Business

Noritake Lanka wins ISO-accredited Carbon Footprint verification

Marking another milestone in its 50-year journey of excellence in Sri Lanka, Noritake Lanka Porcelain Pvt Ltd (NLPL) obtained ISO 14064-1:2018 accredited GHG Carbon Footprint Verification, a company news release said.

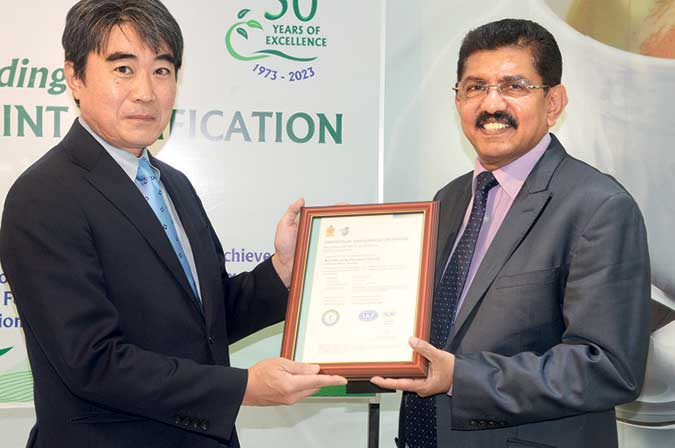

At an event recently held in NLPL’s Colombo office, Secretary to the Ministry of Environment, Dr Anil Jasinghe, who was also the Chief Guest on this occasion, presented the certificate to Deputy Chairman/Managing Director of NLPL, Kenji Obara.

NLPL is the first company in the porcelain and ceramic sector as well as inorganic and nonmetallic sector in Sri Lanka to receive ISO 14064-1:2018 accredited GHG Carbon Footprint Certification. The latest certification adds to NLPLs previous ISO certifications of ISO 9001:2015, ISO 14001:2015 and ISO 45001:2018 for Quality, Environment, Safety & Health respectively, the release said.

“Resting on the pillars of ‘Good quality’, ‘Export’ and ‘Co-prosperity,’ Noritake Group regards the conservation of the environment to be critical for management and seeks to contribute to the realization of a sustainable society through all its business activities. Since Noritake first began manufacturing western-style tableware for export in 1904, it has grown in reach with 25 subsidiaries and seven affiliated companies in Japan and overseas as the Noritake Group. The company began its operations in Sri Lanka in 1973,” it added.

Following the awarding of the GHG Carbon Footprint Verification Certificate, Dr Jasinghe said that minimizing the carbon footprint is very much an integral part of Environmental Social Governance (ESG) which organizations take very seriously today. Sri Lanka Climate Fund affiliated to the Ministry of Environment which is the awarding body of Carbon Footprint Verification, is the first of its kind in South Asia to be accredited and it targets to achieve net zero CO2 by 2050.

“The move towards reducing the carbon footprint also helps businesses to be sustainable,” Dr Jasinghe further said.

Implementing the GHG system at NLPL and obtaining GHG Carbon Footprint Certification is means of benchmarking itself with its parent company in Japan which aims to reduce the CO2 emissions by 50% in 2030 and zero emissions by 2050, remarked the Deputy Chairman and Managing Director of NLPL, Kenji Obara.

“We have formulated this strategy with medium to long-term perspectives in mind,” he noted adding this it is not merely a strategy but a commitment by Noritake towards the world at large.

Business

IMF staff team concludes visit to Sri Lanka

An International Monetary Fund (IMF) team led by Evan Papageorgiou visited Colombo from April 3 to 11, 2025. After constructive discussions in Colombo, Mr. Papageorgiou issued the following statement:

“Sri Lanka’s ambitious reform agenda supported by the IMF Extended Fund Facility (EFF) continues to deliver commendable outcomes. The post-crisis growth rebound of 5 percent in 2024 is impressive. Inflation declined considerably in recent quarters and has fallen to ‑2.6 percent at end-March 2025. Gross official reserves increased to US$6.5 billion at end-March 2025 with sizeable foreign exchange purchases by the central bank. Substantial fiscal reforms have strengthened public finances.

“The recent external shock and evolving developments are creating uncertainty for the Sri Lankan economy, which is still recovering from its own economic crisis. More time is needed to assess the impact of the global shock and how its implications for Sri Lanka can be addressed within the contours of its IMF-supported program.

“The government’s sustained commitment to program objectives is ensuring policy continuity and program implementation remains strong. Going forward, sustaining the reform momentum is critical to safeguard the hard-won gains of the program and put the economy on a path toward lasting macroeconomic stability and higher inclusive growth.

“Against increased global uncertainty, sustained revenue mobilization efforts and prudent budget execution in line with Budget 2025 are critical to preserve the limited fiscal space. Boosting tax compliance, including by reinstating an efficient and timely VAT refund mechanism, will help contribute to revenue gains without resorting to additional tax policy measures. Avoiding new tax exemptions will help reduce fiscal revenue leakages, corruption risks and build much needed fiscal buffers, including for social spending to support Sri Lanka’s most vulnerable. Restoring cost recovery in electricity pricing will help minimize fiscal risks arising from the electricity state-owned enterprise.

“The government has an important responsibility to protect the poor and vulnerable at this uncertain time. It is important to redouble efforts to improve targeting, adequacy, and coverage of social safety nets. Fiscal support needs to be well-targeted, time-bound, and within the existing budget envelope.

“While inflation remains low, continued monitoring is warranted to ensure sustained price stability and support macroeconomic stability. Against ongoing global uncertainty, it remains important to continue rebuilding external buffers through reserves accumulation.

“Discussions are ongoing, and the authorities are encouraged to continue to make progress on restoring cost-recovery electricity pricing, strengthening the tax exemptions framework, and other important structural reforms.

“The IMF team held meetings with His Excellency President and Finance Minister Anura Kumara Dissanayake, Honorable Prime Minister Dr. Harini Amarasuriya ; Honorable Labor Minister and Deputy Minister of Economic Development Prof. Anil Jayantha Fernando, Honorable Deputy Minister of Finance and Planning Dr. Harshana Suriyapperuma, Central Bank of Sri Lanka Governor Dr. P. Nandalal Weerasinghe, Secretary to the Treasury Mr. K M Mahinda Siriwardana, Senior Economic Advisor to the President Duminda Hulangamuwa, and other senior government and CBSL officials. The team also met with parliamentarians, representatives from the private sector, civil society organizations, and development partners.

“We would like to thank the authorities for the excellent collaboration during the mission. Discussions are continuing with the goal of reaching staff-level agreement in the near term to pave the way for the timely completion of the fourth review. We reaffirm our commitment to support Sri Lanka at this uncertain time.”

Business

ComBank unveils new Corporate Branch at Head Office

The Commercial Bank of Ceylon has transformed its iconic ‘Foreign Branch’ into the ‘Corporate Branch,’ reaffirming its commitment to delivering dedicated, comprehensive financial solutions to corporate and trade customers.

The Bank said this transformation represents a new milestone in its illustrious journey, and resonates with the rich commercial heritage of Colombo, a city that has long served as a vital trading hub in the region.

Strategically located at the Bank’s Head Office at Commercial House, 21, Sir Razeek Fareed Mawatha (Bristol Street), Colombo 1, this rebranded Corporate Branch stands as a first of its kind in Sri Lanka —a premier financial hub tailored exclusively to the needs of corporate customers, the Bank said. The transformation aligns with the Bank’s vision of providing unparalleled service excellence, bespoke financial solutions, and fostering long-term business partnerships.

Commenting on this strategic initiative, Commercial Bank’s Managing Director/CEO Sanath Manatunge stated: “It is our aspiration that just as the historic Delft Gateway, at which our Head Office is located, once opened the path to the Dutch Fort, our Corporate Branch will chart a new era of enduring and prosperous business collaborations, that will extend beyond Sri Lanka’s shores.”

Business

Fits Retail and Abans PLC Unveil Exclusive DeLonghi Premium Coffee Experience

Fits Retail has partnered with retail giant Abans PLC to showcase the iconic DeLonghi coffee machines at two of Colombo’s most prestigious locations: Abans Elite Colombo 3 and Abans Havelock City Mall showrooms.

At these dedicated demonstration zones, visitors can discover the unparalleled precision engineering and user-friendly technology that have made DeLonghi machines the preferred choice for discerning coffee lovers in more than 46 countries worldwide. Renowned for consistently delivering café-quality espresso, cappuccino, and even specialty cold brews, DeLonghi machines exemplify Italian innovation at its finest.

Yasas Kodituwakku, CEO of Fits Retail, expressed excitement about the collaboration: “This partnership represents our unwavering commitment to bringing global coffee excellence to Sri Lankan connoisseurs. With Abans PLC, we’re creating more than just demonstration spaces; we’re curating premium destinations for an authentic coffee experience.”

“As pioneers of premium lifestyle experiences in Sri Lanka, our collaboration with Fits Retail aligns seamlessly with our vision of elevating everyday moments into exceptional experiences,” said Tanaz Pestonjee, Director Business Development at Abans PLC.

-

News5 days ago

News5 days agoSuspect injured in police shooting hospitalised

-

Features6 days ago

Features6 days agoRobbers and Wreckers

-

Business5 days ago

Business5 days agoSanjiv Hulugalle appointed CEO and General Manager of Cinnamon Life at City of Dreams Sri Lanka

-

Business6 days ago

Business6 days agoBhathiya Bulumulla – The Man I Knew

-

Business7 days ago

Business7 days agoNational Anti-Corruption Action Plan launched with focus on economic recovery

-

Features4 days ago

Features4 days agoLiberation Day tariffs chaos could cause permanent damage to US economy, amid global tensions

-

Business4 days ago

Business4 days agoMembers’ Night of the Sri Lanka – Russia Business Council of The Ceylon Chamber of Commerce

-

Features4 days ago

Features4 days agoMinds and Memories picturing 65 years of Sri Lankan Politics and Society