Business

Sizeable moderation in trade deficit – CBSL

External Sector Performance – February 2023

• Import expenditure declined notably, compared to the reduction in export earnings in February 2023 (y-o-y), resulting into sizeable moderation in the trade deficit.

• Workers’ remittances and earnings from tourism continued to improve in February 2023.

• Gross official reserves strengthened further by end February 2023, compared to recent months.

• The exchange rate appreciated notably in March 2023 following the greater flexibility that was allowed in the determination of the exchange rate.

• The Colombo Stock Exchange (CSE) and foreign investment in the government securities market recorded net inflows during February 2023.

• The Extended Fund Facility (EFF) from the International Monetary Fund (IMF) of US dollars 3 billion was approved and the first tranche was disbursed in March 2023.

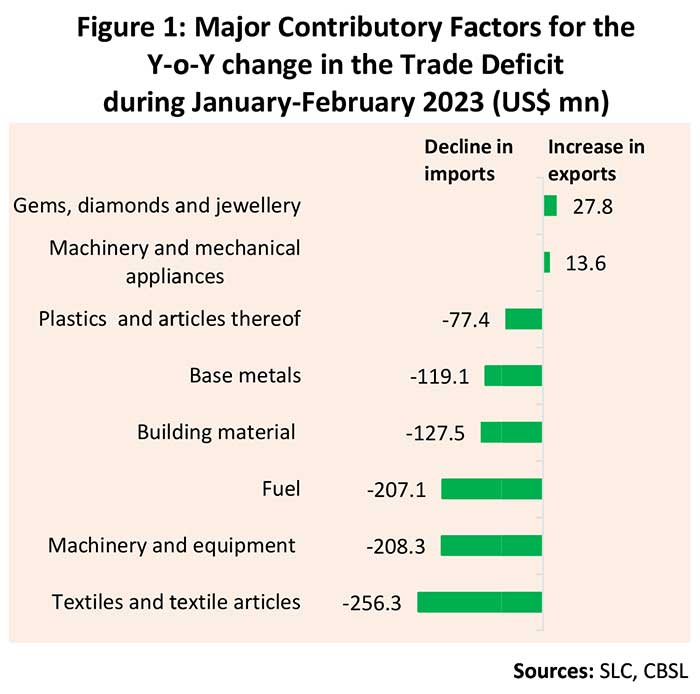

The deficit in the merchandise trade account narrowed significantly to US dollars 39 million in February 2023, from US dollars 780 million in February 2022, mainly reflecting the impact of significant moderation of import expenditure due to subdued aggregate demand conditions. The cumulative deficit in the trade account during January-February 2023 was US dollars 449 million, a sizeable decline from US dollars 1,636 million recorded over the same period in 2022. The major contributory factors for this are shown in Figure 1.

Overall Exports: Despite recording a marginal growth compared to January 2023, earnings from merchandise exports declined by 10.2 per cent in February 2023, year-on-year, to US dollars 982 million. Exports earnings recorded below US dollar 1 billion level for the second consecutive month. While the decline in earnings was observed across all main categories, industrial exports mainly contributed to the overall contraction. Cumulative export earnings during January-February 2023 declined by 10.7 per cent over the same period in the last year.

Industrial Exports: Earnings from the exports of industrial goods declined in February 2023, compared to February 2022, with a substantial share of the decline being contributed by garments. Reduced demand from major markets for garments due to unfavourable economic conditions globally mainly contributed for this outcome. Earnings from rubber products continued to decline due to the lower exports of household rubber gloves. Similarly, earnings from the exports of petroleum products

1 The CBSL classification of exports and the classification of exports based on the Standard International Trade Classification Revision 4, are presented in Annex II and Annex III, respectively. also declined due to the drop in volumes of bunker and aviation fuel exports despite the higher aviation fuel prices. In contrast, earnings from machinery and mechanical appliances (mainly, electronic equipment); and gems, diamonds, and jewellery increased in February 2023.

Agricultural Exports: Earnings from the export of agricultural goods marginally declined in February 2023, compared to a year ago, since the increase in earnings from spices and tea was offset by the decline in earnings from coconut related products (primarily, fibres and desiccated coconut). Export earnings from spices improved due to higher export volumes of cloves; cinnamon; and nutmeg and mace. Increased earnings from tea exports were mainly due to price increases as the volumes registered a decline.

Mineral Exports: Earnings from mineral exports declined in February 2023, compared to February 2022, mainly due to the decline in exports of titanium ores.

Overall Imports: Expenditure on merchandise imports was almost halved in February 2023 at US dollars 1,021 million, compared to February 2022, recording the lowest imports since May 2020. All major import sectors declined while the decline in expenditure on intermediate goods was significant. Meanwhile, cumulative import expenditure during January-February 2023 also declined by 37.1 per cent over the corresponding period in 2022.

Consumer Goods: Expenditure on the importation of consumer goods declined in February 2023, compared to February 2022, driven by lower expenditure on both food and non-food consumer goods. Decline in expenditure on non-food consumer goods was broad-based but the drop in imports

2 The CBSL classification of imports and the classification of imports based on the Standard International Trade Classification Revision 4, are presented in Annex IV and Annex V, respectively.

Business

JAT Holdings celebrates the 6th Pintharu Abhiman Convocation, uplifting over 800 painters through NVQ certification

JAT Holdings PLC marked a significant milestone with the successful conclusion of the 6th JAT Pintharu Abhiman Convocation, recognising more than 800 painters who have earned their NVQ Level 3 qualification, an internationally recognised professional certification delivered in partnership with the National Apprentice and Industrial Training Authority (NAITA).

JAT Pintharu Abhiman was established to uplift Sri Lanka’s painter community through structured skills development, professional recognition and stronger earning potential. This year’s graduating cohort reflects the programme’s expanding reach and the tangible changes it continues to deliver for individuals, families and communities.JAT in collaboration with NAITA has streamlined the certification process such that what would traditionally take up to six months has been refined into an efficient and high-impact three-day assessment model. This approach ensures painters can obtain their qualification without sacrificing extended periods of work, while JAT fully absorbs the certification cost, removing financial barriers and enabling wider access to formal recognition.

Research conducted amongst NVQ qualified participants shows meaningful improvements in livelihoods, with 90 percent reporting increased personal confidence and 76 percent noting an improvement in their overall standard of living. This uplift demonstrates the long-term value of industry-aligned professional training.

A noteworthy moment at this year’s convocation was the recognition of four female painters who received their NVQ certifications. Their achievement marks an important step in broadening female participation in a field that has historically been male dominated, reinforcing JAT Holdings’ commitment to creating inclusive pathways for technical development and sustainable employment.

Speaking at the ceremony, Mr. Wasantha Gunaratne, Director Sales and Technical (South Asia) of JAT Holdings PLC, said:

“Pintharu Abhiman is fundamentally about development, giving painters the knowledge, structure and recognition they need to progress in their careers. By equipping over 800 painters with an internationally recognised NVQ qualification, we are not only strengthening the technical standards of the industry but also creating real pathways for entrepreneurship and financial independence. It is especially encouraging to see that one in five certified painters have already begun building their own businesses. These are the outcomes that matter because they show that when we invest in skills, we unlock opportunity. JAT remains committed to expanding these avenues so every painter has the chance to grow, lead and build a sustainable future.”

The 6th JAT Pintharu Abhiman Convocation underscores JAT’s continued dedication to uplifting the painter community, enhancing industry standards and supporting national skills development through accessible, professionally recognised qualifications.

Business

Industry bodies flag gaps in Draft National Electricity Policy

The Ceylon Chamber of Commerce, together with the American Chamber of Commerce, Exporters Association of Sri Lanka, Federation of Renewable Energy Developers, Joint Apparel Association Forum, National Chamber of Commerce of Sri Lanka and Sri Lanka Association for Software and Services Companies, has submitted joint observations on the Draft National Electricity Policy, highlighting that several key issues have not been adequately addressed.

Whilst recognizing the need for reform in the electricity sector, the submission flags several gaps in the draft policy that require closer attention. Key areas such as affordability, decarbonisation commitments, incentives for renewable energy, competition, and the long-term financial health of the sector are either missing or not addressed in sufficient depth.

The proposed tariff revisions outlined in the draft energy policy raise concerns, particularly regarding the removal of cross-subsidies and the proposal to restrict subsidies exclusively to households consuming less than 30 kWh per month. Without detailed analysis, these measures could weaken access to sustainable and affordable energy and potentially lead to fiscal risks.

The provisions allowing uncompensated curtailment, removing feed-in tariffs, and imposing mandatory time-of-use tariffs on rooftop solar users could make renewable energy projects un-bankable for international lenders, thereby increasing the cost of capital for Sri Lanka.

Calling for a more future-focused approach, the submission stresses the need for a policy that reflects modern electricity systems, including planning for the energy transition, energy storage, market competition, cross-border electricity trading, and emerging technologies.

The Chambers and Associations request a comprehensive revision of the Draft National Electricity Policy, alignment with the Electricity Act, and resubmission following substantive consultation, and reiterate support to engage constructively with policymakers to shape a policy that supports affordability, investment confidence, and Sri Lanka’s long-term energy security.

Business

Bank of Ceylon partners with 36th APB Sri Lanka Convention

Bank of Ceylon (BOC) partnered with the 36th Annual Convention of the Association of Professional Bankers (APB) Sri Lanka, reaffirming its commitment to promoting professional excellence and knowledge sharing within the banking sector. The partnership was officially handed over by Sameera D. Liyanage, Chief Marketing Officer of Bank of Ceylon and M. R. N. Rohana Kumara, Deputy General Manager Business Revival Unit of Bank of Ceylon, reflecting BOC’s focus on empowering banking professionals and supporting the sustainable growth of Sri Lanka’s financial services industry.

-

Business1 day ago

Business1 day agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Business5 days ago

Business5 days agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

News5 days ago

News5 days agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Features5 days ago

Features5 days agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

Features5 days ago

Features5 days agoSubject:Whatever happened to (my) three million dollars?

-

Business1 day ago

Business1 day agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App

-

Business1 day ago

Business1 day agoHayleys Mobility unveils Premium Delivery Centre

-

News5 days ago

News5 days agoLevel I landslide early warnings issued to the Districts of Badulla, Kandy, Matale and Nuwara-Eliya extended