News

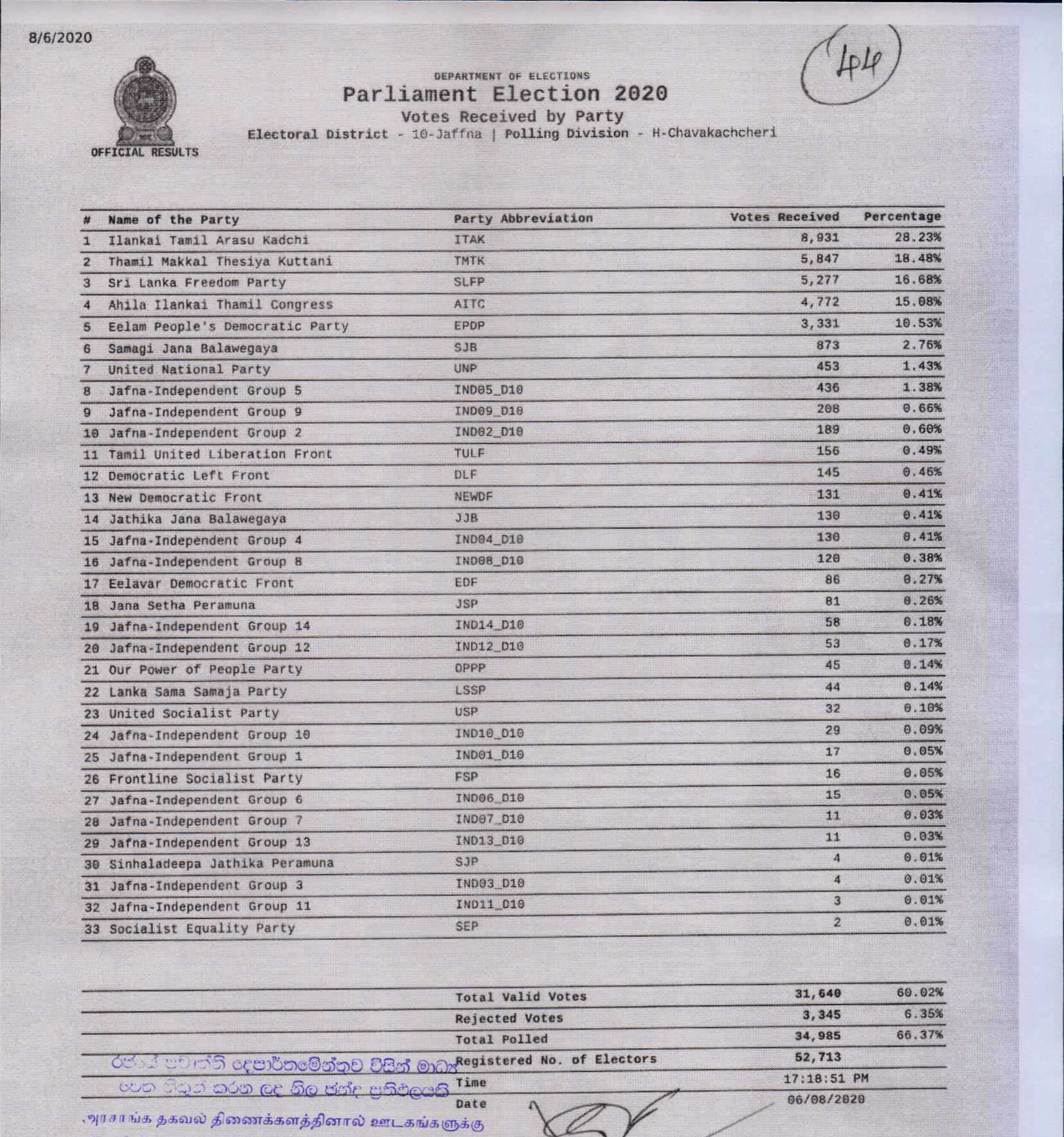

Parliamentary Election 2020 – Jaffna -Chavakachcheri

News

IGP complains of 32,000 personnel shortage

IGP Priyantha Weerasooriya yesterday said that the Police were currently facing a shortage of nearly 32,000 personnel, with the service operating well below its required strength.

He made these remarks while attending a ceremony held yesterday morning (30) to appreciate the contribution of fingerprint officers, crime analysis officers, and forensic photographers attached to the Criminal Investigation Department for their role in solving crimes.

Addressing the gathering, the IGP noted that 2,500 police officers are due to retire this year, while a further 2,700 officers are expected to retire next year.

In light of the situation, he said that plans are underway to recruit 10,000 new officers to the Sri Lanka Police in the future.

News

Public alerted to rising credit card scams using fake SMS messages

Sri Lanka CERT has alerted the public to a rising credit card scam involving fake SMS messages and online alerts claiming cards have been suspended due to “suspicious activity.”Victims are tricked into clicking links and entering personal information, including NIC numbers, after being warned their cards will be cancelled within 24 hours. Scammers then use this data and obtain OTPs to steal funds from accounts, CERT said yesterday in a statement, titled Public Advisory: Financial Fraud – Do Not be Deceived by Bank or Police Impersonation Scams’.

Full text of the statement: Sri Lanka CERT has received multiple complaints regarding an ongoing fraudulent scheme in which scammers send SMS messages and online notifications falsely claiming that credit cards have been suspended, with the intention of unlawfully obtaining money and personal information from the public.

Approach Used by Fraudsters

1. Fake Bank Alerts via SMS and Online Messages

It has been reported that scammers send messages stating that a credit card has been suspended due to “suspicious activity,” often mentioning the names of several well-known banks to appear credible. Recipients are instructed to reactivate their cards by clicking on a link and providing sensitive personal information, including their National Identity Card (NIC) number.

These messages typically warn that the card will be permanently cancelled if the information is not provided within 24 hours, creating a sense of urgency. Alarmed recipients may then click on the link and submit their details. Subsequently, fraudsters gain access to the victims’ bank accounts, send a One-Time Password (OTP) to the victim’s phone, obtain that OTP through deception, and proceed to steal funds from the account.

2. Police Impersonation via WhatsApp Video Calls

In another reported method, some victims have received WhatsApp video calls from individuals dressed in police uniforms, impersonating Assistant Superintendents of Police. These callers claim that a criminal is in police custody and allege that the criminal has used the victim’s name and NIC details to obtain credit cards from multiple banks and commit large-scale fraud.

The impersonators pressure and intimidate victims by questioning them while quoting their NIC numbers and bank account details. Complaints indicate that this information is often data previously obtained through earlier fraudulent messages but is presented in a way that makes victims believe it is being accessed by law enforcement. Victims are then threatened with arrest, leading to some transfer of large sums of money in an attempt to avoid legal action.

Advisory to the Public

Sri Lanka CERT strongly urges the public to:

Never share personal or financial information, including NIC numbers, card details, passwords, or OTPs, through unknown or unverified links received via SMS, email, or online messages. Be cautious of unsolicited calls or video calls, even if the caller claims to be a police officer or bank official. Verify directly with your bank or the relevant authorities using official contact details before taking any action. Report suspected fraud immediately to your bank. Staying vigilant and informed is essential to protecting yourself and others from these fraudulent activities.

News

Case against Rajitha and another for allegedly causing loss of Rs. 20mn to govt. put off to 10 July

The Colombo Magistrate’s Court yesterday ordered that the complaint filed against two defendants, including former Minister Rajitha Senaratne, regarding the alleged incurring of a loss exceeding Rs. 20 million to the government, be recalled on 10 July.

The case involves the awarding of a sand mining project, at the Kirinda Fisheries Harbour, to a Korean company.

The case was taken up yesterday (30) before Colombo Chief Magistrate Asanga S. Bodaragama.

During the proceedings, officials from the Bribery Commission submitted that investigations into the incident have not yet been concluded and requested a date to report on the progress.

After considering the facts presented, the Magistrate fixed 10 July to recall the complaint and ordered that the progress of the investigations be reported on that day.

-

Business5 days ago

Business5 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business6 days ago

Business6 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion6 days ago

Opinion6 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Business2 days ago

Business2 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion1 day ago

Opinion1 day agoSri Lanka, the Stars,and statesmen

-

Opinion5 days ago

Opinion5 days agoLuck knocks at your door every day

-

News6 days ago

News6 days agoRising climate risks and poverty in focus at CEPA policy panel tomorrow at Open University

-

Business2 days ago

Business2 days agoBourse positively impacted by CBSL policy rate stance