Business

Stagflation in Sri Lanka? Risks and policy responses

By Binura Seneviratne

The world economy is showing signs of a serious slowdown due to overlapping crises including the Russia-Ukraine War, the COVID-19 pandemic, China’s real estate crisis and the global tightening of monetary policy.

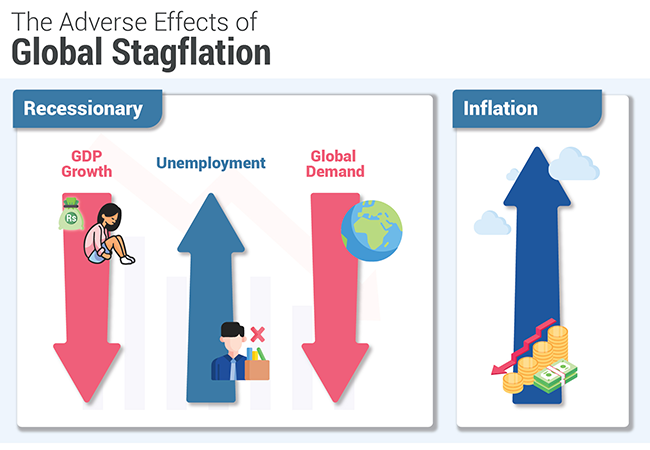

In June, the World Bank revised the 2022 growth prediction downward to 2.9% from its January forecast of 4.1%. The slowdown has come along with a decade-high bout of inflation worldwide with the global median Consumer Price Inflation (CPI) inflation rising to around 7.8% on a year-on-year (YoY) basis, the highest since 2008, according to April 2022 data (Figure 1). The emergence of a low-growth international environment together with a significant rise in inflation has raised concerns of stagflation; a period of low growth combined with high inflation.Monthly CPI Inflation, Year-On-Year The Effects of Stagflation

A global stagflationary environment could further weaken global economic growth while increasing inflation. To combat inflation, many central banks including the US Federal Reserve, the Bank of England and the European Central Bank have resorted to monetary tightening measures. The rise in global interest rates as a direct attempt to anchor inflation expectations will further subdue economic growth thereby increasing borrowing costs globally. This results in a downward economic cycle as rising borrowing costs will reflect in lower investments. The effects for developing countries could be more pronounced as inflation will hit the poorest and the marginalised the most. Weak global growth will decrease export income in these markets while higher global commodity prices will increase import expenditure leading to macroeconomic imbalances.

Risks for Sri Lanka

A global stagflationary environment can worsen Sri Lanka’s current economic crisis restricting growth and increasing inflation. Higher global borrowing costs will be detrimental to Sri Lanka’s future growth when the country resumes international borrowing once an IMF agreement is in place. The rise in commodity prices could further increase the country’s worsening food insecurity, with the World Food Programme reporting that 25% of the population is food insecure. Higher commodity costs will also increase import expenditure while lower global demand could reduce export revenue thus expanding the current account deficit. However, if global inflation is transient, the effects on the current account would be ambiguous. The global economic downturn will spark lower demand for commodities such as oil which could lower import expenditure but also reduce the demand for Sri Lankan exports.

Due to rising inflation and lower growth, the Sri Lankan economy is approaching stagflation. Growth expectations for the country have nosedived after the sovereign default with the economy projected to decline by -7.8% in 2022 and -3.7% in 2023 according to the World Bank. The combination of a myopic “organic” agricultural policy, the inflation pass through from the depreciation of the Sri Lankan Rupee by 80%, an expansionary monetary policy and global market conditions have resulted in inflation surging to 59% in June (YOY) (Figure 2).

Consumer Price Inflation (Jan 20 – May 22)

The tightening global economic conditions along with domestic supply-side factors such as shortages in food and fuel will continue to drive inflation in the country. Increased policy rates to combat inflation will result in lower investments. These factors, combined with political instability, lower than expected remittances, and lower productivity due to acute shortages of essential items will further constrict the Sri Lankan economy, pushing it into stagflation.Change in Policy Interest Rates of the Central Bank of Sri Lanka Policy Options

Sri Lankan policymakers are constrained within this economic environment. The country will need to impose austerity measures to receive an extended fund facility from the IMF. These measures will include tax reforms to increase government revenue, curtailing non-essential government spending and reducing subsidies. While a fiscal stimulus package is out of the equation, the country needs to target the most vulnerable groups in providing emergency subsidies, as rising inflation and job losses have led to lower standards of living, especially among the vulnerable segments of the population. Due to financing constraints, Sri Lanka will have to look for further bilateral and multilateral aid in securing funding for short term, targeted “in-kind” transfers such as food stamps. It is also imperative to have a bridge financing arrangement, to import essential commodities like fuel, so that supply shortages reduce. This should help in keeping productivity intact and inflationary pressure in check.

Monetary tightening should also continue. The CBSL hiked interest rates by 700 basis points in April this year. Interest rates were increased by another 100 basis points in July to control the rising inflation (Figure 3). Monetary policy decisions need to be communicated very clearly so that there is a stronger anchoring of inflation expectations. Anchored inflation expectations would limit a wage-price spiral to control inflationary pressure so that production costs do not rise further. Due to a global economic downturn, rising commodity prices and high rates of borrowing, Sri Lanka can expect a challenging external sector environment next year. Policymakers will need to understand these global challenges and make pragmatic economic decisions to minimise further damage to the economy.

Link to the blog https://www.ips.lk/talkingeconomics/2022/08/10/stagflation-in-sri-lanka-risks-and-policy-responses/

Author

Binura Seneviratne is a Research Officer working on macroeconomic policy, poverty and social welfare research at IPS. He holds a Master of Economic Policy from the Australian National University and a BSc in Economics and Finance from the University of York. (Talk with Binura: binura@ips.lk)

Business

Sri Lanka Customs exceeds revenue targets to enters 2026 with a surplus of Rs. 300 billion – Director General

The year 2025 has been recorded as the highest revenue-earning year in the history of Sri Lanka Customs, stated Director General of Sri Lanka Customs, Mr. S.P. Arukgoda, noting that the Department had surpassed its expected revenue target of Rs. 2,115 billion, enabling it to enter 2026 with an additional surplus of approximately Rs. 300 billion.

The Director General made these remarks at a discussion held on Tuesday (30) morning at the Sri Lanka Customs Auditorium, chaired by President Anura Kumara Dissanayake.

The President visited the Sri Lanka Customs Department this to review the performance achieved in 2025 and to scrutinize the new plans proposed for 2026. During the visit, the President engaged in extensive discussions with the Director General, Directors and senior officials of the Department.

Commending the vital role played by Sri Lanka Customs in generating much-needed state revenue and contributing to economic and social stability, the President expressed his appreciation to the entire Customs employees for their commitment and service.

Emphasizing that Sri Lanka Customs is one of the country’s key revenue-generating institutions, the President highlighted the importance of maintaining operations in an efficient, transparent and accountable manner. The President also called upon all officers to work collectively, with renewed plans and strategies, to lead the country towards economic success in 2026.

The President further stressed that the economic collapse in 2022 was largely due to the government’s inability at the time to generate sufficient rupee revenue and secure adequate foreign exchange. He pointed out that the government has successfully restored economic stability by achieving revenue targets, a capability that has also been vital in addressing recent disaster situations.

A comprehensive discussion was also held on the overall performance and progress of Sri Lanka Customs in 2025, as well as the new strategic plans for 2026, with several new ideas and proposals being presented.

Sri Lanka Customs currently operates under four main pillars, revenue collection, trade facilitation, social protection and institutional development. The President inquired into the progress achieved under each of these areas.

It was revealed that the Internal Affairs Unit, established to prevent corruption and promote an ethical institutional culture, is functioning effectively.

The President also sought updates on measures taken to address long-standing allegations related to congestion, delays and corruption in Customs operations, as well as on plans to modernize cargo inspection systems.

The discussion further covered Sri Lanka Customs’ digitalization programme planned for 2026, along with issues related to recruitment, promotions, training and salaries and allowances of the staff.

Highlighting the strategic importance of airports in preventing attempts to create instability within the country, the President underscored the necessity for Sri Lanka Customs to operate with a comprehensive awareness of its duty to uphold the stability of the State, while also being ready to face upcoming challenges.

The discussion was attended by Minister of Labour and Deputy Minister of Finance and Planning, Dr. Anil Jayanta Fernando, Deputy Minister of Economic Development, Nishantha Jayaweera, Secretary to the President, Dr. Nandika Sanath Kumanayake, Deputy Secretary to the Treasury, A.N.Hapugala, Director General of Sri Lanka Customs, S.P.Arukgoda, members of the Board of Directors and senior officials of the Department.

Business

Construction industry offers blueprint for Sri Lanka’s recovery

The dawn of 2026 represents a time for critical recalibration, not just ceremony, for the nation’s vital construction sector, says Eng Nissanka N Wijeratne, Secretary General/CEO of the Chamber of Construction Industry (CCI).

In a New Year message, Wijeratne reframes the annual greeting as a strategic call to action. “For Sri Lanka’s construction industry – the true backbone of our economy – the turning of the calendar is an ideal moment for a realistic and forward-looking assessment,” he states.

His vision sketches a practical blueprint where the unprecedented challenges of the recent past become the foundation for a smarter, more sustainable future.

The industry, long considered a barometer of national prosperity, has weathered severe headwinds: economic volatility and spiraling material costs. “These were not mere business cycles, but unprecedented tests,” Wijeratne notes, acknowledging the severe strain on firms and professionals. Yet, the sector’s response, he observes, has been “nothing short of remarkable,” showcasing a deeply ingrained resilience.

The Chamber’s chosen theme for the year, “Resilience through Innovation,” signals a pivotal shift from enduring hardship to actively engineering progress.

The pathway forward, Wijeratne outlines, is built on three interdependent pillars.

First is the revitalization of Infrastructure. “This is not a simple call for new projects,” he clarifies, “but a strategic push to reactivate stalled ventures and initiate sustainable developments in concert with the government and international agencies.” He emphasises that construction activity is intrinsically linked to the broader economy’s pulse, where resuming projects catalyses employment, energises supply chains, and restores public confidence.

The second pillar, technological Integration, addresses the urgent need to modernise the sector’s core. Advocacy for Building Information Modeling (BIM), green building practices, and digital project management is a direct answer to past inefficiencies. “It is a commitment to ensuring Sri Lankan construction is not just rebuilt, but upgraded becoming more competitive, cost-effective, and environmentally responsible,” Wijeratne says. ” Innovation must move from slogan to practice, transforming how the nation conceives, builds, and maintains its infrastructure,” he notes.

The third pillar, consistent policy advocacy, underpins all efforts. The Chamber positions itself as a vital intermediary, fighting for fair pricing mechanisms, streamlined regulations, and a protective framework for local contractors. Wijeratne stresses that the best-laid plans of engineers can falter without a conducive policy environment, calling for a strengthened partnership with the state to create a level playing field where skill and enterprise determine success.

Ultimately, Wijeratne’s message is a powerful reminder of the industry’s profound legacy. “When we build, the nation grows,” he states, elevating construction from a commercial activity to a national mission. The structures that rise from the ground are more than concrete and steel; they are the schools, hospitals, roads, and homes that shape the nation’s future.

As Sri Lanka steps into 2026, the construction industry’s message is clear: it is ready to transform resilience from a trait of survival into a dynamic force for innovation.

The past challenges, according to Wijeratne, have been met with grit. Now, the future must be built with vision.

By Sanath Nanayakkare

Business

Expo Commodities and STAY Naturals honoured at the Presidential Export Awards 2024/25

Expo Commodities (Pvt) Ltd, together with its member company STAY Naturals (Pvt) Ltd, has been recognized with Merit Awards at the Sri Lanka Export Development Board (EDB) Presidential Export Awards 2024/25, one of the country’s most prestigious platforms celebrating export excellence.

The awards were presented under the categories of Spices and Allied Products and Essential Oils, Oleoresins & Condiments, recognizing the companies’ consistent performance, product quality, and contribution to strengthening Sri Lanka’s presence in global markets.

The recognition reflects Expo Commodities’ continued focus on delivering high-quality, value-added Sri Lankan products while upholding international standards across innovation, sustainability, and responsible sourcing. Through STAY Naturals, the group has expanded its reach in key export markets, promoting Sri Lanka’s essential oils, oleoresins, and condiments derived from its rich agricultural heritage to customers worldwide.

The achievement also reflects the collective effort, technical expertise, and commitment of the teams behind the operations, alongside the continued trust of global partners and customers. Expo Commodities (Pvt) Ltd, part of Expo Commodities Global, is strategically focused on driving sustainable export growth and strengthening Sri Lanka’s global positioning as a reliable supplier of high-quality natural products.

Expo Commodities Global is a globally active Agri-commodity enterprise with operations spanning multiple origins including Sri Lanka, Vietnam, Indonesia, Madagascar, Comoros, Egypt, the UAE, India, Germany, and the Netherlands. The company specializes in the production, processing, and export of premium organic and conventional spices, coconut products, essential oils, oleoresins, and value-added agricultural products, delivering consistent quality through integrated and sustainable operations.

Expo Commodities Global and STAY Naturals (Pvt) Ltd are part of Aberdeen Holdings, a diversified Sri Lankan conglomerate with interests across pharmaceuticals, packaging, commodities, transport and logistics, power generation, and digital innovation, supporting long-term growth through strong governance, sustainability, and global market engagement.

-

News7 days ago

News7 days agoBritish MP calls on Foreign Secretary to expand sanction package against ‘Sri Lankan war criminals’

-

News6 days ago

News6 days agoStreet vendors banned from Kandy City

-

Sports7 days ago

Sports7 days agoChief selector’s remarks disappointing says Mickey Arthur

-

Opinion7 days ago

Opinion7 days agoDisasters do not destroy nations; the refusal to change does

-

Sports3 days ago

Sports3 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne

-

News6 days ago

News6 days agoLankan aircrew fly daring UN Medevac in hostile conditions in Africa

-

Sports4 days ago

Sports4 days agoTime to close the Dickwella chapter

-

News22 hours ago

News22 hours agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges