Business

Colombo Development Symposium highlights the Road Not Taken

The Colombo Development Symposium, organized by BiZnomics, was successfully held at the Shangri-La Hotel in Colombo on March 24, with the attendance of corporate leaders, captains of industry, and foreign emissaries.

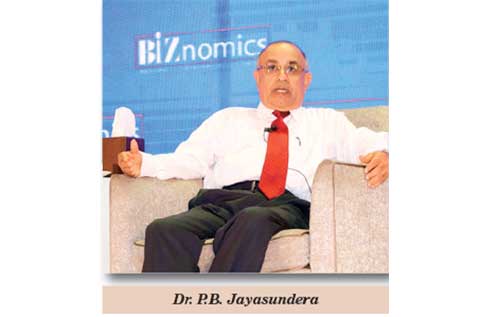

Secretary to the President, Dr. P.B. Jayasundera delivered a keynote address titled “The Road Not Taken”, where he outlined Sri Lanka’s development story so far, and the critical reforms needed to stimulate inclusive growth and development in line with President Gotabaya Rajapaksa’s manifesto: “Visions of Prosperity and Splendor”.

Jayasundera said that Sri Lanka’s debt problem has been exaggerated, and that total external debt declined by 500 million US dollars in 2020. Emphasizing that Sri Lanka has never defaulted on a debt or LC (Letter of Credit), even amid war and natural disasters. He said that the government has taken progressive steps for debt sustainability, such us reducing foreign borrowing, relying on domestic financing, and rationalizing imports.

He said that resorting to the IMF to deal with the country’s current challenges would force the government to raise taxes, which would harm both consumers and producers, throttle growth, and cause the economy to contract. The government would instead maintain a stable tax policy for five years and that the government would opt for currency SWAPS with friendly countries such as China to buffer foreign reserves.

Jayasundera urged the private sector to change its thinking. Local banks which enjoy high profitability and low rates of non-performing loans should engage in long term lending for production, and develop new instruments and investment banking. Large plantation companies should learn from the innovative examples set by smallholders and companies such as Dilmah.

More investment should be poured into expanding the production, processing and value-addition of agricultural products, especially for export. He also urged local businesses to start using CNY (Chinese Yuan) and also embrace usage of the Chinese Renminbi, which is an IMF basket currency.

He said that the government, led by President Gotabaya Rajapaksa has identified five areas in need of critical reforms in order to facilitate inclusive growth. The President has appointed bodies to research and recommend reforms in the areas of business regulation, commercial law, customs, finance, and land use.

The Jayasundera speech was followed by a panel discussion featuring Secretary to the Treasury S.R. Attygalle, Board of Investment Chairman Sanjaya Mohottala, Access Engineering Chairman Sumal Perera, and John Keells Holdings Chairman Krishan Balendra. The panel was moderated by senior broadcast journalist Indeewari Amuwatte.

During the broad ranging discussion, Attygalle said that government’s Budget for 2021 was designed to enhance inclusive growth, with a focus on lower taxation, rural investment and domestic financing mechanisms. He said that the country will depend less on external borrowing, while ironing out bottlenecks for investment.

Mohottala said that the country needs law reforms and digitization of processes such as customs and tax reforms in order to enhance the ease of doing business and foreign companies required large local companies to partner for investments here. He requested the private sector to rise to this task.

Sumal Perera expressed the need for media cooperation in presenting a positive image of Sri Lanka to the world. The media has a responsibility to build Sri Lanka as a brand and showcase positive success stories from the country.

Krishan Balendra said that the country’s tourism sector continues to be badly affected by the fallout of the COVID-19 pandemic. However successful rollout of vaccines will alleviate these problems. Domestic consumption has recovered since lifting of lockdowns and footfall in the Western Province is close to pre-pandemic levels.

The Symposium was organized by BiZnomics, a magazine about business, economics and lifestyle. BiZnomics has an in-house research team that dissects raw data into analysis and provides insights into current business trends. The magazine also celebrates local entrepreneurs who have gone beyond our shores to become “Global Sri Lankans”.

The event was sponsored by Capital Alliance Limited, LOLC Holdings PLC, Bank of Ceylon, People’s Bank, Sri Lanka Insurance Corporation, and CHEC Port City Colombo. The official media partner for the event was Ada Derana and the official newspaper for the event was the Daily FT.

Business

ADB approves support to strengthen power sector reforms in Sri Lanka

The Asian Development Bank (ADB) has approved a $100 million policy-based loan to further support Sri Lanka in strengthening its power sector. This financing builds on earlier initiatives to establish a more stable and financially sustainable power sector.

This second subprogram of ADB’s Power Sector Reforms and Financial Sustainability Program will accelerate the unbundling of the Ceylon Electricity Board (CEB) into independent successor companies for generation, transmission, system operation, and distribution, as mandated by the Electricity Act of 2024 and its 2025 amendment. The phased approach ensures a structured transition, ensuring progress in reform actions and prioritizing financial sustainability.

“Sri Lanka has made important progress in stabilizing its economy and strengthening its fiscal position. A well-functioning power sector is vital for the country’s continued recovery and sustainable growth,” said ADB Country Director for Sri Lanka Takafumi Kadono. “ADB is committed to supporting Sri Lanka’s long-term development and advancing key reforms in the power sector. This initiative will enhance power sector governance, foster private sector participation, and accelerate renewable energy development to drive sustainable recovery, resilience, and inclusive growth.”

To improve financial sustainability, the program will help implement cost-reflective tariffs and a comprehensive debt restructuring plan for the CEB. It will support the new independent successor companies in transparent allocation of existing debts. This will continue to strengthen their financial viability, enhance creditworthiness, and enable these companies to operate on a more sustainable footing.

The program also aims to strengthen renewable energy development and private sector participation by enhancing transparency and supporting power sector entities that are financially sustainable. It will enable competitive procurement for large-scale renewable energy projects and identified priority generation schemes, while upholding strong environmental standards.

Promoting gender equality and social inclusion is integral to the program. Energy sector agencies have implemented annual women’s leadership programs, adopted inclusive policies, and launched feedback mechanisms to ensure equitable participation of female consumers and entrepreneurs. The program includes targeted support for vulnerable groups, such as maintaining lifeline tariffs and implementing measures to soften the impact of tariff adjustments and sector reforms.

ADB will provide an additional $2.5 million technical assistance grant from its Technical Assistance Special Fund to support program implementation, build the capacity of successor companies, and help develop their business plans and power system development plans.

Business

Union Assurance becomes first insurer to earn the YouTube Silver Play Button

Union Assurance, Sri Lanka’s longest-standing private Life Insurer, has achieved a milestone in its digitalisation journey by being awarded the YouTube Silver Play Button, recognising the Company for surpassing 100,000 subscribers on its official channel. This achievement marks a first in Sri Lanka’s Insurance industry, across both Life and General Insurance, and underscores Union Assurance’s pioneering role in digital engagement.

This accomplishment reflects the Company’s unwavering commitment to making Life Insurance accessible, simplified, and engaging for all Sri Lankans. Through innovative content strategies, Union Assurance has successfully transformed complex Insurance concepts into relatable, informative, and inspiring narratives that empower individuals to protect what matters most; health, wealth, family, and future.

Receiving the Silver Play Button is more than a symbolic accolade; it is a testament to the strength and credibility of Union Assurance’s digital presence. In an era where trust and transparency define brand loyalty, this recognition validates the company’s ability to create content that resonates deeply with a growing audience. It enhances the brand’s authority, reinforces its visibility across digital platforms, and further solidifies Union Assurance as a leader in customer engagement.

Celebrating this achievement, Mahen Gunarathna, the Chief Marketing Officer at Union Assurance stated: “This milestone is a testament to the trust and engagement of our audience and reflects our dedication to innovation, transparency, and customer-centric communication.

Business

LOLC Finance Factoring powers business growth

LOLC Finance PLC, the largest non-banking financial institution in Sri Lanka, brings to light the significant role of its Factoring Business Unit in providing indispensable financial solutions to businesses across the country. With a robust network of over 200 branches, LOLC Finance Factoring offers distinctive support to enterprises, ranging from small-scale entrepreneurs to corporate giants.

In light of the recent economic challenges, LOLC Finance Factoring emerged as a lifeline for most businesses, ensuring continuous liquidity to navigate through turbulent times. By facilitating seamless transactions through online platforms and expediting payments, the company played a pivotal role in sustaining essential services, including supermarkets and pharmaceuticals.

Deepamalie Abhaywardane, Head of Factoring at LOLC Finance PLC, emphasized the increasing relevance of factoring in today’s economy. “As economic conditions become more stringent, factoring emerges as the most sought-after financial product for businesses across various sectors. It offers a win-win solution by providing upfront cash up to 85% of the credit sale to suppliers while allowing end-users/buyers better settlement period.”

One of the standout features of LOLC Finance Factoring is its hassle-free application process. Unlike traditional bank loans that require collateral, LOLC Factoring extends credit facilities without such obligations. Furthermore, LOLC Finance Factoring relieves business entities of the burden of receivable management and debt collection. Through nominal service fees, businesses can outsource these tasks, allowing them to focus on core operations while ensuring efficient cash flow management.

For businesses seeking Shariah-compliant factoring solutions, LOLC Al-Falaah’s Wakalah Future-Cash Today offers an efficient and participatory financing model that meets both financial needs and ethical principles. Understanding the diverse challenges faced by businesses, LOLC Finance Factoring deliver tailored solutions that enhance cash flow, reduce credit risk, and support sustainable growth. Working together with LOLC Al-Falaah ensures access to a transparent, well-structured receivable management solution strengthened by the credibility and trust of Sri Lanka’s largest NBFI, LOLC Finance.

The clientele of LOLC Finance Factoring spans into various industries, including manufacturing, trading, transportation, healthcare, textiles, plantations, and other services, all contributing significantly to Sri Lanka’s economic growth. By empowering businesses with accessible and convenient working capital solutions, LOLC Finance’s Factoring arm plays a vital role in fostering economic development and prosperity of the country.

In the upcoming quarter, LOLC Finance Factoring remains committed to delivering innovative financial solutions tailored to meet the evolving needs of businesses. As Sri Lanka’s economic landscape continues to develop, LOLC Finance Factoring stands ready to support enterprises on their journey towards growth and success.

-

News6 days ago

News6 days agoWeather disasters: Sri Lanka flooded by policy blunders, weak enforcement and environmental crime – Climate Expert

-

Latest News7 days ago

Latest News7 days agoLevel I landslide RED warnings issued to the districts of Badulla, Colombo, Gampaha, Kalutara, Kandy, Kegalle, Kurnegala, Natale, Monaragala, Nuwara Eliya and Ratnapura

-

Latest News7 days ago

Latest News7 days agoINS VIKRANT deploys helicopters for disaster relief operations

-

News3 days ago

Lunuwila tragedy not caused by those videoing Bell 212: SLAF

-

Latest News4 days ago

Latest News4 days agoLevel III landslide early warnings issued to the districts of Badulla, Kandy, Kegalle, Kurunegala, Matale and Nuwara-Eliya

-

News2 days ago

News2 days agoLevel III landslide early warning continue to be in force in the districts of Kandy, Kegalle, Kurunegala and Matale

-

Features4 days ago

Features4 days agoDitwah: An unusual cyclone

-

Latest News5 days ago

Latest News5 days agoUpdated Payment Instructions for Disaster Relief Contributions