Business

Trump tariffs trigger steepest US stocks drop since 2020 as China, EU vow to hit back

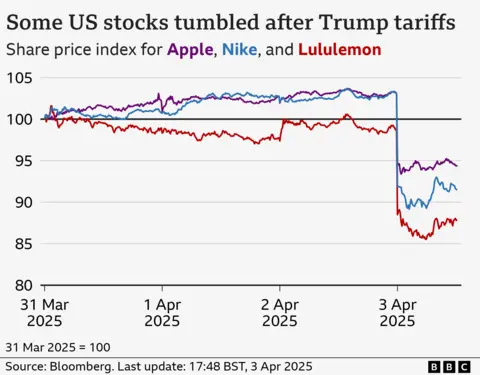

Global stocks have sunk, a day after President Donald Trump announced sweeping new tariffs that are forecast to raise prices and weigh on growth in the US and abroad.

Stock markets in the Asia-Pacific region fell for a second day, hot on the heels of the US S&P 500, which had its worst day since Covid crashed the economy in 2020.

Nike, Apple and Target were among big consumer names worst hit, all of them sinking by more than 9%.

At the White House, Trump told reporters the US economy would “boom” thanks to the minimum 10% tariff he plans to slap on imports in the hope of boosting federal revenues and bringing American manufacturing home.

The Republican president plans to hit products from dozens of other countries with far higher levies, including trade partners such as China and the European Union. China, which is facing an aggregate 54% tariff, and the EU, which faces duties of 20%, both vowed retaliation on Thursday.

Tariffs are taxes on goods imported from other countries, and Trump’s plan that he announced on Wednesday would hike such duties to some of the highest levels in more than 100 years.

The World Trade Organization said it was “deeply concerned”, estimating trade volumes could shrink as a result by 1% this year.

Traders expressed concern that the tariffs could stoke inflation and stall growth.

In early trading on Friday, Japan’s benchmark Nikkei 225 index fell by 1.8%, the Kospi in South Korea was around 1% lower and Australia’s ASX 200 dipped by 1.4%.

On Thursday, the S&P 500 – which tracks 500 of the biggest American firms – plunged 4.8%, shedding roughly $2tn in value.

The Dow Jones closed about 4% lower, while the Nasdaq tumbled roughly 6%. The US shares sell-off has been going on since mid-February amid trade war fears.

Earlier, the UK’s FTSE 100 share index dropped 1.5% and other European markets also fell, echoing declines from Japan to Hong Kong.

On Thursday at the White House, Trump doubled down on a high-stakes gambit aimed at reversing decades of US-led liberalisation that shaped the global trade order.

“I think it’s going very well,” he said. “It was an operation like when a patient gets operated on, and it’s a big thing. I said this would exactly be the way it is.”

He added: “The markets are going to boom. The stock is going to boom. The country is going to boom.”

Trump also said he was open to negotiating with trade partners on the tariffs “if somebody said we’re going to give you something that’s so phenomenal”.

On Thursday, Canada’s Prime Minister Mark Carney said that country would retaliate with a 25% levy on vehicles imported from the US.

Trump last month imposed tariffs of 25% on Canada and Mexico, though he did not announce any new duties on Wednesday against the North American trade partners.

Firms now face a choice of swallowing the tariff cost, working with partners to share that burden, or passing it on to consumers – and risking a drop in sales.

That could have a major impact as US consumer spending amounts to about 10% – 15% of the world economy, according to some estimates.

While stocks fell on Thursday, the price of gold, which is seen as a safer asset in times of turbulence, touched a record high of $3,167.57 an ounce at one point on Thursday, before falling back.

The dollar also weakened against many other currencies.

In Europe, the tariffs could drag down growth by nearly a percentage point, with a further hit if the bloc retaliates, according to analysts at Principal Asset Management.

In the US, a recession is likely to materialise without other changes, such as big tax cuts, which Trump has also promised, warned Seema Shah, chief global strategist at the firm.

She said Trump’s goals of boosting manufacturing would be a years-long process “if it happens at all”.

“In the meantime, the steep tariffs on imports are likely to be an immediate drag on the economy, with limited short-term benefit,” she said.

On Thursday, Stellantis, which makes Jeep, Fiat and other brands, said it was temporarily halting production at a factory in Toluca, Mexico and Windsor, Canada.

It said the move, a response to Trump’s 25% tax on car imports, would also lead to temporary layoffs of 900 people at five plants in the US that supply those factories.

On the stock market, Nike, which makes much of its sportswear in Asia, was among the hardest hit on the S&P, with shares down 14%.

Shares in Apple, which relies heavily on China and Taiwan, tumbled 9%.

Other retailers also fell, with Target down roughly 10%.

Motorbike maker Harley-Davidson – which was subject of retaliatory tariffs by the EU during Trump’s first term as president – fell 10%.

In Europe, shares in sportswear firm Adidas fell more than 10%, while stocks in rival Puma tumbled more than 9%.

Among luxury goods firms, jewellery maker Pandora fell more than 10%, and LVMH (Louis Vuitton Moet Hennessy) dropped more than 3% after tariffs were imposed on the European Union and Switzerland.

“You’re seeing retailers get destroyed right now because tariffs extended to countries we did not expect,” said Jay Woods, chief global strategy at Freedom Capital Markets, adding that he expected more turbulence ahead.

[BBC]

Business

Acuity Knowledge Partners fuels global finance with Sri Lanka’s homegrown talent

In an era where global financial markets demand innovation and agility, Acuity Knowledge Partners has positioned Sri Lanka as a strategic hub for high-value knowledge services. At the helm of this transformation is Jehan Jeyaretnam, Country Head of Acuity’s Sri Lanka operations, whose two-decade journey with the firm mirrors the nation’s growing prominence in the global knowledge process outsourcing (KPO) sector.

Sri Lanka’s exceptional talent pool, which is highly educated, tech-savvy, and globally aware, is the cornerstone of Acuity’s success, asserted Jeyaretnam during an interview with The Island Financial Review. The following are some excerpts from the interview.

“With over 500 professionals in Sri Lanka supporting global clients in investment research, compliance, and data analytics, the firm has forged robust partnerships with universities like Kelaniya, fostering talent through graduate programmes, mentorship, and initiatives such as its decade-long sponsorship of inter-university academic competitions.’’

“Acuity’s commitment to nurturing expertise is evident in its status as a leading employer of CFA charter holders locally and its consistent recognition as a top employer by AICPA & CIMA, climbing to 9th place globally in 2024. Our people access global opportunities and clear career pathways,” Jeyaretnam noted, emphasising long-term growth over talent development.

“Beyond its economic footprint, Acuity’s “Be Kind” ethos drives community initiatives focused on education, sustainability, and welfare. Partnerships with NGOs like Child Action Lanka, tree-planting campaigns, and digital literacy programmes underscore Acuity’s dedication to uplifting underserved communities. Giving back isn’t optional. It’s ingrained in our culture,” Jeyaretnam stated.

Reflecting on his 20-year journey, Jeyaretnam attributed Acuity’s evolution from a ‘small team with big ambitions’ to a global KPO leader with a philosophy centered on trust and empowerment.

“Leadership is about building others up,” he said, highlighting mentorship and continuous learning as catalysts for innovation.

When asked about his personal accomplishments, he said, “Witnessing employees ascend to leadership roles is my most rewarding accomplishment.”

To youth eyeing careers in capital markets, Jeyaretnam advised adaptability, curiosity, and integrity.

“Success stems from asking questions, seeking feedback, and grounding yourself in financial fundamentals,” he stressed, citing Acuity analysts who’ve risen to become industry experts.

As Acuity eyes the future, Jeyaretnam reaffirmed its commitment to innovation, talent development, and scaling Sri Lanka’s capabilities.

“We’ll keep investing in Sri Lanka, ensuring we’re resilient and ready to meet tomorrow’s challenges together,” he asserted, encapsulating Acuity’s clients, employees and stakeholders.

In a world where knowledge is currency, Acuity Knowledge Partners and Sri Lanka’s talent are proving to be invaluable global assets.

By Sanath Nanayakkare

Business

John Keells Properties and MullenLowe unveil “Minutes Away”

In a bold and pioneering move, John Keells Properties (JKP), in collaboration with MullenLowe, has launched “Minutes Away – The Smartest Campaign in Sri Lanka” for JKP’s smart apartment development, TRI-ZEN. Redefining how real estate is experienced and promoted in the digital age, this campaign is the first in Sri Lanka to utilize Meta Ray- Ban Smart Glasses—bringing viewers into a fully immersive, first-person perspective that captures the essence of smart urban living like never before.

As Sri Lanka’s first smart apartment complex, TRI-ZEN has consistently set new benchmarks in urban innovation. Now, with the Minutes Away campaign, John Keells Properties elevates its brand storytelling by delivering a unique point-of-view (POV) journey, giving audiences the chance to see through the eyes of a resident navigating the conveniences of smart city living—from seamlessly connected spaces to vibrant city life just minutes away.

“Innovation is embedded in the DNA of John Keells Properties,” said Chamal Fonseka, Assistant Vice President of John Keells Holdings and Head of Brand Strategy s Customer Experience at John Keells Properties. “With ‘Minutes Away’, we wanted to push the boundaries of how real estate is communicated. The use of Meta Ray-Ban Glasses not only allows us to immerse our audience in the daily rhythm of a TRI-ZEN resident—it also marks a first for Sri Lanka in terms of campaign technology and narrative style. This campaign is not just about showcasing a product—it’s about enabling prospective homeowners to feel the lifestyle TRI-ZEN offers. And there’s no better way than putting them quite literally in the shoes of a resident.”

The Meta Ray-Ban Glasses are at the heart of this one-of-a-kind activation, enabling content to be captured from a natural, unfiltered perspective—no gimbals, no staging, just real- time storytelling. Whether it’s a short commute to Colombo’s key hotspots, smart home features activating at a touch, or the energy of city life just steps away, the viewer experiences it all through the eyes of the modern, connected homeowner.

Business

Amana Life policyholders enjoy 19 percent return on their Gold Investment Fund

As global gold prices soar and investors worldwide turn to gold as a trusted store of value, Amana Life Insurance stands out for offering Sri Lankans a rare and rewarding opportunity to invest in gold through life insurance.

Amana Life Insurance is the only life insurer in Sri Lanka offering customers access to a dedicated Gold Investment Fund across all life insurance products including retirement, education, and health plans. This presents a unique opportunity for Sri Lankans to save in gold and receive gold at maturity, combining financial protection with the long-term stability of a globally valued asset.

As of March 31st, 2025, the Gold Investment Fund delivered an impressive 12-month return of 19 percent, offering strong returns for policyholders who chose the Gold Fund investment option as part of their wealth planning strategy.

Whether you’re planning for your child’s education, retirement, or long-term wealth creation, Amana Life Insurance gives you access to one of Sri Lanka’s most diverse and high-performing investment portfolios. These include the Protected Multiple Fund, Stable Multiple Fund, Growth Multiple Fund, Volatile Multiple Fund, Bullion Multiple Fund, and the standout Gold Investment Fund, each designed to match different financial goals and risk profiles.

Commenting on the fund’s performance, Gehan Rajapakse, CEO of Amana Life Insurance, stated: “The continued rise in global gold prices underscores the importance of offering innovative, long-term investment options. The strong performance of our Gold Investment Fund reflects our deep commitment to creating lasting value for our policyholders. However, we remind customers that past performance is not indicative of future results, and every investment should be aligned with one’s financial goals and market outlook.”

As Sri Lanka’s most awarded insurer, Amana Life Insurance continues to lead with foresight, innovation, and a customer-first mindset, enabling every Sri Lankan to secure their future with confidence and clarity.

-

News6 days ago

News6 days agoRanil’s Chief Security Officer transferred to KKS

-

Opinion4 days ago

Opinion4 days agoRemembering Dr. Samuel Mathew: A Heart that Healed Countless Lives

-

Business2 days ago

Business2 days agoAitken Spence Travels continues its leadership as the only Travelife-Certified DMC in Sri Lanka

-

Business2 days ago

Business2 days agoLinearSix and InsureMO® expand partnership

-

Business6 days ago

Business6 days agoCCPI in April 2025 signals a further easing of deflationary conditions

-

Latest News23 hours ago

Latest News23 hours agoNPP win Maharagama Urban Council

-

Features6 days ago

Features6 days agoExpensive to die; worship fervour eclipses piety

-

Latest News4 days ago

Latest News4 days agoThe Heat index is likely to increase up to ‘Caution level’ at some places in Eastern, Northern, North-central and North-western provinces and in Monaragala and Hambantota districts.