Features

Nexus between money, exchange rate, money printing and inflation

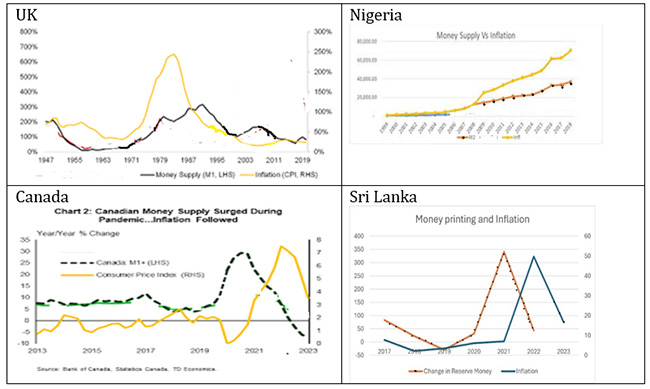

Money, exchange rates, and money printing are crucial components of a nation’s monetary policy framework, wielding significant influence over economic and financial stability. This intricate relationship between these fundamental factors directly affects financial and economic dynamics. I am going to examine the nexus between these factors, clarifying their roles in the financial system and the implications of their interactions. The relationship between money supply and money printing is symbiotic, with the latter directly influencing the former.

Money, exchange rates, and money printing are crucial components of a nation’s monetary policy framework, wielding significant influence over economic and financial stability. This intricate relationship between these fundamental factors directly affects financial and economic dynamics. I am going to examine the nexus between these factors, clarifying their roles in the financial system and the implications of their interactions. The relationship between money supply and money printing is symbiotic, with the latter directly influencing the former.

Money

Recently, Emeritus Professor of Economics, Sirimal Abeyratne, explained the meanings of some economic concepts about money and inflation. He emphasised that in economics, money transcends mere physical notes and coins circulating in the system. Similarly, he clarified that money printing does not entail the simplistic act of “multiplying sacks of coins or bundles of notes”, akin to minting physical currency.

Money supply, often referred to as the money stock, encompasses the total quantity of money circulating within an economy at a given time. It includes various forms of money such as currency, demand deposits, and other liquid instruments. Money supply acts as the lifeblood of economic transactions, facilitating exchange, investment, and consumption activities. Central to the concept of money supply are its determinants, including central bank policies, commercial bank lending practices, and public demand for money. Changes in these determinants can influence the quantity of money in circulation, impacting economic activity and price levels.

Reverse causal relationships

Crucially, Professor Abeyratne highlighted the concept of reverse causation between the stock of money, which is determined (a multiplier) by reserve money, and inflation through the mechanism of increased aggregate demand. It suggests that money supply, can impact aggregate demand, subsequently influencing inflationary pressures within the economy. Therefore by understanding the complexities inherent in concepts like money supply, money printing, and their implications for inflation and aggregate demand, policymakers and economists can formulate more informed and effective monetary policy strategies to foster economic stability and growth.

Money printing

According to Dr. Nandalal Weerasinghe, the Governor of the Central Bank of Sri Lanka (CBSL), money printing can be defined as the change in reserve money, denoted as M0, which represents the injection of fresh money into the economy. Reserves consist of the stock of cash and funds, including statutory reserves, deposited by commercial banks with the CBSL. In 2020 and 2021, the increase in M0 (money printing) was LKR 372 billion, while the money stock (M2 broad) rose by LKR 3,024 billion.

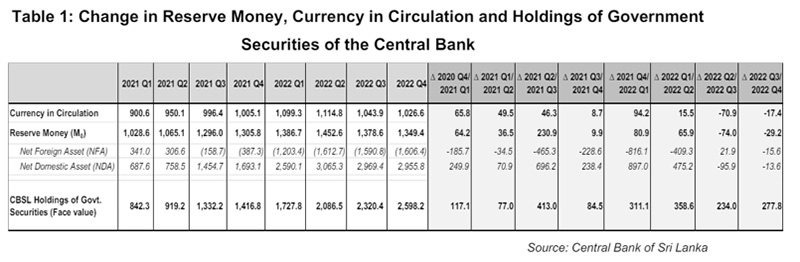

CBSL further explains (Janaka Edirisinghe Deputy Director Economic Research Department) that in economic terms, the Central Bank has two primary methods for issuing new money into the economy. Firstly, when the Central Bank extends credit to licensed commercial banks or the government, it effectively creates new money, termed as the accumulation of domestic assets. Secondly, when the Central Bank acquires foreign exchange from the domestic foreign exchange market or government inflows, it generates new money, known as the accumulation of foreign assets. The combined value of these two assets is referred to as reserve money. Therefore, the main way to measure money printing is by looking at the change in Reserve Money. Table 1 shows this indicator along with other measures used to evaluate money printing. (See Table 01)

Money and Economic Growth

Money printing, also known as quantitative easing (QE) when conducted by central banks, involves the electronic creation of new money to purchase financial assets like government bonds or mortgage-backed securities. Central banks employ money printing as a monetary policy tool to achieve specific objectives such as lowering interest rates, boosting aggregate demand, and achieving target levels of inflation.

When central banks engage in money printing through QE programs, they inject newly created money into the financial system, thereby increasing the overall money supply. This liquidity infusion aims to lower interest rates, stimulate borrowing and spending, and ultimately expand the money supply to support economic activity especially during economic downturns or deflationary periods. However, the effectiveness of money printing in achieving these goals is debated due to potential unintended consequences like asset price inflation and currency depreciation.

Conversely, a contractionary monetary policy, such as reducing the pace of money printing or tightening monetary conditions, can lead to a decrease in the growth rate of the money supply or even a contraction. This reduction in money supply growth can dampen economic activity, increase borrowing costs, and potentially contribute to deflationary pressures.

Nexus of financial factors

From a financial perspective, we may have to go beyond analysing the bi-directional relationship between reserve money and inflation, via mediation of aggregate demand. Deeper study is necessary to explore the multi-directional and mutually co-integrated nature of relationships among the most prominent variables in financial market dynamics. While central banks employ money printing to achieve objectives like lowering interest rates and boosting aggregate demand, its effectiveness and potential drawbacks, such as asset price inflation and currency depreciation, remain subjects of debate.

The nexus between money supply, money printing, aggregate demand, inflation, exchange rate and stock market performance are complex and mutually influential. When central banks engage in money printing, they aim to bolster aggregate demand by injecting liquidity into the financial system. This liquidity expansion can lead to increased consumer spending, business investment, and overall economic activity. Conversely, a contractionary monetary policy, such as reducing the pace of money printing, can dampen aggregate demand by limiting liquidity and tightening financial conditions.

Aggregate Demand

Incorporating aggregate demand into the nexus provides a holistic view of monetary policy’s impact on economic outcomes. Changes in money supply and money printing influence aggregate demand, which in turn affects consumption, investment, and overall economic growth. Moreover, fluctuations in aggregate demand can feedback into monetary policy decisions, shaping central banks’ strategies to achieve macroeconomic objectives.

Foreign Reserves and Exchange Rate

Incorporating the value of money against the US dollar into the nexus reveals another dimension. Changes in money supply and money printing can influence the value of the currency against the US dollar, which in turn affects various aspects of the economy such as trade competitiveness and foreign exchange reserves.

Sri Lanka receives foreign exchange from exports, remittances, tourism, investments, loans, and other sources. Commercial banks handle most inflows for their clients, while the Central Bank manages government transactions. When the government needs foreign currency but lacks it, the Central Bank steps in, reducing its foreign assets. To cover this, the government exchanges Sri Lankan rupees with the Central Bank, possibly reducing the money supply unless it borrows more. Once all foreign exchange needs are met, the Central Bank can buy foreign currency from banks, increasing its assets and injecting new money into the economy.

Conclusion

In conclusion, the nexus between money, money printing, aggregate demand, inflation, exchange rate and stock market performance underscores the intricate relationship between monetary policy actions and economic and financial dynamics. While money printing can influence money supply dynamics, its effectiveness and implications depend on various factors such as economic conditions, policy implementation, and market expectations.

Sri Lanka receives foreign exchange from various sources. When the government requires foreign currency, the Central Bank of Sri Lanka (CBSL) uses its foreign assets to exchange Sri Lankan rupees, potentially reducing the money supply unless the government borrows more. After meeting all requirements, the CBSL purchases foreign currency from banks, increasing its assets and injecting new money into the economy.

Hence, it’s crucial to craft policy tools meticulously, navigating these dynamics to meet the country’s goals of stable prices, sustainable economic growth, and financial stability.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)

Features

Disaster-proofing paradise: Sri Lanka’s new path to global resilience

iyadasa Advisor to the Ministry of Science & Technology and a Board of Directors of Sri Lanka Atomic Energy Regulatory Council A value chain management consultant to www.vivonta.lk

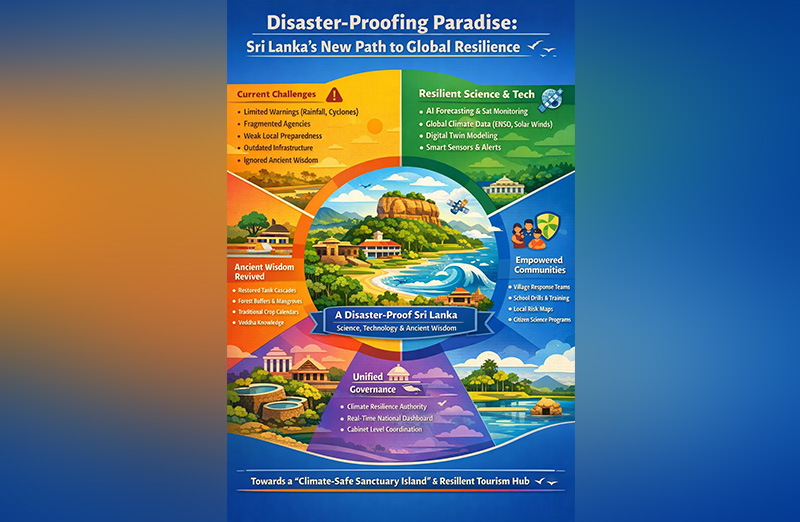

As climate shocks multiply worldwide from unseasonal droughts and flash floods to cyclones that now carry unpredictable fury Sri Lanka, long known for its lush biodiversity and heritage, stands at a crossroads. We can either remain locked in a reactive cycle of warnings and recovery, or boldly transform into the world’s first disaster-proof tropical nation — a secure haven for citizens and a trusted destination for global travelers.

The Presidential declaration to transition within one year from a limited, rainfall-and-cyclone-dependent warning system to a full-spectrum, science-enabled resilience model is not only historic — it’s urgent. This policy shift marks the beginning of a new era: one where nature, technology, ancient wisdom, and community preparedness work in harmony to protect every Sri Lankan village and every visiting tourist.

The Current System’s Fatal Gaps

Today, Sri Lanka’s disaster management system is dangerously underpowered for the accelerating climate era. Our primary reliance is on monsoon rainfall tracking and cyclone alerts — helpful, but inadequate in the face of multi-hazard threats such as flash floods, landslides, droughts, lightning storms, and urban inundation.

Institutions are fragmented; responsibilities crisscross between agencies, often with unclear mandates and slow decision cycles. Community-level preparedness is minimal — nearly half of households lack basic knowledge on what to do when a disaster strikes. Infrastructure in key regions is outdated, with urban drains, tank sluices, and bunds built for rainfall patterns of the 1960s, not today’s intense cloudbursts or sea-level rise.

Critically, Sri Lanka is not yet integrated with global planetary systems — solar winds, El Niño cycles, Indian Ocean Dipole shifts — despite clear evidence that these invisible climate forces shape our rainfall, storm intensity, and drought rhythms. Worse, we have lost touch with our ancestral systems of environmental management — from tank cascades to forest sanctuaries — that sustained this island for over two millennia.

This system, in short, is outdated, siloed, and reactive. And it must change.

A New Vision for Disaster-Proof Sri Lanka

Under the new policy shift, Sri Lanka will adopt a complete resilience architecture that transforms climate disaster prevention into a national development strategy. This system rests on five interlinked pillars:

Science and Predictive Intelligence

We will move beyond surface-level forecasting. A new national climate intelligence platform will integrate:

AI-driven pattern recognition of rainfall and flood events

Global data from solar activity, ocean oscillations (ENSO, MJO, IOD)

High-resolution digital twins of floodplains and cities

Real-time satellite feeds on cyclone trajectory and ocean heat

The adverse impacts of global warming—such as sea-level rise, the proliferation of pests and diseases affecting human health and food production, and the change of functionality of chlorophyll—must be systematically captured, rigorously analysed, and addressed through proactive, advance decision-making.

This fusion of local and global data will allow days to weeks of anticipatory action, rather than hours of late alerts.

Advanced Technology and Early Warning Infrastructure

Cell-broadcast alerts in all three national languages, expanded weather radar, flood-sensing drones, and tsunami-resilient siren networks will be deployed. Community-level sensors in key river basins and tanks will monitor and report in real-time. Infrastructure projects will now embed climate-risk metrics — from cyclone-proof buildings to sea-level-ready roads.

Governance Overhaul

A new centralised authority — Sri Lanka Climate & Earth Systems Resilience Authority — will consolidate environmental, meteorological, Geological, hydrological, and disaster functions. It will report directly to the Cabinet with a real-time national dashboard. District Disaster Units will be upgraded with GN-level digital coordination. Climate literacy will be declared a national priority.

People Power and Community Preparedness

We will train 25,000 village-level disaster wardens and first responders. Schools will run annual drills for floods, cyclones, tsunamis and landslides. Every community will map its local hazard zones and co-create its own resilience plan. A national climate citizenship programme will reward youth and civil organisations contributing to early warning systems, reforestation (riverbank, slopy land and catchment areas) , or tech solutions.

Reviving Ancient Ecological Wisdom

Sri Lanka’s ancestors engineered tank cascades that regulated floods, stored water, and cooled microclimates. Forest belts protected valleys; sacred groves were biodiversity reservoirs. This policy revives those systems:

Restoring 10,000 hectares of tank ecosystems

Conserving coastal mangroves and reintroducing stone spillways

Integrating traditional seasonal calendars with AI forecasts

Recognising Vedda knowledge of climate shifts as part of national risk strategy

Our past and future must align, or both will be lost.

A Global Destination for Resilient Tourism

Climate-conscious travelers increasingly seek safe, secure, and sustainable destinations. Under this policy, Sri Lanka will position itself as the world’s first “climate-safe sanctuary island” — a place where:

Resorts are cyclone- and tsunami-resilient

Tourists receive live hazard updates via mobile apps

World Heritage Sites are protected by environmental buffers

Visitors can witness tank restoration, ancient climate engineering, and modern AI in action

Sri Lanka will invite scientists, startups, and resilience investors to join our innovation ecosystem — building eco-tourism that’s disaster-proof by design.

Resilience as a National Identity

This shift is not just about floods or cyclones. It is about redefining our identity. To be Sri Lankan must mean to live in harmony with nature and to be ready for its changes. Our ancestors did it. The science now supports it. The time has come.

Let us turn Sri Lanka into the world’s first climate-resilient heritage island — where ancient wisdom meets cutting-edge science, and every citizen stands protected under one shield: a disaster-proof nation.

Features

The minstrel monk and Rafiki the old mandrill in The Lion King – I

Why is national identity so important for a people? AI provides us with an answer worth understanding critically (Caveat: Even AI wisdom should be subjected to the Buddha’s advice to the young Kalamas):

‘A strong sense of identity is crucial for a people as it fosters belonging, builds self-worth, guides behaviour, and provides resilience, allowing individuals to feel connected, make meaningful choices aligned with their values, and maintain mental well-being even amidst societal changes or challenges, acting as a foundation for individual and collective strength. It defines “who we are” culturally and personally, driving shared narratives, pride, political action, and healthier relationships by grounding people in common values, traditions, and a sense of purpose.’

Ethnic Sinhalese who form about 75% of the Sri Lankan population have such a unique identity secured by the binding medium of their Buddhist faith. It is significant that 93% of them still remain Buddhist (according to 2024 statistics/wikipedia), professing Theravada Buddhism, after four and a half centuries of coercive Christianising European occupation that ended in 1948. The Sinhalese are a unique ancient island people with a 2500 year long recorded history, their own language and country, and their deeply evolved Buddhist cultural identity.

Buddhism can be defined, rather paradoxically, as a non-religious religion, an eminently practical ethical-philosophy based on mind cultivation, wisdom and universal compassion. It is an ethico-spiritual value system that prioritises human reason and unaided (i.e., unassisted by any divine or supernatural intervention) escape from suffering through self-realisation. Sri Lanka’s benignly dominant Buddhist socio-cultural background naturally allows unrestricted freedom of religion, belief or non-belief for all its citizens, and makes the country a safe spiritual haven for them. The island’s Buddha Sasana (Dispensation of the Buddha) is the inalienable civilisational treasure that our ancestors of two and a half millennia have bequeathed to us. It is this enduring basis of our identity as a nation which bestows on us the personal and societal benefits of inestimable value mentioned in the AI summary given at the beginning of this essay.

It was this inherent national identity that the Sri Lankan contestant at the 72nd Miss World 2025 pageant held in Hyderabad, India, in May last year, Anudi Gunasekera, proudly showcased before the world, during her initial self-introduction. She started off with a verse from the Dhammapada (a Pali Buddhist text), which she explained as meaning “Refrain from all evil and cultivate good”. She declared, “And I believe that’s my purpose in life”. Anudi also mentioned that Sri Lanka had gone through a lot “from conflicts to natural disasters, pandemics, economic crises….”, adding, “and yet, my people remain hopeful, strong, and resilient….”.

“Ayubowan! I am Anudi Gunasekera from Sri Lanka. It is with immense pride that I represent my Motherland, a nation of resilience, timeless beauty, and a proud history, Sri Lanka.

“I come from Anuradhapura, Sri Lanka’s first capital, and UNESCO World Heritage site, with its history and its legacy of sacred monuments and stupas…….”.

The “inspiring words” that Anudi quoted are from the Dhammapada (Verse 183), which runs, in English translation: “To avoid all evil/To cultivate good/and to cleanse one’s mind -/this is the teaching of the Buddhas”. That verse is so significant because it defines the basic ‘teaching of the Buddhas’ (i.e., Buddha Sasana; this is how Walpole Rahula Thera defines Buddha Sasana in his celebrated introduction to Buddhism ‘What the Buddha Taught’ first published in1959).

Twenty-five year old Anudi Gunasekera is an alumna of the University of Kelaniya, where she earned a bachelor’s degree in International Studies. She is planning to do a Master’s in the same field. Her ambition is to join the foreign service in Sri Lanka. Gen Z’er Anudi is already actively engaged in social service. The Saheli Foundation is her own initiative launched to address period poverty (i.e., lack of access to proper sanitation facilities, hygiene and health education, etc.) especially among women and post-puberty girls of low-income classes in rural and urban Sri Lanka.

Young Anudi is primarily inspired by her patriotic devotion to ‘my Motherland, a nation of resilience, timeless beauty, and a proud history, Sri Lanka’. In post-independence Sri Lanka, thousands of young men and women of her age have constantly dedicated themselves, oftentimes making the supreme sacrifice, motivated by a sense of national identity, by the thought ‘This is our beloved Motherland, these are our beloved people’.

The rescue and recovery of Sri Lanka from the evil aftermath of a decade of subversive ‘Aragalaya’ mayhem is waiting to be achieved, in every sphere of national engagement, including, for example, economics, communications, culture and politics, by the enlightened Anudi Gunasekeras and their male counterparts of the Gen Z, but not by the demented old stragglers lingering in the political arena listening to the unnerving rattle of “Time’s winged chariot hurrying near”, nor by the baila blaring monks at propaganda rallies.

Politically active monks (Buddhist bhikkhus) are only a handful out of the Maha Sangha (the general body of Buddhist bhikkhus) in Sri Lanka, who numbered just over 42,000 in 2024. The vast majority of monks spend their time quietly attending to their monastic duties. Buddhism upholds social and emotional virtues such as universal compassion, empathy, tolerance and forgiveness that protect a society from the evils of tribalism, religious bigotry and death-dealing religious piety.

Not all monks who express or promote political opinions should be censured. I choose to condemn only those few monks who abuse the yellow robe as a shield in their narrow partisan politics. I cannot bring myself to disapprove of the many socially active monks, who are articulating the genuine problems that the Buddha Sasana is facing today. The two bhikkhus who are the most despised monks in the commercial media these days are Galaboda-aththe Gnanasara and Ampitiye Sumanaratana Theras. They have a problem with their mood swings. They have long been whistleblowers trying to raise awareness respectively, about spreading religious fundamentalism, especially, violent Islamic Jihadism, in the country and about the vandalising of the Buddhist archaeological heritage sites of the north and east provinces. The two middle-aged monks (Gnanasara and Sumanaratana) belong to this respectable category. Though they are relentlessly attacked in the social media or hardly given any positive coverage of the service they are doing, they do nothing more than try to persuade the rulers to take appropriate action to resolve those problems while not trespassing on the rights of people of other faiths.

These monks have to rely on lay political leaders to do the needful, without themselves taking part in sectarian politics in the manner of ordinary members of the secular society. Their generally demonised social image is due, in my opinion, to three main reasons among others: 1) spreading misinformation and disinformation about them by those who do not like what they are saying and doing, 2) their own lack of verbal restraint, and 3) their being virtually abandoned to the wolves by the temporal and spiritual authorities.

(To be continued)

By Rohana R. Wasala ✍️

Features

US’ drastic aid cut to UN poses moral challenge to world

‘Adapt, shrink or die’ – thus runs the warning issued by the Trump administration to UN humanitarian agencies with brute insensitivity in the wake of its recent decision to drastically reduce to $2bn its humanitarian aid to the UN system. This is a substantial climb down from the $17bn the US usually provided to the UN for its humanitarian operations.

‘Adapt, shrink or die’ – thus runs the warning issued by the Trump administration to UN humanitarian agencies with brute insensitivity in the wake of its recent decision to drastically reduce to $2bn its humanitarian aid to the UN system. This is a substantial climb down from the $17bn the US usually provided to the UN for its humanitarian operations.

Considering that the US has hitherto been the UN’s biggest aid provider, it need hardly be said that the US decision would pose a daunting challenge to the UN’s humanitarian operations around the world. This would indeed mean that, among other things, people living in poverty and stifling material hardships, in particularly the Southern hemisphere, could dramatically increase. Coming on top of the US decision to bring to an end USAID operations, the poor of the world could be said to have been left to their devices as a consequence of these morally insensitive policy rethinks of the Trump administration.

Earlier, the UN had warned that it would be compelled to reduce its aid programs in the face of ‘the deepest funding cuts ever.’ In fact the UN is on record as requesting the world for $23bn for its 2026 aid operations.

If this UN appeal happens to go unheeded, the possibilities are that the UN would not be in a position to uphold the status it has hitherto held as the world’s foremost humanitarian aid provider. It would not be incorrect to state that a substantial part of the rationale for the UN’s existence could come in for questioning if its humanitarian identity is thus eroded.

Inherent in these developments is a challenge for those sections of the international community that wish to stand up and be counted as humanists and the ‘Conscience of the World.’ A responsibility is cast on them to not only keep the UN system going but to also ensure its increased efficiency as a humanitarian aid provider to particularly the poorest of the poor.

It is unfortunate that the US is increasingly opting for a position of international isolation. Such a policy position was adopted by it in the decades leading to World War Two and the consequences for the world as a result of this policy posture were most disquieting. For instance, it opened the door to the flourishing of dictatorial regimes in the West, such as that led by Adolph Hitler in Germany, which nearly paved the way for the subjugation of a good part of Europe by the Nazis.

If the US had not intervened militarily in the war on the side of the Allies, the West would have faced the distressing prospect of coming under the sway of the Nazis and as a result earned indefinite political and military repression. By entering World War Two the US helped to ward off these bleak outcomes and indeed helped the major democracies of Western Europe to hold their own and thrive against fascism and dictatorial rule.

Republican administrations in the US in particular have not proved the greatest defenders of democratic rule the world over, but by helping to keep the international power balance in favour of democracy and fundamental human rights they could keep under a tight leash fascism and linked anti-democratic forces even in contemporary times. Russia’s invasion and continued occupation of parts of Ukraine reminds us starkly that the democracy versus fascism battle is far from over.

Right now, the US needs to remain on the side of the rest of the West very firmly, lest fascism enjoys another unfettered lease of life through the absence of countervailing and substantial military and political power.

However, by reducing its financial support for the UN and backing away from sustaining its humanitarian programs the world over the US could be laying the ground work for an aggravation of poverty in the South in particular and its accompaniments, such as, political repression, runaway social discontent and anarchy.

What should not go unnoticed by the US is the fact that peace and social stability in the South and the flourishing of the same conditions in the global North are symbiotically linked, although not so apparent at first blush. For instance, if illegal migration from the South to the US is a major problem for the US today, it is because poor countries are not receiving development assistance from the UN system to the required degree. Such deprivation on the part of the South leads to aggravating social discontent in the latter and consequences such as illegal migratory movements from South to North.

Accordingly, it will be in the North’s best interests to ensure that the South is not deprived of sustained development assistance since the latter is an essential condition for social contentment and stable governance, which factors in turn would guard against the emergence of phenomena such as illegal migration.

Meanwhile, democratic sections of the rest of the world in particular need to consider it a matter of conscience to ensure the sustenance and flourishing of the UN system. To be sure, the UN system is considerably flawed but at present it could be called the most equitable and fair among international development organizations and the most far-flung one. Without it world poverty would have proved unmanageable along with the ills that come along with it.

Dehumanizing poverty is an indictment on humanity. It stands to reason that the world community should rally round the UN and ensure its survival lest the abomination which is poverty flourishes. In this undertaking the world needs to stand united. Ambiguities on this score could be self-defeating for the world community.

For example, all groupings of countries that could demonstrate economic muscle need to figure prominently in this initiative. One such grouping is BRICS. Inasmuch as the US and the West should shrug aside Realpolitik considerations in this enterprise, the same goes for organizations such as BRICS.

The arrival at the above international consensus would be greatly facilitated by stepped up dialogue among states on the continued importance of the UN system. Fresh efforts to speed-up UN reform would prove major catalysts in bringing about these positive changes as well. Also requiring to be shunned is the blind pursuit of narrow national interests.

-

Sports5 days ago

Sports5 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne

-

News3 days ago

News3 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Sports6 days ago

Sports6 days agoTime to close the Dickwella chapter

-

Features4 days ago

Features4 days agoIt’s all over for Maxi Rozairo

-

News6 days ago

News6 days agoEnvironmentalists warn Sri Lanka’s ecological safeguards are failing

-

News4 days ago

News4 days agoDr. Bellana: “I was removed as NHSL Deputy Director for exposing Rs. 900 mn fraud”

-

News3 days ago

News3 days agoDons on warpath over alleged undue interference in university governance

-

Features6 days ago

Features6 days agoDigambaram draws a broad brush canvas of SL’s existing political situation