Business

Sri Lanka Insurance hosted Insurance Brokers’ Appreciation Night

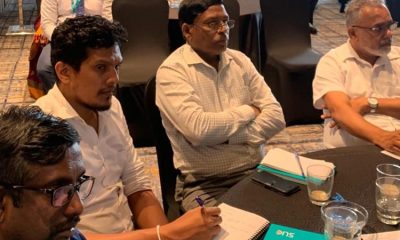

The Nations’ Insurer, Sri Lanka Insurance (SLIC) recently hosted a special event in appreciation of the remarkable contribution made by the Insurance Brokers to the Insurance industry of Sri Lanka. The event was held on Oct 18 at the Hilton, Colombo.

Insurance Broker companies plays a key role in uplifting the Insurance industry and contribute significantly to the economy of a country. They are essential intermediaries that add value to the insurance industry and the economy by providing expertise, market access, risk management, and personalised solutions to individuals and businesses.

Acknowledging the contribution, the Insurance Brokers has made to SLIC, the company annually holds an event for the Brokers. This year the event was special as Sri Lanka Insurance felicitated five Broker veterans from the insurance industry. Their dedication and commitment is praiseworthy and up to date they are still working as Insurance Brokers and contributed to the Insurance industry of the country.

Nihal Senarathna, Chairman of Senaratne Insurance Brokers has provided his services as an Insurance Broker for the past 70 years. A student of Royal College, Colombo, he is a Charter Member of the International Insurance Society based in Alabama, USA, Associateships from Charted Insurance Institute and Indian Insurance institute, a Chartered Insurance Broker and a fellow of Chartered Management Institute. Mr. Senarathna is also the only Sri Lankan to have been invited by the Association of British Insurance to address Britain’s Insurance Industry in 1986.

Hema Wijeratne, a product of Nalanda College, is the founder of Mercantile Insurance Brokers. He is a Fellow of Chartered Insurance Institute and a Chartered Insurance Broker. In 1967 he joined Sri Lanka Insurance Corporation and held various esteemed positions. He was a pioneer in the Insurance industry creating opportunity for insurance education. Mr. Wijeratne was instrumental in establishing Sri Lanka Insurance Institute. Furthermore, he also established the Sri Lanka Insurance Broker Association in 1980 to create a platform for the Broker community of Sri Lanka. Imparting his knowledge to the youth, Mr. Hema Wijeratne has also lectured at Sri Lanka Insurance Institute, Sri Lanka Institute of Bankers, and University of Sri Jayawardenapura. Mr. Wijerante has served the Insurance industry for over 60 years and continues his service to date.

Vernon Edirisinghe, a student from St. Joseph’s College, Colombo, is the Managing Director and Principle Officer at Equity Insurance Brokers. He is also the Co-founder of Equity Insurance Brokers. He holds a Bsc. in Economics from the University of London. Mr. Edirisinghe has served as the Managing Director of leading insurance companies and have been continuing to serve the insurance industry for the past 58 years.

Victor Colambage, a student of Christian College Kotte, is a pioneer in the Insurance industry with a service record of 50 plus years. He is a Chartered Insurer and has extensively contributed to the growth and evolution of the industry. Mr. Colombage has held many esteemed positions in the industry in insurance companies and Broker companies.

Ray Pompeus, has been in the Insurance industry for more than 58 years and continues to serve the industry up to date. He is currently working as a Consultant at LM & A Insurance Brokers. He has held many senior positions at numerous Insurance Broker companies in Sri Lanka. Mr. Pompeus is also a student from St. Joseph’s College, Colombo.

This special occasion was graced by Boards of Directors and senior officials of Insurance Broker Companies, President Counsel Mr. Ronald C Perera – Chairman (SLIC), Mr. Chandana L Aluthgama – Chief Executive Officer (SLIC), Chief Officers and other senior officials from Sri Lanka Insurance.

Sri Lanka Insurance understands the pivotal role the Brokers play in the industry and therefore they ensure to give them their due recognition and appreciate their hard work and commitment.

Business

Sri Lanka sets bold target to slash cash use, seeks unified Fintech regulator

The inaugural Sri Lanka Fintech Summit 2025 concluded with industry leaders and regulators establishing two critical national priorities: a bold target to reduce physical cash usage and a push for consolidated regulatory oversight.

In a key decision, participants set a clear three-year goal to lower the ratio of cash in circulation to GDP from 4.5% to 3.5%. The strategy will focus on digitizing high-cash sectors like transport, utilities, and SME payments, while expanding digital access through post offices and cooperatives.

For the long-term health of the ecosystem, stakeholders agreed to lobby for the creation of a single, unified regulatory authority dedicated to fintech oversight. This aims to streamline approvals and provide clearer guidance for innovators.

“Our members needed to leave with concrete action points,” said Channa de Silva, Chairman of the Fintech Forum, Sri Lanka. The summit, designed as a series of closed-door roundtables with regulators including the Central Bank, produced actionable frameworks. “It was about defining KPIs, setting targets, and giving the industry a shared direction,” de Silva explained.

The outcomes signal a concerted shift from discussion to execution, aiming to build a more inclusive, efficient, and secure digital financial economy for Sri Lanka.

By Sanath Nanayakkare ✍️

Business

Kukus Group plans 18 outlets across three distinct Sri Lankan hospitality concepts

A new force in Sri Lanka’s food industry, Kukus Group, is gaining momentum with a clear vision to deliver authentic cuisine, high hygiene standards, and affordability. Founded by young entrepreneurs Nadeera Senanayaka, Lakmini Gurusinghe, and Randila Gunasinghe, the group has successfully launched its pilot outlet and is now preparing for a significant nationwide expansion.

The inaugural in Kotte has served as a successful proof of concept. Operating for five months, this modern street-food outlet has garnered a strong customer response, confirming market demand and providing the confidence to fund the group’s ambitious growth strategy.

“The positive reception has been overwhelming and has solidified our plans,” said Lakmini Gurusinghe and Randila Gunasinghe. “Our Kotte outlet is the operational model we will replicate – ensuring consistent quality, disciplined operations, and excellent service across all future locations.”

The group’s expansion strategy is built on three distinct thematic brands:

Kukus Street: Targeting young urban customers, these outlets offer a vibrant, casual dining experience with a menu of Sri Lankan rice and curry, kottu, snacks, and BBQ, with most meals priced under Rs. 1,500. Services include dine-in, takeaway, and delivery.

Kukus Beach: Planned for coastal areas, beginning in the South, this concept will feature an urban-style beach restaurant and pub designed for relaxed social dining.

Kukus Bioscope: Celebrating Sri Lanka’s cinematic heritage, this dedicated restaurant concept will create a nostalgic cultural space inspired by the golden eras of Sinhala cinema, with the first outlet slated for Colombo.

The immediate plan includes transforming the flagship Kotte location into Kukus Pub & Bar, pending regulatory approvals. The long-term vision is to develop 18 outlets nationwide: 10 Kukus Street locations, 5 Kukus Beach venues, and 3 Kukus Bioscope establishments.

“Kukus Group is more than a hospitality brand; it’s a celebration of Sri Lankan flavors and culture,” the founders concluded. “Our mission is to build trusted, recognizable brands that connect deeply with communities and offer lasting cultural value alongside authentic cuisine. We are dynamic and excited to proceed with this strategic expansion,” they said.

By Sanath Nanayakkare

Business

Fcode Labs marks seven years with awards night

Fcode Labs marked its seventh anniversary by hosting its annual Awards Night 2025 at Waters Edge, celebrating team achievements and reinforcing its organizational values.

The event featured keynote addresses from Co-Founders & CEOs Buddhishan Manamperi and Tharindu Malawaraarachchi, who reflected on the company’s annual progress and future strategy. Chief Operating Officer Pamaljith Harshapriya outlined operational priorities for the next phase of growth.

Awards were presented across three key categories. Prabhanu Gunaweera and Dushan Pramod received Customer Excellence awards for partner collaboration. Performance Excellence awards were granted to Munsira Mansoor, Thusara Wanigathunga, Thushan De Silva, Adithya Narasinghe, Avantha Dissanayake, Amanda Janmaweera, Sithika Guruge, and Sandali Gunawardena. The Value-Based Behaviour awards were given to Thilina Hewagama, Udara Sembukuttiarachchi, and Kavindu Dhananjaya for exemplifying company values.

-

News2 days ago

News2 days agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Business2 days ago

Business2 days agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

Features2 days ago

Features2 days agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

News7 days ago

News7 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

Features2 days ago

Features2 days agoSubject:Whatever happened to (my) three million dollars?

-

News1 day ago

News1 day agoLevel I landslide early warnings issued to the Districts of Badulla, Kandy, Matale and Nuwara-Eliya extended

-

News7 days ago

News7 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

News2 days ago

News2 days ago65 withdrawn cases re-filed by Govt, PM tells Parliament