Business

People’s Bank reports consolidated profit after tax of LKR 4.6 billion

People’s Bank announced the results for its quarter ended March 31, 2023 reporting total consolidated operating income and pre-tax profit amounting to LKR 24.0 billion and LKR 7.2 billion, respectively (Q1-2022: LKR 42.6 billion and LKR 11.0 billion).

Similar to 2022, the quarter continued to be characterized by higher interest costs; due to the high interest rate environment which prevailed. This saw consolidated net interest income dip by 49.7% to LKR 15.3 billion during the period relative to Q1-22. This, in part, also reflected the Bank efforts to defer re-pricing of some of its loans to its more sensitive customer segments. Consolidated net fees & commission income amounted to LKR 4.5 billion which, excluding one off items during Q1-22, represented over a 40.0% growth on a like for like basis.

Reflecting inflation pushed cost pressures, much of which originated in the period after Q1-22, saw consolidated total operating expenses rise by 10.1% to reach LKR 14.4 billion (Q1-22: LKR 13.1 billion). This compared well with the industry and, in part, also reflected Group efforts for greater cost control at every instance so reasonably possible.

Total consolidated customers deposits grew to reach LKR 2,513.1 billion – i.e., by 2.6%, whilst consolidated net loans contracted by 4.2% to LKR 1,835.1 billion. The dip in net loans reflected a conscious effort on part of the Bank and the Group to control lending more so in a yet contracting macro-economic context. Total consolidated assets stood at LKR 3,072.2 billion at period end (end 2022: LKR 3,133.1 billion).

The Bank’s Tier I and Total Capital Adequacy Ratios were 11.8% and 16.2%, respectively at March 31, 2023 (end 2022: 11.9% and 16.3%) whilst, on a consolidated basis, it was 13.0% and 16.9%, respectively (end 2022: 13.3% and 17.2%). The Bank’s solvency levels remain sound ultimately reflecting efforts made since the onset of Basel III on July 1, 2017. Further efforts to bolster its regulatory capital, including for the purposes of additional contingency, is currently ongoing. In addition, the Bank successfully met all key regulatory measures during the said period.

Commenting on the results of the Bank and the Group, the Chairman of People’s Bank, Mr. Sujeewa Rajapakse, stated that: “Whilst the sector has, and continues to reel with many headwinds over the last several years. our first quarter results remains testimony to our continued strength and resilience, and adaptability even in the most adverse set of circumstances. Over the last several years, the Bank has successfully met the needs of its diverse stakeholders, leading from the front in many instances so to ensure the country is first prioritized, customer interest are safeguarded, government endeavors are supported whilst, at the same time, the Bank’s commercial interests are also met. Our top line growth during the quarter attest to the growth of our core banking operations whilst the high interest rate environment which prevailed has naturally led to the inevitable earnings pressure as seen throughout the industry. The quarter was however witness to several accomplishments from an Institutional standpoint both from a quantitative and qualitative front. This included, amongst other, our ability to successfully drive identified strategic growth areas, ensure sustained improvements in liquidity both from a rupee and foreign currency standpoint and instill further improvements from a risk management perspective. In addition, our digital investments continues to bear fruit, which augurs well for the Bank’s future growth prospects!

Looking ahead, with several positive developments seen on a macro-economic front including those stemming from the IMF’s Extended Fund Facility, we look forward to the future with a great degree of optimism. As we have done so over the last several years, we reaffirm our unwavering commitment to play our role to safeguard national interest and those of our stakeholders. I take the opportunity to thank our loyal customers for their continued trust and confidence in the Institution!”

Commenting on the results, the Bank’s Chief Executive Officer/ General Manager (Acting) Mr. Clive Fonseka, stated that: “Despite the many pressures, including those unique to a State-Owned Institution, we have continued to make noteworthy progress on several fronts and have addressed some of the most pressing matters within a short span of time. Our primary focus has, and continues to be, in further bolstering our liquidity, driving key areas of strategic importance, and managing our asset quality whilst supporting our customers navigate through these challenging times. We are currently also taking early steps to bolster our regulatory capital from current levels. The success of our delivery remains ultimately best reflected in the sustained improvements shown across several key performance indicators.

Relating to the recent news being circulated in select social media platforms on non-performing loan write-offs – I seek to confirm that there have been no such write offs. Our usual due process for recovering such loans are currently in process.

He further stated that: “The foundation of People’s Bank’s success primarily rests with our staff and that of our loyal customers. While the road ahead is likely to be filled with many more challenges, we look forward to facing them with confidence and vigor as we have done so over the last several years!

Business

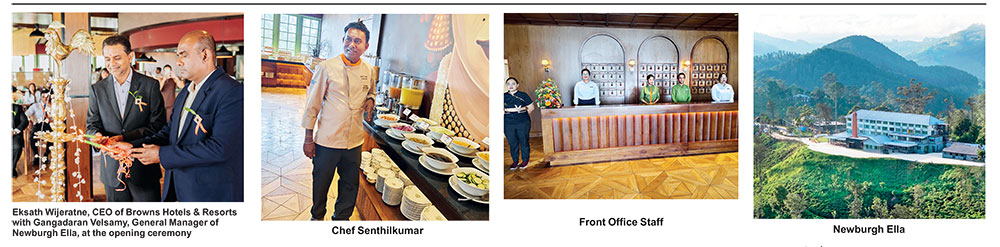

Newburgh Ella set to fill a critical gap in luxury hotel infrastructure

Strategic Rs. 1.5 billion project by Browns Hotels & Resorts under LOLC Group

The Sri Lankan leisure landscape saw a significant addition on January 30, 2026, with the official opening of Newburgh Ella – The Tea Factory Resort. This Rs. 1.5 billion project, a strategic diversification by Browns Hotels & Resorts under the LOLC Group, transforms a 123-year-old tea factory into a luxury destination designed to capture the growing global interest in Ella.

The resort is housed in a structure originally established in 1903 by Scottish planter George Thomson. During the conversion, LOLC ensured the core structure was preserved, even reusing steel and other structural raw materials to maintain the factory’s industrial soul.

“We decided to transform it into a hotel without harming the core structure, ensuring the prevention of nature,” noted Gangadaran Velsamy, General Manager of Newburgh Ella. This commitment to sustainability extends to the resort’s operations, which follow a fully paperless concept and are currently undergoing LEED and green certification processes.

At the helm of the hotel’s operations is Gangadaran Velsamy, the seasoned professional with over 25 years of experience across 10 international and local hotel brands, including Dubai One and Only and Taj Samudra. A graduate of the Ceylon Hotel School, Velsamy brings a mission-driven approach to the property.

“My mission is to make Newburgh Ella the best hotel in Ella that offers nothing but the best for the guests that Ella couldn’t offer ever before in its history,” Velsamy told The Island Financial Review. His management style is notably people-centric, utilising multiple management approaches to maximise the potential of his human resource.

A key highlight of the project’s “human side” was the absorption of the original Finlays tea factory staff. These employees underwent six months of intensive theoretical and on-the-job training at 5-star properties to transition into the hospitality sector.

Further supporting the local economy, 50% of the hotel’s workforce is recruited from the immediate neighborhood. This integration is reflected in the resort’s service culture; for instance, pre-booked restaurant tables are marked with “Promised” tags rather than the standard “Reserved,” signaling a deeper level of commitment to the guest.

Newburgh Ella features 41 rooms categorised as Silver, Gold, and Bronze – a naming convention inspired by tea tips. Room rates range from USD 250 to 350 per day (approximately LKR 75,000 to 100,000).

Key Facilities Include:

1903 – The Dining Room: An all-day dining venue.

Eastern Valley: An open-air restaurant specialising in Asian fusion.

George Thomson – The Founder’s Tavern: A bar named in honour of the factory’s founder.

Three Tips Tea Lounge: A dedicated space for tea tasting and the “living tea experience”.

SKY Observation Deck: Offering views of Ella Rock and Little Adam’s Peak.

From a business perspective, the resort addresses a critical need for high-end infrastructure in Ella, a destination famed for its “exhilarating vibes” but often underserved in the premium segment.

Eksath Wijeratne, CEO of Browns Hotels & Resorts, expressed confidence in the property’s financial trajectory, estimating a breakeven point within five to six years.

“If we see Sri Lanka achieving more arrivals in correlation with increased revenue inflows, we should be able to reach a breakeven within a shorter period,” Wijeratne stated. He emphasised that the resort is a key piece of infrastructure to boost foreign currency earnings, attracting discerning travelers whose spending directly bolsters the country’s economy.

Ultimately, the success of Newburgh Ella lies in its details – such as the “Promised” tags on restaurant tables that replace the cold, standard “Reserved” signs. This subtle shift in language, championed by Velsamy’s team, encapsulates the resort’s mission: to honour a century of history while delivering a standard of service that Ella has never before hosted.

The “gastronomical delights” of Newburgh Ella are presented perfectly with the seasoned artistry of Chef Senthilkumar. Having spent over 18 years refining his craft across the luxury landscapes of Dubai, Kuwait, and the Maldives, the Chef transforms world-class techniques into unforgettable dining experiences, redefining the art of the meal in the heart of Ella.

In addition to Newburgh Ella’s refined hospitality and “yummy” gastronomy, guests have easy access to the region’s crown jewels such as Ella Gap and Ravana Cave to the thundering beauty of Ravana Falls.

By Sanath Nanayakkare

Business

A deep dive into Fitch Lanka report shows ‘Resilience of the Few’

The domestic credit landscape is currently anchored by a handful of high-performing institutions that have displayed significant resilience through the nation’s most turbulent years, a deep dive into the latest monthly report of Fitch Lanka shows.

While the public often equates the often-adulated private sector credit growth with widespread business expansion, the Fitch Lanka data shows a concentration of capital among the country’s elite ‘blue-chip’ firms.

This latest assessment from Fitch Ratings (Lanka) Ltd. is being hailed by experts as a vital assessment for the country’s financial system. While the technical details of credit ratings can seem dense, an independent economic analyst told The Island Financial Review that these reports act as a ‘global report card,’ fundamentally demonstrating how much international trust is placed in Sri Lankan enterprises.

According to the analyst, the ratings issued as of January 31, 2026, serve as more than just corporate scores; they are the primary benchmark used by global investors to determine the safety of bringing capital into the country.

“High ratings are essential for attracting Foreign Direct Investment (FDI), which is the engine for job creation and infrastructure development. These scores are critical for trade finance, allowing local businesses to import essential goods and export products without friction. The ratings provide a real-time snapshot of how Sri Lankan entities are viewed within the highly competitive global capital markets,” he said.

“Banking sector stability is crucial here. Major institutions like Commercial Bank and HNB maintain strong long-term positions. Meanwhile, blue-chip firms including Dialog Axiata PLC and Hemas Plc continue to operate within the elite AAA(lka) to AA(lka) range.The presence of top-tier firms in the ‘AAA’ to ‘AA’ range indicates a robust internal capacity to meet debt obligations, providing a buffer even when the global economy is unpredictable,” the analyst noted.

When asked if the contents of the report may encourage investors to pay close attention to entities appearing in Red font, the analyst said that he views it as a ‘vital signal’ of a dynamic and transparent market rather than a sign of crisis,

“Entities such as JAT Holdings and CIC Holdings PLC have recently undergone rigorous reviews. This scrutiny is largely centred on the manufacturing and agricultural sectors, which are currently adapting to volatile global supply chain trends.

Looking forward, the ability of these ‘Red font’ companies to stabilise their outlooks will serve as the ultimate litmus test for the national economy.If these key players can maintain their scores and stabilise their trajectories through the middle of the year, it will be a definitive indicator that Sri Lanka’s broader economic path is secure,” the analyst said.

When asked if this was the case across the board including SMEs, he replied,” In fact, a deeper dive into the latest assessments by Fitch Ratings Lanka reveals a different reality: the engine of this credit growth is not the average entrepreneur, but a select group of ‘big ticket’ corporate giants.

” A superficial glance at the financial headlines might suggest a private sector in the midst of a borrowing spree. With the Central Bank reporting a notable 25.2% year-on-year growth in private sector credit as of December 2025, the outlook of a broad-based economic awakening is tempting. However, the Fitch Ratings Lanka monthly report reveals a different reality: the engine of this credit growth is not the average entrepreneur, but a select group of ‘big ticket’ corporate giants. In essence, these are the ‘safe harbours; where capital is currently docking.

“The data provided by Fitch Ratings Lanka underscores a critical distinction in the 2026 economy that credit is indeed flowing. And the authorities are rightly encouraged by private sector growth. Yet, this is not a tide lifting all boats; it is a strategic fortification of the nation’s most resilient pillars. As the year unfolds, the strength of these ‘big ticket’ borrowers will determine whether the rest of the private sector can eventually follow their lead into a more prosperous era or not,” he noted in conclusion.

By Sanath Nanayakkare

Business

Moose Clothing Company earns Superbrand 2026 recognition

Moose Clothing Company has been recognised as a Superbrand for 2026, a proud milestone for a young Sri Lankan brand that has grown steadily through trust, consistency, and a strong connection with its customers. The award ceremony was held on 12 January 2026 at the Hilton, celebrating brands that have earned lasting respect and loyalty.

Superbrand status is not awarded lightly. It is reserved for brands that demonstrate excellence beyond numbers, brands known for quality, reliability, emotional connection, and long-term relevance. Selection is based on independent research, expert evaluation, and consumer perception, making it one of the most respected recognitions a brand can receive.

For Moose Clothing Company, this honour is especially meaningful. Founded with a simple belief that Sri Lankans deserve well-made, thoughtfully designed clothing at honest prices the brand has grown by listening closely to its customers and improving with every season. From everyday essentials to performance wear, Moose has focused on getting the fundamentals right: fit, comfort, durability, and value for money.

Commenting on the achievement, Hasib Omar, CEO of Moose Clothing Company, said:

“Being named a Superbrand is deeply meaningful for us because it comes from trust. Moose is still a young brand, and this recognition belongs to our customers who believed in us from the beginning, our teams who work with care and purpose, and everyone who chose Moose Clothing Company as part of their everyday life. It reminds us why we started and encourages us to keep building with integrity.”

-

Features1 day ago

Features1 day agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business2 days ago

Business2 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business6 days ago

Business6 days agoSLIM-Kantar People’s Awards 2026 to recognise Sri Lanka’s most trusted brands and personalities

-

Business1 day ago

Business1 day agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business1 day ago

Business1 day agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business1 day ago

Business1 day agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business6 days ago

Business6 days agoAPI-first card issuing and processing platform for Pan Asia Bank

-

Business2 days ago

Business2 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards