently perceptive to ascertain that a Bangladesh rife with religious and ethnic tensions, and therefore unstable, would not be in the interests of Bangladesh and those of the region’s countries.

Unfortunately, politicians region-wide fall for the lure of ethnic, religious and linguistic chauvinism. This happens even in the case of politicians who claim to be democratic in orientation. This fate even befell Bangladesh’s Awami League Party, which claims to be democratic and socialist in general outlook.

We have it on the authority of Taslima Nasrin in her ground-breaking novel, ‘Lajja’, that the Awami Party was not of any substantial help to Bangladesh’s Hindus, for example, when violence was unleashed on them by sections of the majority community. In fact some elements in the Awami Party were found to be siding with the Hindus’ murderous persecutors. Such are the temptations of hard line majoritarianism.

In Sri Lanka’s past numerous have been the occasions when even self-professed Leftists and their parties have conveniently fallen in line with Southern nationalist groups with self-interest in mind. The present NPP government in Sri Lanka has been waxing lyrical about fostering national reconciliation and harmony but it is yet to prove its worthiness on this score in practice. The NPP government remains untested material.

As a first step towards national reconciliation it is hoped that Sri Lanka’s present rulers would learn the Tamil language and address the people of the North and East of the country in Tamil and not Sinhala, which most Tamil-speaking people do not understand. We earnestly await official language reforms which afford to Tamil the dignity it deserves.

An acid test awaits Bangladesh as well on the nation-building front. Not only must all forms of chauvinism be shunned by the incoming rulers but a secular, truly democratic Bangladesh awaits being licked into shape. All identity barriers among people need to be abolished and it is this process that is referred to as nation-building.

On the foreign policy frontier, a task of foremost importance for Bangladesh is the need to build bridges of amity with India. If pragmatism is to rule the roost in foreign policy formulation, Bangladesh would place priority to the overcoming of this challenge. The repatriation to Bangladesh of ex-Prime Minister Hasina could emerge as a steep hurdle to bilateral accord but sagacious diplomacy must be used by Bangladesh to get over the problem.

A reply to N.A. de S. Amaratunga

A response has been penned by N.A. de S. Amaratunga (please see p5 of ‘The Island’ of February 6th) to a previous column by me on ‘ India shaping-up as a Swing State’, published in this newspaper on January 29th , but I remain firmly convinced that India remains a foremost democracy and a Swing State in the making.

If the countries of South Asia are to effectively manage ‘murderous terrorism’, particularly of the separatist kind, then they would do well to adopt to the best of their ability a system of government that provides for power decentralization from the centre to the provinces or periphery, as the case may be. This system has stood India in good stead and ought to prove effective in all other states that have fears of disintegration.

Moreover, power decentralization ensures that all communities within a country enjoy some self-governing rights within an overall unitary governance framework. Such power-sharing is a hallmark of democratic governance.

Features

Celebrating Valentine’s Day …

Valentine’s Day is all about celebrating love, romance, and affection, and this is how some of our well-known personalities plan to celebrate Valentine’s Day – 14th February:

Valentine’s Day is all about celebrating love, romance, and affection, and this is how some of our well-known personalities plan to celebrate Valentine’s Day – 14th February:

Merlina Fernando (Singer)

Yes, it’s a special day for lovers all over the world and it’s even more special to me because 14th February is the birthday of my husband Suresh, who’s the lead guitarist of my band Mission.

We have planned to celebrate Valentine’s Day and his Birthday together and it will be a wonderful night as always.

We will be having our fans and close friends, on that night, with their loved ones at Highso – City Max hotel Dubai, from 9.00 pm onwards.

Lorensz Francke (Elvis Tribute Artiste)

On Valentine’s Day I will be performing a live concert at a Wealthy Senior Home for Men and Women, and their families will be attending, as well.

I will be performing live with romantic, iconic love songs and my song list would include ‘Can’t Help falling in Love’, ‘Love Me Tender’, ‘Burning Love’, ‘Are You Lonesome Tonight’, ‘The Wonder of You’ and ‘’It’s Now or Never’ to name a few.

To make Valentine’s Day extra special I will give the Home folks red satin scarfs.

Emma Shanaya (Singer)

I plan on spending the day of love with my girls, especially my best friend. I don’t have a romantic Valentine this year but I am thrilled to spend it with the girl that loves me through and through. I’ll be in Colombo and look forward to go to a cute cafe and spend some quality time with my childhood best friend Zulha.

JAYASRI

Emma-and-Maneeka

This Valentine’s Day the band JAYASRI we will be really busy; in the morning we will be landing in Sri Lanka, after our Oman Tour; then in the afternoon we are invited as Chief Guests at our Maris Stella College Sports Meet, Negombo, and late night we will be with LineOne band live in Karandeniya Open Air Down South. Everywhere we will be sharing LOVE with the mass crowds.

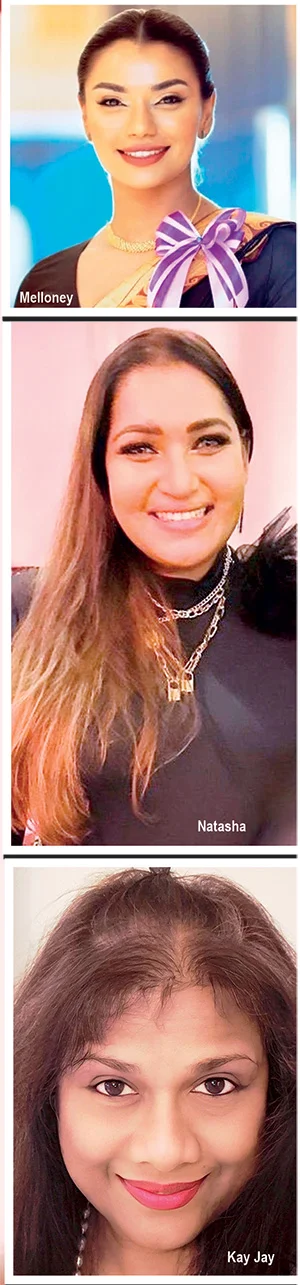

Kay Jay (Singer)

I will stay at home and cook a lovely meal for lunch, watch some movies, together with Sanjaya, and, maybe we go out for dinner and have a lovely time. Come to think of it, every day is Valentine’s Day for me with Sanjaya Alles.

Maneka Liyanage (Beauty Tips)

On this special day, I celebrate love by spending meaningful time with the people I cherish. I prepare food with love and share meals together, because food made with love brings hearts closer. I enjoy my leisure time with them — talking, laughing, sharing stories, understanding each other, and creating beautiful memories. My wish for this Valentine’s Day is a world without fighting — a world where we love one another like our own beloved, where we do not hurt others, even through a single word or action. Let us choose kindness, patience, and understanding in everything we do.

Janaka Palapathwala (Singer)

Janaka

Valentine’s Day should not be the only day we speak about love.

From the moment we are born into this world, we seek love, first through the very drop of our mother’s milk, then through the boundless care of our Mother and Father, and the embrace of family.

Love is everywhere. All living beings, even plants, respond in affection when they are loved.

As we grow, we learn to love, and to be loved. One day, that love inspires us to build a new family of our own.

Love has no beginning and no end. It flows through every stage of life, timeless, endless, and eternal.

Natasha Rathnayake (Singer)

We don’t have any special plans for Valentine’s Day. When you’ve been in love with the same person for over 25 years, you realise that love isn’t a performance reserved for one calendar date. My husband and I have never been big on public displays, or grand gestures, on 14th February. Our love is expressed quietly and consistently, in ordinary, uncelebrated moments.

With time, you learn that love isn’t about proving anything to the world or buying into a commercialised idea of romance—flowers that wilt, sweets that spike blood sugar, and gifts that impress briefly but add little real value. In today’s society, marketing often pushes the idea that love is proven by how much money you spend, and that buying things is treated as a sign of commitment.

Real love doesn’t need reminders or price tags. It lives in showing up every day, choosing each other on unromantic days, and nurturing the relationship intentionally and without an audience.

This isn’t a judgment on those who enjoy celebrating Valentine’s Day. It’s simply a personal choice.

Melloney Dassanayake (Miss Universe Sri Lanka 2024)

I truly believe it’s beautiful to have a day specially dedicated to love. But, for me, Valentine’s Day goes far beyond romantic love alone. It celebrates every form of love we hold close to our hearts: the love for family, friends, and that one special person who makes life brighter. While 14th February gives us a moment to pause and celebrate, I always remind myself that love should never be limited to just one day. Every single day should feel like Valentine’s Day – constant reminder to the people we love that they are never alone, that they are valued, and that they matter.

I truly believe it’s beautiful to have a day specially dedicated to love. But, for me, Valentine’s Day goes far beyond romantic love alone. It celebrates every form of love we hold close to our hearts: the love for family, friends, and that one special person who makes life brighter. While 14th February gives us a moment to pause and celebrate, I always remind myself that love should never be limited to just one day. Every single day should feel like Valentine’s Day – constant reminder to the people we love that they are never alone, that they are valued, and that they matter.

I’m incredibly blessed because, for me, every day feels like Valentine’s Day. My special person makes sure of that through the smallest gestures, the quiet moments, and the simple reminders that love lives in the details. He shows me that it’s the little things that count, and that love doesn’t need grand stages to feel extraordinary. This Valentine’s Day, perfection would be something intimate and meaningful: a cozy picnic in our home garden, surrounded by nature, laughter, and warmth, followed by an abstract drawing session where we let our creativity flow freely. To me, that’s what love is – simple, soulful, expressive, and deeply personal. When love is real, every ordinary moment becomes magical.

Noshin De Silva (Actress)

Valentine’s Day is one of my favourite holidays! I love the décor, the hearts everywhere, the pinks and reds, heart-shaped chocolates, and roses all around. But honestly, I believe every day can be Valentine’s Day.

It doesn’t have to be just about romantic love. It’s a chance to celebrate love in all its forms with friends, family, or even by taking a little time for yourself.

Whether you’re spending the day with someone special or enjoying your own company, it’s a reminder to appreciate meaningful connections, show kindness, and lead with love every day.

And yes, I’m fully on theme this year with heart nail art and heart mehendi design!

Wishing everyone a very happy Valentine’s Day, but, remember, love yourself first, and don’t forget to treat yourself.

Sending my love to all of you.

Features

Banana and Aloe Vera

To create a powerful, natural, and hydrating beauty mask that soothes inflammation, fights acne, and boosts skin radiance, mix a mashed banana with fresh aloe vera gel.

To create a powerful, natural, and hydrating beauty mask that soothes inflammation, fights acne, and boosts skin radiance, mix a mashed banana with fresh aloe vera gel.

This nutrient-rich blend acts as an antioxidant-packed anti-ageing treatment that also doubles as a nourishing, shiny hair mask.

* Face Masks for Glowing Skin:

Mix 01 ripe banana with 01 tablespoon of fresh aloe vera gel and apply this mixture to the face. Massage for a few minutes, leave for 15-20 minutes, and then rinse off for a glowing complexion.

* Acne and Soothing Mask:

Mix 01 tablespoon of fresh aloe vera gel with 1/2 a mashed banana and 01 teaspoon of honey. Apply this mixture to clean skin to calm inflammation, reduce redness, and hydrate dry, sensitive skin. Leave for 15-20 minutes, and rinse with warm water.

* Hair Treatment for Shine:

Mix 01 fresh ripe banana with 03 tablespoons of fresh aloe vera gel and 01 teaspoon of honey. Apply from scalp to ends, massage for 10-15 minutes and then let it dry for maximum absorption. Rinse thoroughly with cool water for soft, shiny, and frizz-free hair.

-

Features4 days ago

Features4 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business5 days ago

Business5 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business4 days ago

Business4 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business4 days ago

Business4 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business4 days ago

Business4 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business1 day ago

Business1 day agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Business5 days ago

Business5 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Business5 days ago

Business5 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check