Business

Report to be soon out on those who slip through the tax net

by Sanath Nanayakkare

Acting Minister of Finance Ranjith Siyambalapitiya told the media recently that he is making a report on tax evasions and ways to bring those who evade taxes under the tax net and the complete report would be presented to President Ranil Wickremesinghe on June1.

“Sri Lanka is one of the few countries in the world pursuing the hardest fiscal targets to restore stability, therefore, nothing matters more to reach these targets than maintaining the country’s fiscal discipline and this report is primarily aimed at increasing state revenue,” he said.

Further speaking he said:

“Sri Lanka has been carrying a large budget deficit over the years. The IMF has asked us to maintain our budget deficit at 13% percent of the Gross Domestic Product (GDP) if we are to get out of the serous fiscal imbalances. But the challenge here is currently this ratio stands at 25%. This means we have to cut the budget deficit by half in the next few years. This is going to be a very difficult task for the Ministry of Finance and the government. There are two ways to do it. One is by increasing state revenue and the other is by reducing state expenditure. At present there is no room for the government to increase state revenue through taxes because we have already come to a maximum tax-increase threshold. So what we have to do is expanding the tax base to ensure a structurally sound revenue level. There are people and businesses that make taxable earnings but still do not pay due taxes. They keep evading taxes.”

“These days I am making a report on how these individuals manage to slip through the tax net and how they can be brought under it. This report is also being made with the objective of eliminating the need for levying taxes from the same industries and investments and professionals and establishing a neutral tax code for all taxable entities and individuals. I will be handing this report to President Ranil Wickremesinghe on 1st June 2023,” he said.

The International Monetary Fund (IMF) said recently that Sri Lanka’s tax reforms were necessary for the cash-strapped country to regain the confidence of creditors, following which hikes in taxes and utility bills came into effect.

President Ranil Wickremesinghe who is also the finance minister hiked corporate tax to 30 per cent from 24 per cent in January 2023, after raising Value Added Tax (VAT) to 15 per cent last year. He introduced tax hikes with effect from January 2023 widely believed to be on demand by the IMF.

“Sri Lanka is among the countries to collect the least amount of fiscal revenue in the world, with tax revenue to GDP ratio at only 7.3 per cent in 2021. External creditors are not willing to provide financing to fill this gap”, the IMF said in a recent statement.

President Wickremesinghe said in Aranayake on May 20 that the IMF imposed tough conditions on Sri Lanka but the authorities had no other option but to seek its assistance.

“Similar conditions were presented to consecutive governments during negotiations with the IMF in the past and they withdrew from transactions with the IMF and I was one of them. But today we have to follow through the IMF programme as what is prescribed in it is what the country should do to achieve stability in the long term. I believe it will be possible to complete the debt restructuring programme by September this year, recommence paying our suspended loans and get rid of our declared bankrupt status,” he said.

Business

Global Insurance leaders to converge in Colombo for MDRT Sri Lanka Day 2026

In a first for Sri Lanka’s insurance industry, the country will host MDRT Sri Lanka Day 2026, also known as International Insurance Day, bringing together global leaders, professionals and organisations from the international financial services and insurance sectors.

The initiative, organised by the Million Dollar Round Table (MDRT), will mark Sri Lanka’s inaugural MDRT Day and is scheduled to be held on 18 May 2026.

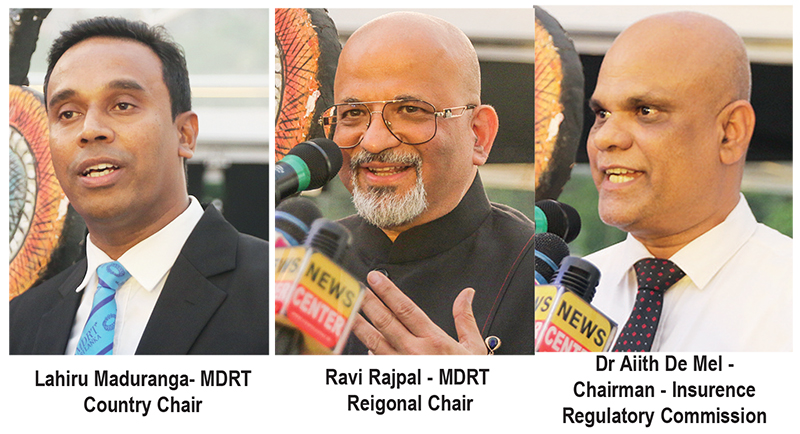

MDRT Country Chair – Sri Lanka, Lahiru Maduranga, said the event would provide a significant opportunity to position Sri Lanka on the global insurance and financial services map.

“This is an excellent opportunity for Sri Lanka to host such a prestigious event and to promote the country’s standing globally,” Maduranga said.

He made these remarks at the official sundown launch announcing the event, held on 26 January at 8 Degrees on the Lake, Cinnamon Lakeside, Colombo.

The launch was attended by the Chairman and Director General of the Insurance Regulatory Commission of Sri Lanka, chief executive officers of insurance companies, and regional and zonal chairs of MDRT, at which the official date of MDRT Sri Lanka Day 2026 was unveiled.

Maduranga said the landmark event aims to bring the spirit and experience of the MDRT Annual Meeting to the Sri Lankan MDRT community. The programme will feature the MDRT President, Executive Committee members and internationally renowned speakers, offering world-class insights, inspiration and professional development aligned with MDRT values.

He noted that many Sri Lankan MDRT members face challenges in attending the Annual Meeting overseas due to foreign exchange constraints and visa limitations. Of more than 1,200 MDRT achievers in Sri Lanka, only around 50 were able to attend the Annual Meeting in the United States.

“This initiative marks a significant step forward in strengthening the MDRT culture in Sri Lanka and in elevating professional standards within the local insurance services sector,” Maduranga said.

The MDRT Membership Communication Committee (MCC) serves as the official liaison between MDRT Headquarters in the United States and the Sri Lankan MDRT community, overseeing communication, engagement and coordination with the local financial services sector.

Founded in 1927 in the United States, the Million Dollar Round Table (MDRT) is the world’s most prestigious association of insurance and financial services professionals. MDRT represents the highest standards of professional excellence, ethics and performance in the industry. Its Annual Meeting, traditionally held in the United States, attracts more than 10,000 top-performing members from around the world each year.

By Hiran H Senewiratne

Business

ESOFT UNI Kandy leads the charge in promoting rugby among private universities

With the aim of fostering a passion for rugby among students in private universities and higher education institutes across Sri Lanka, ESOFT UNI Kandy has launched a special sports development initiative.

As a part of this program, a series of rugby encounters were recently organized between the ESOFT UNI Kandy rugby team and the SLIIT Kandy Uni rugby team. The matches were held at the Peradeniya University Rugby Grounds.

Two highly competitive matches were played during the event. In the first game, the ESOFT UNI Kandy rugby team secured a victory over SLIIT Kandy Uni with a score of 17-07. They maintained their winning streak in the second match as well, defeating their opponents with a final score of 12-07.

This initiative is seen as a significant step toward building a robust sporting culture within the private higher education sector in the hill capital.

The initiation has been started with Rugby and will soon be extended to Cricket, Football, Martial Arts, Badminton, Hockey, Chess, and other areas of sports as well. ESU believes that the development of soft skills, parallel to higher education, will help shape highly capable, industry-ready, and employable students who can confidently face any personal and professional challenges they encounter during their journey.

Dimuthu Thammitage, General Manager, ESU Central Region said: Today’s job market demands highly employable individuals who possess not only educational qualifications but also strong soft skills, which can be effectively developed through sports. Therefore, we warmly invite other educational institutions to join hands with us in producing highly employable students together through sports.

Lakpriya Weerasinghe, Deputy General Manager, ESU Kandy said: At ESOFT Uni, we believe that sports play a vital role in improving students’ personalities through the development of essential soft skills. Therefore, we encourage our students to actively join our clubs and enhance their soft skills alongside their academic education.

Oshara Chamod Bandara, MIC Rugby Club, ESU Kandy said: Sports are iconic to Kandy. As the MIC of the ESU Kandy Rugby Team, I am truly happy to see the enthusiasm of our students towards sports while actively engaging in their studies. I warmly invite other students to join our clubs and further develop their skills alongside their academic journey.

Text and Pix By S.K. Samaranayake

Business

Altair issues over 100+ title deeds post ownership change

Altair Residences have, over the past six months, seen more than 100 individual title deeds being executed by apartment owners, providing owners with a clear, registered, legal title to their apartments in accordance with Sri Lankan property law. This has been a key initiative by the new owners and management of Altair to improve governance and will continue in an orderly manner in the coming months.

With the transition of ownership to Blackstone India, Altair’s Management Council has also been formally constituted, enabling owners to play an active and proactive role in the management of the Altair building. In addition, the management council has appointed Realty Management Services (RMS), a subsidiary of Overseas Realty Ceylon PLC, as the new facility manager of Altair.

Commenting on these milestones, Thilan Wijesinghe, Chairman of TWC Holdings, who, together with a team from TWC, represents Blackstone’s interests in Sri Lanka, said, “The issuance of individual title deeds is a critical step in any professionally developed residential asset. Over the past six months, this process at Altair has moved forward in a structured and transparent manner, alongside the formal establishment of owner-led governance. This, combined with the appointment of experienced facility managers are fundamental building block for long-term value-creation for apartment owners and proper asset stewardship.”

With ongoing improvements to the building being undertaken by Indocean Developers Pvt Ltd (IDPL), the owning company of Altair, the issuance of deeds to owners is expected to accelerate over the coming months.

-

Business6 days ago

Business6 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business3 days ago

Business3 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion2 days ago

Opinion2 days agoSri Lanka, the Stars,and statesmen

-

Business1 day ago

Business1 day agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Opinion6 days ago

Opinion6 days agoLuck knocks at your door every day

-

Business1 day ago

Business1 day agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business1 day ago

Business1 day agoArpico NextGen Mattress gains recognition for innovation

-

Editorial1 day ago

Editorial1 day agoGovt. provoking TUs