Business

AIA delivers ‘excellent growth’ in first half of 2023

The Board of AIA Group Limited (the “Company”) announced the Group’s financial results for the six months ended June 30, 2023.Growth rates are shown on a constant exchange rate basis:

New business performance

Value of new business (VONB) grew by 37 per cent to US$2,029 million Annualised new premiums (ANP) increased by 49 per cent to US$3,984 million All reportable segments and all distribution channels delivered positive VONB growth

Earnings and capital

Embedded value (EV) operating profit of US$4,423 million, up 20 per cent per share Operating return on EV (ROEV) of 13.3 per cent, up from 9.4 per cent in full year 2022 Underlying free surplus generation (UFSG) of US$3,288 million, up 10 per cent per share Operating profit after tax (OPAT) of US$3,272 million, up 4 per cent per share EV Equity of US$70.6 billion after returning US$3.6 billion in dividend and share buy-back Free surplus of US$16.3 billion at 30 June 2023 Very strong Group LCSM coverage ratio of 260 per cent on the PCR basis(2) Interim dividend and share buy-back programme Interim dividend of 42.29 Hong Kong cents per share, up 5 per cent

US$2.0 billion returned to shareholders through the share buy-back programme in the first half of 2023 Lee Yuan Siong, AIA’s Group Chief Executive and President, said:

“AIA has delivered excellent new business results with VONB up 37 per cent to over US$2 billion for the first half of 2023. We also reported growth in our other key financial metrics, namely OPAT, EV operating profit, UFSG and EV Equity.

“We have seen our business return to strong and sustainable growth in the first half of 2023 and all of our reportable segments and all distribution channels delivered higher VONB. With the pandemic disruption behind us, the strength of AIA’s unrivalled distribution platform across Asia has powered a return to very strong new business momentum, including double-digit VONB growth from AIA China, our combined ASEAN business and Tata AIA Life, our joint venture in India. AIA Hong Kong more than doubled VONB compared to the first half of 2022, driven by substantial business from Mainland Chinese visitors (MCV).

“Our growing high-quality in-force portfolio and consistent financial discipline supported an increase in both OPAT and UFSG. We returned a total of US$3.6 billion to shareholders in the first half of 2023 through the dividend and our ongoing share buy-back programme, which has enhanced shareholder returns and significantly benefited OPAT and UFSG per share.

EV Equity of US$70.6 billion was up 6 per cent over the first half of 2023 before dividend and share buy-back. AIA’s capital position remained very strong with free surplus of US$16.3 billion and a Group LCSM coverage ratio(2) of 260 per cent at 30 June 2023.

“The Board has declared a 5 per cent increase in the interim dividend to 42.29 Hong Kong cents per share. This follows AIA’s established prudent, sustainable and progressive dividend policy, allowing for future growth opportunities and the financial flexibility of the Group.”

Business

Seylan Bank posts a remarkable PAT of LKR 10 Bn for 2024

The Bank recorded a Profit before Income Tax (PBT) of LKR 16.04 Bn for the period under review with a 59% growth over the previous year, while recording a Profit after Tax (PAT) of LKR 10.05 Bn for the year with a 61% growth over the previous year, demonstrating a robust performance despite challenging macro-economic conditions. The reported PAT of LKR 10 Bn is the highest performance in the Bank’s 36 year history.

Net Interest Income of the Bank was reported as LKR 37 Bn in 2024 compared to LKR 40 Bn reported in 2023 with a decline of 8% corresponding to reduction in Net Interest Margins during 2024, due to reduction in market interest rates throughout the year.

Net fee and commission income of the Bank reported a growth of 7% to LKR 8 Bn compared to LKR 7.4 Bn reported in the previous year. The growth in 2024 was mainly due to increase in income from Cards, Remittances and other services relating to Lending.

The Bank’s net gains from trading reported a gain of LKR 0.46 Bn, a decrease of 44% over the gain of LKR 0.82 Bn reported in previous year due to exchange / interest rate changes.

Net gains / (losses) from de-recognition of financial assets reported a loss of LKR 0.26 Bn in 2024, compared to the gain of LKR 0.15 Bn reported in the previous year. The loss due to the restructuring of SLISBs amounted to LKR 2.71 Bn and was recorded in Q4 2024.

Other Operating Income of the Bank was reported as LKR 1 Bn in 2024, a growth of 5% over the previous year. This increase is mainly from foreign exchange income, which represents both revaluation gain/ (loss) on the Bank’s net open position and realized exchange gain/ (loss) on foreign currency transactions.

The Bank’s Total Operating Income decreased by 11.6% to LKR 44 Bn in 2024 compared to LKR 49 Bn in the previous year mainly due to decrease in net interest income and the loss on restructuring of SLISBs.

The Bank made impairment provision to capture the changes in the macro economy, credit risk profile of customers and the credit quality of the Bank’s loan portfolio in order to ensure adequacy of provisions recognized in the financial statements. The impairment charge on Loans and Advances and other credit related commitments amounted to LKR 6.6 Bn (2023 – LKR 15.5 Bn). The impairment reversal due to the SLISBs exchange amounted to LKR 4.9 Bn (2023 – LKR 1.5 Bn charge).

(Seylan Bank)

Business

An initiative to bring light into the lives of Galle residents

By Ifham Nizam

For decades, many rural communities in Sri Lanka have struggled with an unreliable power supply, outdated infrastructure, and slow responses from authorities. However, a new initiative aims to change this narrative, bringing hope to thousands in the Galle District who have long been in the dark—both literally and figuratively.

Speaking to The Island Financial Review, Dr. Chathura Welivitiya, CEO of HELP-O, an expert in infrastructure development, emphasizes the importance of this project, stating, “Access to reliable electricity is not just about lighting homes; it is about empowering communities, enabling education, fostering business opportunities, and ensuring overall development.”

He said in many villages, the lack of a stable electricity supply has hindered progress. Residents report frequent power outages, damaged lines left unattended for weeks, and new connections taking months—if not years—to be processed. Such issues have not only inconvenienced households but have also impacted local businesses, schools, and healthcare facilities.

According to a Weligama Municipal Council official: “Our children cannot study at night due to power failures. Businesses suffer because they cannot store perishable goods properly. We have raised complaints multiple times, but the response has been slow.”

Recognizing these challenges, a new project has been launched to address the inefficiencies in power distribution. The initiative includes:

Expansion of the Electrification Network: Efforts to extend power lines to remote areas that still rely on kerosene lamps or battery-operated sources.

Upgrading Infrastructure: Replacement of outdated transformers, damaged poles and weak wiring systems to ensure a stable and safe electricity supply.

Community Engagement: A digital reporting system that allows residents to highlight issues in real time, ensuring faster response and accountability from relevant authorities.

Sustainability Measures: Exploration of renewable energy options, such as solar power, to complement the grid and provide backup solutions for power outages.

Dr. Chathura explains, “This project is not just about fixing wires and poles; it is about creating a sustainable and efficient system that meets the growing energy demands of rural areas. Transparency and community participation are key to its success.”

The Southern Province Governor Bandula Haischandra has voiced strong support for the initiative, recognizing its potential to transform rural communities.

“Ensuring a stable electricity supply is a fundamental responsibility of the government, the Governor told The Island Financial Review. “For too long, these communities have been neglected. We are committed to fast-tracking infrastructure improvements and working closely with relevant authorities to resolve longstanding issues.”

The Governor further emphasized the role of accountability and efficiency in the implementation process. “We cannot afford delays and inefficiencies. With the use of modern technology, we are ensuring that complaints are addressed swiftly and that no village is left behind in development.”

Business

Elpitiya Plantations clinches fourth consecutive victory at Inter Plantation Cricket Tournament

Elpitiya Plantations emerged victorious at the 22nd Inter Plantation Cricket Tournament, organised by the Dimbula Athletic and Cricket Club, held on the 21st and 22nd of February 2025 at the Radella Cricket Ground.

The tournament saw participation from 11 plantation companies, showcasing exceptional talent and sportsmanship. Elpitiya Plantations, led by their dynamic captain Wajira Mannapperuma, demonstrated outstanding performance throughout the tournament.

The winning team from Elpitiya Plantations consisted of Wajira Mannapperuma, Asela Udumulla, Dilukshan Neshan, Lakshan Thenabadu, Kavinda Sulochana, Yasitha Koswaththa, Anushka Baddevithana, Kanishka Ranchagoda, Pramoth Bandara, and Sajith Edirisinghe.

In the semi-final match, Elpitiya faced Horana Plantations PLC and secured a decisive victory by bowling out the Horana team for just 20 runs within 4 overs, paving their way to the finals. The final match was a thrilling encounter against Talawakelle Tea Estates PLC, where Elpitiya’s formidable bowling lineup made it challenging for Talawakelle to score. Within the first four overs, Talawakelle’s top batsmen were back in the pavilion, allowing Elpitiya to clinch the championship title with ease.

This victory marks Elpitiya Plantations’ fifth overall win in the history of the tournament and their fourth consecutive triumph, having previously won in 2022, 2023, and 2024. The team’s consistent performance and dedication have solidified their reputation as a formidable force in plantation cricket.

The management of Elpitiya Plantations extends heartfelt congratulations to the team and expresses gratitude to all the supporters and organisers who made this event a grand success.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

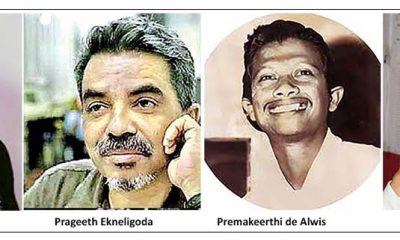

Features4 days agoThe Murder of a Journalist

-

Sports4 days ago

Sports4 days agoMahinda earn long awaited Tier ‘A’ promotion

-

Features4 days ago

Features4 days agoExcellent Budget by AKD, NPP Inexperience is the Government’s Enemy

-

News5 days ago

News5 days agoMobile number portability to be introduced in June