Business

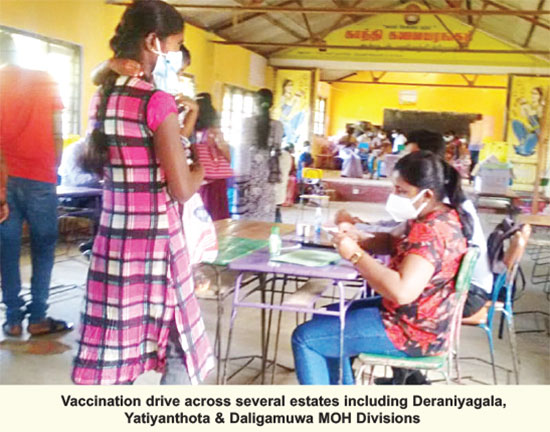

‘Over 85% of Sri Lanka’s estate community receive first jab, 63% fully vaccinated’

The Planters’ Association of Ceylon (PA) and the Plantation Human Development Trust (PHDT) announced major progress in their collective efforts to safeguard all residents of Sri Lanka’s estate community, with over 85% of the community across 7 regions having received their first dose of a COVID-19 vaccine, and 63% being fully as at 10th September 2021.

Working in close partnership with the Ministry of Health (MoH), Provincial Health Authorities & PHDT, Regional Plantation Companies (RPCs) have been able to fast track the rate of vaccinations for its estate workers and their families.

“With the number of COVID cases on the rise once again, ensuring the safety of our estate workers and their families is a priority for all RPCs. Vaccinations are being carried out systematically while continuous investments are being made to strengthen safety protocols. Our mission is to ensure that all our workers and the community at large, are fully vaccinated by end September 2021.” PA media spokesperson Dr. Roshan Rajadurai said.

“We are deeply grateful to the authorities for their vital assistance in this endeavor and we remain totally committed to ensuring the safety and wellbeing of all our employees.”

As of 10th of September, over 87% of those between the ages of 30-59 received their 1st doses, while over 58% received their 2nd doses thus far. Priority has also been given to those above 60 years, with over 92% having received their first jab and over 79% having received their 2nd jab in the estate sector.

The PA noted that the inoculation drive commenced from the Nuwara-Eliya district (Covering Hatton & Nuwara Eliya) since the largest community of estate workers reside in this area. Over 85% of 30-60 year olds having already received their first dose while over 54% received their 2nd dose. Meanwhile, over 89% of individuals from the other plantation districts belonging to the same age category received their 1st dose while 62% received their 2nd dose.

“The vaccination distribution is held under three phases with priority being given to frontline workers, secondly the factory workers inclusive of community leaders & thirdly, the staff and the wider community. We are pleased to note that we have reached the final half of the third phase. The rate at which vaccinations were conducted could not have been achieved without the assistance of relevant stakeholders.

“Prior to the vaccines being distributed, estate managers worked closely with MoH officials and PHIs in order to raise awareness about the vaccine, and alleviate all doubts. This drastically reduced any hesitancy which the community had towards vaccines, which in turn was instrumental to the successful rollout of vaccines among the estate community,” PHDT Director-General Lal Perera said.

“While we continue to keep up the momentum of the vaccine drive, COVID 19 awareness programmes and basic healthcare/welfare services continue to operate unhindered. Proactive measures like a regional help desks have been set up for the estate community throughout the pandemic. A COVID 19 steering committees with relevant stakeholders along with RPC coordinators have also been appointed to ensure guidelines meted out by the MOH are being adhered to across all factories.” Dr. Rajadurai concluded.

Business

Foreign Minister defends India pacts, sidesteps transparency demand

In a press conference marked by both clarity and pointed omission, Foreign Affairs and Tourism Minister Vijitha Herath, yesterday offered a robust defence of two controversial bilateral agreements with India but conspicuously avoided committing to tabling their full texts in Parliament.

The minister’s appearance, billed as a year-opening briefing, took a sharp turn when questioned on the strategic implications of the India-Sri Lanka Defence Cooperation Agreement and Sri Lanka’s acceptance of the Indian Pharmacopoeia.

“No Indian military camps on our soil”

Responding in Sinhala to a question posed in English, Minister Herath moved first to allay what he suggested were widespread misapprehensions about the defence pact.

“This agreement is especially for data and information exchange purposes regarding drug trafficking, drug mafias, human trafficking, and any terrorist activities that could threaten regional security and peace,” Herath stated.

He emphasised that it would also facilitate “various support related to the defence sector.”

In his most definitive assertion, aimed at quieting a persistent national anxiety, the Minister declared: “We must clearly say that there is no plan or possibility of setting up Indian defence camps on Sri Lankan soil.” He categorised the pact not as a “defence agreement” but a “defence cooperation agreement in its real sense,” claiming it creates an “advantageous position” for Sri Lanka.

He linked recent post-‘Ditwah’ cyclone disaster support from India, as well as U.S. aerial support during recovery efforts, to the frameworks established by such cooperation agreements, arguing they have proven beneficial.

Indian Pharmacopoeia: A reputation-based advantage

On the equally contentious acceptance of the Indian Pharmacopoeia – a standard synopsis for drug manufacturing – Minister Herath framed it as a logical step that formalises existing practice.

“We already import a significant share of medicines from India,” he noted. The agreement, he explained, signifies the acceptance of medicines exported by a “reputed Indian pharmaceutical company” approved by its national regulators.

He assured the public that Sri Lanka’s National Medicine Regulatory Authority (NMRA) will continue to remain the monitor. “By entering into this, no disadvantage will happen to us. Only an advantage will happen… it will only be beneficial to us,” he emphasised.

The unanswered question

Despite the detailed assurances, the Minister pointedly ignored the final and arguably most critical part of the question posed by The Island Financial Review : whether the government would table the full text of the two agreements in Parliament for transparent debate and discussion.

This omission is likely to fuel further controversy, as opposition parties, civil society groups, and independent analysts have repeatedly demanded full parliamentary scrutiny, arguing that agreements touching on sovereignty and public health mandate the highest level of public transparency.

Tourism Pride

Shifting to his tourism portfolio, Minister Herath struck an optimistic note, citing record tourist arrivals and foreign remittances in 2025 as a sign of resilient recovery post-Ditwah.

The conference also touched on global affairs. When asked about the U.S. arrest of Venezuelan President Nicolás Maduro, Herath presented a nuanced governmental position. He stated that while his party, the JVP, condemns the action, the government’s official stance is to urge respect for national sovereignty in line with the UN Charter – a reflection of the coalition’s delicate balancing act between ideological roots and diplomatic pragmatism once in governance.

Minister Herath’s explanations provide the government’s clearest public rationale yet for the India agreements, directly confronting fears over militarisation and pharmaceutical quality. However, the deliberate sidestepping of the transparency query left a communication deficit at the heart of the press conference.

High-stakes diplomacy

It reflected a perception that while the administration is willing to defend its policy outcomes, it remains reluctant to subject the processes of high-stakes diplomacy to the full glare of parliamentary and public scrutiny. As these agreements continue to shape Sri Lanka’s strategic and health landscape, the call for their full disclosure is now accompanied by a louder question about the government’s commitment to open governance.

by Sanath Nanayakkare

Business

‘Vehicle-Testing Can Save Lives’

Automobile Association of Ceylon (AAC), in collaboration with the Federation Internationale de L’ Automobile (FIA) and under the UN Decade of Action for Road Safety has been consistently engaging in road safety enhancement programs for all citizens of Sri Lanka.

Current data indicates that while over 08 million vehicles are registered in the country, only heavy vehicles (less than 20% of the vehicle population) are subjected to compulsory road-worthiness tests.

Fatal accidents due to technical failures in vehicles are on the rise and the damage to lives and property is severe.

We also understand that there is a death every three hours and eight deaths per day in road accidents. This amounts to nearly 3000 deaths in road accidents per year.

AA of Ceylon has launched the “Vehicle Testing can Save Lives” project with the advice and support given to execute our campaign by the Minister of Transport, chairman, National Council for Road Safety (NCRC), Deputy Inspector General of Police (Traffic Division), Dr. Indika Jagoda, Deputy Director (Accident Service), National Hospital, president, Lions Club of Boralasgamuwa, Metro(Lions Club International – District 306 D 2) and other stake-holders to find a workable, low / cost solution for mandatory vehicle testing in Sri Lanka.

Therefore, this project aims to educate the public on the necessity of checking essential safety features in all vehicles and the benefits of same to all road users.

AAC has therefore respectfully requested Anura Kumara Dissanayake, President of the Democratic Socialist Republic of Sri Lanka, to consider implementing the proposal we have submitted to him, to minimize fatal accidents, injuries to people and damage to vehicles and property due to road accidents and to also implement a rule to have compulsorily road-worthiness checking of all vehicles. (AAC)

Business

INSEE Lanka appoints new Chief Executive Officer

Siam City Cement (Lanka) Limited (INSEE Lanka) has announced the appointment of Eng. Thusith C. Gunawarnasuriya as its new Chief Executive Officer, effective 01 January 2026. He succeeds Nandana Ekanayake, who will continue to serve as Chairman, ensuring leadership continuity and strategic stability for the organisation.

A long-standing contributor to INSEE’s journey, Thusith has worked with the company through its evolution under Holcim (Lanka) Ltd, LafargeHolcim and INSEE, playing pivotal roles that influenced both operational progress and strategic direction.

Rejoining INSEE Lanka in January 2025 as Chief Operating Officer, he has since demonstrated exceptional leadership, driving topline growth, improving EBITDA performance, and strengthening talent development initiatives that enhanced organisational capability and business outcomes.

His expertise in business strategy, operations excellence, and supply chain transformation is well-recognised, supported by over 25 years of multi-industry and multi-country leadership experience. His career includes senior positions at Lion Brewery (Ceylon) PLC, Hemas Manufacturing, Fonterra Brands Lanka, GlaxoSmithKline, MAS Active, and DMS Software Engineering. His international exposure spans India, Bangladesh, and Thailand.

Thusith is a proud alumnus of Dharmaraja College, Kandy, and holds a BSc (Hons) in Electrical & Electronic Engineering from the University of Peradeniya, an MBA from the University of Colombo, and an MSc in Business & Organizational Psychology from Coventry University, UK. He has completed executive leadership programs at IMD (Switzerland) and the National University of Singapore. He is also a member of IEEE (US), CILT (UK), ISMM (Sri Lanka), and IESL (Sri Lanka).

Chairman’s Quote – Nandana Ekanayake:

“Thusith’s deep understanding of our business, strong operational mindset, and proven leadership make him the ideal successor to lead INSEE Lanka into the next phase of growth. His experience within INSEE and across multiple industries, positions him well to deliver on our long-term ambitions and uphold the values that define the organisation.”

-

News1 day ago

News1 day agoPrivate airline crew member nabbed with contraband gold

-

News3 days ago

News3 days agoHealth Minister sends letter of demand for one billion rupees in damages

-

News6 days ago

News6 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Opinion5 days ago

Opinion5 days agoRemembering Douglas Devananda on New Year’s Day 2026

-

Latest News1 day ago

Latest News1 day agoCurran, bowlers lead Desert Vipers to maiden ILT20 title

-

Features1 day ago

Features1 day agoPharmaceuticals, deaths, and work ethics

-

News1 day ago

News1 day agoBellana says Rs 900 mn fraud at NHSL cannot be suppressed by moving CID against him

-

News22 hours ago

News22 hours agoPM lays foundation stone for seven-storey Sadaham Mandiraya