Opinion

What good is the UN in its present shape

The veto is a permanent bug. Unfortunately, this is how the UN was designed from the very beginning. And this is part of the reason why it is so useless.

By ATANU BISWAS

Exactly eight years ago, Russia invaded Ukraine to annex Crimea. While talking on the phone with the then United Nations Secretary-General Ban Ki Moon, the interim President of Ukraine at that time, Oleksandr Turchinov, asked for the UN’s support.

The Secretary-General replied that peacekeepers could be sent in only should Russia withhold its veto. What a pity! The UN could do virtually nothing during Russia’s invasion in 2022 also; Russia vetoed a draft UN Security Council resolution deploring Moscow’s “aggression against Ukraine” and demanding the immediate withdrawal of its troops. The veto is a permanent bug. Unfortunately, this is how the UN was designed from the very beginning. And this is part of the reason why it is so useless.

A few days before Russia’s Ukraine invasion, in February 2022, when the crisis was looming, the UN Secretary-General António Guterres said that the situation was testing “the entire international system”, adding “we must pass this test.”

The UN, however, failed utterly – as it was destined to – in instrumenting effective international diplomacy. How worthy is it then to maintain a white elephant like the UN? One may recall that the Nobel Peace Prize for 1988 was awarded to the United Nations Peacekeeping Forces “for preventing armed clashes and creating conditions for negotiations.”

However, the United Nations has failed to prevent war and fulfil peacekeeping duties many times during its history: in Palestine, ever since the creation of the Jewish state in 1948, in Cambodia during the 1970s, in the Somali civil war since 1991, in the Rwandan civil war in 1994, during the Srebrenica Massacre in 1995, during the Darfur conflict in Sudan since 2003, in the Iraq invasion during 2003-11, in the Syrian civil war since 2011, in South Sudan since 2013, in the Yemen civil war since 2014, during the Rohingya crisis in Myanmar since 2017, among others.

On the 20th anniversary of the Rwandan genocide in Kigali, Ban KiMoon admitted that the UN had done a lot to prevent the slaughter of hundreds of thousands of Tutsis but “could have done much more”. Certainly, it could have done more with the Rohingya crisis, in Afghanistan, in the Arab Spring, amid disasters in Haiti, the Philippines, and in many other places. And, of course, there is the classic example of the Security Council’s authorisation of force to turn back Saddam Hussein’s Iraq after its invasion of Kuwait in the early 1990s. Is the 76-year-old UN a toothless and clawless body that no one takes seriously? Is it almost defunct?

António Guterres described Russia’s move (to recognize the so-called ‘independence’ of certain areas of the Donetsk and Luhansk regions) as “a death blow” to the Security Councilendorsed Minsk Agreements, the fragile peace process regulating the conflict in eastern Ukraine. One serious problem of the UN is deeply rooted in the veto power bestowed on the five permanent members. Any of the Big Five can stop any resolution unilaterally.

When the UN was founded in 1945, permanent membership of the Security Council and the veto power ensured that America and the Soviet Union had nothing to worry about – however undemocratic that may sound. Due to this veto power, each of the Big Five could act without any fear of reprisal from the UN. Amnesty International claimed that the five permanent members had used their veto to “promote their political self-interest or geopolitical interest above the interest of protecting civilians”.

It helped Russia in Hungary, Czechoslovakia and Ukraine, the US in various Latin American countries, the UK in the Falklands, France in Africa, and China in Tibet. With about 44,000 staff and 17 legally independent specialized agencies, the UN has spent well over half a trillion dollars in the past 76 years, and half the expense is basically the operational cost of its offices.

In an article in ‘The Guardian’ in 2015, Chris McGreal wrote: “The United Nations has saved millions of lives and boosted health and education across the world. But it is bloated, undemocratic – and very expensive.” The US is the largest provider of financial contributions to the UN, providing 22 per cent of the budget in 2020. Thus, Donald Trump certainly had reason when he had sought major funding cuts to UN agencies, although Congress by and large approved higher contributions than requested by his administration.

During the Cold War, Dag Hammarskjöld, the second Secretary-General of the UN, invented the concept of “peace-keeping” so that superpower standoffs would not paralyse the organization. It worked, to some extent, at least. The shining side is that the UN won several Nobel Peace Prizes for its peace-keeping efforts and the works of several of its organizations over years. But the UN peacekeepers triggered a cholera epidemic in Haiti causing over 10,000 deaths, which the UN took six years to acknowledge.

An Associated Press investigation found “nearly 2,000 allegations of sexual abuse and exploitation by peacekeepers and other personnel around the world” over a 12- year period, of which 300 allegations involved children. Still, many people believe that the UN, simply being a place for nations to come together, is vital in world affairs, and hence is very far from being useless. Also, there are its international development and humanitarian works. Those favouring the UN often quote Dag Hammarskjöld who said that the UN “was created not to lead mankind to heaven but to save humanity from hell”.

Of course, the concept of ‘hell’ might have changed from the realm of the post-World War era and the Cold War period. Many believe that even a weak UN is better than no UN. As Shashi Tharoor recently perceived: “If the United Nations did not exist, today’s divided world would be incapable of inventing it. Let’s be grateful for the UN we have. We’d be much worse off without it.” There are others who would share this view.

“Like everybody says, if you didn’t have the UN you’d have to invent it,” said David Shearer, the New Zealand politician, who served the UN in senior posts. “But it’s imperfect, of course it is, and everybody knows that it is,” he said. Is it time to recreate the United Nations by debugging it as much as practicable? “The United Nations of today is hugely different from the United Nations 70 years ago, and therefore it is very important the United Nations changes and adapts itself to changing circumstances,” Ban Ki-Moon said.

Former US Sen. Bob Corker, the Tennessee Republican, had been calling for reforms in the UN. But would a US Senator agree to abolishing the veto power? For, a new avatar of the UN without the veto power of the Big Five might work much better for humanity. The UN’s dependence on the big powers such as America and China for money is certainly a major constraint. And then, New York is too close to Washington DC, as perceived by Alexander Nekrassov, a former Kremlin and government adviser, in 2014. What about the UN shifting its headquarters from the cozy comfort zone of New York?

Come closer to the ground reality of Kigali or Mogadishu, have the headquarters there, maybe rotate it periodically through Naypuidaw, Sana’a, Colombo and Addis Ababa, if you really want to serve people. The world desperately needs a UN, changed and debugged. (The Statesman/ANN)

(The writer is Professor of Statistics, Indian Statistical Institute, Kolkata)

Opinion

Beyond 4–5% recovery: Why Sri Lanka needs a real growth strategy

The Central Bank Governor’s recent remarks projecting 4–5 percent growth in 2026 and highlighting improving reserves, lower inflation, and financial stability have been widely welcomed. After the trauma of Sri Lanka’s economic crisis, any sign of normalcy is understandably reassuring. Yet, this optimism needs to be read carefully. What is being presented is largely a story of stabilisation and recovery, framed in the familiar IMF language of macroeconomic management. That is necessary, but it is not the same as a pathway to durable growth.

The first issue is the nature of the projected growth itself. A 4–5 percent expansion can occur for many reasons, not all of which strengthen an economy in the long run. In this case, a significant part of the momentum is expected to come from post-cyclone reconstruction and public investment. This will boost activity in construction and related services and create jobs in the short term. But such growth is typically demand-led and temporary. It raises GDP without necessarily expanding the country’s productive capacity, technological capability, or export competitiveness. Once the reconstruction cycle fades, so may the growth.

This points to a crucial distinction that often gets blurred in public debate: economic recovery and durable growth are not the same thing. Recovery means returning to a more normal macro environment—lower inflation, a more stable exchange rate, some rebuilding of reserves, and a functioning financial system. Durable growth, by contrast, requires rising productivity, structural change, and a stronger export base. Sri Lanka can achieve the first without securing the second. Indeed, that is precisely what happened in earlier post-crisis episodes, where short-lived recoveries were followed by renewed external stress.

The Central Governor’s narrative is best understood as an IMF-style stabilisation narrative. Its centre of gravity is macro control: inflation targets, policy rates, reserves, debt service, and financial-sector resilience. These are the right tools for preventing another crisis. But they are not a strategy for accelerating development. IMF programmes are designed primarily to restore confidence, manage risk, and stabilise the macroeconomy. They are not designed to answer the core development questions: What will Sri Lanka produce? What will it export? How will productivity rise? Which sectors will drive long-term growth?

Seen in this light, a projected 4–5 per cent growth rate is best described as moderate recovery growth. It may be entirely plausible—especially if driven by reconstruction and public spending—but it is not the kind of growth that closes income gaps, absorbs underemployment at scale, creates sustained fiscal space, or materially reduces debt burdens. Countries that have successfully caught up in Asia typically sustained 7–8 per cent (or higher) growth for long periods, powered by export expansion, industrial upgrading, and continuous learning.

If the current government’s development agenda is genuinely ambitious, then there is a clear mismatch between the growth implied by that ambition and the growth described in the Central Bank’s outlook. A strategy that settles for 4–5 per cent risks normalising mediocrity rather than mobilising the economy for take-off. Reconstruction-led and consumption-led expansions can lift GDP in the short run, but they do not, by themselves, deliver the productivity and export breakthroughs needed for sustained 7–8 per cent growth.

There is also a risk that reconstruction-driven growth will recreate old external vulnerabilities. Large-scale rebuilding increases demand for cement, steel, fuel, machinery, and transport services—many of which are import-intensive in Sri Lanka. This means higher growth can go hand in hand with a widening trade deficit, renewed pressure on foreign exchange, and imported inflation. The Governor has rightly warned about inflationary and external pressures, but the deeper issue is structural: without a parallel expansion of export capacity and domestic production of tradables, stimulus-driven growth can quickly collide with the same constraints that caused past crises.

The improvement in reserves and the claim that debt service is “manageable” are positive developments. But they should be treated as buffers, not proof of long-term security. Sri Lanka’s recent history shows how quickly reserves can be run down when imports surge, exports disappoint, or global conditions tighten. Reserves buy time. They do not, by themselves, change the underlying growth model.

Similarly, the focus on bringing inflation back towards target and maintaining steady policy rates reflects sound central banking. Price stability and financial-sector resilience are public goods. But an inflation target is not a growth strategy. Durable growth comes from investment in productive capacity, from learning and technological upgrading, from moving into higher-value activities, and from building competitive export sectors. Without these, macro stability becomes an exercise in maintenance rather than transformation.

The repeated reference to “structural reforms” also needs to be treated with care. In policy practice, this often means reforms to pricing, state-owned enterprises, taxation, and public finance management. These may improve efficiency and governance, and they matter. But in development economics, structural transformation means something more demanding: a change in what the country produces, how it produces, and what it sells to the world. It means shifting resources into higher-productivity, more technologically advanced, and more export-oriented activities. Without that shift, an economy can be well-managed and still remain fragile.

What is striking in the Governor’s statement is not that it is wrong, but that it is incomplete. We hear a great deal about stability, recovery, and resilience. We hear much less about the growth strategy itself. Which sectors are expected to lead the next phase of growth beyond construction and consumption? How will exports be diversified and upgraded? What is the plan for skills, technology, and productivity? How will private investment be steered toward tradable, foreign-exchange-earning activities?

These are not academic questions. They go to the heart of whether Sri Lanka is merely staging another rebound or beginning a genuine breakthrough. The country’s repeated crises have shown that returning to “normal” is not enough if the underlying growth model remains unchanged.

In sum, the Central Bank Governor’s optimism should be understood for what it is: a stabilisation narrative, not yet a development strategy. It tells us that the economy is becoming calmer, more predictable, and less crisis-prone—and that is a real and necessary achievement. But it does not yet tell us how Sri Lanka will grow fast enough, long enough, and differently enough to escape its long-standing cycle of weak exports, external vulnerability, and stop–go growth.

A recovery built on reconstruction, consumption, and macro control can deliver 4–5 per cent growth. But the government’s own ambitions—and Sri Lanka’s development needs—require 7–8 per cent sustained growth driven by productivity, exports, and structural transformation. That kind of growth does not emerge automatically from stability. It must be designed, coordinated, and pursued through a clear strategy for production, learning, and upgrading.

Stability is essential. Without it, nothing else is possible. But stability is not a development strategy. It is the foundation on which a strategy must be built. The real test for policymakers now is not whether they can keep the economy stable, but whether they can articulate and implement a credible growth strategy that turns stability into momentum and recovery into transformation. Until that strategy is clearly on the table, Sri Lanka’s current optimism—welcome as it is—should be read with caution, not complacency.

by Prof. Ranjith Bandara

Opinion

V. Shanmuganyagam (1940-2026): First Clas Engineer, First Class Teacher

Quiet flows another don. The aging fraternity of Peradeniya Engineering alumni has lost another one of its beloved teachers. V. Shanmuganayagam, an exceptionally affable and popular lecturer for nearly two decades at the Peradeniya Engineering Faculty, passed away on 15 January 2026, in Markham, Toronto, Canada. Shan, as he was universally known, graduated with First Class Honours in Civil Engineering, in 1962, when the Faculty was located in Colombo. He taught at Peradeniya from 1967 to 1984, and later at the Nanyang Technological University in Singapore, before retiring to live in Canada.

In October last year, one of our colleagues, Engineer P. Balasundram, organized a lunch in Toronto to felicitate Shan. It was very well attended and Shan was in good spirits. At 85 he was looking as young as any of us, except for using a wheelchair to facilitate his movement. The gathering was remarkable for the outpouring of warmth and gratitude by nearly 40 or 50 Engineers, who had graduated in the early 1970s and now in their own seventies. One by one every one who was there spoke and thanked Shan for making a difference in their lives as a teacher and a mentor, not only in their professional lives but by extension in their personal lives as well.

As we were leaving the luncheon gathering there were suggestions to have more such events and to have Shan with us for more reminiscing. That was not to be. Within three months, a sudden turn for the worse in his condition proved to be irreversible. He passed away peacefully, far away across the world from the little corner of little Sri Lanka where he was born and raised, and raised in a manner to make a mark in his life and to make a difference in the lives of others who were his family, friends and several hundreds of engineering professionals whom he taught.

V. Shanmuganayagam was born on May 30, 1940, in Point Pedro, to Culanthavel and Sellam Venayagampillai. His family touchingly noted in the obituary that he was raised in humble beginnings, but more consequentially his values were cast in the finest of moulds. He studied at Hartley College, Point Pedro, and was one of the four outstanding Hartleyites to study engineering, get their first class and join the academia. Shan was preceded by Prof. A. Thurairajah, easily Sri Lanka’s most gifted academic engineering mind, and was followed by David Guanaratnam and A.S. Rajendra. All of them did Civil Engineering, and years later Hartley would send a new pair of outstanding students, M. Sritharan and K. Ramathas who would go on to become highly accomplished Electrical Engineers.

Shan graduated in 1962 with First Class Honours and may have been one of a very few if not the only first class that year. Shan worked for a short while at the Ceylon Electricity Board before proceeding to Cambridge for postgraduate studies specializing in Structures. His dissertation on the Ultimate Strength of Encased Beams is listed in the publications of the Cambridge Structures Group. He returned to his job at CEB and then joined the Faculty in 1967. At that time, Shan may have been one of the more senior lecturers in Structures after Milton Amaratunga who too passed away late last year in Southampton, England.

When we were students in the early 1970s, there was an academic debate at the Faculty as to whether a university or specific faculties should give greater priority to teaching or research. Shan was on the side of teaching and he was quite open about it in his classes. He would supplement his lectures with cyclostyled sheets of notes and the students naturally loved it. It was also a time when Shan and many of his colleagues were young bachelors at Peradeniya, and their lives as academic bachelors have been delightfully recounted in a number of online circulations.

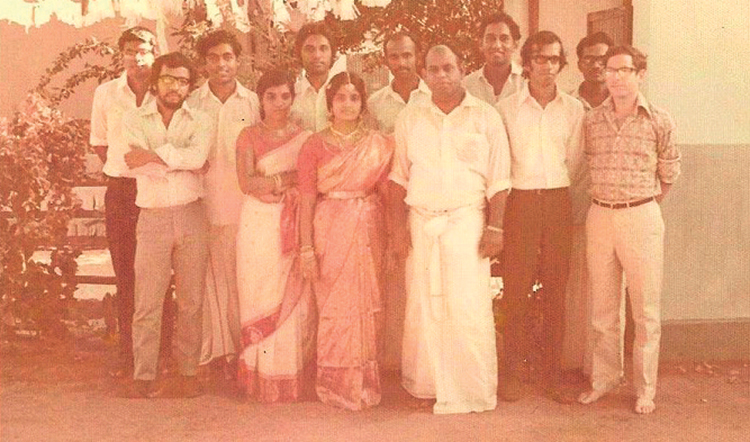

The cross-sectional camaraderie at the Faculty in those days is well captured in one of the photographs taken at Shan’s wedding at Point Pedro, in 1974, which too has been doing the rounds and which I have inserted above. Flanking Shan and his bride Kalamathy, from Left to Right are, M. Dhanendran, Nandana Rambukwella, K. Jeyapalan, Wickrama Bahu Karunaratne, A.S. Rajendra, Lal Tennekoon, Tusit Weerasooria, and R. Srikantha. Sadly, Rambukwella, Karunaratne (Bahu), Tennekoon and now Shan himself, are no longer with us.

Like other faculty members, Shan kept contact with his former students turned practising engineers and they would reach out to him to solicit his expertise in their projects. In the early 1980s, when I was working as Resident Project Manager with my Peradeniya contemporaries, JM Samoon and K. Balasundram, at the Hanthana Housing Scheme undertaken by the National Development Housing Authority (NHDA), Shan was one of the project consultants helping us with concrete technology involving mix design and in situ strength testing using the testing facilities at the Faculty.

The Hanthana Team Looking back, the Hanthana housing scheme construction was the engineering externalization of the architectural imaginings of Tanya Iousova and Suren Wickremesinghe, for building houses on hill slopes without flattening the hills. The project involved the construction of hundreds of housing units with supporting infrastructure comprising roads and drainage, water supply and sanitary, and electricity distribution using underground cables. Tanya & Suren Wickremasinghe were the Architects with an Italian construction company as contractors.

To their credit, Tanya and Suren assembled quite a team of Consulting Engineers that was a cross-section of E’Fac alumni, viz., Siripala Kodikkara and Siripala Jayasinghe (Contract Administration); Prof. Thurairajah (Foundations & Soil Mechanics); S.A. Karunaratne (Structures); V. Shanmuganyagam (Concrete Technology); Neville Kottagama and DLO Mendis (Roads & Drainage); K. Suntharalingam (Water Supply & Sanitary); and Chris Ratnayake (Electrical).

As esoteric gossip goes, DLO Mendis had an informal periodization of engineering graduates, identifying them as either Before-Thurai or After-Thurai, centered on 1957 – the year Prof. Thurairajah graduated with supreme distinction and went on to do groundbreaking theoretical research in Soil Mechanics at Cambridge. Of the Hanthana consultant team, Neville Kottagama and DLO Mendis were before Thurai by six years, Shan was five years after, and all the others came later. Sadly though, only Tanya and Chris are with us today from the 1980s group named above.

After Hanthana came 1983 when all hell broke loose and hundreds of professionals and their families were forced to leave Sri Lanka. Shan left Peradeniya and joined Nanyang Technological University in Singapore, encouraged by his Cambridge contemporaries from Singapore. He taught at Nanyang for twelve years (1984-1996) before moving to Canada with his wife and three sons who were by then ready for university education.

All three children have done exceptionally well in their studies and professional careers. The oldest, Dhanansayan, is a Medical Doctor and a Professor at the University of Wisconsin School of Medicine and Public Health, in Madison, United States. That was where India’s Jayaprakash Narayan and Sri Lanka’s Philip Gunawardena had their university education a hundred years ago.

The younger two sons took to Engineering. The second son, Kalaichelvan, is Program Manager at Creation Technologies, an award-winning global electronics manufacturing service provider. And the youngest, Dhaksayan, is the Chief Information Officer (CIO) at the Toronto Transit Commission (TTC), which is North America’s third-largest urban transit system.

All three have done their parents proud and Shan would have been gratified to see them achieve exemplary success in their chosen fields. A first class Engineer and a first class teacher, Shan was also a great father and a loving grandfather. As we remember Professor Shanmuganyagam, we extend our thoughts and sympathies to his beloved wife Kalamathy, his sons and their young families

by Rajan Philips

Opinion

Cannavarella: Estate once owned by OEG with a heritage since 1880

Established in 1880, Cannavarella Estate stands among the most historically significant plantations in Sri Lanka, carrying a legacy that intertwines agricultural heritage, colonial transitions and modern development. Its story begins with the cultivation of cinchona, a medicinal bark used to produce quinine, which is a vital treatment for malaria at the time, introduced when coffee estates across the island were failing.

Under the ownership of Messrs Macfarlane, Cannavarella rapidly gained a reputation for producing cinchona at ideal elevations between 4,000 and 5,000 feet above sea level. At that time, the estate spanned around 750 acres and played a pivotal role in the island’s shift from coffee to alternative plantation crops during the late 19th century.

A transformative chapter began when Christopher B. Smith purchased the property and unified several surrounding estates- Moussagolla, Cannavarella, East Gowerakelle, and Naminacooly- into what became known as the Cannavarella Group. This amalgamation created a vast holding of approximately 1,800 acres. By 1915, nearly 1,512 acres of this extent were cultivated in tea, marking the estate’s full transition from cinchona to the crop that would define its identity for generations.

The Group was managed by the Eastern Produce and Estates Company from 1915 until 1964, after which stewardship passed successively to Walker & Sons Company Ltd, and then to George Steuart Company Ltd by 1969.

A defining moment in the estate’s history arrived in 1971 when Sir Oliver Goonetilleke, former Governor General of Ceylon, acquired the estate. Under his ownership, it came under the London-based company Ceyover Ltd., a name derived from “Cey” for Ceylon and “Over” for Oliver.

The estate remained under private ownership until the nationalization wave of 1975, during which Cannavarella was brought under the Janatha Estates Development Board (JEDB). For nearly two decades it was managed under government purview until the plantation sector was re-privatised in 1992.

Thereafter, Cannavarella Estate moved under the management of Namunukula Plantations Limited, first through BC Plantation Services, then under John Keells Holdings’ Keells Plantation Management Services and eventually under the ownership of Richard Pieris & Company PLC, where it continues today as part of the Arpico Plantations portfolio.

Blending heritage, landscape and community

Situated along the northeastern slopes of the scenic Kabralla-Moussagolla range and bordering the Namunukula mountain range, Cannavarella Estate spans a total extent of 800 hectares. Its six divisions rise across elevations from 910 to 1,320 metres above sea level, creating a landscape ideal for cultivating premium high-grown tea. Of the total land area, 351 hectares are dedicated to mature tea, while 54 hectares consist of VP tea, representing 16 % of the estate.

Among its most remarkable features are fields containing seedling tea bushes more than a century old, living symbols of Sri Lanka’s plantation legacy that continue to thrive across the slopes. The estate is also home to the origin of the Menik River, which begins its journey in the Moussagolla Division, adding an ecological richness to Cannavarella’s natural environment.

Cannavarella’s history of leadership reflects broader transformations within the plantation industry. The last English superintendent, Mr. Charles Edwards, oversaw the estate during the final phase of British management. In 1972, he was succeeded by Franklin Jacob, who became the first Sri Lankan superintendent of the Cannavarella Group, marking a shift toward local leadership and expertise in plantation management.

Development within Cannavarella Estate has never been confined to agriculture alone. Over the past decade, the estate has strengthened its emphasis on community care, diversification and improving living conditions for its workers. In 2022, coffee planting was initiated in Fields 7 and 8 of the NKU Division, covering 2.5 hectares as part of a broader effort to introduce alternative revenue streams while complementing tea cultivation.

The estate’s commitment to early childhood development is reflected in the initiation of a morning meal programme across all Child Development Centres from 2025, ensuring that children receive nutritious meals each day. A newly constructed Child Development Centre in the EGK Division, completed in 2020, now offers modern facilities including a play area, study room and kitchen, symbolizing the estate’s dedication to nurturing the next generation. In 2015, a housing scheme consisting of 23 new homes was completed and handed over to workers in the CVE Division, significantly improving quality of life and providing families with safer, more stable living environments.

A future built on stability and renewal

Cannavarella Estate is preparing to undertake one of its most important social development initiatives. A major housing programme has been proposed to relocate 69 families currently residing in landslide-prone areas of the Moussagolla Division. Supported by the Indian Housing Programme, this effort aims to provide secure, sustainable housing in safer terrain, ensuring long-term stability for vulnerable families and reducing disaster risk in the region.

Across its history, Cannavarella Estate has remained a landscape shaped both by the land and the people who call it home. Cannavarella continues to honour its roots while building a modern legacy that uplifts both the estate and its people. (Planters Association news release)

-

Features3 days ago

Features3 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business4 days ago

Business4 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business3 days ago

Business3 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business3 days ago

Business3 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business3 days ago

Business3 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business4 days ago

Business4 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Business4 days ago

Business4 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check

-

Editorial6 days ago

Editorial6 days agoAll’s not well that ends well?