Business

Skills Beyond Borders: Are Sri Lankan returnee migrant workers equipped for migration triumph?

Piyumi Ranadewa is a Research Assistant working on migration and urbanisation policy research at IPS. She holds a BSc (Hons) in Agriculture, specialising in Agriculture Economics and Business (First Class) from Wayamba University of Sri Lanka, graduating with Dean’s Honours. She also holds a Master of Agri-Enterprise and Technology Management from Wayamba University of Sri Lanka. Her research interests include urbanisation, tourism, green economy, climate change and agribusiness value chains. (Talk with Piyumi – piyumir@ips.lk)

Piyumi Ranadewa is a Research Assistant working on migration and urbanisation policy research at IPS. She holds a BSc (Hons) in Agriculture, specialising in Agriculture Economics and Business (First Class) from Wayamba University of Sri Lanka, graduating with Dean’s Honours. She also holds a Master of Agri-Enterprise and Technology Management from Wayamba University of Sri Lanka. Her research interests include urbanisation, tourism, green economy, climate change and agribusiness value chains. (Talk with Piyumi – piyumir@ips.lk)

By Piyumi Ranadewa

“I can speak the language and based on my previous experiences, I believe I can handle the work once I remigrate, and I don’t need further training,” says Ms Herath Manike from Maho in Kurunegala. She has previously migrated to Kuwait and Jordan as a domestic housekeeping assistant and is now contemplating re-migration.

Returnee migrant workers often possess a wealth of knowledge and skills acquired during their time overseas, leading them to feel adequately equipped for the global job market. However, in today’s rapidly evolving international job market, adaptability and acquiring new skill sets are essential for sustained career growth. Relying solely on existing skills can lead to complacency and hinder long-term prospects. Continuous up-skilling can open doors to more stable and higher-earning employment opportunities. The Global Compact for Safe, Orderly and Regular Migration (GCM) also underscores the necessity to invest in skills development and promote mutual recognition of skills, qualifications, and competencies.

A recent study by the Institute of Policy Studies of Sri Lanka (IPS) for Skilled and Resilient Migrant Workers (SRMW) project focusing on 511 return migrants in Sri Lanka revealed that among the surveyed participants, 56% of respondents had taken steps towards re-migration, and 193 are considering re-migration within 2023. Notably, among them [out of 193), 68% have not pursued further formal training. Moreover, 84% of these respondents believed their current skills were sufficient for overseas employment. As Sri Lanka unveils its Labour Migration Policy 2023-2027, it is timely to shed light on the importance of skill development for re-migration.

The Context: Potential for Upskilling

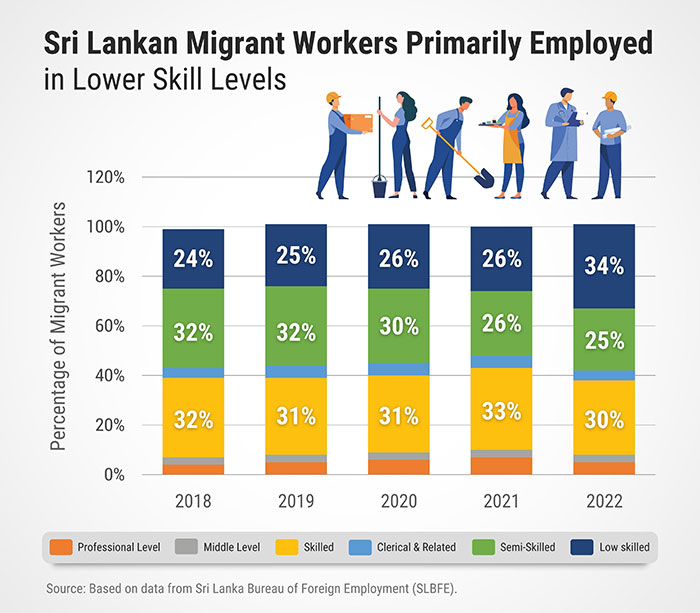

In Sri Lanka, migration is seen as a promising pathway to improved job opportunities, as evident from the recent long queues at passport offices. A significant proportion of Sri Lankan migrant workers were in semi-skilled and low-skilled categories. Most labour migrants are concentrated in Middle Eastern countries, which are common destinations for both skilled and unskilled workers. This aligns with the study findings, which indicated that many of these migrants were engaged in elementary occupations (domestic workers and other low and semi-skilled categories) during their recent overseas employment.

Although most re-migrants from Sri Lanka have been employed in lower-skilled jobs, they have great potential to improve their prospects by acquiring new skills through upskilling. However, the practice of upskilling is not widespread among this group. For example, Sri Lanka predominantly relies on foreign domestic workers among its migrant workers. However, there is a growing demand for specialised services like nursing and elderly care. These specialised jobs often offer better pay than foreign domestic workers. Enhancing the skills of returning domestic workers can open up job opportunities in sectors beyond domestic work, particularly in healthcare.

Reluctance for Skill Development

Ms Manike, who pursued a small coir business after her recent migration, is now facing economic difficulties that have led her to consider re-migration. However, she hesitates to participate in skill development programmes, driven by her immediate need to generate income through migration and her confidence in her past experience. Therefore, her primary focus is on addressing urgent financial needs, leaving limited space for dedicating time and effort to upskilling.

Similar to Manike’s perspective, most returnee migrant workers planning to remigrate believe their previous training or experience from overseas would suffice, overlooking the need for continuous skill upgrading. Furthermore, in scenarios where re-migration is not voluntary but a necessity due to compelling circumstances, individuals may be forced to re-migrate without the opportunity or motivation to upgrade skills to pursue better employment opportunities overseas.

If returnee migrant workers consider upskilling, many often opt for informal training or overlook skill development due to perceived opportunity costs and age-related barriers associated with formal skill training programmes available in the country. They fear that dedicating time and resources to formal training might not yield immediate returns on investment, leading them to choose informal learning options instead. Additionally, age-related concerns can make some migrant workers reluctant to enrol in formal training, as they feel they are past the ideal age for learning new skills.

Another significant barrier to skill development for returning migrants is the lack of targeted and tailored training programmes. For instance, during a Focus Group Discussion (FGD) conducted in Anuradhapura, reluctance to undergo formal training on the grounds that there is no suitable training available in Sri Lanka for the specific machines used while working abroad, was cited as an example. As these workers aspire to find better opportunities upon their return, access to advanced and customised training becomes a pivotal factor in their career growth.

Skill Gap and Awareness

While Sri Lanka has taken many steps to provide support services for upskilling and skill recognition for migrant workers, such as the recent collaboration between the SLBFE and the Vocational Training Authority (VTA) to offer specialised training tailored to foreign employment needs, concerns remain regarding the effective dissemination of vital information to the intended beneficiaries.

As found in the IPS’ study, while a majority of respondents have completed their education up to Grade 10, surprisingly, only 20% were aware of National Vocational Qualification (NVQ) levels. Although returnee migrant workers tend to favour informal training, a notable 76% (out of 511 individuals) had not acquired Recognition of Prior Learning (RPL) credentials. These credentials serve to formally acknowledge the skills acquired through informal means. This highlights a significant gap and lack of awareness regarding formal skill development and recognition among the respondents.

The Way Forward

While the self-perceived competence of returnee migrant workers is a positive attribute, relying solely on existing skills without further training and formal recognition of available qualifications may hinder the personal and professional growth opportunities of returnee migrant workers. Therefore, it is crucial to foster a culture of lifelong learning and skill development to support returnee migrant workers in their re-migration journey and enable them to thrive in a dynamic job market. This involves creating awareness about the importance of ongoing education and training and providing accessible and relevant learning opportunities. Some recommended strategies include:

Improve dissemination of information and guidance about skill development programmes and raise awareness about the importance of upskilling,

Facilitate awareness and accessibility to available skill development programmes through easily accessible user-friendly platforms like websites or mobile applications.

Foster collaboration between the public and private sectors and educational institutes to develop targeted training programmes specifically tailored for migrant workers planning to remigrate. These programmes should align closely with industry needs and incorporate hands-on experience.

Establish networking and mentorship programmes that connect migrant workers with professionals in their fields, providing guidance, collaboration opportunities, and skill enhancement support.

Promote existing RPL and accreditation of informal skills, encouraging migrant workers to pursue upskilling opportunities.

Link to original blog: https://www.ips.lk/talkingeconomics/2023/09/11/skills-beyond-borders-are-sri-lankan-returnee-migrant-workers-equipped-for-migration-triumph/

Business

Tax revenue rebound seen as reshaping SL’s sovereign risk outlook

Sri Lanka’s improving tax performance is reshaping its sovereign risk outlook. With the tax-to-GDP ratio rebounding to 15.4% from pre-crisis lows near 10%, markets are seeing early signs that fiscal consolidation is becoming structurally anchored—supporting debt sustainability, IMF programme credibility and a gradual return to capital markets.

Finance and Planning Deputy Minister Dr. Anil Jayantha Fernando said on Monday that tax revenue is on track to reach 16% of GDP by the end of this year, marking one of the strongest fiscal reversals in the country’s recent history. Speaking at a ceremony at the Inland Revenue Department (IRD) to present appointment letters to 100 newly recruited Assistant Commissioners, he said all three main revenue-collecting agencies—the IRD, Sri Lanka Customs and the Excise Department—have exceeded their annual targets.

From a macroeconomic standpoint, the recovery in revenue mobilisation reduces Sri Lanka’s reliance on debt accumulation, monetary financing and ad hoc tax measures—key vulnerabilities highlighted during the economic crisis. Dr. Fernando said the Government’s medium-term objective of lifting the tax-to-GDP ratio to 20% is achievable if credibility in fiscal governance continues to improve.

He attributed the revenue surge primarily to the restoration of trust between the state and taxpayers rather than to technology or enforcement alone. Improved compliance, he said, reflects growing confidence that public funds are being managed transparently and directed towards development priorities, reversing years of entrenched tax evasion linked to weak governance.

Fernando also stressed the correlation between higher tax ratios and lower corruption, noting that Sri Lanka’s revenue base had eroded sharply during periods of institutional decay. The recent rebound, he said, signals renewed accountability and more disciplined public financial management.

On public sector reform, he rejected the narrative that the public service is inherently a fiscal burden, arguing that inefficiencies stemmed from decades of politically motivated recruitment. The government, he said, is now rebuilding the public service through merit-based, competitive recruitment, aligned with broader public sector transformation and fiscal capacity. The newly appointed officers, he added, will play a critical role in strengthening revenue administration and policy implementation.

Turning to structural growth constraints, Dr. Fernando highlighted low labour force participation—particularly among women—as a key drag on income expansion and future revenue potential. Despite women accounting for a majority of the population, female participation remains below 30%, limiting productivity growth and narrowing the tax base. Raising participation levels, he said, is essential to sustaining higher growth over the medium term.

He also stressed the importance of simplifying the tax system to improve predictability and compliance while ensuring all eligible taxpayers are captured. Sustainable revenue growth, he reiterated, must come from broadening the base rather than imposing excessive burdens on a narrow segment of taxpayers.

By Ifham Nizam

Business

WTS IPO opens tomorrow

The Initial Public Offering (IPO) of WealthTrust Securities Limited (WTS) will open tomorrow, inviting the public to subscribe for 71,548,244 Ordinary Voting Shares at an Issue Price of LKR 7.00 per share. Through the Issue, WTS seeks to raise a total of LKR 500,837,708, with the Company’s shares expected to be listed on the Diri Savi Board of the Colombo Stock Exchange (CSE).

WTS is a Primary Dealer authorised by the Central Bank of Sri Lanka, and is also licensed by the Securities and Exchange Commission of Sri Lanka as a Stock Broker (Debt) and Stock Dealer (Debt). The proceeds of the IPO are intended to further strengthen the Company’s core capital buffer and support the expansion of its investment and trading portfolio in government securities, enhancing capacity to manage market and interest rate risk while supporting sustained value creation.

The Issue is being managed by Asia Securities Advisors (Private) Limited as Manager and Financial Advisor to the Issue. With the offering priced at a discount to valuation benchmarks cited in the Prospectus, and with broad-based interest typically seen in well-positioned capital market listings, WTS enters its opening day with positive sentiment and strong anticipation among prospective investors.

Business

CBC Finance lists on the Colombo Stock Exchange

CBC Finance Ltd, a subsidiary of the Commercial Bank of Ceylon PLC commemorated its listing on the Colombo Stock Exchange (CSE) by way of the issuance of LKR 1.5 bn worth of debentures by the ceremonial ringing of the market opening bell on the CSE trading floor.

CBC Finance Ltd raised LKR 1.5 Bn on 27th November 2025 with an oversubscription of an issue of 15 Mn Listed Rated Unsecured Subordinated Redeemable Debentures for a tenure of five years and a fixed interest rate of 11.50% p.a. payable annually (AER 11.50%), with a par value of LKR 100/- and an issue rating of “BBB+(lka)” by Fitch Ratings Lanka Limited.

Sharhan Muhseen, Chairman of CBC Finance Ltd and the Commercial Bank of Ceylon PLC, who was the events keynote speaker remarked upon the companies listing and CBC Finance’s role, commenting: “We are a key part of the economy. The development of the capital market is essential for the economic growth of the country. Thus, through this debenture issue, we encourage investors to participate in the development of the capital markets which is a key driver of economic growth.”

Delivering her welcome address at the event, Ms. Nilupa Perera, Chief Regulatory Officer of CSE, remarked upon the wide array of products CSE offers, stating: “The Colombo Stock Exchange has introduced several innovative instruments, from Shariah compliant debt instruments to GSS+ instruments – Green bonds, Social Bonds, Blue Bonds, sustainable and sustainability linked bonds, perpetual bonds and high yield debenture bonds. We hope that CBC Finance Ltd will use CSE to raise capital through these instruments.”

CBC Finance Ltd., formerly known as Indra Finance Ltd. and subsequently re-named as Serendib Finance Ltd., was acquired by Commercial Bank of Ceylon PLC in 2014. The company was established in 1987 as Indra Finance Ltd and has 21 branches island wide, delivering a wide range of financial services to Individual and SME segments, and enjoys an A (lka) Stable from Fitch Ratings Lanka Limited. In the financial year 2024, the company recorded a net profit of LKR 82 Mn and successfully expanded its Total Asset Base to LKR 17 bn. Its parent company, The Commercial Bank of Ceylon PLC, was named Sri Lanka’s Best Trade Finance Bank at the prestigious Euromoney Transaction Banking Awards 2025.

-

Business6 days ago

Business6 days agoCabinet approves establishment of two 50 MW wind power stations in Mullikulum, Mannar region

-

News7 days ago

News7 days agoGota ordered to give court evidence of life threats

-

Features6 days ago

Features6 days agoCliff and Hank recreate golden era of ‘The Young Ones’

-

Features6 days ago

Features6 days agoSri Lanka and Global Climate Emergency: Lessons of Cyclone Ditwah

-

Editorial6 days ago

Editorial6 days agoExperience vs. Inexperience

-

News6 days ago

News6 days agoWFP scales up its emergency response in Sri Lanka

-

News7 days ago

News7 days agoSpecial programme to clear debris in Biyagama

-

Features3 days ago

Features3 days agoWhy Sri Lanka Still Has No Doppler Radar – and Who Should Be Held Accountable