Business

Lolc Finance concludes a remarkable year with its highest profits ever recorded

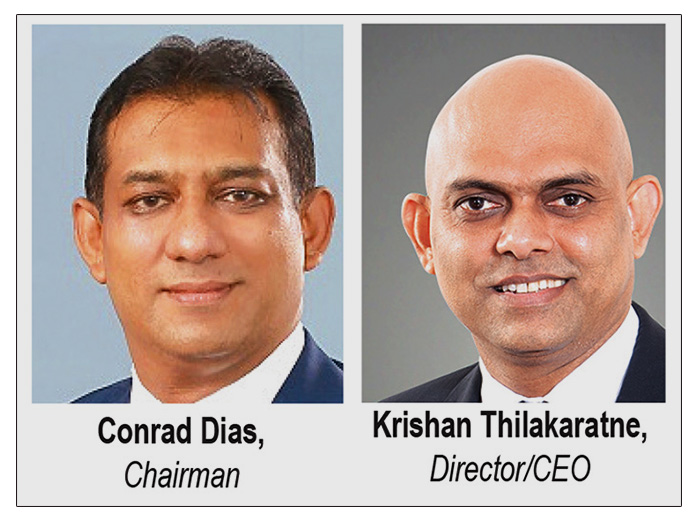

LOLC Finance PLC, the largest non-banking financial institution in Sri Lanka has reported exceptional performance recording Rs.21.5 billion profits for the fiscal year 2023/24 with 39% YoY growth, representing an ROE of 20%. This outstanding performance underscores the company’s strategic excellence and robust market position, achieved through a series of strategic consolidations and a steadfast commitment to cost efficiency, digital transformation, and customer-centricity.

As at the end of the fiscal year, the Company reported a portfolio of Rs. 250 billion and a deposit base of Rs. 206 billion along with a capital base of Rs. 122 billion, the largest in the NBFI sector. Through these results, the company not only demonstrates its dominance in the non-banking financial industry but also its successful navigation through an evolving macroeconomic landscape and the company’s ability to adapt and thrive amidst challenges.

Over the past three years, LOLC Finance has successfully executed three significant mergers, solidifying its market leadership and expanding its operational footprint. These strategic consolidations have enhanced the company’s capabilities, diversified its product offerings, and increased its customer base. Each merger was meticulously planned and executed, ensuring seamless integration and the realization of substantial operational synergies in the forthcoming years.

A cornerstone of LOLC Finance’s strategy has been a relentless focus on cost efficiency. By optimizing operational processes and leveraging economies of scale, the company has been focusing on lowering its cost base.

This is reflected by the cost to income ratio of 40% and is expected to reduce further with the benefits of the merger being extracted. This focus on efficiency improvement has been complemented by a comprehensive digital transformation strategy. The company has invested heavily in cutting-edge technologies and digital solutions, streamlining operations, enhancing customer service, and improving overall business agility. The digital initiatives have not only driven cost savings but also positioned the company at the forefront of technological innovation in the financial services sector.

At the heart of LOLC Finance PLC’s success is its unwavering commitment to customer-centricity. The company has consistently prioritized understanding and meeting the evolving needs of its customers. By offering tailored financial solutions and exceptional customer service, LOLC Finance has built strong, enduring relationships with its clients. This customer-first approach has been instrumental in driving customer loyalty and retention, further reinforcing the company’s market leadership.

Assuming its role as an Economic Enabler for most parts of the segments in the economy, LOLC Finance PLC offers comprehensive lending portfolio, with an array of financial solutions, including auto finance, speed drafts, housing loans, mortgage loans, personal loans, corporate loans, working capital solutions, gold loans, educational loans, and flexi interest loans, among others. This diverse portfolio caters to the specific needs of individuals and enterprises across the economic spectrum.

Boasting over 230 branches across the island and a culturally diverse workforce, LOLC Finance stands prioritise personalized services to its wide-ranging customer base. Setting itself apart from other non-banking financial institutions (NBFIs), LOLC Finance offers doorstep services for clients, encompassing both service provision and post-credit disbursement support. The well-trained employee base of LOLC Finance contributes significantly to the organization’s exceptional service delivery.

Business

Dialog delivers strong growth, stronger national contribution in FY 2025

Dialog Axiata PLC announced, Friday 6th February 2026, its consolidated financial results (Reviewed) for the year ended 31st December 2025. Financial results included those of Dialog Axiata PLC (the “Company”) and of the Dialog Axiata Group (the “Group”).

Group Performance

The Group delivered a strong performance across Mobile, Fixed Line and Digital Pay Television businesses recording a positive Core Revenue growth of 16% Year to Date (“YTD”). Group Headline Revenue reached Rs179.6Bn, up 5% YTD, despite the continued strategic scaling down of low-margin international wholesale business. In Q4 2025, Revenue was recorded at Rs46.5Bn up 2% Quarter-on-Quarter (“QoQ”) and 2% Year-on-Year (“YoY”).

The Group Earnings Before Interest, Tax, Depreciation and Amortisation (“EBITDA”) reached Rs86.0Bn up 30% YTD supported by Core Revenue performance and Cost Rescaling Initiatives. On a QoQ basis Group EBITDA demonstrated a modest growth to record at Rs23.0Bn up 2% QoQ with an EBITDA margin of 49.5% in line with the Revenue performance. Group EBITDA margin reached 47.9% for FY 2025, up 9.2pp.

Group Net Profit After Tax (“NPAT”) reached Rs20.8Bn for FY 2025, up 67% YTD mainly resulting from robust EBITDA growth, despite higher tax and net finance costs. Normalized for forex impact, NPAT growth was recorded at +>100% YTD to reach Rs22.1Bn. On a QoQ basis NPAT grew 3% to reach Rs5.9Bn resulting from strong EBITDA performance.

On the back of strong operational performance, the Group recorded Operating Free Cash Flow (“OFCF”)

of Rs49.3Bn for FY 2025 up >100% YTD.

Dividend Payment to Shareholders

In line with the dividend policy and financial performance of the Group and taking into account the forward investment requirements to serve the nation’s demand for Broadband and Digital services, the Board of Directors of Dialog Axiata PLC at its meeting held on 6th February 2026, resolved to propose for consideration by the Shareholders of the Company, a dividend to ordinary shareholders amounting to Rs1.50 per share. The said dividend, if approved by shareholders, would translate to a Dividend Yield of 5.0% based on share closing price for FY 2025. The dividend so proposed will be considered for approval by the shareholders at the Annual General Meeting (AGM) of the Company, the date pertaining to which would be notified in due course.

Company and Subsidiary Performance

At an entity level, Dialog Axiata PLC (the “Company”) continued to be the primary contributor to Group Revenue (76%) and Group EBITDA (74%). Aided by sustained growth in the Data segment and cost-rescaling initiatives, Company revenue was recorded at Rs135.8Bn for FY 2025, up 18% YTD, EBITDA rose 32% YTD to reach Rs63.6Bn. On a QoQ basis, Q4 2025 Revenue was recorded at Rs34.8Bn, down 1% QoQ due to a reclassification of Hubbing Revenue, while EBITDA decline 1% QoQ to record Rs17.0Bn, largely attributable to network restoration costs and donations made in relation to the Cyclone Ditwah relief efforts. Furthermore, NPAT was recorded at Rs15.6Bn for FY 2025, up 41% YTD. Normalised for forex impacts, the company NPAT was up +>100% YTD to reach Rs17.0Bn. On a QoQ basis, Company NPAT was recorded at Rs4.5Bn, down 6% QoQ.

Business

Ceylinco Life’s Pranama Scholarships reach 25-year milestone

Ceylinco Life has announced the launch of the 25th consecutive edition of its flagship Pranama Scholarships programme, marking a significant milestone in the company’s long-standing commitment to recognising and rewarding excellence among the children of its policyholders.

Under the 2026 programme, the life insurance market leader will present scholarships with a total cumulative value of Rs. 22.7 million, continuing a rewards initiative that has now been conducted without interruption for a quarter of a century. Since its inception, the Ceylinco Life Pranama Scholarships programme has benefitted 3,466 students across the country, representing a total investment of Rs. 240 million in nurturing academic achievement and outstanding performance in sports, arts and other extracurricular pursuits.

Business

Sri Lankans’ artistic genius glowingly manifests at Kala Pola ‘26

The artistic genius of Sri Lankans was amply manifest all over again at ‘Kala Pola ‘26’ which was held on February 8th at Ananda Coomaraswamy Mawatha Colombo 7; the usual, teeming and colourful venue for this annual grand exhibition and celebration of the work of local visual artists.

If there is one thing that has flourished memorably and resplendently in Sri Lanka over the centuries it is the artistic capability or genius of its people. It is something that all Sri Lankans could feel a sense of elation over because from the viewpoint of the arts, Sri Lanka is second to no other nation. With regard to the visual arts a veritable dazzling radiance of this inborn and persisting capability is seen at the annual open air ‘Kala Pola’.

A bird of Sri Lanka created from scraps of iron waste.

All capable visual artists, wherever they hail from in Sri Lanka, enjoy the opportunity of exhibiting their work at the ‘Kala Pola’ and this is a distinctive ‘positive’ of this annual event that draws numberless artists and viewers. There was an abundance of paintings, sketches and sculptures, for instance, and one work was as good as the other. Ample and equal space was afforded each artist. Its widely participatory and open nature enables one to describe the exhibition as exuding a profoundly democratic ethos.

Accordingly, this time around at ‘Kala Pola ‘26’ too Sri Lankans’ creative efforts were there to be viewed, studied and enjoyed in the customary carnival atmosphere where connoisseurs, local and foreign, met in a sprit of camaraderie and good cheer. Many thanks are owed once again to the George Keyt Foundation for the presentation of the event in association with the John Keells Group and the John Keells Foundation, not forgetting the Nations Trust Bank, which was the event’s Official Banking Partner. The exhibition was officially declared open by Chief Guest Marc-Andre Franche, UN Resident Coordinator in Sri Lanka.

By Lynn Ockersz

-

Features2 days ago

Features2 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business3 days ago

Business3 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business2 days ago

Business2 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business2 days ago

Business2 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business2 days ago

Business2 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business3 days ago

Business3 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Business3 days ago

Business3 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check

-

Editorial5 days ago

Editorial5 days agoAll’s not well that ends well?