Business

iPay powered by LOLC, joined the latest LANKAQR drive in Kurunegala

Sri Lanka’s most preferred and most trusted financial services provider LOLC Finance PLC continues to sustain its committed support to expand the adoption of digital payments in the country through iPay.

iPay, powered by LOLC Finance has advanced from a mere payment gateway in to a beyond lifestyle payment application offering an exceptional service and convenience to their customers at a distance of a fingertip. Over the years of excellence, iPay has positioned their brand name as the most vivid and vibrant finance application available in Sri Lanka.

The latest LANKAQR event of the nationwide rollout campaign by Central Bank of Sri Lanka (CBSL) took place in Vehera Grounds, in the city of Kurunegala on the 19th of March 2022 with a large participation of partnered banks, financial service providers, merchants, dignitaries and other invitees.

Lanka QR launched the “Rata Purama LankaQR” campaign, with the purpose of promoting the usage of a common national Quick Response (QR) code. This QR code was developed by the CBSL with the idea of eliminating the need for merchants to have multiple QR codes for different platforms, facilitating fast, secure and affordable digital payments.

In view of transforming the Sri Lankan economy to a cashless podium, iPay actively participated in a day-long activation to raise awareness and to network with merchants. The opportunity was made use to explain the participants on the benefits of using LankaQR-integrated payments. iPay was also able to attain a number of merchants on-boarding, during the event.

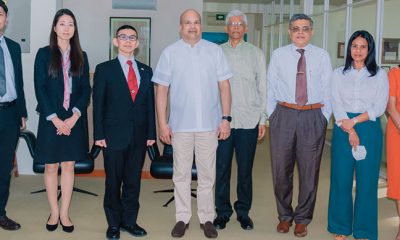

Dhammika Nanayakkara, Deputy Governor, Central Bank of Sri Lanka graced the occasion as the Chief Guest. D. Kumarathunga, Assistant Governor, Central Bank of Sri Lanka attended as the guest of honour. LOLC Finance PLC Head of iPay, Charitha Jayasinghe and the Regional Manager, Chaminda Ranaweera were also present at the event. LOLC Finance teams from Kurunegala branch also joined to support the activation.

Charitha Jayasinghe, Head of iPay, LOLC Finance PLC stated, “Being the leading Fintech platform of the country, we are privileged and humbled to take part in this national initiative by CBSL. Considering the increasing numbers of people adopting cashless transactions through iPay, we are truly pleased that we have been able to contribute immensely towards this national drive, over time. We also believe that these continuous initiatives will further enhance the knowledge and interest of the regional communities to understand and use these digital platforms better. As the leading Non-Banking Financial Institute (NBFI) in Sri Lanka, we remain committed to support this nationwide interest”.

Business

CEB calls for proposals to develop two 50MW wind farm facilities in Mullikulam

The Ceylon Electricity Board (CEB) has announced an international call for proposals to develop two 50 MW wind farm facilities in Mullikulam on a Build, Own & Operate (BOO) basis. The initiative aims to bolster Sri Lanka’s renewable energy capacity, aligning with the government’s strategy to increase the share of clean energy in the national grid.

The bidding process, launched on behalf of the Cabinet Appointed Negotiating Committee, invites local and international project proponents to finance, design construct and maintain the wind farms under a 20-year agreement. The deadline for proposal submissions is June 12, 2025.

A senior electrical engineer at the CEB, speaking on the significance of the project, told The Island Financial Review: “This initiative is a crucial step towards achieving Sri Lanka’s renewable energy goals. Wind power is a key component of our strategy to reduce reliance on fossil fuels and enhance energy security.”

According to the CEB, interested parties can obtain the Request for Proposal (RFP) document by paying a non-refundable fee of Rs. 300,000 (or USD 1,035 for foreign applicants). The RFP provides comprehensive details on project requirements and evaluation criteria.

“Given the global shift towards clean energy, we expect strong interest from both local and international developers. This project not only supports our sustainability targets but also creates investment opportunities in Sri Lanka’s energy sector, the engineer added.

The wind farm project is part of a broader initiative to achieve 70% renewable energy generation by 2030, a key target set by the Ministry of Energy. Experts believe that projects like these will play a vital role in stabilizing electricity supply and reducing carbon emissions.

by Ifham Nizam

Business

The people crown Lolc for ninth consecutive year

LOLC once again emerges as the “People’s Financial Services Brand of the Year”, securing the prestigious title bestowed at the SLIM Kantar People’s Choice Awards 2025 for an unparalleled ninth consecutive year. This recognition, conferred through a comprehensive consumer research, reflects the brand’s firm connection with the Sri Lankan people and its consistent leadership in financial services.

Unlike many industry awards, the SLIM Kantar People’s Choice Awards is determined by independent consumer research conducted by Kantar, a global leader in brand insights. Instead of relying on a judging panel, this recognition is purely based on public perception, brand recall, and customer loyalty, making it one of the most authentic measures of a brand’s standing. Securing this title for ninth consecutive years highlights LOLC’s deep-rooted connection with its customers and its ability to evolve with their changing needs while maintaining a firm commitment to excellence.

Kapila Jayawardena-

Group Managing

Director/CEO of LOLC

Holdings PLC

LOLC’s continued success is driven by its assurance to financial empowerment, innovation, and inclusiveness. It has redefined accessibility to financial services by reaching underserved communities and pioneering digital transformation. Beyond its core financial solutions, LOLC is a brand that stands with the people, for the people, embodying resilience and hope through the years. In times of crisis, be it economic hardships or global disruptions, LOLC has remained a pillar of strength, stepping in when the nation needed it most. This deep-rooted connection with the people is what truly sets LOLC apart. The company has also been recognized for initiatives that create real social impact, such as the Divi Saviya Humanitarian Project, which uplifts vulnerable communities through sustainable support.

Business

Orient Finance reports robust financial growth for 9-month period ended December 31, 2024

Orient Finance PLC has reported an outstanding financial performance for the nine-month period ended December 31, 2024, showcasing significant growth in key financial indicators compared to the corresponding period in 2023.

The Company recorded a remarkable 161% increase in profit after tax, reaching Rs. 254.6 million compared to Rs. 97.6 million in the same period of the previous year. Net interest income surged by 37%, amounting to Rs. 1.66 billion from Rs. 1.21 billion, demonstrating strong portfolio growth and enhanced operational efficiencies.

Total assets expanded by 28%, rising to Rs. 25.3 billion, while loans and receivables increased by 36% to Rs. 19.76 billion. The Company’s deposit base grew to Rs. 15.12 billion, marking a 19% increase, reflecting continued customer confidence. Meanwhile, total equity improved by 12%, standing at Rs. 3.86 billion.

Earnings per share (EPS) grew 163% to Rs. 1.21, up from Rs. 0.46, while net assets per share (NAPS) rose by 12% to Rs. 18.27.

For the month of December 2024, Orient Finance reported a Cost-to-Income Ratio of 68%, reflecting continued efforts towards cost management amidst challenging market conditions. The Gross Non-Performing Loan (NPL) Ratio stood at 9.62%, while the Provision Cover was maintained at a healthy 65.37%, demonstrating company’s prudent approach to credit risk management. As the quarter ended 31st December 2024, Orient Finance’s Tier 1 Capital Ratio stood at 13.14%, with the Total Capital Ratio recorded at 13.16%, both remaining comfortably above the minimum regulatory requirements.

Commenting on the results, Rajendra Theagarajah, Chairman of Orient Finance PLC, stated, “These exceptional results underscore our commitment to sustainable growth and operational excellence. Our focus on innovation and customer-centric financial solutions has strengthened our position in the market. As we continue to evolve, we remain dedicated to offering innovative financial products that meet the diverse needs of our customers while driving long-term shareholder value.”

-

Business6 days ago

Business6 days agoCargoserv Shipping partners Prima Ceylon & onboards Nestlé Lanka for landmark rail logistics initiative

-

News4 days ago

News4 days agoSeniors welcome three percent increase in deposit rates

-

Features4 days ago

Features4 days agoThe US, Israel, Palestine, and Mahmoud Khalil

-

News4 days ago

News4 days agoScholarships for children of estate workers now open

-

Business6 days ago

Business6 days agoSri Lankans Vote Dialog as the Telecommunication Brand and Service Brand of the Year

-

News5 days ago

News5 days agoDefence Ministry of Japan Delegation visits Pathfinder Foundation

-

Features6 days ago

Features6 days agoThe Vaping Veil: Unmasking the dangers of E-Cigarettes

-

News6 days ago

News6 days ago‘Deshabandu is on SLC payroll’; Hesha tables documents