Business

Deutsche Bank continues its steadfast commitment to Sri Lanka

Deutsche Bank today reiterated its commitment as a steadfast global banking services provider amidst the country’s journey through economic challenges. Operating in Sri Lanka since 1980, Deutsche Bank AG, has been a reliable partner for over 43 years, providing fully-fledged commercial banking operations, connecting Sri Lanka to Asian, European and US markets.

As the only European bank operating in Sri Lanka, with a dedicated team well-versed in local regulations and market trends, Deutsche Bank’s onshore presence and proven track record in frontier markets, help provide clients with seamless solutions.

Kaushik Shaparia, CEO India & Emerging Asia, Deutsche Bank, expressed strong confidence in the green shoots of Sri Lanka’s economy during his visit to the country. Emphasizing the bank’s commitment, he stated, “Sri Lanka is a key market for Deutsche Bank. We have remained invested through challenging times, supporting our clients as a trusted banking partner. As the economy strengthens, we look forward to contributing to its recovery and development plans.”

Deutsche Bank’s leading role in debt capital markets is underscored by being appointed as a Joint Lead Manager for international sovereign bond issuances since 2015. The bank’s Colombo branch collaborates closely with multinational companies and local corporates, offering a comprehensive range of services, including being a dominant provider of USD and EUR clearing services, Cash Management, Trade Finance, Securities Services, Foreign Exchange and Debt Capital Markets.

Niranjan Figurado, Chief Country Officer, Deutsche Bank, Sri Lanka, emphasized the bank’s deep understanding of the local economic landscape. He stated, “Deutsche Bank brings tailored solutions to its clients. We are poised to scale up operations, offering our award-winning products and services and uplift the financial landscape of the country.”

Recent accolades, such as being recognized as the Best Domestic Custodian and Best Fund Administrator by The Asset, attest to Deutsche Bank’s excellence.

Business

Dr RAD Jeewantha named most innovative dentist of the year

Dr. R. A. D. Jeewantha was honoured as the Most Innovative Dentist of the Year at the Business World International Awards, 2025. Organised by the Business World International Organisation, the award ceremony was held recently at the Mount Lavinia Hotel. A graduate of the Faculty of Dental Sciences, University of Peradeniya, Dr. Jeewantha has built a reputation as one of Sri Lanka’s most respected and forward-thinking dental surgeons. After gaining vital experience in Government hospitals, including the Teaching Hospital in Karapitiya, he also served at a leading private hospital before launching his own practice—Doctor J Premium Dental Care in Delkanda, Nugegoda.

His dental clinic is known for offering advanced, patient-focused treatments in restorative dentistry, cosmetic procedures, and implantology, using state-of-the-art technology. Dr. Jeewantha is especially skilled in dental implants, having completed the American Residency Course in Dental Implantology at Roseman University, accredited by the American Academy of Implant Dentistry. Dr. Jeewantha holds fellowships from the International College of Continuing Dental Education (FICCDE) and the Pierre Fauchard Academy (USA). His advanced skills include modern root canal treatments using Mineral Trioxide Aggregate (MTA) for both surgical and non-surgical procedures.

He has completed international trainings in digital dentistry, full-arch implantology techniques like All-on-Four and Zygomatic Systems, and smile design using digital 3D scans. He has participated in global dental events such as the Asia-Pacific Dental Congress and completed training at institutions including the University of Manchester and North Western State Medical University in Russia. His courses have covered everything from intraoral scanning to managing tooth wear. He has previously received many local and international awards. Dr. Jeewantha also serves the community as a Justice of the Peace for All Island.

Business

IIHS Foundation in Biological Studies offers fast-track route to global health careers

The Foundation in Biological Studies at IIHS provides a unique alternative for students looking to fast-track their health careers after their Ordinary Level (O/L) exams. This programme offers a direct route to global health careers, bypassing traditional A/Ls. With over 1,000 students already advancing to universities in Australia, the UK, and Finland, IIHS has positioned the course as a reliable launchpad for careers in fields like medicine, nursing, biomedical sciences, and digital health. “This programme is a game-changer, offering a transformative journey into global healthcare education,” said IIHS CEO Dr. Kithsiri Edirisinghe.

Business

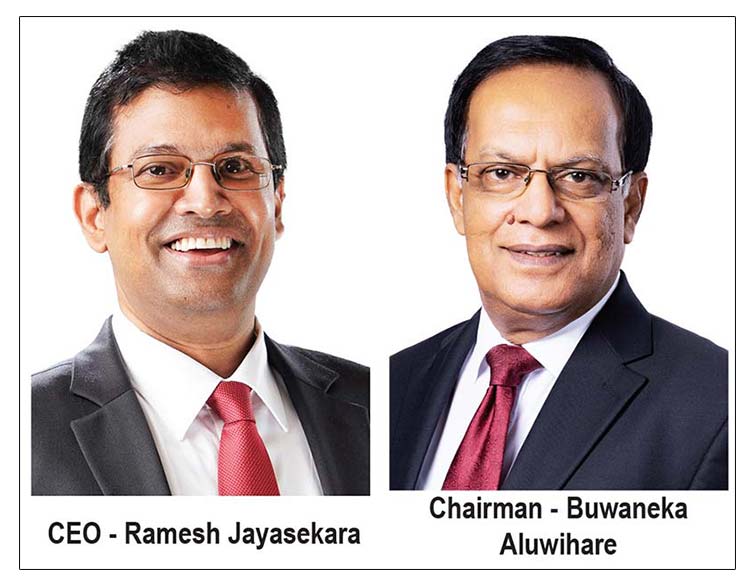

Seylan Bank Reports Strong Growth in Q1 2025 Financials

Seylan Bank has recorded a Profit before Tax (PBT) of LKR 4,199 million in Q1 2025, marking a 13.36% growth compared to LKR 3,704 million in Q1 2024. Profit after Tax (PAT) rose by 20.29%, reaching LKR 2,761 million, up from LKR 2,295 million in the corresponding period of 2024.

Despite a decrease in net interest income by 8.37% due to market interest rate reductions, the bank’s net fee-based income grew by 13.83%, driven by fees from loans, cards, remittances, and other services. Total operating income for the quarter was LKR 11,258 million, a 3.83% decrease from the previous year, while operating expenses rose by 4.62%, largely due to increased personnel and other operating costs.

Impairment charges were significantly reduced by 83.17%, totaling LKR 262 million, reflecting the bank’s solid credit quality and proactive provisions. The bank’s impaired loan ratio improved to 1.98% from 2.10% in Q1 2024, with a provision cover ratio of 80.74%.

Seylan Bank’s total assets grew to LKR 785 billion, with loans and advances reaching LKR 469 billion and deposits totaling LKR 647 billion. The bank’s capital adequacy ratios remained strong, with the Common Equity Tier 1 Capital Ratio at 13.67% and Total Capital Ratio at 17.64%.

In addition to its financial performance, Seylan Bank continued its commitment to education, opening 16 more “Seylan Pahasara Libraries,” bringing the total to 281 libraries across the island.Fitch Ratings upgraded Seylan Bank’s National Long-Term Rating to ‘A+(lka)’ with a Stable Outlook in January 2025, further underscoring the bank’s financial stability and growth trajectory.

-

Features6 days ago

Features6 days agoRuGoesWild: Taking science into the wild — and into the hearts of Sri Lankans

-

News5 days ago

News5 days agoOrders under the provisions of the Prevention of Corruptions Act No. 9 of 2023 for concurrence of parliament

-

Features7 days ago

Features7 days agoNew species of Bronzeback snake, discovered in Sri Lanka

-

News5 days ago

News5 days agoProf. Rambukwella passes away

-

Business21 hours ago

Business21 hours agoPick My Pet wins Best Pet Boarding and Grooming Facilitator award

-

News7 days ago

News7 days agoPhoto of Sacred tooth relic: CID launches probe

-

Opinion6 days ago

Opinion6 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part IX

-

Features7 days ago

Features7 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part VIII