Features

MMT, deficit financing and printing money

By sumanasiri liyanage

E-mail: sumane_l@yahoo.com

“We need a mechanism where money flows out to the economy directly and permanently.” -Kikuo Iwata

Two prominent economists in Sri Lanka, Dr W A Wijewardene, a former Deputy Governor of the Central Bank of Sri Lanka and Prof Sirimevan Colombage, Professor of Economics, Open University of Sri Lanka, published two articles in The Island and Daily FT last week criticizing the extant monetary policy paradigm of the Central Bank of Sri Lanka (CBSL) alleging that the CBSL while distancing itself from inflation-oriented policies has begun to follow closely the policy framework that derived from the main tenets of Modern Monetary Theory (MMT). MMT as new discourse on the monetary-fiscal policy mix gained credence among left leaning Democrats especially during the presidential campaign in the US. Why is the issue of MMT raised in the Sri Lankan discourse? According to Prof. Colombage, Central Bank Governor Prof. W.D. Lakshman’s recent statement at an economic forum that domestic currency debt in a country with sovereign powers of money printing is not a huge problem is in close affinity with MMT argument.

The two economists agree that the continuation of present policy paradigm of the CBSL will necessarily lead to disaster. Dr. Wijewardene in the form of a conversation between two popular tele- drama characters, Ashini and Sarath Mahattaya, gave a clear and lucid narrative on the MMT, tracing its historical roots. This is very useful to economic students. At the end of the conversation with his granddaughter, Sarath Mahattaya, Dr Wijewardene’s narrator had concluded: “So, the present Government’s reliance on MMT is like getting a demon to work for it. If it does not play the game within limits, the demon will turn back and swallow it. This should be properly understood by the present Government’s top policymakers who advocate printing of money to pay for Government spending”. Of course, Dr Wijewardene has admitted that the government may borrow moderately. “What I mean by moderately is that money printing should not cause unwarranted unaffordable inflation”.

Prof Colombage seems to be more reserved giving the impression that MMT may be okay for advanced countries like the USA and Japan with reserved currency, but not for a small country like Sri Lanka. I am sure he may be thinking of the proposal by the former deputy governor at the Bank of Japan Kikuo Iwata. Moreover, he seems to think that MMT like policies are unavoidable at present conjuncture. He writes: “The recent monetary expansion points to imminent dangers in adopting MMT-style monetary policy in a country like Sri Lanka, though such policy stance might be unavoidable amidst the unprecedented economic setback caused by the COVID-19 pandemic.”

This article intends neither to defend the extant monetary policy of the CBSL nor to posit that the main arguments of the MMT are correct. For myriad of reasons, it is hard to say that the CBSL policy per se is governed by MMT. Nonetheless, the interpretation of the MMT given by Dr. Wijewardene and Prof Colombage appears to have missed some of the complexities of the MMT argument as their contestation of the MMT seems to be based on the neo-classical and monetarist premise that money supply is exogeneous. On the contrary, post-Keynesians and MMT theorists posit that money supply is endogenous and linked with the effective demand. Hence, deficit financing does not necessarily lead to inflation.

Modern Monetary Theory

MMT proposes to bring the government to the fore. According to Randall Wray, the main weakness of macroeconomics texts and teaching today is that they start with unanswered question. Where does money come from? Modern macroeconomics skips this question leaving it to circular reasoning. As a result, in present day macroeconomics textbooks the government is brought in not in Chapter 1 as it should be, but in Chapter 8 or 10.

Secondly, the MMT may not be reduced to a notion that upholds deficit financing through printing money. It posits referring to historical evidence a nexus between printing money and redemption of tax. Hence, Dr. Wijewardene’s following statement is a result of simplistic reading of the MMT. Critiquing Stephanie Kelton, he writes: “One of the bold statements of Kelton is that taxes are charged for paying for government expenditure is mere fantasy. That is because there are many other ways of paying for such expenditure such as printing money. Governments can pay for expenditure by borrowing. When it comes to repaying, they can print money and repay the debt. So, there is no problem.”

Thirdly, MMT does not totally neglect as critics say the possibility of inflationary pressure as a result of deficit financing. It has its own explanation of the phenomena of inflationary pressure before achieving full employment and hyper-inflationary situations.

A simple MMT macro model is adequate enough to demonstrate the complexities of its basic postulates. Scott Fullwiler’s MMT macro model as summarized by Michael Roberts is presented below:

Basically, he starts off with a Keynes/Kalecki post-Keynesian macro model of aggregate demand. This model is simply an identity. There are two ways of looking at an economy, by total income or by total spending and they must equal each other.

Thus National Income (NI) = National Expenditure (NE).

Following the ‘Keynesian Marxist’ Michal Kalecki, we can break this down into:

(NI) Profits + Wages = (NE) Investment + Consumption.

Now there are two sorts of income and two sorts of spending. Since rent and interest are paid from Profit, those payments may be excluded.

If we assume that all Wages are spent then and all Profits are saved, we can delete Wages and Consumption from the identity. So

Profits = Investment

But Scott re-expands the parts on the right-hand side to look at flows, so that wages that are saved are added back with profits to get Private Saving (so assuming some household saving); and he also adds in Government saving (taxation less spending) and Foreign Saving (net imports or current account deficit).

Thus, Profits as a separate category disappears into Private Savings and we get:

Investment = Private Saving + (Taxation – Government Spending) + (Imports – Exports)

But then Scott also dispenses with the separate category Investment and converts it into Private Saving less Investment or the Private Sector Surplus. So now we have Private Sector Savings (Wages saved plus Profits less Investment). So Scott continues:

Private Sector Surplus = Government Deficit + Current Account Balance

Or

Private Sector Surplus – Current Account Balance = Government Deficit

This is the key MMT identity. It argues that if the Government deficit rises, then assuming the Current Account balance does not change, the Private Sector Surplus (Wages saved +Profits less Investment) rises. The MMT conclusion (assertion) is that increasing the Government deficit will increase the Private Sector Surplus . And if we exclude Wages saved (the MMT identity does not) and the Current Account balance, then we have:

Net Profits (ie Profits after Investment) = Government deficit

And we can conclude that Government deficits determine Net Profits ie Profits less Investment.

Suppose that the Current Account Balance remains unchanged, an increase in Government Deficit leads to increase in PSS that equals Wages Saved + (Profit – Investment). Assuming that all wages are consumed we may write the fundamental equation of MMT as follows:

Net Profit = (Profit – Investment) = Government Deficit

The above equation shows that Government Deficit increases net Profit.

MMT posits that an increase in government deficit leads to expand the economy that in turn leads to increase the tax base.

Deficit Finance and Inflation

Can deficit finance lead to inflation? MMT has two answers to this question. Agreeing with the post-Keynesians, MMT posits that a continuous increase in money printing through deficit finance after achieving full employment would generate an inflationary pressure. If the resources are not fully employed, deficit financing would not necessarily lead to inflation. Besides, this full employment inflation, Randall shows that inflationary pressure may occur if increased government expenditure focuses on elite projects and highly skilled employment. Such an expenditure may create more what David Graeber called “bullshit jobs”.

MMT has multiple weaknesses. However, those weaknesses have nothing to with the critique of MMT by mainstream economists. If a country like Sri Lanka adopts deficit financing and printing money in a crisis situation, it is imperative such policies should be accompanied by import restrictions, proper direction of government expenditure and increase of direct taxation. Nonetheless, the government decision to dispossess Eastern Container Terminal (ECT) shows that its directionality is fundamentally wrong.

In lieu of conclusion, it is imperative to note without giving room for a misunderstanding that MMT as well as all the varieties of Keynesianism suffer from basic flaw. They seem to inverse the nexus between human labour, value and money. Michael Roberts has highlighted this in the following words: “They ignore that all the things that we need or use in society are the product of human labour power and under a capitalist economy where production is for profit (ie for money over the costs of production), not need, then money represents the socially necessary labor time expended. We see only money, not value, but money is only the representation of value in its universal form, namely abstract labour as measured in socially necessary labour time. It is a fetish to think that money is something that is outside and separate from value.” Anyway, this would be a subject for another article.

(The writer is a retired university teacher in political economy.)

Features

Crucial test for religious and ethnic harmony in Bangladesh

Will the Bangladesh parliamentary election bring into being a government that will ensure ethnic and religious harmony in the country? This is the poser on the lips of peace-loving sections in Bangladesh and a principal concern of those outside who mean the country well.

Will the Bangladesh parliamentary election bring into being a government that will ensure ethnic and religious harmony in the country? This is the poser on the lips of peace-loving sections in Bangladesh and a principal concern of those outside who mean the country well.

The apprehensions are mainly on the part of religious and ethnic minorities. The parliamentary poll of February 12th is expected to bring into existence a government headed by the Bangladesh Nationalist Party (BNP) and the Islamist oriented Jamaat-e-Islami party and this is where the rub is. If these parties win, will it be a case of Bangladesh sliding in the direction of a theocracy or a state where majoritarian chauvinism thrives?

Chief of the Jamaat, Shafiqur Rahman, who was interviewed by sections of the international media recently said that there is no need for minority groups in Bangladesh to have the above fears. He assured, essentially, that the state that will come into being will be equable and inclusive. May it be so, is likely to be the wish of those who cherish a tension-free Bangladesh.

The party that could have posed a challenge to the above parties, the Awami League Party of former Prime Minister Hasina Wased, is out of the running on account of a suspension that was imposed on it by the authorities and the mentioned majoritarian-oriented parties are expected to have it easy at the polls.

A positive that has emerged against the backdrop of the poll is that most ordinary people in Bangladesh, be they Muslim or Hindu, are for communal and religious harmony and it is hoped that this sentiment will strongly prevail, going ahead. Interestingly, most of them were of the view, when interviewed, that it was the politicians who sowed the seeds of discord in the country and this viewpoint is widely shared by publics all over the region in respect of the politicians of their countries.

Some sections of the Jamaat party were of the view that matters with regard to the orientation of governance are best left to the incoming parliament to decide on but such opinions will be cold comfort for minority groups. If the parliamentary majority comes to consist of hard line Islamists, for instance, there is nothing to prevent the country from going in for theocratic governance. Consequently, minority group fears over their safety and protection cannot be prevented from spreading.

Therefore, we come back to the question of just and fair governance and whether Bangladesh’s future rulers could ensure these essential conditions of democratic rule. The latter, it is hoped, will be sufficiently perceptive to ascertain that a Bangladesh rife with religious and ethnic tensions, and therefore unstable, would not be in the interests of Bangladesh and those of the region’s countries.

Unfortunately, politicians region-wide fall for the lure of ethnic, religious and linguistic chauvinism. This happens even in the case of politicians who claim to be democratic in orientation. This fate even befell Bangladesh’s Awami League Party, which claims to be democratic and socialist in general outlook.

We have it on the authority of Taslima Nasrin in her ground-breaking novel, ‘Lajja’, that the Awami Party was not of any substantial help to Bangladesh’s Hindus, for example, when violence was unleashed on them by sections of the majority community. In fact some elements in the Awami Party were found to be siding with the Hindus’ murderous persecutors. Such are the temptations of hard line majoritarianism.

In Sri Lanka’s past numerous have been the occasions when even self-professed Leftists and their parties have conveniently fallen in line with Southern nationalist groups with self-interest in mind. The present NPP government in Sri Lanka has been waxing lyrical about fostering national reconciliation and harmony but it is yet to prove its worthiness on this score in practice. The NPP government remains untested material.

As a first step towards national reconciliation it is hoped that Sri Lanka’s present rulers would learn the Tamil language and address the people of the North and East of the country in Tamil and not Sinhala, which most Tamil-speaking people do not understand. We earnestly await official language reforms which afford to Tamil the dignity it deserves.

An acid test awaits Bangladesh as well on the nation-building front. Not only must all forms of chauvinism be shunned by the incoming rulers but a secular, truly democratic Bangladesh awaits being licked into shape. All identity barriers among people need to be abolished and it is this process that is referred to as nation-building.

On the foreign policy frontier, a task of foremost importance for Bangladesh is the need to build bridges of amity with India. If pragmatism is to rule the roost in foreign policy formulation, Bangladesh would place priority to the overcoming of this challenge. The repatriation to Bangladesh of ex-Prime Minister Hasina could emerge as a steep hurdle to bilateral accord but sagacious diplomacy must be used by Bangladesh to get over the problem.

A reply to N.A. de S. Amaratunga

A response has been penned by N.A. de S. Amaratunga (please see p5 of ‘The Island’ of February 6th) to a previous column by me on ‘ India shaping-up as a Swing State’, published in this newspaper on January 29th , but I remain firmly convinced that India remains a foremost democracy and a Swing State in the making.

If the countries of South Asia are to effectively manage ‘murderous terrorism’, particularly of the separatist kind, then they would do well to adopt to the best of their ability a system of government that provides for power decentralization from the centre to the provinces or periphery, as the case may be. This system has stood India in good stead and ought to prove effective in all other states that have fears of disintegration.

Moreover, power decentralization ensures that all communities within a country enjoy some self-governing rights within an overall unitary governance framework. Such power-sharing is a hallmark of democratic governance.

Features

Celebrating Valentine’s Day …

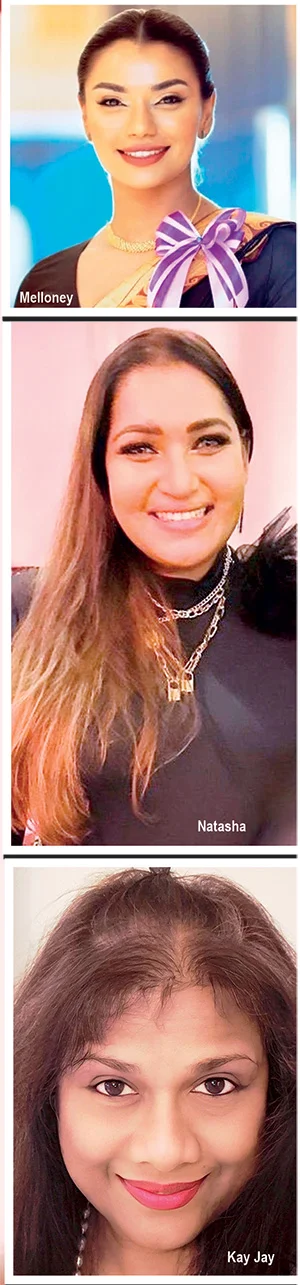

Valentine’s Day is all about celebrating love, romance, and affection, and this is how some of our well-known personalities plan to celebrate Valentine’s Day – 14th February:

Valentine’s Day is all about celebrating love, romance, and affection, and this is how some of our well-known personalities plan to celebrate Valentine’s Day – 14th February:

Merlina Fernando (Singer)

Yes, it’s a special day for lovers all over the world and it’s even more special to me because 14th February is the birthday of my husband Suresh, who’s the lead guitarist of my band Mission.

We have planned to celebrate Valentine’s Day and his Birthday together and it will be a wonderful night as always.

We will be having our fans and close friends, on that night, with their loved ones at Highso – City Max hotel Dubai, from 9.00 pm onwards.

Lorensz Francke (Elvis Tribute Artiste)

On Valentine’s Day I will be performing a live concert at a Wealthy Senior Home for Men and Women, and their families will be attending, as well.

I will be performing live with romantic, iconic love songs and my song list would include ‘Can’t Help falling in Love’, ‘Love Me Tender’, ‘Burning Love’, ‘Are You Lonesome Tonight’, ‘The Wonder of You’ and ‘’It’s Now or Never’ to name a few.

To make Valentine’s Day extra special I will give the Home folks red satin scarfs.

Emma Shanaya (Singer)

I plan on spending the day of love with my girls, especially my best friend. I don’t have a romantic Valentine this year but I am thrilled to spend it with the girl that loves me through and through. I’ll be in Colombo and look forward to go to a cute cafe and spend some quality time with my childhood best friend Zulha.

JAYASRI

Emma-and-Maneeka

This Valentine’s Day the band JAYASRI we will be really busy; in the morning we will be landing in Sri Lanka, after our Oman Tour; then in the afternoon we are invited as Chief Guests at our Maris Stella College Sports Meet, Negombo, and late night we will be with LineOne band live in Karandeniya Open Air Down South. Everywhere we will be sharing LOVE with the mass crowds.

Kay Jay (Singer)

I will stay at home and cook a lovely meal for lunch, watch some movies, together with Sanjaya, and, maybe we go out for dinner and have a lovely time. Come to think of it, every day is Valentine’s Day for me with Sanjaya Alles.

Maneka Liyanage (Beauty Tips)

On this special day, I celebrate love by spending meaningful time with the people I cherish. I prepare food with love and share meals together, because food made with love brings hearts closer. I enjoy my leisure time with them — talking, laughing, sharing stories, understanding each other, and creating beautiful memories. My wish for this Valentine’s Day is a world without fighting — a world where we love one another like our own beloved, where we do not hurt others, even through a single word or action. Let us choose kindness, patience, and understanding in everything we do.

Janaka Palapathwala (Singer)

Janaka

Valentine’s Day should not be the only day we speak about love.

From the moment we are born into this world, we seek love, first through the very drop of our mother’s milk, then through the boundless care of our Mother and Father, and the embrace of family.

Love is everywhere. All living beings, even plants, respond in affection when they are loved.

As we grow, we learn to love, and to be loved. One day, that love inspires us to build a new family of our own.

Love has no beginning and no end. It flows through every stage of life, timeless, endless, and eternal.

Natasha Rathnayake (Singer)

We don’t have any special plans for Valentine’s Day. When you’ve been in love with the same person for over 25 years, you realise that love isn’t a performance reserved for one calendar date. My husband and I have never been big on public displays, or grand gestures, on 14th February. Our love is expressed quietly and consistently, in ordinary, uncelebrated moments.

With time, you learn that love isn’t about proving anything to the world or buying into a commercialised idea of romance—flowers that wilt, sweets that spike blood sugar, and gifts that impress briefly but add little real value. In today’s society, marketing often pushes the idea that love is proven by how much money you spend, and that buying things is treated as a sign of commitment.

Real love doesn’t need reminders or price tags. It lives in showing up every day, choosing each other on unromantic days, and nurturing the relationship intentionally and without an audience.

This isn’t a judgment on those who enjoy celebrating Valentine’s Day. It’s simply a personal choice.

Melloney Dassanayake (Miss Universe Sri Lanka 2024)

I truly believe it’s beautiful to have a day specially dedicated to love. But, for me, Valentine’s Day goes far beyond romantic love alone. It celebrates every form of love we hold close to our hearts: the love for family, friends, and that one special person who makes life brighter. While 14th February gives us a moment to pause and celebrate, I always remind myself that love should never be limited to just one day. Every single day should feel like Valentine’s Day – constant reminder to the people we love that they are never alone, that they are valued, and that they matter.

I truly believe it’s beautiful to have a day specially dedicated to love. But, for me, Valentine’s Day goes far beyond romantic love alone. It celebrates every form of love we hold close to our hearts: the love for family, friends, and that one special person who makes life brighter. While 14th February gives us a moment to pause and celebrate, I always remind myself that love should never be limited to just one day. Every single day should feel like Valentine’s Day – constant reminder to the people we love that they are never alone, that they are valued, and that they matter.

I’m incredibly blessed because, for me, every day feels like Valentine’s Day. My special person makes sure of that through the smallest gestures, the quiet moments, and the simple reminders that love lives in the details. He shows me that it’s the little things that count, and that love doesn’t need grand stages to feel extraordinary. This Valentine’s Day, perfection would be something intimate and meaningful: a cozy picnic in our home garden, surrounded by nature, laughter, and warmth, followed by an abstract drawing session where we let our creativity flow freely. To me, that’s what love is – simple, soulful, expressive, and deeply personal. When love is real, every ordinary moment becomes magical.

Noshin De Silva (Actress)

Valentine’s Day is one of my favourite holidays! I love the décor, the hearts everywhere, the pinks and reds, heart-shaped chocolates, and roses all around. But honestly, I believe every day can be Valentine’s Day.

It doesn’t have to be just about romantic love. It’s a chance to celebrate love in all its forms with friends, family, or even by taking a little time for yourself.

Whether you’re spending the day with someone special or enjoying your own company, it’s a reminder to appreciate meaningful connections, show kindness, and lead with love every day.

And yes, I’m fully on theme this year with heart nail art and heart mehendi design!

Wishing everyone a very happy Valentine’s Day, but, remember, love yourself first, and don’t forget to treat yourself.

Sending my love to all of you.

Features

Banana and Aloe Vera

To create a powerful, natural, and hydrating beauty mask that soothes inflammation, fights acne, and boosts skin radiance, mix a mashed banana with fresh aloe vera gel.

To create a powerful, natural, and hydrating beauty mask that soothes inflammation, fights acne, and boosts skin radiance, mix a mashed banana with fresh aloe vera gel.

This nutrient-rich blend acts as an antioxidant-packed anti-ageing treatment that also doubles as a nourishing, shiny hair mask.

* Face Masks for Glowing Skin:

Mix 01 ripe banana with 01 tablespoon of fresh aloe vera gel and apply this mixture to the face. Massage for a few minutes, leave for 15-20 minutes, and then rinse off for a glowing complexion.

* Acne and Soothing Mask:

Mix 01 tablespoon of fresh aloe vera gel with 1/2 a mashed banana and 01 teaspoon of honey. Apply this mixture to clean skin to calm inflammation, reduce redness, and hydrate dry, sensitive skin. Leave for 15-20 minutes, and rinse with warm water.

* Hair Treatment for Shine:

Mix 01 fresh ripe banana with 03 tablespoons of fresh aloe vera gel and 01 teaspoon of honey. Apply from scalp to ends, massage for 10-15 minutes and then let it dry for maximum absorption. Rinse thoroughly with cool water for soft, shiny, and frizz-free hair.

-

Features5 days ago

Features5 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business6 days ago

Business6 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business5 days ago

Business5 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business5 days ago

Business5 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business5 days ago

Business5 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business2 days ago

Business2 days agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Business6 days ago

Business6 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Midweek Review2 days ago

Midweek Review2 days agoA question of national pride