Business

Some premium tea varieties remaining unsold in November

By Steve A. Morrell

Tea brokers reports for November 2024 indicated that while the quantity of tea sold indicated that demand was not at its peak, some premium district produce remained unsold.

Our information was that BOPF grade tea from Nuwara Eliya remained unsold. Brokers added rather than sell at lower prices such teas were withdrawn. Last week too the same reason was attributed to teas from Nuwara Eliya being unsold.

The main reason given for this phenomenon by the trade was not that the produce was substandard but that prices offered were not commensurate with the quality on offer. We did not receive any positive responses to the effect that this drawback would be rectified any time soon. However, there was a consensus that with the onset of the Western quality season improvements could be expected.

Rainy weather prevailing in most areas of the Western hills affected the quality of tea, but the general view among tea producers was that weather conditions would improve, thereby conducing to the production of quality teas.

Demand from Turkey Russia and CIS countries did not alter; demand was also observed from Libya and Iraq.

Industry sources reported that low growns met with fair demand, particularly the leafy segment. They reported that such demand would continue over the next few weeks.

However, a few members of the Tea Factory Owners Association, were not exuberant over the prices realized. They preferred no to be quoted, but said that prices could have been at better averages. This was the view of smallholders who supplied green leaf to the bought leaf segment.

Smallholders said that they were paid about SLR 150 per kilo of green leaf. Previously they were paid about SLR 250 per kilo for the bought leaf factory segment.

We also place on record that smallholders are responsible for about 75 percent of tea production.

Our position on these matters is that the problems affecting the tea sector should be collectively addressed by the relevant professional bodies; not least the Ministry of Plantation Industries.

Business

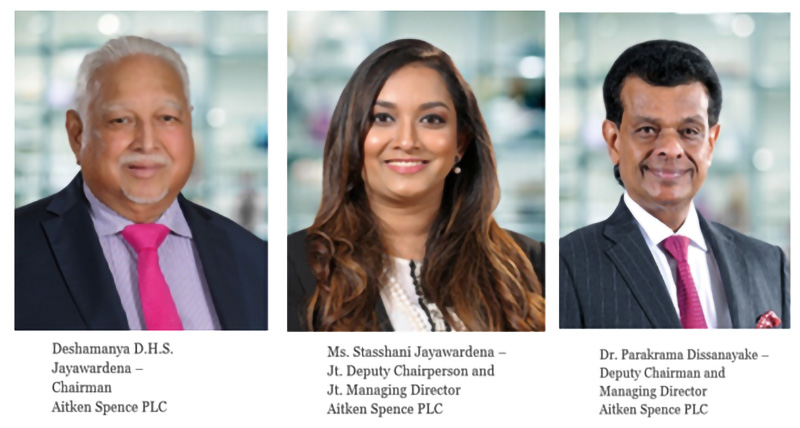

Aitken Spence reports robust performance with a 10.4% growth in EBITDA to reach Rs. 8.9 Bn in the first half of 2024/25

Aitken Spence PLC, a leading conglomerate with a diverse regional presence, reported an EBITDA (excluding impacts from foreign currency exchange gains and losses) of Rs. 8.9 billion for the six months ending 30th September 2024, reflecting a growth of 10.4%. EBITDA includes earnings from equity accounted investees; however, excludes interest expenses, tax, depreciation, and amortization. The Group’s profit from operations (excluding forex) improved significantly by 38.7% from Rs.2.5 billion to Rs. 3.5 billion for the six months ending 30th September.

The Group’s Maritime & Freight Logistics sector reported a PBT of Rs. 2.3 billion for the six months ending 30th September 2024. This performance was affected by a decline in business volumes and exchange rate fluctuations.

The Group’s Strategic Investment sector achieved a PBT of Rs. 728 million, reflecting a growth exceeding 100%. This impressive performance for the first six months of the year was largely driven by the improved results of hydro power companies and the settlement of previously delayed interest received by the other companies within the Group’s renewable energy segment.

The Group’s Tourism sector demonstrated a notable improvement, recording a decrease in losses of 36.9% for the six months ending 30th September 2024. The hospitality segment benefited from increased occupancy rates and higher average room rates, leading to better results for local hotels compared to last year.

However, the destination management segment faced several challenges this period. Macroeconomic factors, including the re-introduction of an 18% VAT on the sector, which could not be added to previously contracted rates with tour operators, significantly impacted results. Additionally, the ongoing conflicts in the Red Sea adversely affected cruise tourism and charter flights from Eastern Europe, further affecting the segment’s performance.

The Group’s Services sector recorded a loss of Rs. 52.1 million, primarily due to increased costs in the elevator segment, driven by additional costs incurred on the accelerated completion of several high-rise buildings in Colombo. Additionally, the sector was affected by a lower exchange rate on remittances in the money transfer business.

During this period, the Group’s Proft Before Tax (PBT) (excluding forex) of Rs. 1.5 billion saw a remarkable improvement recording a complete turnaround from the loss of Rs. 1.2 billion recorded in the previous year.

Sustainability

The Group remains committed to environmental, social, and economic sustainability. Led by Executive Director Dr. Rohan Fernando and reporting to both the Group Supervisory Board and the Main Board, the Group formed a Sustainability Council, comprising of Sectoral Managing Directors and C-Suite officials, to oversee sustainability-related targets, KPIs, and decisions. During the quarter, the Council was sensitised on the IFRS S1 and S2 standards with external topic experts. Within the Group’s Disaster Risk Reduction strategy, the Group conducted its first earthquake drill and night-time fire drill at Aitken Spence Towers. The Group also updated dashboards on its data management platform to monitor non-financial performance indicators. The Group’s total energy consumption within the organisation for 2Q at 376,507 GJ saw a 16% increase from 2Q, 2023-2024 due to increase in operations within the Tourism and Strategic Investments Sectors. Comparatively, the water consumption within the Group in 2Q at 854,243m3 was 34% less than 2Q, 2023-2024. More stringent actions are planned to align with the Group’s pathways for net zero and net positive impact goals. Further, supporting collaborative efforts of the country, Aitken Spence continued to host the Climate Emergency Task Force meetings of the UN Global Compact at Aitken Spence Towers to encourage fostering the discourse on climate action among businesses.

Spence Luminary

In order to create a culture of mentoring, Group HR established a pool of mentors under the ‘Spence Luminary’ banner to guide fellow Spensonians in navigating their careers and realising their full potential. This initiative commenced with a programme tailor-made to equip 50 senior leaders with mentoring/coaching skills. Subsequently, an online platform was launched to connect Spensonian across Aitken Spence with potential mentors/coaches.

Spence Ascend

As part of Aitken Spence DE&I agenda and ongoing theme #SpenceWomenatWork, 40 female Spensonians in the managerial category were provided the opportunity to follow a leadership development programme akin to a mini-MBA curated by Group HR in collaboration with the Postgraduate Institute of Management (PIM). This focused talent intervention is aimed at upskilling high potential female employees to take up leadership roles in the future, aligned with the Group’s aim to increase the percentage of women in leadership positions to 30% by 2030.

Listed in the Colombo Stock Exchange since 1983, Aitken Spence is anchored to a heritage of excellence spanning over 150 years and driven by a team of more than 13,000 across 16 industries in 11 countries: Sri Lanka, Maldives, Fiji, India, Oman, Myanmar, Mozambique, Bangladesh and Cambodia, Singapore, and UAE.

Business

Prof. P.N.D. Fernando assumes duties as Chairman of People’s Bank

Prof. P.N.D. Fernando officially took over as Chairman of People’s Bank on 18th November 2024 at a ceremony held at the bank’s Head Office attended by CEO/GM of People’s Bank, Clive Fonseka and the bank’s senior management.

Prof. Fernando brings with him over 25 years of experience in finance, banking, and higher education. He has made notable contributions as a leading academic, having served as a Professor and Head of the Department of Finance at the University of Kelaniya. With an impressive teaching tenure of more than 27 years, Prof. Fernando is recognized for his pioneering work in the academic sector, where he introduced several innovative degree programs and played a key role in elevating the standards of financial education in Sri Lanka. As Dean of the Faculty of Commerce and Management Studies, he spearheaded numerous initiatives, including the successful acquisition of World Bank AHEAD grants and ISO 21001 certification for the Kelaniya MBA program.

In addition to his academic achievements, Prof. Fernando holds a PhD in Government Economics from Central China Normal University. He also earned an MBA from the West Bengal University of Technology through a prestigious Colombo Plan scholarship and holds an undergraduate degree in Business Management (Accountancy) from the University of Kelaniya.

Prof. Fernando has been a trusted consultant and resource person for leading financial institutions in Sri Lanka, such as the Colombo Stock Exchange and the Securities and Exchange Commission of Sri Lanka.

On this occasion, Prof. Fernando expressed his gratitude for the opportunity to lead one of Sri Lanka’s most respected financial institutions. He emphasized his vision for People’s Bank, aiming to enhance digital transformation, drive customer-centric growth, and build a stronger, more sustainable banking network to support the evolving needs of the nation.

Business

Hela Apparel Holdings reports significantly improved financial performance in Q2 FY 2024/25

Hela Apparel Holdings PLC has announced a significant improvement in its financial performance during the quarter ended 30th September, with a return to operating profit for the first time in eight quarters. This positive result highlights the recovery of demand conditions in its key export markets and underscores the successful outcomes of its ongoing restructuring exercise.

The Hela Group’s revenue surged by 36.5% year-on-year to Rs. 23.4 billion in the second quarter of FY 2024/25. This was primarily driven by the contribution of the recently established Brand Licensing Division, following the acquisition of UK-based Focus Brands in January 2024. Sales for the existing Private Label Manufacturing Division were also supported by the ongoing recovery in demand from its key brand partners across the US and Europe.

Profitability for the Group demonstrated a significant improvement during the quarter, with gross profit increasing by 222.9% year-on-year to Rs. 4.5 billion. Notably, the manufacturing division recorded a gross profit margin of 16.6% in the second quarter, which is the highest level in 14 quarters. This was attributed to improved capacity utilisation and an ongoing shift in its customer mix towards higher-margin apparel brands.

As a result, the Hela Group recorded an operating profit of Rs. 557 million in the second quarter. This is the first recurring operating profit reported by the Group since the second quarter of FY 2022/23 and marks a turnaround in its financial performance. Operating profits were recorded by both divisions during the quarter, with the Brand Licensing Division also posting a profit-before-tax of LKR 343 million.

Expressing his thoughts on the Group’s results, A. R. Rasiah – Chairman of Hela Apparel Holdings PLC said, “I’m pleased with our improved performance during the second quarter, which reflects the positive impact of the strategic steps we’ve taken to reposition the Hela Group for growth and profitability. As we continue to work towards further improvement over the coming quarters, I would like to take this opportunity to thank our teams across the globe for their hard work in delivering this favourable result”.

Hela recently confirmed the successful oversubscription of its rights issue, which was completed immediately following the end of the quarter, to raise approximately Rs 1.6 billion. The Company has indicated that it considers this to be the first phase of a broader capital augmentation strategy to strengthen its balance sheet, with details of the subsequent phases to be determined and announced by the Board of Directors.

Commenting on the outlook, Dilanka Jinadasa – Group CEO of Hela Apparel Holdings PLC added, “We intend to build on the second quarter results to ensure a sustainable return to net profit over the coming quarters. Driving efficiencies across the wider group, whilst leveraging the synergies between the manufacturing and brand licensing divisions, will remain the key focus. Our recent exclusive partnership with Reebok to design, manufacture, and sell their outerwear products across the UK and Europe, is a great example of this and how we are expanding our service offering across the global fashion value chain”.

Hela Apparel Holdings PLC provides sustainability-focused apparel supply chain and brand management solutions encompassing design, sourcing, marketing, and distribution through its global footprint, which includes a brand licensing division based in the UK. The company works closely with global brands in the intimate, active, and kids’ wear product categories. With 10 manufacturing facilities across multiple destinations, 04 design centres, and 06 product showrooms in key markets, the Hela Group’s multifaceted workforce tops 14,000 globally, and leads the industry in providing ethical and sustainable apparel solutions.

-

Life style2 days ago

Life style2 days agoKing of coconuts heads for a golden future

-

Features6 days ago

Features6 days agoAdani’s ‘Power’ in Sri Lanka

-

Latest News4 days ago

Latest News4 days agoColombo district preferential votes announced

-

News3 days ago

News3 days agoPresident warns his party: “We will fail if we view power as an entitlement to do as we please”

-

Editorial6 days ago

Editorial6 days agoWhen millers roar and Presidents mew

-

Midweek Review6 days ago

Midweek Review6 days agoGamani Corea:

-

Latest News4 days ago

Latest News4 days agoGampaha district: NPP 16, SJB 3

-

News1 day ago

News1 day agoNPP appoints two defeated candidates as NL MPs