Business

Adani wind farms in Mannar and procedural challenges in Swiss auction

India’s Adani Group, which has committed SL’s single largest FDI in the power sector by committing to invest over a billion dollars in setting up ~500MW wind projects in Mannar and Pooneryn region, is facing resistance from a lobby group. The reason is unclear, says Vinayak Maheswaran – an equity and economic analyst at an equity markets platform who was also a former analyst at Wells Fargo Advisors.

He puts forward his argument as follows.

“Initially they said the project harms the environment. This when the Environment Impact Assessment (EIA) was done by a renowned professor and the government promised to implement the suggestions made in it and by public to minimize environmental impact. Several other Renewable Energy Organizations, Climate Organizations, environment organisations like the National Environment Caucus, Youth for Renewable Energy Organization, Sri Lanka Blue Green Alliance too conducted their own studies and have decided to back the project.”

“Then they raised questions on process not being followed. Sri Lanka’s Electricity Act allows proposals under G-2-G mechanism and the Adani’s project falls under this. The laid down process being followed for ages is government floats an RFP (Request for Proposal) and developers respond against it. As per procurement guidelines, any tender needs to go through the same process of Technical Evaluation by Project Committee of CEB & thereafter tariff negotiation by Cabinet Appointed Negotiation Committee (CANC). This was followed and done for the Adani project, which has been approved by the Public Utilities Commission of Sri Lanka (PUCSL). So where is the question of process not being followed?”

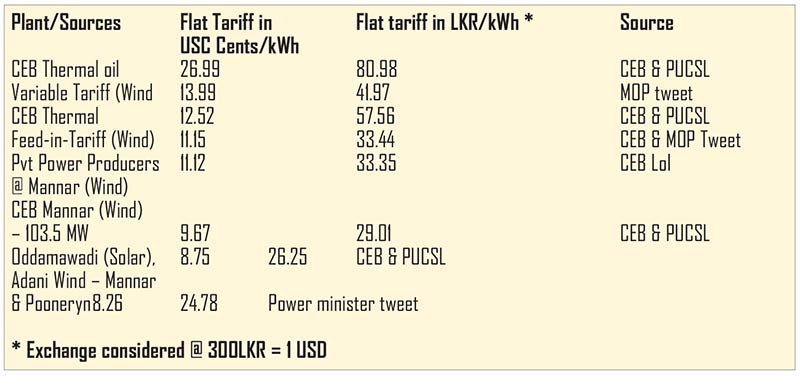

“In spite of the government negotiating an extremely competitive tariff (USC 8.26 or LKR 24.78/ unit), those against it are complaining on it being high and are seeking a Swiss auction (where new players are allowed to bid below the finalized tariff). Are they aware that Swiss auction is illegal in SL, and like most nations, SL too has put an end to this practice, citing procedural challenges? Incidentally, the same Swiss auction is not being demanded on other similar projects which have been cleared in the recent past and at a higher tariff. Double standards, anyone?”

Tariff negotiated by the government is clearly the best SL is getting currently is evident from the table below.

“None of the other recently approved projects are facing any opposition, inspite of their tariffs being higher. Take the example of an Australian firm which has proposed a 700 MW of Solar + Battery capacity with a tariff of 16 cents. Applying the same argument levelled against Adani that global benchmark tariffs for wind projects is lower than the finalized tariff, then this project’s global benchmark tariff is 9-11 cents. Has SL agreed to pay an extra US$ 1.9 billion over 25 years on this project? There is no whimper of protest for that.”

“Another example is the 100 MW Odamavadi Solar project, whose tariff too has been approved at 8.75 cents. As per the argument being made, when benchmarking with global benchmark of 2-3 cents, have we have agreed to pay an extra US$ 350 million over 25 years on this project?

What’s the real reason behind those opposed to the project? Why do we want to chase Adani away, which is reposing tremendous faith in the country by investing in during our time of crisis. Its success will attract fresh investments and will also help SL meet its sustainability goals. On government and civil society’s end, we must ensure the environment and CSR commitment made by it is met.”

“Policymakers and concerned citizens need to look at the larger picture of if somebody has the appetite for implementing such large scale RE projects, why aren’t they doing so, instead of delaying the existing ones? Does it not show that they are not interested in making any investments but rather derailing the projects coming on ground? There are many other wind & solar sites available in the country. Why aren’t they putting money where their mouth is and set up projects there at global benchmark tariffs they themselves are quoting?”

“SL needs RE energy and needs it quick. It needs partners who will offer competitive tariffs and set up projects in time and budget. Hence their antecedents are important. Adani Group is amongst world’s largest RE players and is setting up world’s largest RE park in India. It has a reputation to keep by completing the project in time and budget.”

“SL hasn’t seen a project of this scale which can potentially upend its energy dynamics and take the country closer to self-reliance and reduce dependence on fossil fuels. The Mannar + Pooneryn projects will save US$ 270+ Mn annually by displacing higher cost fuel-based tariffs. The project will generate ~1,500 million units of power per year – corresponding to meeting energy demand of 0.6 million households and equivalent to cutting 1.06 Mn tons of CO2 emission per year,” Maheswaran argues.

Business

FRELLA launches world class wellness products locally with Baurs & Co.

FRELLA, Sri Lankan-born and internationally-respected natural beauty and wellness brand, is setting the stage to expand operations by entering the Sri Lankan retail market. As the country’s only dedicated wellness company operating at an international scale, this move marks a new chapter for a brand with a growing global presence that has already earned the trust of luxury hotels and international customers.

For over seven years, FRELLA has emerged as Sri Lanka’s leading wellness brand, serving clients and partners across more than 15 international markets. The brand’s entry into the Sri Lankan retail market marks a significant milestone, allowing local consumers to access globally respected wellness products developed from the island’s own healing traditions. This retail expansion is supported through a strategic partnership with Baurs, a trusted 170-year-old Swedish multinational company, ensuring sophisticated distribution and access aligned with international retail standards.

FRELLA is rooted in Sri Lanka’s ancient healing traditions and inspired by centuries-old Ayurvedic wisdom. All FRELLA products are specially designed as holistic wellness solutions for the body, skin, hair, and soul, and focuses on providing nourishment, balance, and healthy aging through refined, modern wellness systems.

Business

Writer Business Services enters Sri Lanka to partner with institutions to provide information management and payments solutions

Writer Corporation, one of India’s leading business groups, announced the launch of its subsidiary, Writer Business Services Pvt. Ltd., and the commencement of its operations in Sri Lanka. The expansion reflects Sri Lanka’s strategic importance in Writer’s regional growth plans and its role in supporting a highly regulated digital and financial services market which is currently undergoing digital transformation.

Sri Lanka’s continued focus on strengthening regulatory frameworks, digital platforms, and financial systems is shaping how institutions across banking, government, and enterprise sectors approach their business operations. There is a clear emphasis on secure, compliant, and resilient information and transaction environments that can scale with regulatory and business needs. Writer’s entry into Sri Lanka aligns with this direction, bringing global experience and a partnership-led approach to the market.

As part of its launch, Writer will establish a secure records and information storage facility in Seeduwa, Colombo. Designed to meet global standards for security, compliance, and disaster resilience, the facility will support banks, financial institutions, government bodies, and large enterprises in managing physical and digital information across its lifecycle.

Alongside information management, Writer brings established expertise in integrated payment services to support the modernization of transaction infrastructure across the banking and financial services sector. Its payments capabilities focus on strengthening availability, transaction continuity, and transparency across critical payment channels that underpin institutional reliability and customer confidence.

Writer’s digital payments offerings in Sri Lanka include end-to-end ATM and self-service terminal outsourcing, integrated channel ownership and managed services, field management applications, payment and reconciliation platforms, and remote monitoring with near real-time reporting. These solutions support financial institutions in improving uptime, strengthening governance, and enhancing operational efficiency across payment networks, in line with the continued evolution of electronic and automated payment systems.

Across information management and payments, Writer operates with an integrated portfolio spanning records and information management, business process outsourcing, cloud and digital services, data privacy, cybersecurity and enterprise payments infrastructure. These capabilities support institutions in addressing evolving regulatory requirements, digitization of legacy environments, and rising operational and cyber risks.

Writer’s local presence enables closer collaboration with clients and on-ground delivery, while supporting the development of Centres of Excellence across cybersecurity operations, SOC and NOC services, AI-led solutions, and payments operations and monitoring.

Writer’s Sri Lanka operations will be built, led, and run by Sri Lankan professionals, reflecting a long-term commitment to local talent growth and development.

Commenting on this development, Satyamohan Yanambaka, CEO, Writer Global Services Pvt. Ltd., assured Writer’s long-term commitment to the country’s digital ambitions. He said, “Writer’s entry into Sri Lanka reflects our belief that digital ambition in regulated environments must be supported by trust, sound governance, and strong execution. As institutions scale digital services, the reliability of information and payment systems, channel operations, and governance frameworks becomes increasingly important to public and institutional confidence. Our experience across information management, digital transformation, and enterprise payments enables us to support secure, large-scale financial ecosystems, with a clear commitment to building and leading these capabilities locally.”

Sri Lanka’s Digital Personal Data Protection framework raises expectations around how personal and sensitive information is secured and governed.

Business

Altair issues over 100+ title deeds post-ownership change

Altair Residences have, over the past six months, seen more than 100 individual title deeds being executed by apartment owners, providing owners with a clear, registered, legal title to their apartments in accordance with Sri Lankan property law. This has been a key initiative by the new owners and management of Altair to improve governance and will continue in an orderly manner in the coming months.

With the transition of ownership to Blackstone India, Altair’s Management Council has also been formally constituted, enabling owners to play an active and proactive role in the management of the Altair building. In addition, the management council has appointed Realty Management Services (RMS), a subsidiary of Overseas Realty Ceylon PLC, as the new facility manager of Altair.

Commenting on these milestones, Thilan Wijesinghe, Chairman of TWC Holdings, who, together with a team from TWC, represents Blackstone’s interests in Sri Lanka, said, “The issuance of individual title deeds is a critical step in any professionally developed residential asset. Over the past six months, this process at Altair has moved forward in a structured and transparent manner, alongside the formal establishment of owner-led governance. This, combined with the appointment of experienced facility managers are fundamental building block for long-term value-creation for apartment owners and proper asset stewardship.”

With ongoing improvements to the building being undertaken by Indocean Developers Pvt Ltd (IDPL), the owning company of Altair, the issuance of deeds to owners is expected to accelerate over the coming months.

-

Business4 days ago

Business4 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business5 days ago

Business5 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion5 days ago

Opinion5 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Business1 day ago

Business1 day agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion4 days ago

Opinion4 days agoLuck knocks at your door every day

-

Business6 days ago

Business6 days agoDialog Brings the ICC Men’s T20 Cricket World Cup 2026 Closer to Sri Lankans

-

News5 days ago

News5 days agoRising climate risks and poverty in focus at CEPA policy panel tomorrow at Open University

-

Business1 day ago

Business1 day agoBourse positively impacted by CBSL policy rate stance