Business

Nestlé Lanka inaugurates new Rs.1.1bn biomass boiler at Kurunegala Factory

Continuing its journey of doing good for Sri Lanka, Nestlé Lanka invested in a biomass boiler project at its state-of-the-art factory in Kurunegala. The biomass boiler is a key initiative in the ‘Good Food Good Life’ company’s journey towards reaching net zero carbon emissions across the value chain by 2050.

Nestlé strongly believes in conducting its operations sustainably in a manner which positively impacts not only people, but also the planet. This LKR 1.1 billion investment will facilitate the transition from the use of furnace oil to biomass for generating steam in its manufacturing operations. This transition will lead to a 90% reduction in carbon emissions generated from current steam boilers.

Sunil Handunneththi inaugurated the new biomass boiler at the Kurunegala Factory on the 27th of February 2025. The inauguration ceremony also witnessed the participation of H.E. Dr. Siri Walt, Ambassador of Switzerland to Sri Lanka and the Maldives, Professor Tilak Hewawasam, Chairman – Central Environmental Authority, and Mr. Vish Govindasamy, Past Chairman of the Ceylon Chamber of Commerce and Chair of the Chamber’s Clean Sri Lanka Initiatives.

Sharing her thoughts, Dr. Siri Walt stated “Nestlé has a longstanding presence in Sri Lanka of almost 120 years producing household names like MAGGI, MILO and NESTOMALT. But Nestlé is also a sustainability champion with its aim to reach net zero carbon emissions by 2050. The groundbreaking investment into this biomass boiler is a testimony to this. I am delighted to see Nestlé’s investment into innovation and sustainability, a priority for Switzerland and Sri Lanka.”

Business

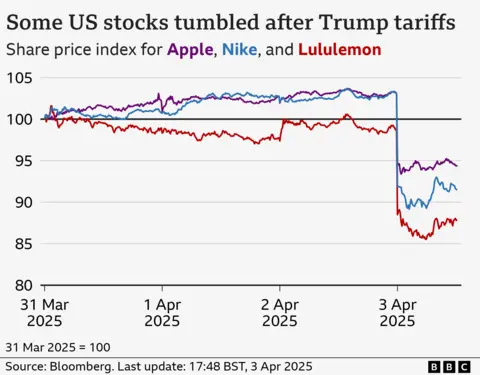

Trump tariffs trigger steepest US stocks drop since 2020 as China, EU vow to hit back

Global stocks have sunk, a day after President Donald Trump announced sweeping new tariffs that are forecast to raise prices and weigh on growth in the US and abroad.

Stock markets in the Asia-Pacific region fell for a second day, hot on the heels of the US S&P 500, which had its worst day since Covid crashed the economy in 2020.

Nike, Apple and Target were among big consumer names worst hit, all of them sinking by more than 9%.

At the White House, Trump told reporters the US economy would “boom” thanks to the minimum 10% tariff he plans to slap on imports in the hope of boosting federal revenues and bringing American manufacturing home.

The Republican president plans to hit products from dozens of other countries with far higher levies, including trade partners such as China and the European Union. China, which is facing an aggregate 54% tariff, and the EU, which faces duties of 20%, both vowed retaliation on Thursday.

Tariffs are taxes on goods imported from other countries, and Trump’s plan that he announced on Wednesday would hike such duties to some of the highest levels in more than 100 years.

The World Trade Organization said it was “deeply concerned”, estimating trade volumes could shrink as a result by 1% this year.

Traders expressed concern that the tariffs could stoke inflation and stall growth.

In early trading on Friday, Japan’s benchmark Nikkei 225 index fell by 1.8%, the Kospi in South Korea was around 1% lower and Australia’s ASX 200 dipped by 1.4%.

On Thursday, the S&P 500 – which tracks 500 of the biggest American firms – plunged 4.8%, shedding roughly $2tn in value.

The Dow Jones closed about 4% lower, while the Nasdaq tumbled roughly 6%. The US shares sell-off has been going on since mid-February amid trade war fears.

Earlier, the UK’s FTSE 100 share index dropped 1.5% and other European markets also fell, echoing declines from Japan to Hong Kong.

On Thursday at the White House, Trump doubled down on a high-stakes gambit aimed at reversing decades of US-led liberalisation that shaped the global trade order.

“I think it’s going very well,” he said. “It was an operation like when a patient gets operated on, and it’s a big thing. I said this would exactly be the way it is.”

He added: “The markets are going to boom. The stock is going to boom. The country is going to boom.”

Trump also said he was open to negotiating with trade partners on the tariffs “if somebody said we’re going to give you something that’s so phenomenal”.

On Thursday, Canada’s Prime Minister Mark Carney said that country would retaliate with a 25% levy on vehicles imported from the US.

Trump last month imposed tariffs of 25% on Canada and Mexico, though he did not announce any new duties on Wednesday against the North American trade partners.

Firms now face a choice of swallowing the tariff cost, working with partners to share that burden, or passing it on to consumers – and risking a drop in sales.

That could have a major impact as US consumer spending amounts to about 10% – 15% of the world economy, according to some estimates.

While stocks fell on Thursday, the price of gold, which is seen as a safer asset in times of turbulence, touched a record high of $3,167.57 an ounce at one point on Thursday, before falling back.

The dollar also weakened against many other currencies.

In Europe, the tariffs could drag down growth by nearly a percentage point, with a further hit if the bloc retaliates, according to analysts at Principal Asset Management.

In the US, a recession is likely to materialise without other changes, such as big tax cuts, which Trump has also promised, warned Seema Shah, chief global strategist at the firm.

She said Trump’s goals of boosting manufacturing would be a years-long process “if it happens at all”.

“In the meantime, the steep tariffs on imports are likely to be an immediate drag on the economy, with limited short-term benefit,” she said.

On Thursday, Stellantis, which makes Jeep, Fiat and other brands, said it was temporarily halting production at a factory in Toluca, Mexico and Windsor, Canada.

It said the move, a response to Trump’s 25% tax on car imports, would also lead to temporary layoffs of 900 people at five plants in the US that supply those factories.

On the stock market, Nike, which makes much of its sportswear in Asia, was among the hardest hit on the S&P, with shares down 14%.

Shares in Apple, which relies heavily on China and Taiwan, tumbled 9%.

Other retailers also fell, with Target down roughly 10%.

Motorbike maker Harley-Davidson – which was subject of retaliatory tariffs by the EU during Trump’s first term as president – fell 10%.

In Europe, shares in sportswear firm Adidas fell more than 10%, while stocks in rival Puma tumbled more than 9%.

Among luxury goods firms, jewellery maker Pandora fell more than 10%, and LVMH (Louis Vuitton Moet Hennessy) dropped more than 3% after tariffs were imposed on the European Union and Switzerland.

“You’re seeing retailers get destroyed right now because tariffs extended to countries we did not expect,” said Jay Woods, chief global strategy at Freedom Capital Markets, adding that he expected more turbulence ahead.

[BBC]

Business

Overcoming initial delays, Sampur solar energy project becomes a reality

The long-anticipated Sampur solar energy project is finally set to break ground, marking a significant leap in Sri Lanka’s renewable energy ambitions. After years of delays and negotiations, the Power Purchase Agreement (PPA) for the Surya Danavi 120 MW Solar Farm in Santhosapuram, Trincomalee District, was officially signed on April 1st between the National Thermal Power Corporation of India (NTPC) and the Ceylon Electricity Board (CEB).

This initiative, spearheaded by Trincomalee Power Company Limited (TPCL), a 50:50 joint venture between NTPC and CEB, is expected to be a game-changer in the country’s energy landscape.

The project will be implemented in two phases. Phase 1 involves the installation of a 50 MW solar plant along with the construction of 37 km of 220 kV transmission lines connecting Sampur to Kappalthurai. In Phase 2, an additional 70 MW capacity will be added, complemented by 77 km of transmission lines extending from Kappalthurai to New Habarana.

President Anura Kumara Dissanayake played a crucial role in renegotiating the unit tariff to 5.97 US Cents, which includes a battery storage system to mitigate fluctuations in solar power generation.

According to Ministry of Energy Director General Eng. Pubudu Niroshan Hedigallage, this project is a testament to Sri Lanka’s commitment to renewable energy and energy security.

“For years, Sampur has been at the center of numerous energy debates. This project not only signifies the shift from fossil fuels to cleaner alternatives but also strengthens our grid resilience. The inclusion of battery storage makes this project particularly promising, said Hedigallage.

He further emphasized the importance of strategic partnerships in achieving energy sustainability. “Collaborations like the one between NTPC and CEB show the potential of cross-border energy projects. With India’s vast experience in solar energy, Sri Lanka can benefit immensely in terms of both technology transfer and cost efficiency.”

The Sampur region has long been embroiled in energy-related controversies. Previously earmarked for a coal power plant, the area saw fierce opposition from environmental activists and policy shifts that led to its cancellation. The transition from coal to solar in Sampur is seen as a redemption of sorts, aligning with global climate goals and Sri Lanka’s own commitment to increasing renewable energy in its power mix.

by Ifham Nizam

Business

SriLankan Airlines positioning Sri Lanka as a hub for culturally discerning travellers

SriLankan Airlines is amplifying its commitment to nurturing Sri Lanka’s performing arts scene, leveraging classical Western music and homegrown talent to position the island as a hub for culturally discerning travelers.

The national carrier partnered with the Gustav Mahler Society of Colombo (GMSC) to support the 2025 Spring Concert at Colombo’s Lionel Wendt Theatre on March 29.

The event showcased Sri Lankan classical guitarist Jude Peiris alongside Japanese artists Hiroshi Kogure (violin) and Miyuki Funatsu (soprano), blending local and global artistry. This marks the airline’s sixth collaboration with GMSC, reinforcing its three-year role as the society’s Official Airline Partner.

Dimuthu Tennakoon, Head of Commercial at SriLankan Airlines, emphasised the strategic value of performing arts saying: “World-class cultural productions can transform Sri Lanka into a magnet for travelers seeking immersive experiences. By honing local talent, we unlock immense potential in the growing cultural tourism sector.”

Deepal Perera, Manager of Corporate Communications, highlighted the airline’s dual role: “We’re not just bridging geographies—we’re fostering global exchanges of music and tradition. Sri Lankan artists deserve platforms to shine internationally, and partnerships like this propel them forward.”

GMSC’s Music Director, Srimal Weerasinghe, praised the airline’s impact: “SriLankan Airlines has been instrumental in developing Western classical music here, sponsoring visiting professionals and helping build Sri Lanka’s first professional orchestra. Their support has elevated our global reputation.”

Beyond GMSC, SriLankan Airlines continues to partner with local arts groups and diplomatic missions, cementing its role as a cultural ambassador.

By Sanath Nanayakkare

-

News5 days ago

News5 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

Sports6 days ago

Sports6 days agoSri Lanka’s eternal search for the elusive all-rounder

-

News7 days ago

News7 days agoGnanasara Thera urged to reveal masterminds behind Easter Sunday terror attacks

-

Sports2 days ago

Sports2 days agoTo play or not to play is Richmond’s decision

-

News6 days ago

News6 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features6 days ago

Features6 days agoSanctions by The Unpunished

-

Features6 days ago

Features6 days agoMore parliamentary giants I was privileged to know

-

Latest News4 days ago

Latest News4 days agoIPL 2025: Rookies Ashwani and Rickelton lead Mumbai Indians to first win