Business

Export earnings from rubber and rubber products grow by 7.1% YoY

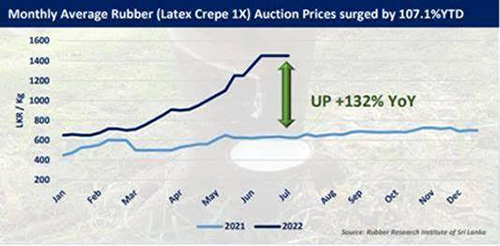

Export earnings from rubber and rubber finished products have reported a growth of 7.1%YoY to USD 102.3Mn in Jun 2022 compared to USD 95.5Mn in Jun 2021, while earnings from pneumatic and retreated rubber tyres and tubes also increased by 15.2%YoY during the month, a review issued by First Research states.

Growth in export earnings was mainly attributable to the continuous rise in rubber auction prices, it states.

The review further states:

“Rubber auction prices continued to elevate during the month of Jun 2022 boosting the earnings growth for the period. Global rubber prices witnessed a plunge during the period yet displayed an increase of 4.9% on a YoY basis on the back of recessionary fears. Accordingly, the monthly local average auction price of rubber for Jun 2022 improved to LKR 1,400/Kg (+122.4%YoY) while YTD price increased by over 100% owing to the steep depreciation of LKR against USD by 80.0%YTD.”

“Although steady demand for all grades of rubber (RSS, Latex crepe and synthetic) was witnessed in Jun 2022, total production hampered to 5.2Mn Kg from 7.2Mn Kg (-27.8%YoY) amidst wet weather conditions that disrupted rubber tapping along with delays in transportation due to the prevailing fuel crisis. Meanwhile, rubber earnings for the 1H2022 reported a slight decline of 0.7%YoY to USD 516.6Mn, although total production dropped by 15.6%YoY during the period amidst the outbreak of the fungal leaf fall disease. Major export markets for Sri Lankan natural rubber are Pakistan, Germany and Japan, whereas US, Germany and Belgium are the key export markets for rubber finished products.”

“Rubber prices have witnessed a growth trend since the beginning of the year, yet it has adjusted downward in the recent auctions in line with the global market price trend while cropping season has started in most of the rubber-producing regions leading the rubber price to drop. Further, the fluctuations in crude oil prices, which influence synthetic rubber prices, have also impacted the prices of natural rubber. On the other hand, with the availability of chemical fertilizer improving in the forthcoming months, we expect plantation sector to command higher yields in 2H2022 while further discussions have started with World Bank, Asia Developments and other international financial institutions to obtain funds to import fertilizer. In addition to that, we may see global consumption of rubber gloves peak over pre-pandemic level supported by increased awareness of health care and hygiene among people which ensures demand for rubber to boost in 2H2022. Considering the stability in production volume and the current price which remains above 2021 level, we expect rubber plantation to see an upside in 2H2022,” First Capital review states.

Business

Sri Lanka’s economy: A slow healing journey in 2026

The latest Purchasing Managers’ Index (PMI) from the Central Bank suggests Sri Lanka’s economy is beginning to find its feet after a severe crisis, revealing tentative signs of hope in factories and business activity. It indicates the deepest economic pain may be over. With prices rising more slowly, families and companies are getting some much-needed relief.

The Island spoke to an independent analyst for an outside perspective. Elaborating on the report, he struck a cautious note: “Yes, the PMI sounds favourable. But no one should think the hard times are completely behind us. The road to recovery is long and full of potholes.”

“While we can hope for slow, steady improvement in coming months, major problems remain,” he continued. “The country’s massive debt is a heavy burden. Staying on track with the IMF programme requires sticking to tough reforms, which won’t be easy. Global economic uncertainty also affects our exports and even other forms of external support.”

“In short, the next phase won’t be a quick boom. It will be a time for careful repair. These small improvements are like young seedlings – they need constant care, sound policy, and continued external support to grow strong. Our task is to turn this shaky stability into a solid foundation for lasting, inclusive growth. The economy is out of emergency care, but full recovery will be a long and patient journey,” he concluded.

When asked if the current political landscape would aid recovery, he pointed to the present stability as a key advantage. “With political stability in place, the path for necessary reforms and recovery should be more navigable now than ever in the past,” he said.

By Sanath Nanayakkare

Business

Sri Lanka Insurance Corporation General Limited inaugurates business operations for 2026

Sri Lanka Insurance Life Ltd and Sri Lanka Insurance General Ltd inaugurated their business operations for the year 2026 on 1st January at the Sri Lanka Insurance Head Office. The event was graced by the Chairman, Board members, Corporate Management, and staff of SLIC.

Parallel business launches were also conducted at branch level, with branch staff joining the head office proceedings via live stream. The day’s programme commenced with blessings observed from the four major religious faiths, symbolising unity and goodwill for the year ahead

Heralding the dawn of the New Year, SLIC brought together all 142 branches in a cohesive celebration, uniting as one family to light the traditional oil lamp. During the celebrations, the theme for SLICGL for 2026 ‘Leading the market, strengthening every step’ was officially unveiled

Celebrating 64 years of service and expertise, SLIC continues to stand as Sri Lanka’s most respected and trusted name in insurance. Over the decades, the organisation has remained at the forefront of the sector, sustaining industry‑wide growth and equity even through testing times.

The year 2025 brought many meaningful and positive achievements for SLICGL, yet it concluded with significant challenges as the nation faced the aftermath of the devastating Cyclone Ditwah. Rising to the occasion, SLICGL honoured claims and delivered timely relief, offering protection and reassurance to communities impacted by the catastrophe.

SLICGL proudly reflects on a year of remarkable achievements in 2025. The organisation was ranked

Sri Lanka’s highest-rated insurance brand as the only A+ Fitch rated insurer in the country and became the first and only insurer to surpass Rs. 30 billion in Gross Written Premium. SLICGL secured Carbon Neutral Certification, highlighting a commitment to sustainability. SLICL was also recognised as the Most Valuable General Insurance Brand by Brand Finance.

The lifting of the vehicle import ban in January 2025 helped to revitalize the automotive sector and also reaffirmed SLICGL’s role as the nation’s most trusted insurer. Stepping in to protect new vehicle owners, SLICGL strengthened its portfolio, supported national growth, and supported families and businesses to move forward with confidence.

During 2025, SLICGL continued its partnership with the Ministry of Education on the Suraksha Insurance Scheme, a national initiative aimed at securing the health and wellbeing 4.5 million schoolchildren throughout the country. The partnership provides students regardless of background, access to essential insurance coverage, safeguarding health, supporting families, and strengthening the nation’s future.

SLIGL’s mission places customers at the heart of everything it does. The organisation continues in the commitment of meeting and exceeding customer expectations through its expertise and specialised services. Aligning business strategies with this vision, SLIC delivers a superior customer experience through all touchpoints.

Business

MILCO turns around fortunes, posts Rs. 1.49 bn record profit in 2025

The Milk Industries of Lanka Company (MILCO) has recorded the highest profit and sales revenue in its history, driven by strong performance under the flagship Highlands brand, Agriculture Minister Lal Kantha said.

Addressing a Performance Incentive Awards Ceremony held at the MILCO Head Office in Narahenpita on December 31, the Minister said the achievement marked a decisive turnaround for the state-owned dairy enterprise, which had earlier been prepared for divestment.

“When we assumed office, MILCO was being readied for sale. Today, we have been able to rescue it and transform it into a profitable institution,” Minister Lal Kantha said. “By October 2025, the company had generated profits amounting to Rs. 1,490 million, the highest profit ever recorded in MILCO’s history.”

He noted that 2025 has also become the year with the highest sales revenue since the company’s establishment, reflecting improved operational efficiency, renewed consumer confidence and stronger market penetration under the Highlands brand.

The Minister said the government intends to ensure that the gains from the company’s financial recovery are shared across the value chain. “A portion of the profits will be distributed as incentives among dairy farmers,” he said, adding that plans are also in place to provide free life insurance coverage to 15,000 dairy farmers in 2026.

The incentive awards ceremony was organised to recognise employees who played a key role in achieving record sales targets and historic profitability, with senior management highlighting improvements in production planning, supply chain management and farmer engagement.

Minister Lal Kantha paid tribute to the dedication of the MILCO workforce, stating that the turnaround was the result of collective effort.

“This achievement belongs to everyone who worked tirelessly to restore confidence in this institution. I extend my sincere appreciation to all those who contributed to this success,” he said.

MILCO’s performance in 2025 is being viewed as a benchmark for the revival of state-owned enterprises, particularly within Sri Lanka’s agri-based industrial sector.

By Ifham Nizam

-

Sports4 days ago

Sports4 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne

-

News2 days ago

News2 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Sports5 days ago

Sports5 days agoTime to close the Dickwella chapter

-

Features3 days ago

Features3 days agoIt’s all over for Maxi Rozairo

-

News5 days ago

News5 days agoEnvironmentalists warn Sri Lanka’s ecological safeguards are failing

-

News3 days ago

News3 days agoDr. Bellana: “I was removed as NHSL Deputy Director for exposing Rs. 900 mn fraud”

-

News2 days ago

News2 days agoDons on warpath over alleged undue interference in university governance

-

Features5 days ago

Features5 days agoDigambaram draws a broad brush canvas of SL’s existing political situation