News

Leading rice miller stops paddy purchasing citing losses, PMB still out of picture

By Sanath Nanayakkare

Leading rice miller, Lankeshwara Mithrapala says he has suspended purchasing paddy because it is not proper to purchase paddy from farmers at prices lower than Rs. 120 per kilo, and if he did purchase at that price, he would have to absorb a loss of Rs. 23 from each kilo of rice.

This is happening at a time the government has declared a certified price for paddy at Rs. 120 and the state-run Paddy Marketing Board (PMB) is keeping itself completely out of its main task of purchasing paddy from farmers to ensure a competitive and fair price to them.

When asked if there was some connivance between government officials and private millers to enable the purchasing of paddy at the lowest prices imaginable, Mithrapala said,” We don’t want anyone’s help to run our rice mills. But we can’t buy paddy at Rs. 120 per kilo and let the end-consumer buy a kilo of rice at Rs. 220-230 because of the loss we have to absorb in the process. There are various other brands, Nipuna, Araliya, Lak Sahal etc. If they could buy paddy at Rs. 120, they would because this is a competitive business. But they can’t buy at that price either because that would cause a substantial loss,” he said.

“If the government starts purchasing paddy, the farmers will be relieved,” he said.

Responding to queries, he said: “I bought paddy at Rs. 118-119 about 3-4 days ago. We can’t ask for paddy from farmers at prices lower than that. So, I decided to stop purchasing paddy and produce rice from existing stocks and release them to the market. It is better to stop buying paddy if Rs. 120 can’t be paid for a kilo of paddy. So, the government must intervene,” he said.

When asked if his business was running at a loss, he said,” I have enough money to operate my businesses. But I don’t have funds to collect and keep paddy stocks. What I am saying is that I will purchase paddy at Rs. 120 and will give rice at Rs. 220 per kilo. But to do that the government must declare a six-month moratorium on bank loans. If we have money to buy paddy stocks we would do so without seeking bank facilities because working with our own capital would bring us higher returns. But what do we do if we don’t have money?”

Elaborating on his costing issue he said: “When you buy paddy at Rs. 120 a kilo, there are other costs to take into calculation to run the business sustainably. It takes 1.6 kilos of paddy to produce a kilo of rice. This means the paddy cost itself would be Rs. 192. So when you buy at Rs.120, it actually costs Rs. 192 for paddy alone. For each kilo of rice; Rs. 7 for packaging, Rs. 7 for transport, Rs. 3.50 for electricity, Rs. 8.50 for employee salaries and food, Rs. 10-12 for bank interest.

Then there are the EPF and ETF payments and wear and tear costs of machinery. All these need to be calculated and recovered. These costs amount to about Rs 46 per kilo of rice. Effectively, therefore, the total cost of a kilo of rice is Rs. 238. But we sell to retailers at Rs. 215 and they sell at Rs. 220.

“So, this means that we are releasing our stocks to the market at a loss. That’s why we are saying that we can’t buy paddy at Rs. 120,” he said.

Meanwhile, a group of farmers in Polonnaruwa said: “We are compelled to sell our paddy to private sector traders because the government is just sitting around leaving the big rice millers to buy paddy. When the government does not come forward to break the monopoly of the private traders, we have no option but to sell our harvest to them at lower prices. When we sell them paddy at Rs. 100 a kilo, the income from one acre of paddy is only about Rs. 200,000 ,which is not enough to cover our inputs and labour cost. Big rice millers are making the most of this situation.”

The warehouses of PMB still remain closed and farmers have not been informed whether it would enter the market to purchase their paddy.A source familiar with state sector banking told The Island that PMB had outstanding loans of over Rs. 2 billion payable to the state banks.

News

Maldives Coast Guard Ship Huravee departs island

The Maldives Coast Guard Ship Huravee which arrived in Sri Lanka for replenishment purposes, departed the island on 04 Mar 26.

In accordance with naval tradition, the Sri Lanka Navy extended a customary farewell to the departing ship at the Port of Colombo

News

‘IRIS Dena was Indian Navy guest, hit without warning’, Iran warns US of bitter regret

A day after a US submarine sunk an Iranian Navy warship off the coast of Sri Lanka, the Foreign Minister of Iran, Sayed Abbas Araghchi, has warned that the US would “pay bitterly” for targeting a ship in international waters, The Tribune has reported.

Araghchi posted on social media platform X on Thursday saying, “The US has perpetrated an atrocity at sea, 2,000 miles away from Iran’s shores.”

The frigate IRIS Dena, a guest of India’s Navy carrying almost 130 sailors, was struck in international waters without warning, said the Iran Foreign Minister, adding, “Mark my words: The US will come to bitterly regret the precedent it has set.”

US Secretary of War, Pete Hegseth, on Wednesday confirmed that a US submarine fired a torpedo and sank the Iranian Navy vessel IRIS Dena west of Sri Lanka.

In a way, the Iran and US-Israel conflict has reached close to the Indian coast. The strike today at sea was almost 4,000 kms away from Iran, significantly expanding the radius of war. Already, fearing Iranian missile strikes, several US warships have moved eastward towards India.

These ships are in international waters. India has denied that any US Navy assets were using Indian ports. The Iranian ship, hit on Wednesday, was returning after participating in the international fleet review and exercise Milan hosted by India at Visakhapatnam.

The Iranian ship went down with almost 130 sailors on board missing. The Sri Lankan Navy, acting on a distress call, rescued 32 of the Iranian sailors. Hegseth confirmed the act by the US forces, saying the ship was hit in the Indian Ocean, stating, “an Iranian warship that thought it was safe in international waters. .. Instead, it was sunk by a torpedo”.

Hegseth did not name the Iranian ship that was attacked. But earlier, the Sri Lankan Navy reported the distress call from IRIS Dena when it was some 40 kms west of Galle, located on the south-western part of the island country. On February 16, the Iranian ship had sailed into the port of Visakhapatnam, where seventy-four nations participated.

Warships from Australia, Japan, South Korea, Russia, and dozens of others were anchored alongside the now-sunk Iranian vessel. Iran’s Navy Commander, Rear Admiral Shahram Irani, held talks with India’s Chief of Naval Staff on strengthening maritime security cooperation.

The theme was “United through Oceans.” Notably, the US Navy was supposed to send the guided-missile destroyer USS Pinckney to the exercise Milan; however, the ship was diverted to Singapore on February 15. The US did not field its warship in Milan, which had ships from Russia and Iran.

The exercise ended on February 25. Three days later, on February 28, the United States and Israel launched Operation Epic Fury. The IRIS Dena was transiting home. This morning at 5:08 a.m. local time, the IRIS Dena issued a distress call. Sri Lanka’s Foreign Minister, Vijitha Herath, informed parliament that two navy vessels and an aircraft were deployed. Thirty crew members were rescued and admitted to Karapitiya Hospital in Galle.

The Straits Times reported 32 critically wounded survivors. Reuters reported 101 missing and 78 wounded. The Sri Lankan Navy spokesman said the operation was conducted in line with the International Convention on Maritime Search and Rescue.

News

Risk of power cuts due to use of low-quality coal,PUCSL warns

The Public Utilities Commission of Sri Lanka (PUCSL) has warned of a possible risk of power cuts due to the use of inferior quality coal affecting generation capacity at the Lakvijaya Power Plant, according to a recent commission report.

The commission said the risk to the continuous electricity supply was assessed based on the peak demand forecast submitted by the Ceylon Electricity Board (CEB) for 2026.

According to the report, the analysis assumed that hydropower plants could contribute up to 1,300 MW to meet the night peak demand, while the Lakvijaya Power Plant (LVPS) would be able to contribute only up to 690 MW due to a capacity shortfall, assuming a 40 MW generation capacity reduction from each unit.

The PUCSL said the assessment was carried out taking into account the planned maintenance schedule submitted by the CEB. Under the schedule, Unit 1 of the Lakvijaya plant is due to undergo maintenance checks and repairs in June for a period of 25 days, while Unit 2 is scheduled for maintenance in July for another 25 days.

The report also noted that the 270 MW West Coast Power Plant is scheduled to undergo maintenance in April for 10 days, while the 150 MW Kelanitissa Combined Cycle Power Plant (KCCP 2) is expected to undergo maintenance during May, June and July.

Under normal conditions, the report said, there is a potential risk of a generation capacity shortage if electricity demand reaches 3,030 MW in April, 3,070 MW in June and 3,000 MW in July.

The highest recorded night peak demand so far in 2026 was 2,949 MW on February 25.

The PUCSL further warned that if one coal unit or any major power plant becomes unavailable from the existing generation mix, there would be a significant risk of a generation capacity shortage to meet the night peak demand, particularly during April, June and July.

Energy sector analysts said the use of substandard coal could further aggravate operational challenges at the Norochcholai plant, potentially affecting generation efficiency and reliability if corrective measures are not taken promptly.

By Ifham Nizam

-

Features5 days ago

Features5 days agoBrilliant Navy officer no more

-

Opinion5 days ago

Opinion5 days agoSri Lanka – world’s worst facilities for cricket fans

-

News2 days ago

News2 days agoLegal experts decry move to demolish STC dining hall

-

Features5 days ago

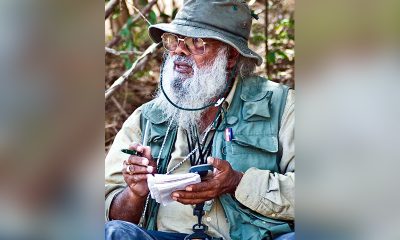

Features5 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

Business2 days ago

Business2 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

Features6 days ago

Features6 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features6 days ago

Features6 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone

-

Latest News2 days ago

Latest News2 days agoAround 140 people missing after Iranian navy ship sinks off coast of Sri Lanka