Business

PLC’s profits surge 80.9% in Q1, amidst challenging environment

People’s Leasing & Finance PLC (PLC), a pillar of strength and stability in Sri Lanka’s financial sector, successfully concluded the 1st Quarter of the fiscal year 2023/24 with a year-on-year increase in Profit of 80.9% in the midst of a challenging economic landscape.

PLC’s top line interest income recorded an impressive 10.2%, reaching Rs. 7,465 million owing to the increased investment income during the quarter. However, the company’s net interest income showed a modest fall when compared to the first quarter of 2022/23. This was mostly the result of higher interest expenses brought on by the repricing of deposits to higher rates in line with higher policy rates. Despite the stated decrease in net interest income, PLC was able to end the first quarter with a profit after tax (PAT) of Rs. 331 million as opposed to Rs. 183 million recorded in Q1 2022/23 thanks to the significant year-on-year reduction in Impairment Charges as well as reduction in operating expenses, demonstrative of an intensified commitment to internal sustainability.

Similarly, PLC Group also recorded a PAT of Rs. 552 million during Q1 2023/24, reflecting a year-on-year increase of 21.5% mainly driven by the significant reduction in the Group’s impairment charges and other losses for loans and receivables.

Even in the face of a highly inflationary environment, PLC successfully reduced total operating expenses by 3.5% compared to the corresponding quarter in the year prior due to a determined effort to increase efficiency through digital initiatives, right-sizing of branches, and improvements in internal processes. PLC recognized the significance of recalibrating its balance sheet in a setting not favourable to business expansion and took strategic measures to ensure the right sizing of its balance sheet resulting a total asset base of Rs. 155,380 million as of 30 June 2023. Backed by these strategic moves, total asset base of the PLC Group also remained resilient at Rs. 179,948 million as of 30 June 2023.

In an extremely volatile and complex business setting PLC adopted a highly disciplined liquidity management approach to ensure financial stability whilst maintaining capital adequacy ratios well ahead of the statutory minimums at the end of Q1. The majority of PLC’s funding needs were met through improved collections enabling PLC to remain watchful in growing its deposit base in a high-interest environment. Despite these measures, the deposit base of PLC remained robust at Rs. 93,228 million as of 30 June 2023, showcasing strong customer confidence. The Group deposit base also remained strong at Rs. 100,439 million, as at 30 June 2023.

Meanwhile, PLC retained its No.1 position as Sri Lanka’s Most-Loved Brand in Leasing and Finance category, as ranked by Brand Finance in LMD Brands Annual. The company’s steadfast dedication to excellence was also evident in its ascent from 51 to 36 in the esteemed “Most Respected Entities” ranking by LMD within just one year, further cementing its position as one of Sri Lanka’s most respected and trusted financial services providers.

Business

Redefining Industry Standards: Home Lands Group Emerges as Sri Lanka’s Premier Force in Lifestyle and Developer Leadership

At a time when Sri Lanka’s property landscape is experiencing rapid transformation, one organisation continues to define the direction of the market through scale, innovation, and an unwavering commitment to quality. At the 2025 PropertyGuru Asia Property Awards (Sri Lanka), the Home Lands Group of Companies maintained its place at the peak of the industry, acquiring two of the most influential awards of the year: Best Developer for the Group and Best Lifestyle Developer for Home Lands Skyline (Private) Limited.

These distinctions signify more than just project-level success. They reflect the organisation’s leadership in shaping how Sri Lankans aspire to live, work, and invest.

The Home Lands Group has built a broad presence throughout Sri Lanka’s most active corridors, from the rapidly evolving suburbs of Colombo to the developing lifestyle hubs of Negombo, Malabe, and Kahathuduwa, guided by extensive market research. The Group has transformed its in-depth knowledge of the property market into a portfolio of assets embodying superior residential living experiences, supported by strategically located branches that deliver an integrated suite of real estate services for buyers nationwide.

Home Lands Skyline, the Group’s flagship development arm and the 2025 Best Lifestyle Developer, is responsible for this on-ground reach. The company was commended for shaping communities through visionary residential environments and for its ability to combine cutting-edge sustainability with expansive lifestyle amenities. With 19 completed projects, including the largest integrated golf community in Sri Lanka and nine sustainable developments, Home Lands Skyline keeps raising the bar for efficiency, design, and placemaking.

Both ambition and operational strength are evident in its recent accomplishments. The company completed a number of landmark projects such as Elixia 3C’s Apartments, Santorini Resort Apartments & Residencies, and the 1,200-unit Canterbury Golf Resort Apartments & Residencies, which has more than 50 resort amenities that meet international standards and the nation’s first day-and-night golf course. In addition, the Group’s remarkable 58% market share earned it the title of Sri Lanka’s Most Preferred Residential Real Estate Brand in the RIU Brand Health Survey.

This growth is supported by a sustainability-first philosophy. The company incorporates environmental responsibility into every stage of development, from modular construction, renewable energy integration, and ethical sourcing throughout its supply chain to passive design principles that improve natural light and ventilation. This dedication is demonstrated by its Platinum Award at the CIOB Green Awards 2024.

The Home Lands Group is at the forefront of creating new lifestyle expectations as demand for well-planned, resort-style communities rises. In addition to confirming past achievements, the Group’s 2025 victories at the PropertyGuru Asia Property Awards (Sri Lanka) indicate a trajectory of ongoing leadership, positioning it as a transformative force in the future of Sri Lankan real estate.

Business

Cheaper credit expected to drive Sri Lanka’s business landscape in 2026

The opening weeks of 2026 are offering a glimmer of cautious hope for the business community weary from years of economic turbulence and steep financing costs. The Central Bank’s latest weekly economic indicators signal more than just macroeconomic stability. They point to early signs of a long-awaited trend; a measurable dip in borrowing costs.

“If sustained, this shift could transform steady growth into a robust, investment-led expansion,” a senior economist told The Island Financial Review.

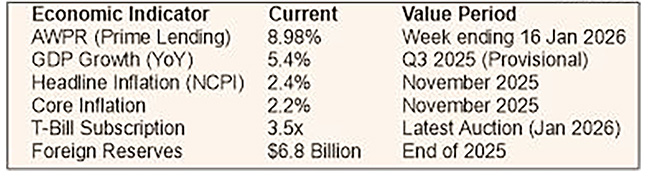

The benchmark Average Weighted Prime Lending Rate (AWPR) declined by 21 basis points to 8.98% for the week ending 16 January, according to the Central Bank.

“For entrepreneurs and CEOs, this is not just another statistic. It could mean the difference between postponing an expansion and hiring new staff. Across boardrooms, the hope is that this marks the start of a sustained downward trend that holds through 2026,” he said.

When asked about the instances where Treasury Bills are not fully subscribed by the investors, he replied,” Treasury Bill yields remained broadly stable, with only minimal movement across 91-day, 182-day, and 364-day tenors. Strong demand was clear, with the latest T-Bill auction oversubscribed by about 3.5 times. This sovereign-level stability creates room for the gradual easing of commercial lending rates, allowing the Central Bank to nurture a more growth-supportive monetary policy.”

Replying to a question on how he views the inflation numbers in this context, he said, “The year-on-year increase in the National Consumer Price Index stood at a manageable 2.4% in November, with core inflation at 2.2%. Such an environment should allow interest rates to fall without sparking a price spiral. For businesses, it means the real cost of borrowing adjusted for inflation, and it is becoming more favourable for them. While consumers still face weekly price shifts in vegetables and fish, the broader disinflation trend gives policymakers leeway to keep credit affordable.”

Referring to the growth trajectory, he mentioned, “With GDP growth provisionally at 5.4% in the third quarter of 2025 and Purchasing Managers’ Indices signalling expansion in both manufacturing and services, the economy is in a growth phase. However, to accelerate this momentum businesses need capital at lower cost to modernise machinery, boost export capacity, and spur innovation. Affordable credit is, therefore, not merely helpful, it is essential to shift growth into a higher gear.”

In conclusion , he said,” The coming months will be watched closely, because for Sri Lankan businesses, a sustained decline in borrowing costs isn’t just an indicator; it’s the foundation for growth. There’s hope that this easing in the cost of money will prevail through most of the year.”

By Sanath Nanayakkare ✍️

Business

Mercantile Investments expands to 90 branches, backed by strong growth

Mercantile Investments & Finance PLC has expanded its national footprint to 90 branches with a new opening in Tangalle, reinforcing its commitment to community accessibility. The trusted non-bank financial institution, with over 60 years of service, now supports diverse communities across Sri Lanka with leasing, deposits, gold loans, and tailored lending.

This physical expansion aligns with significant financial growth. The company recently surpassed an LKR 100 billion asset base, with its lending portfolio doubling to Rs. 75 billion and deposits growing to Rs. 51 billion, reflecting strong customer trust. It maintains a low NPL ratio of 4.65%.

Chief Operating Officer Laksanda Gunawardena stated the branch network is vital for building trust, complemented by ongoing digital investments. Managing Director Gerard Ondaatjie linked the growth to six decades of safeguarding depositor interests.

With strategic plans extending to 2027, Mercantile Investments aims to convert its scale into sustained competitive advantage, supporting both customers and Sri Lanka’s economic progress.

-

Editorial2 days ago

Editorial2 days agoIllusory rule of law

-

News3 days ago

News3 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business5 days ago

Business5 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial3 days ago

Editorial3 days agoCrime and cops

-

Features2 days ago

Features2 days agoDaydreams on a winter’s day

-

Editorial4 days ago

Editorial4 days agoThe Chakka Clash

-

Features2 days ago

Features2 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Business5 days ago

Business5 days agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App