Business

Construction related counters active for second consecutive day

By Hiran H.Senewiratne

Construction related counters were notably active for the second consecutive day yesterday after President Anura Kumara Dissanayake’s assurance that a considerable amount of funds will be allocated in the forthcoming budget to the sector. This gave some impetus to the sector despite witnessing profit- takings at month end, stock market analysts said.

Amid those developments both indices moved upwards slightly. The All Share Price Index went up by 7.5 points while S and P SL20 rose by 1.59 points. Turnover stood at Rs 5.1 billion with 12 crossings.

Those crossings were reported in HNB, which crossed 400,000 shares to the tune of Rs 140 million and its shares traded at Rs 350, Hemas Holdings one million shares crossed to the tune of Rs 114 million and its shares sold at Rs 114, Commercial Bank 700,000 shares crossed for Rs 103 million; its shares sold at Rs 148, Dialog six million shares crossed to the tune of Rs 68.4 million; its shares traded at Rs 22.8, Central Finance 200,000 shares crossed for Rs 44 million; its shares traded at Rs 220, Ambeon Holdings 850,000 shares crossed to the tune of Rs 28.4 million; its shares traded at Rs 33.50.

Hayleys Fabrics 500,000 shares crossed to the tune of Rs 26.75 million; its shares sold at Rs 53.50, Sampath Bank 200,000 shares crossed for Rs 24.1 million; its shares traded at Rs 120.50, Hayleys 3.5 million shares crossed for Rs 21.3 million; its shares traded at Rs 6.10, Access Engineering 516,000 shares crossed for Rs 20.6 million and its shares fetched Rs 40 and Alumax 1.2 million shares crossed to the tune of Rs 20.1 million; its shares traded at Rs 16.80.

In the retail market, companies that mainly contributed to the turnover were; Access Engineering Rs 999 million (26.3 million shares traded), Hayleys Fabrics Rs 197 million (3.6 million shares traded), Browns Investments Rs 166 million (18.4 million shares traded), Commercial Bank Rs 122 million (825,000 shares traded), Softlogic Rs 114 million (18.2 million shares traded) and JKH Rs 111 million (4.9 million shares traded).During the day 197 million share volumes changed hands in 31000 transactions.

It is said that banking, manufacturing and construction sector counters were active. Access Engineering was one of the highest contributors to the market. JKH was also active as manufacturing sector counters were also active during the day.

Union Assurance and Sampath Bank have entered into a bancassurance partnership for Life Insurance products, the company said.

“Union Assurance PLC entered into a long-term referral bancassurance partnership for Life Insurance products with Sampath Bank PLC (“Bank”), on 30 January 2025, consequent to Board approval,” the insurance provider said, according to CSE sources.

Yesterday, the rupee was quoted at Rs 297.30/40 to the US dollar in the spot market, stronger from Rs 297.70/85 to the US dollar the previous day, dealers said, while bond yields were broadly flat.

Stocks were up 0.29 percent. A bond maturing on 15.12.2026 was quoted at 9.00/10 percent, up from 8.95/9.10 percent. A bond maturing on 01.05.2027 was quoted at 9.50/55 percent. A bond maturing on 15.03.2028 was quoted at 10.09/12 percent. A bond maturing on 01.05.2028 was quoted at 10.15/20 percent. A bond maturing on 15.10.2028 was quoted flat at 10.25/35 percent. A bond maturing on 15.09.2029 was quoted at 10.71/76 percent, up from 10.68/75 percent. A bond maturing on 15.10.2030 was quoted at 11.20/25 percent, up from 11.20/24 percent.

Business

Deviations from inflation target come under COPF scrutiny

By Ifham Nizam

The Committee on Public Finance (COPF) recently discussed the Central Bank of Sri Lanka’s (CBSL) report on deviations from the inflation target, as outlined in the Monetary Policy Framework Agreement (MPFA), for the second and third quarters of 2024.

This report was presented in accordance with Section 26(5) of the Central Bank Act No. 16 of 2023, which requires CBSL to submit a report to parliament via the Minister of Finance, if inflation deviates from the specified target for two consecutive quarters.

According to CBSL, the year-on-year headline inflation rate, as measured by the Colombo Consumer Price Index, remained below the MPFA’s specified inflation target of 5% ± 2% for both quarters, recording 1.4% and 0.8%, respectively. As a result, the Central Bank was obligated to report this deviation to parliament.

During the discussion, special attention was also given to measures for supporting and strengthening the Small and Medium Enterprises (SME) sector. Under CBSL’s relief program, borrowers with outstanding loans of less than Rs. 25 million have been granted a 12-month repayment extension, those with loans between Rs. 25 million and Rs. 50 million received a 9-month extension, while all other borrowers were granted a 6-month extension.

Deputy Minister Chaturanga Abeysinghe, who participated in the COPF session, commented on the importance of balancing inflation control with economic stability. He stated:

“Our priority is to maintain a proper equilibrium between inflation control and economic stabilization. The SME sector is a fundamental pillar of our economy, and our focus is not only on providing short-term relief but also on ensuring their long-term resilience.”

CBSL officials further elaborated on the key factors influencing inflation deviations, including electricity tariffs, domestic fuel prices, food prices, appreciation of the Sri Lankan rupee against the US dollar, private sector credit expansion, interest rates and the overall effectiveness of monetary policy transmission.

The session was chaired by Dr. Harsha de Silva, with the participation of Deputy Minister Chaturanga Abeysinghe, several Members of Parliament and CBSL officials. The discussion also highlighted the importance of holding such reviews regularly to assess monetary policy performance and economic progress.

Business

Shangri-La Colombo rings in the Chinese New Year with a spectacular lion dance and festive delights

Shangri-La Colombo rang in the Year of the Snake with a vibrant and auspicious Chinese New Year celebration on 29th January 2025, bringing tradition, joy and prosperity to all in attendance.

Held at the grand lobby, the event showcased a mesmerizing lion dance, symbolic blessings and cherished Chinese customs, creating a festive atmosphere for guests and colleagues alike. The celebrations began with the lion eye-dotting ceremony, performed at the entrance by Mr. Zal Tarapore, Director of Operations – Shangri-La Colombo, a revered ritual believed to awaken the lions’ spirits and invite good fortune.

The celebration came to life with the dramatic lighting of firecrackers, followed by the powerful rhythm of the lion dance at the hotel’s entrance. The lions then made their way into the lobby, surrounding the stunning Chinese New Year tree, creating an atmosphere of joy and festivity. Shang Palace staff added to the merriment by offering chocolate coins and assorted candies, which the lions later playfully tossed to delighted guests.

A highlight of the morning was the traditional Yee Sang tossing, a cherished custom symbolizing prosperity, unity and success. Guests enthusiastically tossed the ingredients high into the air, making heartfelt wishes for the year ahead. The festivities continued with a delightful selection of food and beverages, ensuring a well-rounded culinary experience.

The celebration extended beyond the lobby as the lions embarked on a blessing route, visiting various departments and outlets within the hotel. From restaurants to the offices, the lions danced their way through, bestowing luck and prosperity at every stop. Employees had prepared ang paos tied with lettuce, a symbolic offering believed to attract wealth, which the lions eagerly “devoured” as part of the traditional ritual.

With a perfect blend of heritage, culture and festivity, Shangri-La Colombo’s Chinese New Year celebration was a memorable start to the Year of the Snake, embracing the spirit of renewal, joy and prosperity.

Exquisite Dining Offers for the Lunar New Year

To complement the festivities, Shangri-La Colombo presents an array of exclusive dining experiences at Shang Palace, available until 6th February 2025. Guests can indulge in special set menus crafted to symbolize prosperity and togetherness. The Grand Fortune Vegetarian Set Menu (LKR 13,888++ per person) and the Abundant Blessing Celebration Set Menu (LKR 18,888++ per person) feature an exquisite selection of flavors, perfect for sharing with loved ones. These limited-time menus are available from 29th January to 4th February 2025.

Adding to the festive spirit, guests can take part in the Ang Pao Wishing Tree, a cherished tradition of giving and appreciation, available until 4th February. Additionally, diners at Shang Palace can enjoy exclusive special offers when their bill reaches LKR 50,000 nett or more, making the celebrations even more rewarding.

The hotel offers a Nian Gao Fish Hamper for LKR 3,888++, combining the traditional sweet glutinous rice cake with fresh fish, symbolizing growth and prosperity. Ideal for gifting or personal indulgence, this hamper is available from 25th January to 6th February 2025 at Shang Palace and Little Gems.

Business

Browns Battery & Tyres: Unstoppable at SLIM Awards 2024

A key leader in the automotive battery industry in Sri Lanka, Browns Battery & Tyres was yet again recognised recently at the annual SLIM National Sales Awards 2024, a prestigious ceremony held to honour high-performers for their achievements, while being the only country-level awards ceremony which acknowledges sales personnel amongst a diverse range of industries.

Under the Automotive/Frontliners segment, Browns Battery & Tyres earned four prestigious awards with Sameera Abeysinghe, Eshan Wijerathna, Ravindu Ranasinghe and Chinthaka Herath securing gold, bronze and merit accolades respectively. In the Corporate Sales/Territory Manager category, Chief Manager – Business Development, Abdul Faizer was honoured with a bronze award for leadership, strategy, innovation and market growth.

Commending the achievements, Ajith De Silva – Chief Operating Officer, Automotive & Hardware Cluster – Brown & Company PLC said, “We have and continue to equip our sales staff with the latest trends and technical innovations. By creating a conducive environment that fuels their passions, we motivate them to not only achieve their goals, but additionally reinvent their personal best. It is with the most assured confidence I can state that the Browns’ Battery & Tyres Sales Team is inimitable within the automotive sector. Despite a myriad of challenges, they have been able to achieve the best top line sales in the history of our business unit in the year under review.”

-

Opinion5 days ago

Opinion5 days agoCost of ‘Sinhala Only’

-

Features5 days ago

Features5 days agoA conversation that cannot be delayed

-

Sports5 days ago

Sports5 days agoAussies brought the best out of me – Aravinda

-

Features6 days ago

Features6 days agoNihal Fernando: Journey and Legacy

-

Opinion6 days ago

Opinion6 days agoNalini S. Kariyawasam – A personification of charming magnanimous lady

-

Life style6 days ago

Life style6 days agoThe Hidden City in United Kingdom

-

Features6 days ago

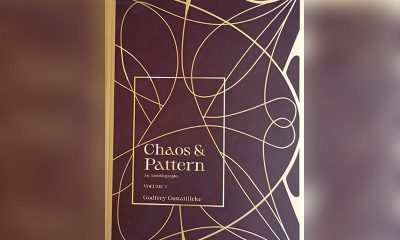

Features6 days agoChaos and Pattern – Memoirs of Godfrey Goonetilleke

-

Editorial5 days ago

Editorial5 days agoOnly delivery can save govts.