Business

Learnings for Sri Lanka on SOE Reforms – Singapore’s Temasek Holdings

Introduction

A super-holding company for managing State-Owned Enterprises (SOEs) has been identified as a globally successful model for SOE management. This model allows the government to adopt a more arms-length approach to SOEs’ operational decision-making, relieving it of the direct responsibility of overseeing all the SOEs dispersed across various industries, and redirect its budget and energy elsewhere. The merits of this model have enabled countries such as Malaysia and Singapore, which have similar holding company structures, to ensure impressive performances of their SOEs.

This article is the first of a three-part series where part one and two provide an in depth analysis of the case of Singapore’s and Malaysia’s SOE holding company models (Singapore’s Temasek Holdings and Malaysia’s Khazanah Nasional), and their role in enabling economic growth and development for the respective countries. Part three will provide learnings for Sri Lanka, which can be adopted for the country’s SOE reform process. This series of articles is a joint effort by the Ceylon Chamber of Commerce (CCC) and the Colombo Stock Exchange (CSE).

Part One: Singapore’s Temasek Holdings

Overview

Temasek was incorporated in 1974 under the Singapore Companies Act to hold and manage assets previously held by the Singapore Government. The objective of transferring assets to a commercial company was to free the Ministry of Finance of the responsibility so that it could focus on its core role of policymaking and regulations, while Temasek would own and manage these SOEs (also known as Government-linked Companies – GLCs) on a commercial basis.

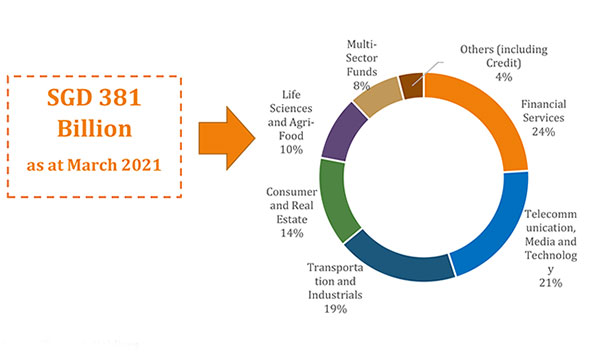

Similar to any commercial company, Temasek has its own Board of Directors and a professional management team. It pays taxes to the government and distributes dividends to its shareholders. Temasek was established to contribute to Singapore’s economic growth by nurturing entities into world-class companies through effective stewardship and strategically driven commercial investments. Today, it operates in 9 countries and its portfolio value amounted to SGD 381 billion as at the end of March 2021. This is equivalent to around USD 283 billion, which is about 6 times Sri Lanka’s external debt accumulated over the years and about 4 times the amount of Sri Lanka’s Gross Domestic Product (GDP).

Temasek invested mainly in Singaporean companies in its early days, but it has turned into a major global investor in recent years. Geographically, the majority of these investments are in China (27%) followed by Singapore (24%), America (20%) and rest of the world (12%). Temasek operates a diversified portfolio spread across many segments such as Financial Services, Telecom, Media, Technology and Transportation and Industry. Please refer figure 01 for a breakdown of sectors.

Source: Temasek Holdings

Why was Temasek Successful?

SOEs are generally regarded as inefficient firms because of political interference, and corruption. Despite this, various studies have shown that Singaporean SOEs exhibit higher valuations than non-SOEs, even after controlling for firm specific factors and also have better corporate governance practices.

The reasons for this lies in the political, social and economic context that Singapore faced during the period of self-governance to the early years of independence from the late 1950s to the early 1970s. The difficult economic conditions coupled with a challenging political environment in Singapore during this period played a significant role in nurturing good political governance in Singapore, which was in turn transposed to Singapore’s SOEs with good corporate governance practices. The Temasek corporate governance framework covers the following broad areas:

1. Board Governance

Temasek aims to help SOEs build effective boards by setting out guidelines on the appropriate composition of board, tenure of the directors, their size, and formation of specialized board committees.

2. Business Charters

Temasek encourages SOEs to stay focused on their core competencies and it will not disapprove of SOEs diversifying if it is done in the best interest of its shareholders.

3. Talent and Remuneration

Temasek encourages SOEs to recruit the best global talent and to reward them competitively.

4. Value Creation

Temasek works closely with their SOEs to adopt appropriate performance benchmarks to maximize returns on shareholder investments. It expects its companies to be profitable and generate a high rate of return on investment like any shareholder.

Therefore, Temasek’s stewardship has enabled SOEs to create value for their shareholders. This has led to the SOEs on average demonstrating higher valuations than non-SOEs, even after controlling for firm specific factors such as profitability, leverage, firm size, industry effect, and foreign ownership.

How has it Contributed to Development Goals?

Temasek is a government holding company that acts as a shareholder on behalf of the Singaporean government (Ministry of Finance). It pursues its developmental mandate by buying direct stakes in global companies, mostly in Singapore and Asian, and then reinvesting its proceeds from asset sales and dividend income into foreign assets, acting similar to a private equity fund.

The arms-length approach from the government has made it possible for Temasek’ to manage its financing and exercise independence. Temasek hasn’t received any regular financing from the government in its close to 50-year history, but receives ad-hoc occasional injections from time to time, which are publicly disclosed.

The compounded annualised total shareholder return since inception in 1974 is at 14% in Singapore dollar terms. The Temasek foundation oversees 23 non-profit philanthropic projects, and has positively impacted 1.5 million lives across Asia and Singapore through their community work.

Contribution to Reserves

In terms of the contributions to the Singaporean economy, the Singapore government can include around 50% of Temasek’s expected long term returns along with the Government of Singapore Investment Corporation (GIC) and Monetary Authority of Singapore (MAS) investment returns. These three institutions contribute to government reserves through the Net Investment Returns Contribution (NIRC). NIRC is comprised of up to 50% of the Net Investment Returns (NIR) on the net assets invested by GIC, MAS and Temasek, and the Net Investment Income (NII) derived from past reserves from the remaining assets.

The full brief can be accessed at: Holding Company for SOEs: Learnings for Sri Lanka.

Business

Budget 2025: A spectrum of reactions and perspectives

By Sanath Nanayakkare

The 2025 Government Budget has begun to attract multiple comments from the corporate sector, academics, the government ranks and the Opposition. Reproduced below are a few of them.

First Capital Research’s analysts pointed out that the budget heavily leant towards social welfare and infrastructure development significantly increasing government expenditure.

“The already announced tax revenue measures and the digitalization drive are expected to boost Government Revenue allowing the Budget Deficit to be contained at 6.7% of GDP. A significant portion of increased government spending has been directed towards social spending with increased public sector salaries and pensions, coupled with higher allocation for assistance programs such as Aswesuma and other additional social benefits. While this ensures financial relief for many households, it also influences overall economic behavior in ways that will be felt across society. Efforts have also been made to support the lagging economy via public investments with spending targeted towards road construction, water projects, housing and city developments,” First Capital said.

“Despite the extravagant spending increases, a substantial increase in revenue is also planned with bulk of the revenue increase expected from taxes on vehicles while VAT on digital services, the imposition of corporate income tax on the export of services, and an increase in the corporate tax on cigarettes/liquor, and gaming is expected support to achieve the target. Further support is anticipated via digitalization and the expansion in the economy where the Government expects to provide a boost through spending on infrastructure, with the aim to balance spending with fiscal discipline while fostering long-term economic stability,” First Capital noted.

Government

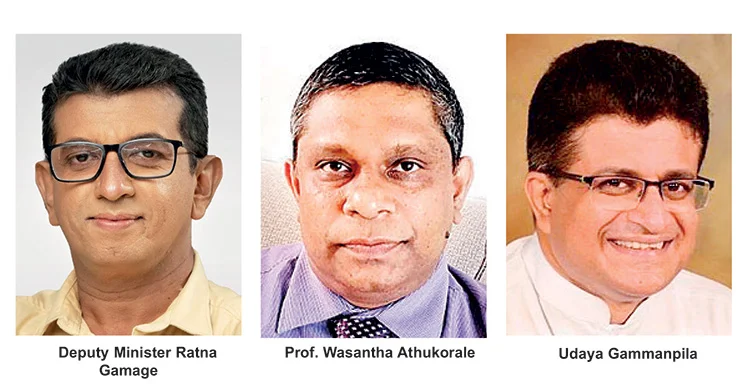

“The Opposition was helpless when the President presented a progressive budget that brings good times for the people of this country. It was the most successful budget when looking back at the budgets presented in the past few decades,” Deputy Minister of Fisheries Ratna Gamage said.

“The government has delivered the best salary increments for state employees. The basic salaries of all state employees have increased across the board in significant amounts. Deputy Minister of Labour, Mahinda Jayasinghe said.

Academics

“Sri Lanka needs new technology-driven production economy. For that the contribution of the private sector is needed. The budget has not focused on that aspect,” Economist Professor Wasantha Athukorale said.

“There is some risk emanating from the increase of state employee salaries which will cost Rs. 300 billion within the next three years. This is more than what is collected from PAYEE tax. Dhananath Fernando of Advocata said.

Opposition

“The Budget represented the voice of the IMF, the sovereign bondholders and the scam-laden super-rich,” Peratugami Activist Pubudu Jayagoda said.

“The Budget presented by President Anura Kumara Dissanayake was the mother of all deceptions”, SLPP General Secretary Sagara Kariyawasam said.

“When state employees get their salary in April, they will realize that they have been taken for a ride by the government, SJB MP Marikkar said.

Janasetha Peramuna leader Ven. Baththaramulle Seelarathan said the government which came to power through the massive support of Buddhist monks., has not made an allocation in the budget for enhancing the quality of education at Pirivenas although other areas of education had allocations.”

Udaya Gammanpila , Leader, Pivithuru Hela Urumaya said that they have identified 12 projects that no allocations were set apart for, through the budget.

Referring to a popular verse about wearing someone else’s pants and strutting about, Gammanpila said,” “The essence of the Budget reveals that the President is confidently adopting Ranil Wickremesinghe’s policies as if they were his own.

Business

‘Dependence on solar panels hindering national power grid stability’

By Ifham Nizam

As Sri Lanka accelerates its transition to renewable energy, particularly through the widespread adoption of rooftop solar installations, it is encountering significant hurdles in maintaining the stability of its national power grid.

While the country’s commitment to sustainability aligns with global trends, the increasing reliance on intermittent sources like solar energy has introduced complex challenges, especially during periods of low industrial demand such as weekends and holidays.

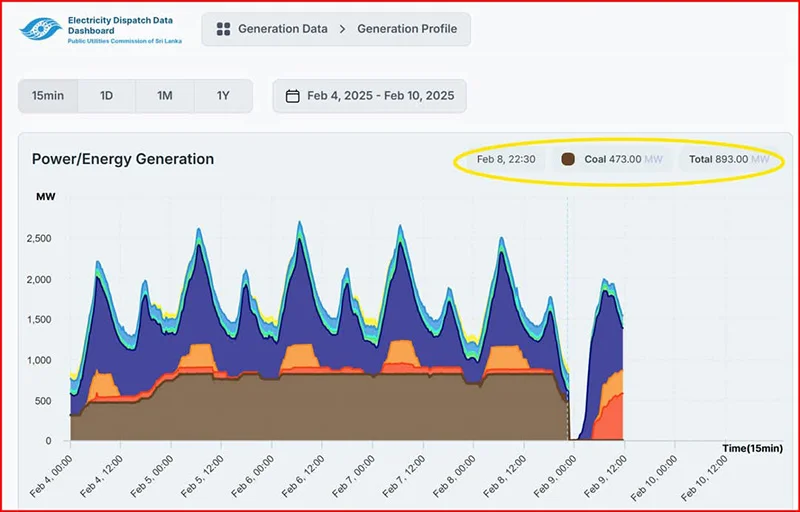

A senior electrical engineer, speaking to The Island Financial Review, raised alarm over the escalating frequency fluctuations and instability in the power system, particularly on sunny Sundays when energy demand plummets. The high penetration of non-despatchable renewable energy (NCRE), such as solar power, has reduced system inertia, putting the grid at a heightened risk of failure during these low-demand periods.

He said one critical example was on September 22, 2024, when the national grid registered its lowest demand of 670 MW at 10:53 AM. To keep the grid stable, the Ceylon Electricity Board (CEB) had to curtail 160 MW of solar power and other NCRE sources between 10:00 AM and 3:00 PM. This action was taken to elevate the grid demand to 820 MW, thus ensuring the dispatch of higher-inertia power plants that provide more stability.

Despite these efforts, the CEB has warned that continued low demand could lead to more frequent instances of under-frequency load shedding (UFLS). In extreme cases, the instability could even result in the tripping of large thermal power plants, such as the Lakvijaya Power Plant in Norochcholai.

The CEB has identified a series of interventions aimed at mitigating these risks and ensuring the power grid remains stable:

New Tariff Structures for Industries: The CEB proposes incentivized electricity rates for industries during weekends and holidays to encourage higher electricity consumption, helping to balance demand fluctuations.

Hydropower as a Stability Solution: Large hydroelectric plants, including Victoria, Kothmale, and Samanalawewa, could be operated in synchronous condenser mode, which would allow them to provide reactive power support without generating electricity, bolstering grid stability.

Gas Turbine Generators for Inertia Support: The operation of the Kelanitissa Gas Turbine 7, with its high inertia, in synchronous condenser mode is being considered to provide further grid stability.

Fast Frequency Response and Energy Storage: Investments in energy storage technologies such as battery energy storage systems (BESS), flywheel storage, and fast-acting gas turbines are seen as critical for stabilizing frequency fluctuations quickly.

NCRE Control Desk Implementation: A dedicated monitoring and forecasting unit for renewable energy generation will help to manage the fluctuating supply of renewable energy more effectively.

Review of Spinning Reserve Requirements: The CEB is reassessing the adequacy of the current hot spinning reserve of 5%, considering the growing proportion of renewable energy on the grid.

Regulatory Framework for NCRE Curtailments: The establishment of a regulatory mechanism to control the dispatch of renewable energy, particularly from plants larger than 5 MW, will be essential in ensuring grid stability.

Optimization of Power Plant Operations: The CEB is exploring ways to optimize the operations of hydro and thermal power plants, particularly concerning their minimum operating power levels and ramp rates, to increase the overall inertia of the system.

Business

Sri Lanka Bank’s Association welcomes budget as “Positive,” stresses importance of implementation

Sri Lanka’s banks have welcomed the maiden budget of the new government, describing it as “positive” and one that seeks to maintain policy consistency, especially on the fiscal path.

In a statement, the Sri Lanka Banks’ Association (SLBA), which represents all licensed banks in Sri Lanka, commended the budget proposals presented to Parliament by President Anura Kumara Dissanayake in his capacity as Minister of Finance, Planning and Economic Development.

In particular, the SLBA commended the budget’s emphasis on digitization, the proposed establishment of Credit Guarantee Institute for Small and Medium Enterprises (SMEs), and the focus on export orientation, and said the key to achieving the envisaged outcomes would be effective and consistent implementation of the proposals in both “letter and spirit.”

Pointing out that the banking sector contributed about 10% of government revenues in 2024 and continues to play a significant role in the growth agenda of the country, the SLBA said the country’s banks remain committed to supporting the implementation of the proposals in the budget.

The Association noted that Point-of-Sale (POS) machines at every VAT registered business entity would lead to transparent business transactions in digitized form, reducing the use of physical cash, and that this would result in a greater percentage of cash-flows being captured in the banking channels.

“Increased digitalization of the financial economy would also increase investments from the financial institutions into digital infrastructure to drive online transactions, tighten anti-money laundering procedures, improve surveillance, and control cyber-crime,” the SLBA said.

It said the establishment of a credible Credit Guarantee Institute for the SMEs and establishing a development bank through the infrastructure of an existing state bank are positive steps that should enhance the segment’s capacity to secure credit and improve the quality of its relationship with the banking sector.

-

News7 days ago

News7 days agoOracle Corporation pledges support for Sri Lanka’s digitalization

-

Sports4 days ago

Sports4 days agoRemarkable turnaround for Sri Lanka’s ODI team

-

Editorial7 days ago

Editorial7 days agoGroping in the dark

-

Opinion7 days ago

Opinion7 days agoShortage of medicines: Senaka Bibile Policy is the solution

-

Opinion7 days ago

Opinion7 days agoThe passing of Sarjana Karunakaran

-

News5 days ago

News5 days agoSpeaker agrees to probe allegations of ‘unethical funding’ by USAID

-

Business4 days ago

Business4 days agoUN Global Compact Network Sri Lanka: Empowering Businesses to Lead Sustainability in 2025 & Beyond

-

Features4 days ago

Features4 days agoScammed and Stranded: The Dark Side of Sri Lanka’s Migration Industry