Business

Merchandise trade deficit expands in Jan. 2024

The merchandise trade deficit recorded an expansion in January 2024, mainly due to higher import expenditure.With regard to services trade, notable inflows were observed in January 2024 into sea transport, air transport, and computer and IT/BPO related services compared to January 2023. Meanwhile, major outflows were recorded in the form of air transport, sea transport, and management and consulting services.

Workers’ remittances recorded an improvement in January 2024, compared to the corresponding period of the previous year.

Earnings from tourism recorded the highest monthly value in January 2024 since January 2020.Foreign investments in the government securities market recorded a net outflow in January 2024.

Gross Official Reserves continued to improve to US dollars 4.5 billion by end January 2024 and the Sri Lanka rupee recorded an appreciation of 4.4 per cent during the year up to 29 February 2024.

The deficit in the merchandise trade account widened to US dollars 541 million in January 2024 from US dollars 445 million recorded in January 2023, mainly with higher increase in imports. In addition, trade deficit in January 2024 widened compared to the deficit of US dollars 487 million in December 2023.

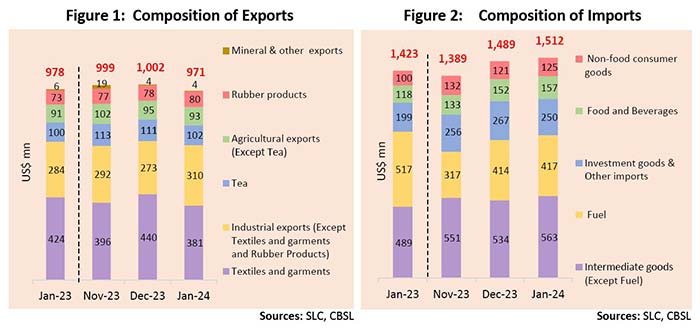

Earnings from merchandise exports recorded a marginal decline of 0.8 per cent to US dollars 971 million in January 2024 compared to US dollars 978 million in January 2023. A decline in earnings was observed in industrial exports and mineral exports, while agricultural exports increased in January 2024. The decline in industrial goods exports in January 2024 compared to January 2023 was mainly contributed by garments, resulting from lower exports of garments to most major markets.

However, earnings from petroleum products increased due to the increase in volumes of bunkering and aviation fuel exports. Earnings from the exports of agricultural goods improved in January 2024, compared to a year ago, mainly contributed by minor agricultural products, coconut related products, and tea. Meanwhile, earnings from mineral exports declined due to the base effect of higher exports of zirconium ores in January 2023.

( CBSL)

Business

Japanese firms signal expansion drive amid reform push — JETRO

More than half of Japanese companies operating in Sri Lanka are planning to expand their businesses over the next two years, reflecting renewed investor confidence as the country stabilises its economy, according to the latest survey by the Japan External Trade Organization (JETRO).

Hiroki Oi, Resident Representative of JETRO Colombo Office, said the findings indicate a steady recovery in sentiment among Japanese investors.

“The share of Japanese companies in Sri Lanka planning expansion has risen to 51.6%. This marks a significant increase from 36.7% in 2024, 25% in 2023 and just 9.5% in 2022,” Oi said, presenting the 2025 Survey on Business Conditions of Japanese-Affiliated Companies Overseas.

He noted that expansion intentions have increased for three consecutive years, signalling that Japanese firms are taking a longer-term view of Sri Lanka’s potential.

At the same time, operating profit expectations show cautious optimism. According to the survey, 39.3% of Japanese companies expect operating profit to increase in 2025 compared to 2024, while 50% expect no change and 10.7% anticipate a decrease.

For 2026, the share expecting an increase rises further, while those forecasting a decline drops.

However, profitability levels remain a concern. Only 46.4% of Japanese firms in Sri Lanka expect to record profits in FY2025 — unchanged from the previous year — while 39.3% foresee losses.

“Sri Lanka needs to improve profitability to remain competitive with neighbouring countries,” Oi stressed, pointing out that several regional markets report higher shares of profitable Japanese affiliates.

Japanese companies in Sri Lanka operate across diverse sectors including manufacturing, construction, trade and finance, logistics, tourism, healthcare and IT.

Japan remains the largest export destination for Japanese-affiliated companies based in Sri Lanka, accounting for 43.9% of exports, followed by Europe at 13.4% and the United States at 12.1%.

The survey also highlights both strengths and risks in the local investment climate. Companies cited fewer linguistic and communication barriers (56.7%) and relatively low labour costs (40%) among the key advantages of operating in Sri Lanka.

Market scale and growth potential were also viewed positively.

Yet concerns persist. Political and social instability was identified as the top risk by 83.3% of respondents, followed by unclear policy management by local authorities (60%) and underdeveloped legal systems (46.7%). Time-consuming tax and administrative procedures were also flagged as significant operational hurdles.

Oi emphasised that policy clarity and administrative efficiency will be crucial to sustaining investor confidence.

“Clear, transparent and consistent policy management, along with improvements in administrative procedures, will further enhance Sri Lanka’s attractiveness as an investment destination,” he said.

As Sri Lanka advances its reform agenda, the survey suggests that while Japanese firms remain watchful on profitability, a majority are prepared to deepen their engagement — provided stability and structural improvements continue.

“The steady rise in expansion intentions demonstrates that Japanese companies recognise Sri Lanka’s long-term potential,” Oi observed. “The challenge now is to convert that potential into sustained profitability and competitiveness.”

By Ifham Nizam

Business

Vintage Vignettes from the Life and Times of Upali Wijewardene

Extracts from the book titled ‘Vintage Vignettes’ by

Vinodh Wickremeratne, which provides some interesting recollections of the life and times of Philip Upali

Wijewardene, Founder and Chairman of the Upali

Group of Companies, the first multinational business in Sri Lanka.

PHILIP UPALI WIJEWARDENE (1938-1983).

GREATER COLOMBO ECONOMIC COMMISSION Chairman/DG UPALI WIJEWARDENE (UW) walked down from the GCEC building (PRINCE BUILDING) occasionally to have a CHAT with me during lunch breaks. (Spelled out MACRO ideas to make Sri Lanka a REGIONAL POWER), he suggested I JOIN the GCEC as a Coordinator, also after Being informed of my VARIED CAPABILITIES in Middle-Management and Mercantile ethics (he met me in Singapore and Kuala Lumpur), OFFERED ME A PLACEMENT (to assist and stand in for MR. PELIMUHANDIRAM) in the FAR EAST (Upali Malaysia Sdn Bhd) with flights in his LEAR JET.

DELTA FORCE chuck Norris, Lee Marvin

We toured Colombo ‘in style’ in His MERCEDES BENZ 280S numbered 6 SRI 7500 with a driver. He mentioned that he personally mixed the solution to perfect DELTA TOFFEES. He showed a very old house in the SEDAWATTE area and mentioned it as ‘Ancestral Helena Wijewardene’s house’.

GOING ROUND THE MULBERRY BUSH

He mentioned that Mulberry had been tried as an experiment in the DUTCH ERA in this area. Sedawatte had been so named for this reason.

UW was keen on visiting RAILWAY LOCOMOTIVE Sheds (ELS, HLS and RS), I gave the ‘FULL GEN’ which was recorded on a dictaphone.

He spoke about FATHERLESS LIFE (The LAKE HOUSE Uncle late D R Wijewardene and Uncle late Sarath Wijesinghe had helped), MGA Twin Cam, racing his mother’s OPEL KAPITAN, DRINKING parties in England, he said other than a Wine or a Sherry, never touched Alcohol though he BOUGHT

all of it, Mercantile history, Englebert and Tom Jones concerts, meeting John Lennon and Royston Ellis, DEGREE in ECONOMICS, University studies in England, Genealogy, Fashion, PILOT’S LICENCE, Tram cars and half an hour on Ceylon HORSE RACING, Shoesstring, budget student Iiving

in England, Air Ceylon and TWA Constellations to London taking nearly TWO DAYS, Lever Brothers, Jockeys, Trainers, YVONNE, colourful owners and names of HORSES.

UW grimaced when he saw TRADE UNION boards at every corner of the Railway yard.

When he saw some STEAM locomotives in the RUNNING SHED, he mentioned ‘there is a GOLD MINE sitting here, a VINTAGE TRAIN would be a super idea.’ Only who will have the GUTS to undertake such a project?

One noon UW inquired ‘Vinodh, have you got any Business appointments in the office? I said nothing till evening. He suggested

‘Let’s go to Fort Railway Station’.

At the station he instructed the Driver to meet at the Katunayaka Railway Station, ‘Let’s go 3rd Class’

UW mentioned he wants to EXPERIENCE WORKING CLASS difficulties, in the train he got chatting with GARMENT SERVANTS and mentioned that a new KALAPAYA would be established near Kamburupitiya and that Karnburupitiya will be developed like Malayasiya and Singapore.

At Katunayake we visited a few factories. UW recommended, better restrooms and a five minute AEOROBIC stretch classes after lunch before the next shift.

Also, that he would provide INDOOR BADMINTON facilities at his OWN COST.

LASZLO CARREIDAS’S TOY

UW took me to see his JET on the Airport tarmac, I had a look inside (quite Hot). He was about to arrange a FULL explanatory tour when I strategically cut in that I have to meet my parents at 6 pm in Thimbirigasyaya, he sent me in his Benz 280S, the Driver was instructed to

wait for him at the Fort Railway Station in four hours, as he wanted to WALK around more FTZ factories.

Driver mentioned that Boss goes to Matara by 3RD Class TRAIN and from there to Kamburupitiya by CTB BUS.

He goes by car only if he has several STOPS on the way.

THE FIRST OF MAY The Bee Gees

Boss wants to see Kamburupitiya like SINGAPORE. He is unhappy about BAD HABITS like lazy Trade Unionists working hard ONLY on MAY DAY.

Boss wants to give Air-Conditioned SEWING HALLS and delivery vans to some JVP people and start them off on business ventures.

BOSS is SURE to WIN any ELECTION.

The next morning UW called me to find out HOW to establish a SPECIAL Railway Station for the benefit of ZONE workers.

I adviced him on the process and the sequence.

(Later established are FTZ 1 and FTZ 2 Railway Sub-stations)

I went to Singapore by AIR LANKA’s Lockheed Tristar to be met by Michael Yeow and Patrick Tan of COLD STORAGE PTE, who introduced me to my Training supermarket.

A Messenger for UW met me at the Singapore supermarket to convey the message that: ‘the Upali and the Tao won meeh yu in the evening’, he said, ‘I will Taxicome at four thirty O’ clock la’.

I met UW After my Day ‘ s training at COLD STORAGE PTE. (Jelita. Holland Village). At the meeting (in the cigarette smoke filled room) was S. P. TAO of the Shing Kwan Group, since, in the near future I was thought to join them, Tao gave me A PIECE OF HIS MIND.

You must be like a shadow, we fall you fall la

YESTERDAY Lennon-McCartney.

Britain left Ceylon PlENTY, Railways, loadways, harbours, airports, Tea gardens, tramways, yet dancing on ONE place. LEE won to IMPROVE Singapore like the Colombo and Ceylon.

Britain left Ceylon PlENTY, Railways, loadways, harbours, airports, Tea gardens, tramways, yet dancing on ONE place. LEE won to IMPROVE Singapore like the Colombo and Ceylon.

We were SHANTY TOWN, but see now, where WE are la.

(In 1962, my father remembered Singapore like OUR 5th CROSS STREET).

(Singapore came from Nowhere to SOMEWHERE, from Nothing to SOMETHING.)

‘Singapore have No land, no Population, only BRAINS, you have plenty land, plenty people, not climbing tree to pluck Mango but SIT and WAIT till MANGO FALL DOWN, also when hunting, not shooting but WAIT wait and wait for DEAD BIRD TO FALL.’

‘In your CENTRAL BUSINESS DISTRICT you have buildings AS FAT AS A PIZZA, correct way is to Go UP, I will be doing that with

OVERSEAS TRUST BANK of Hong Kong at ECHELON, next General Stike I PULL OUT la’.

‘We come from NOTHING TO SOMETHING’ .

Your womens only thinking Temple, kitchen and babies or Babies kitchen and Temple, CORRECT PLACES are Factories and the fields la.’

Tao said ‘Unions like NTUC own and operate Taxi services, Supermarkets, small Hotels and are part of the PRODUCTIVTY PROCESS.’

Then UW SPOKE HIS HEART OUT.

Mr. Wijewardene mentioned the UNIONS in Sri Lanka are like a BRICK at the END of the DIGESTIVE system and will propose to the Employers’ Federation to device a mechanism to ISSUE COMPANY SHARES to Unions, then they would be a part of PROSPERITY STREET unlike the POVERTY LINE bent on DESTRUCTIVITY rather than PRODUCTIVITY.

At the same time, widening the INVESTMENT LANDSCAPE.

UW was of the idea that PRISONS need to be ENLARGED to hold Trade Union parasites.

He said, he was ON A FLIGHT EVERY WEEK (at His OWN COST in his Lear jet) to GET INVESTMENTS to Lanka and that MATSUSHITA ELECTRIC was considering setting up a large factory employing THOUSANDS. Similarly, TOYO KOGYO was to manufacture components to assemble Front Wheel Drive MAZDA CARS, these moves could reduce UNEMPLOYMENT and Under employment, with Unions BUSY MAKING PROFITS and TAXATION in order, the MACRO REVENUE picture would improve UW mentioned that Ceylon has had an Economic SURPLUS in the Mid 1950s.

I cut in that’ Unions fight for NON WORKERS ‘ RIGHTS’.

OUR MATARA RESIDENCY VISITOR

Suddenly Mr. Wijewardene inquired, ‘Vinodh, WAS YOUR FATHER THE GA OF MATARA long years ago?’

I said ‘YES, I remember your visit,’

JAMES HADLEY CHASE

UW said ‘I remember, Asthma brother said to be resting upstairs, when my mother brought out an UNWANTED SUBJECT your mother CHASED you out! ‘

‘I also remember your grand father the FLOWER ROAD DOCTOR when my mother took me for Fever, very BIG Left Hand Drive LINCOLN and fashionable wife with a small AUSTIN.’

(Correction note: the LINCOLN had been my great grand father Bertram James Pieries’ car, since after an economic setback could not afford its 12 CYLINDER fuel consumption, left it with his son in law)

I updated that grandmother is now KIDNEY DISEASE affected and DEPEPENDENT on a Caregiver.

Then UW said to Mr. Tao, Vinodh is from TOP FAMILY, son of Mahee Wickremeratne. I am at this successful situation DUE TO HIS FATHER’S ADVICE.

TAO said ‘I meet him at CEYLINCO DEER BAR with the Gamini Minister la,

Now where he?

I said CEO/MD of CATERPILLAR Co.

Mr. Wijewardene announced that he will MANUFACTURE SOAP to teach LEVER BROTHERS a thing or two, and that he will recruit specialists from Levers and BCC towards this goal. Socialites would be engaged as Brand Ambassadors.

(Upali Group later made CRYSTAL, TINGLE and SIKURU brands for soaps and detergents.)

Also, would enter the domestic and regional AIRLINE sector with more aircraft, with operating stations in Malaysia, Singapore, Indonesia, Thailand, Male, Nepal and India.

Boeing 727, DC 9, MD80 and some TURBOPROPS have been looked to Lease or buy helicopters for CHOP HOP touring, with a total SRI LANKAN employee situation.

He mentioned to me that experienced people from Air Ceylon, the Air Force and Air Lanka would be recruited.

COME ON DOVER

Also, a THOROUGHBREDS horses project in Nuwara Eliya under GCEC conditions, with (Equestrian Vets, Trainers and Groomers.) to EXPORT Show jumper, Polo and RACING HORSES.

He mentioned that he will enter PARLIAMENT from Kamburupitiya and that he wants to build a TEAM OF PUBLICITY PEOPLE by way of Artists, Dramatists, Religious, Doctors, Sports personalities, etc.

Tao said ‘Unless you become PM or President, politics unprofitable business. Also NO GOOD for health.

Tao finally RESTED at age 105.

UW mentioned he would REACTIVATE some COLOMBO PLAN proposals (which he LEARNED ABOUT from my father), i.e EXPORT CANNERIES for Fish, Poultry, Meats, Fruit & Veg, also Beer.

When Tao said Buddhist country you will have problem, UW said ‘then better , CLOSE DOWN all factories, send Workers HOME’.

Export Component furniture factory.

Harnessing the SUN for energy.

Small scale OIL EXPLORATION.

DREAM DREAM DREAM Everly Brothers

That night at the YMCA, I dream my dreams of Jolly Old Ceylon being the Economic WONDER BOY of Asia.

UW let it be known that unfortunately Ronnie and PM have not been in agreement with him in recent times, though Lalith and Wickrema understood.

UW mention that Lalith wants to have an Investments Board in later years.

Making Sri Lanka the Production Hub if Asia to emerge with a favourable BOT (Balance of Trade).

UW mentioned that Kamburupitiya would be the most advanced area of Sri Lanka and was looking around for a flight passage to create an Airstrip capable of handling medium sized Passenger Aircraft.

KDA

Kamburupitiya Development Authority or the Kamburupitiya Corporation would be activated to achieve this. The small airport to be out-fitted for occasional regional Overseas flights with a Customs Unit, immigration & Emigration Unit and refueling arrangements.

MOTORBAHNS from Kamburupitiya to Matara and Galle, UW said Vinodh, since ground transport your speciality, sometime hire CGR Railtracks Engineer, TCEO or PWD and a Matara District Surveyor take leave from Appos, FLY IN MY CHOPPER to see whether 120 km/h railway lines and motorways could be laid to Kamburupitiya from Galle and Matara.

Continued Tomorrow

Business

Dialog partners with Xiaomi to introduce Redmi Note 15 5G Series in Sri Lanka

Dialog Axiata PLC, Sri Lanka’s #1 connectivity provider, in collaboration with Xiaomi Sri Lanka, announced the introduction of the Redmi Note 15 5G Series, further expanding access to 5G smartphones supported by Dialog’s 5G Ultra Network. The series includes the Redmi Note 15 5G and the Redmi Note 15 Pro+ 5G, designed to deliver high performance, advanced imaging, and durable features at accessible price points.

Both devices support 5G connectivity and are powered by Snapdragon processors, enabling smooth performance across streaming, gaming, browsing, and everyday applications. The Redmi Note 15 5G is available in 6GB RAM with 128GB storage, as well as 8GB RAM with 256GB storage, while the Redmi Note 15 Pro+ 5G comes with 8GB RAM and 256GB storage.

The Redmi Note 15 5G features a 6.77-inch display and a 108MP camera system, while the Redmi Note 15 Pro+ 5G features a 6.83-inch display and a 200MP camera system. Selected models also offer dust and water resistance for added durability. The devices are equipped with large-capacity batteries supported by fast-charging capability and are backed by a one-year official company warranty, plus two screen replacements within the first year for added peace of mind.

The Redmi Note 15 5G Series is now available through Dialog retail outlets, authorised dealers, and online platforms nationwide.

-

Features4 days ago

Features4 days agoWhy does the state threaten Its people with yet another anti-terror law?

-

Features4 days ago

Features4 days agoReconciliation, Mood of the Nation and the NPP Government

-

Features4 days ago

Features4 days agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features3 days ago

Features3 days agoLOVEABLE BUT LETHAL: When four-legged stars remind us of a silent killer

-

Features4 days ago

Features4 days agoVictor, the Friend of the Foreign Press

-

Latest News5 days ago

Latest News5 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Latest News5 days ago

Latest News5 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News5 days ago

Latest News5 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction