Business

‘AIA delivers excellent financial results for 2024’

The Board of AIA Group Limited (the “Company”) is pleased to announce the Group’s financial results for the year ended 31 December 2024. Growth rates are shown on a constant exchange rate basis:

New business performance

Value of new business (VONB) up 18 per cent to US$4,712 million

All reportable segments delivered double-digit VONB growth

Annualised new premiums (ANP) up 14 per cent to US$8,606 million

New business profitability increased with VONB margin up 1.9 pps to 54.5 per cent.

Embedded value

EV Equity of US$71.6 billion after capital returns to shareholders, up 9 per cent per share

Embedded value (EV) operating profit of US$10,025 million, up 19 per cent per share

Operating ROEV of 14.9 per cent, up 200 basis points from 12.9 per cent in 2023

IFRS earnings

Operating profit after tax (OPAT) of US$6,605 million, up 12 per cent per share

On track to meet OPAT per share CAGR target of 9 to 11 per cent from 2023 to 2026

Operating ROE of 14.8 per cent, up 130 basis points from 13.5 per cent in 2023

Free surplus generation

Underlying free surplus generation (UFSG) of US$6,327 million, up 10 per cent per share

Net free surplus generation (net FSG)(3) of US$4,020 million after reinvestment in organic new business

Shareholder capital ratio(4) of 236 per cent at 31 December 2024

Dividends and share buy-back

Final dividend increased by 10 per cent to 130.98 Hong Kong cents per share

New US$1.6 billion share buy-back(5) in accordance with our enhanced capital management policy

US$6.5 billion returned to shareholders in 2024 through dividends and our share buy-back programme

Lee Yuan Siong, AIA’s Group Chief Executive and President, said:

“AIA has delivered an excellent performance in 2024 with record new business profits, strong earnings growth and free surplus generation. We have continued to drive higher operating ROEV and ROE while returning substantial capital to shareholders. VONB was up 18 per cent to US$4,712 million with all reportable segments achieving double-digit growth, reflecting the diversification and strength of our business. Successive layers of profitable new business drive sustained growth in earnings and cash generation with OPAT per share up 12 per cent and UFSG per share up 10 per cent. EV Equity per share increased by 9 per cent, after returning US$6.5 billion to our shareholders through dividends and share buy-back.

“Following our prudent, sustainable and progressive dividend policy, the Board has recommended a 10 per cent increase in the final dividend to 130.98 Hong Kong cents per share, which results in an increase of 9 per cent in total dividend per share for 2024. In addition, following our enhanced capital management policy, the Board has also announced a new share buy-back of US$1.6 billion. This comprises US$0.6 billion to meet the payout ratio target of 75 per cent of annual net FSG and an additional US$1.0 billion following a regular review of the Group’s capital position. Together, the dividends and share buy-backs amount to a total yield(6) of approximately 6 per cent for shareholders.

“AIA is uniquely well-positioned to capitalise on the long-term structural growth potential in the world’s most attractive market for life and health insurance through the consistent execution of our clear and ambitious strategy. I am confident that AIA’s long-term business prospects remain exceptional. We will continue to strengthen our substantial competitive advantages to capture the opportunities ahead of us and create sustainable value for all our stakeholders.”

Business

HNB Assurance Elevates ‘Liya Harasara’ 2026 with Unmatched Benefits to Honor the Spirit of Womanhood

HNB Assurance PLC launched the 2026 edition of Liya Harasara, its flagship annual initiative dedicated to celebrating and empowering women in line with International Women’s Day. Recognized as one of the most anticipated campaigns of the year, Liya Harasara continues to evolve, delivering meaningful protection and exclusive privileges designed to support women in every stage of life.

This year’s edition introduces the most rewarding benefits in the history of the initiative. Women who sign up for eligible Regular Premium Life Insurance policies will receive a Free Life Cover of up to Rs. 2 Million for one year, along with a Free Critical Illness Benefit of up to Rs. 500,000, providing enhanced financial security and reassurance when it matters most. Additionally, female policyholders are also entitled to pregnancy related hospitalization cash benefit for Life Insurance Policies with in-force Hospitalization Benefit, for a maximum of three days per annum.

Commenting on the significance of this year’s campaign, Lasitha Wimalarathne, Executive Director / CEO of HNB Assurance, stated: “As we mark our 25th year as a trusted life insurer, we wanted Liya Harasara 2026 to reflect the strength of the journey that brought us here. For 25 years, women have been at the heart of our story, as leaders, advisors, customers and changemakers. This special edition is our way of honoring that partnership and reaffirming our commitment to protecting their aspirations for the future. When women progress, families prosper and communities thrive and we are proud to stand by them with meaningful protection and lasting assurance.”

Sharing his thoughts, Dinesh Yogaratnam, Chief Marketing and Customer Experience Officer of HNB Assurance, added, “Liya Harasara has grown into more than just an annual campaign, it is a tribute to the Spirit of Womanhood, to resilience, ambition and strength. The 2026 edition has been thoughtfully enhanced to deliver greater value and deeper impact, ensuring women receive protection that truly supports their ambitions and wellbeing. We remain committed to creating solutions that empower confidence and provide peace of mind, enabling women to focus on achieving their goals without compromise.”

Business

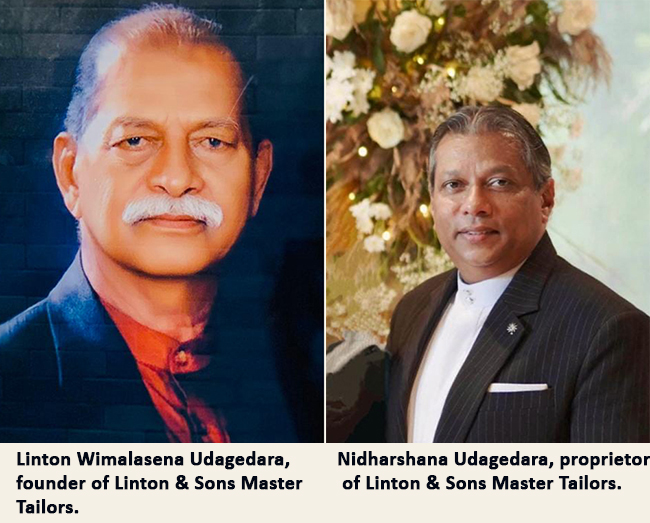

Seven decades of sartorial excellence: The legacy of Linton Master Tailors in Kandy

In the 1950s, Linton Wimalasena Udagagedara served as the tailoring instructor at the rehabilitation unit of the Bogambara Prison. Known affectionately by all as “Linton Master,” he laid the foundation for a legacy that would eventually redefine men’s fashion in the hill capital.

In 1958, Linton Master ventured into private business by renting a small shop in Trincomalee Street, Kandy, under the name “Linton Master Tailors.”

Supported by a handful of employees and the unwavering strength of his wife, Srima Alwala, the business began its humble journey. In those early days, Linton Master would travel from Kandy to Pettah, Colombo, walking miles to handpick high-quality fabrics at affordable prices. Though the initial years were a struggle, he never compromised on quality.

Due to his commitment to superior craftsmanship and impeccable finishing, “Linton Master’s Shop” in Trincomalee Street soon became a household name across the Kandy region. By the 1970s, the thriving business moved to Yatinuwara Veediya. As the enterprise grew, Linton Master eventually purchased the rented building and the adjacent premises. In the 1990s, the brand reached its zenith, becoming a hallmark of excellence.

Following the passing of Linton Master in 2009, the business transitioned into a new era. Today, it stands proud at the same familiar location in Yatinuwara Veediya, rebranded as “Linton & Sons Master Tailors.” His legacy is carried forward by his children; while one son manages a printing press and a daughter runs a bridal wear brand under the Linton name, his son Nidarshana Udagagedara has significantly expanded the core tailoring business.

Today, Kandy is home to three main institutions bearing the prestigious Linton brand. Linton & Sons Master Tailors, now employing around 20 skilled professionals, is a nationally recognized name. Known for their international standards, it is said that anyone who gets a full suit tailored at Linton & Sons invariably returns for their second.

The business that once started with fabric handpicked from Pettah now utilizes world-renowned international brands. Linton & Sons is currently the only tailor shop in Kandy that creates garments using prestigious fabrics such as Raymonds, Pacific Gold, Medici, and Macone.

Current Chairman Nidarshana Udagagedara notes that they serve a loyal customer base, with complete groom’s suit packages ranging from Rs. 30,000 to Rs. 90,000. With a highly experienced team, they now offer an exclusive one-day service, allowing customers to have bespoke designs created to their exact specifications in record time.

Spanning seven decades, the Linton lineage, which has brought fame to Kandy, has now successfully expanded from the second generation to the third, ensuring that the master’s stitch continues to define elegance for years to come.

By S.K. Samaranayake

Business

LANKATILES Captivates Architect 2026 with a Spectacular Celebration of Fine Living

At the prestigious Architect 2026 Exhibition, LANKATILES unveiled an immersive Concept Studio of contemporary design, where every surface spoke in allusive ways of exquisite craftsmanship and architectural vision.

Among a host of outstanding participants, the Concept Studio was recognized with two of the exhibition’s highest accolades: Overall Best Stall and Best Trade Stall Displaying Local Products. This is a resounding testament to five decades of trust, quality, and innovation.

The Concept Studio was thoughtfully zoned to evoke the ambiance of curated interiors and sophisticated entryways, unveiling the latest designs introduced to the market. Visitors were guided through a seamless spatial journey, beginning with the Living Zone, where expansive surfaces harmonized durability with refined design to elevate everyday living. The Kitchen Ambience Zone presented a contemporary culinary environment enriched with elegant finishes, demonstrating how functionality and elevated aesthetics coexist in modern homes.

The experience continued into the Bedroom Zone, an intimate and serene setting curated with soothing palettes and luxurious surfaces to create a tranquil retreat defined by comfort and understated elegance. Complementing this was the Bathware Zone — a sanctuary of calm showcasing precision-crafted porcelain surfaces that seamlessly blended purity of form with superior performance, redefining modern bathroom sophistication.

Extending beyond interiors, the Poolside Zone highlighted elegant outdoor settings framed by resilient, high-performance tiles, where aesthetic excellence met enduring strength in expressive interpretations of contemporary luxury. Featuring the latest Mosaic designs alongside the grand large-format tile series, Majestica, each zone illustrated how LANKATILES transforms raw materials into architectural poetry, reinforcing its leadership in innovation and design excellence.

Another defining feature of the Concept Studio was the AI-powered Tile Visualizer; an advanced digital interface designed to offer architects and homeowners an intelligent and immersive visualization experience that redefines the way interiors are selected and conceptualized. Within minutes, users can upload an image of their dream space and instantly explore precisely matched tile designs and colour palettes tailored to their aesthetic preferences.

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

News2 days ago

News2 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

Business4 days ago

Business4 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News1 day ago

News1 day agoWife raises alarm over Sallay’s detention under PTA