News

Lankans will have to pay more to send postal packages to EU member countries

Following imposition of revised tax policy

by Suresh Perera

With the European Union (EU) revising its tariff regime on postal shipments with effect from July 1, all postal packages up to EUR 150 (approximately Rs. 35,500) in market value mailed from Sri Lanka to any of the 27 member countries in the economic and political grouping will be subject to direct Value Added Tax (VAT).

The new tax policy will not be applicable to letters sent to EU member states, Post Master General (PMG) Ranjith Ariyaratne clarified.

However, postal customers, online sellers and marketplaces, which send items within the specified EUR 150 value will be liable to VAT, he said.

Postal goods that exceed the stated value will be subjected to other customs regulations as determined by the relevant government in addition to the VAT policy of the EU member country, the PMG explained.

He said that all applicable customs duties on postal items exceeding EUR 150 in value will be charged from the recipient of postal item/items at the destination.

Asked how the VAT component could be paid directly to the EU member country concerned, Ariyaratne said the payment can be done by registering online.

Customers can obtain all information about the tax policies, payment options and the procedures to be followed in terms of the relevant laws and regulations by accessing the relevant web links. (See below)

He said that customers should be aware of these policies, regulations and updates by referring to the web links before handing over their items to postal counters for onward delivery.

Asked on what basis the values on postal packages are calculated for taxation, the PMG said there is a variance depending on the category.

“The tax is applicable even to a personal gift item sent from Sri Lanka to a person living in any EU member country”.

All postal customers, including online retailers and online marketplaces, are required to provide the Import One Stop Shop (IOSS) ID Number with the parcel/postal item at the post office counter, to ensure smooth customs clearance and timely delivery of the goods to the destination.

In the event of non-compliance with applicable tax policies, the destination country reserves the right to add relevant taxes including VAT and other import tariffs. In addition, the recipient may have to pay an extra clearance fee according to the import rules and regulations of the destination country.

Additional charges at the time of import may cause the customer to refuse the goods. The customer is responsible for any further action taken by the Postal Administration or the Customs in respect of the relevant product.

The Sri Lanka Postal Department is not responsible for the imposition and collection of VAT or any other tax levied by the EU countries, the PMG stressed.

More information on the revised EU tax policy can be obtained by visiting the following web links:

https://europa.eu/youreurope/business/taxation/vat/vat-rules-rates/index_en.htm

https://ec.europa.eu/taxation_customs/business/union-customs-code/ucc-introduction_en

https://ec.europa.eu/taxation_customs/business/union-customs-code/ucc-legislation_en

https://ec.europa.eu/taxation_customs/business/vat/vat-e-commerce_en

https://ec.europa.eu/vat-ecommerc

Latest News

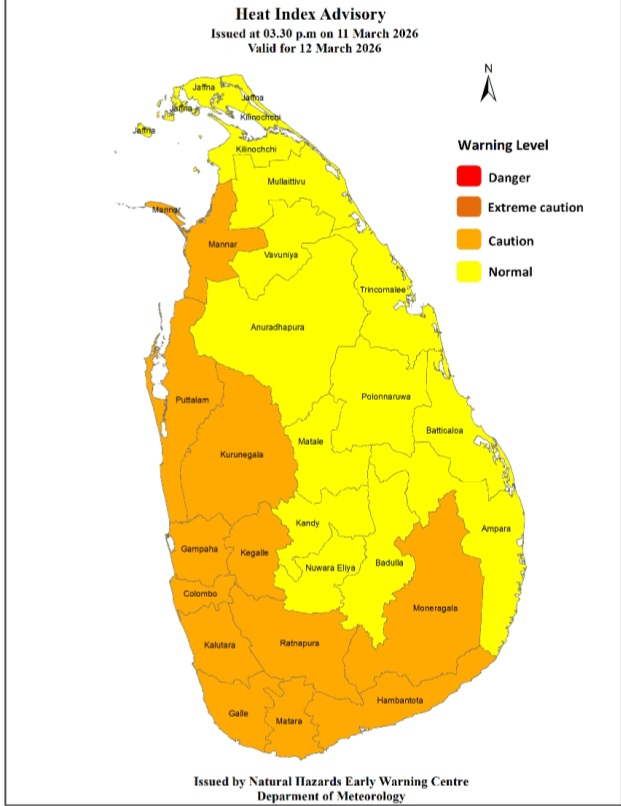

Heat Index at ‘Caution level’ at some places in the Western, Sabaragamuwa, Southern and North-western provinces and in Monaragala and Mannar districts

Warm Weather Advisory

Issued by the Natural Hazards Early Warning Centre of the Department of Meteorology at 3.30 p.m. on 11 March 2026, valid for 12 March 2026.

The public are warned that the Heat index, the temperature felt on human body is likely to increase up to ‘Caution level’ at

some places in the Western, Sabaragamuwa, Southern and North-western provinces and in Monaragala and Mannar districts.

The Heat Index Forecast is calculated by using relative humidity and maximum temperature and this is the condition that is felt on your body. This is not the forecast of maximum temperature. It is generated by the Department of Meteorology for the next day period and prepared by using global numerical weather prediction model data.

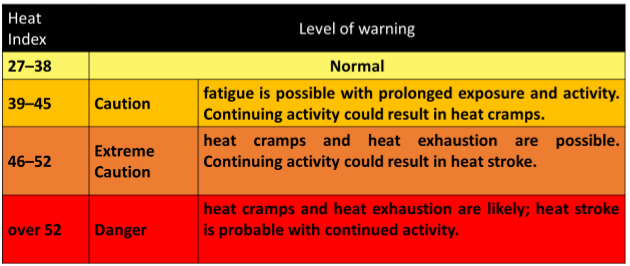

Effect of the heat index on human body is mentioned in the above table and it is prepared on the advice of the Ministry of Health and Indigenous Medical Services.

ACTION REQUIRED

Job sites: Stay hydrated and takes breaks in the shade as often as possible.

Indoors: Check up on the elderly and the sick.

Vehicles: Never leave children unattended.

Outdoors: Limit strenuous outdoor activities, find shade and stay hydrated.

Dress: Wear lightweight and white or light-colored clothing.

Note:

In addition, please refer to advisories issued by the Disaster Preparedness & Response Division, Ministry of Health in this regard as well.

For further clarifications please contact 011-744649

News

Power sector reforms jolted by 40% pay hike demand

The government’s sweeping electricity sector restructuring programme ran into fresh turbulence yesterday, with authorities warning that meeting a 40 percent salary increase, demanded by striking power sector unions, could push electricity tariffs up by nearly 100 percent.

Chairman of the National Transmission Network Service Provider (NTNSP), Nusith Kumaratunga, issuing the warning at a media briefing, said the additional salary burden would significantly escalate operating costs in the newly formed power sector companies.

According to Kumaratunga, granting the 40 percent salary increase would raise the monthly wage bill by about Rs. 1.8 billion, amounting to nearly Rs. 22 billion annually, placing enormous pressure on the already fragile financial position of the electricity sector.

“If that additional burden is passed on to consumers, electricity tariffs may have to increase by close to 100 percent,” he said.

The briefing was organised by the management of the successor companies created following the restructuring of the Ceylon Electricity Board (CEB).

Kumaratunga said electricity sector trade unions had presented 64 demands in the wake of the restructuring exercise.

“Out of the 64 demands, 62 have already been agreed to,

while the remaining two have been referred to President Anura Kumara Dissanayake for discussion,” he said.

He explained that the majority of the demands related to the continuation of privileges previously enjoyed by employees under the CEB structure.

“During the initial round of discussions itself, the boards of directors agreed to 59 of those demands,” he noted.

Among the concessions already granted was the continuation of bonus payments, similar to those previously paid by the CEB, at least temporarily, until a performance-based incentive system is introduced.

The management had also agreed to grant an allowance of Rs. 11,000, in addition to the existing cost-of-living allowance, bringing the average additional monthly benefit to around Rs. 17,000 per employee, he said.

Kumaratunga stressed that management had approved all demands that could be granted at the ministerial level.

However, he said the proposed 40 percent salary increase would be difficult to justify, particularly at a time when other segments of the public service were not receiving similar benefits.

He also revealed that unions had requested that a 25 percent salary adjustment, granted to senior executives in 2024, be extended to all employees, with retrospective effect from January 1, 2024.

Granting such a request would require amending an existing Cabinet decision, which the boards of directors of the newly established companies do not have the authority to do, Kumaratunga explained.

He pointed out that the newly created electricity sector companies had only commenced operations on Monday, and their work had already been disrupted by the ongoing trade union action.

“It is difficult to understand why the strike continues when the vast majority of demands have already been addressed,” he said.

However, the Ceylon Electricity Board Engineers’ Union clarified that the 40 percent salary increase was not their primary demand.

Union representatives said that the electricity sector employees were originally due for a salary revision in January 2027, but the ongoing restructuring had raised concerns that the scheduled increase might not materialise.

“That is why we requested at least a reasonable percentage increase in order to secure some form of salary revision,” a senior electrical engineer said.

The dispute comes at a critical moment as the government presses ahead with the unbundling of the CEB into separate generation, transmission and distribution entities, a reform programme, officials say, is aimed at improving efficiency and attracting investment to Sri Lanka’s troubled power sector.

However, the restructuring has been strongly opposed by trade unions, which argue that the reforms could undermine employee security and weaken state control over a strategic national utility.

With industrial action continuing and tariff hikes looming as a possibility, the confrontation between the government and electricity sector unions appears set to intensify in the coming days.

By Ifham Nizam

News

UN scientific research ship here amidst ban on such vessels

A UN vessel arrived in Colombo yesterday (11) to conduct a month-long marine scientific survey in Sri Lanka’s Exclusive Economic Zone (EEZ). This is the first foreign scientific research vessel here since President Ranil Wickremesinghe banned such visits on January 1, 2024, for a period of one year. However, the ban remains in place with the NPP government yet to announce its new decision on the issue.

The following is the text of statement issued by the Foreign Ministry yesterday: “On the invitation of the Government of Sri Lanka, the United Nations-flagged vessel R/V Dr. Fridtjof Nansen, under the Food and Agriculture Organisation (FAO), is scheduled to arrive in Sri Lanka today to conduct a marine scientific survey in Sri Lanka’s Exclusive Economic Zone (EEZ) in collaboration with the Ministry of Fisheries, Aquatic and Ocean Resources and the National Aquatic Resources Research and Development Agency (NARA).

R/V Dr. Fridtjof Nansen supports countries in collecting critical scientific data for sustainable fisheries management and in understanding how climate change is affecting marine ecosystems. The survey, spanning 32 days, will focus on assessing marine living resources and marine ecosystems, providing updated scientific data that will support Sri Lanka’s sustainable fisheries management and ocean governance. During the mission, scientists will undertake a range of activities, including hydro-acoustic surveys to estimate the biomass and distribution of key fish stocks in Sri Lankan waters; assessment of marine pollution levels; and biodiversity monitoring.

An important component of the programme is capacity building. The mission will bring together Sri Lankan scientists from NARA and other national institutions with international experts, promoting scientific collaboration and knowledge exchange.

Sri Lanka previously hosted the R/V Dr. Fridtjof Nansen in 2018, when the vessel conducted a comprehensive survey of Sri Lanka’s continental shelf and upper slope, in collaboration with national institutions. Earlier, Nansen surveys were also carried out in Sri Lankan waters in 1978–1980, reflecting a long-standing scientific partnership under the Nansen programme.

Sri Lanka’s participation in this survey reflects the country’s continued commitment to sustainable fisheries, marine ecosystem protection, and international scientific cooperation in the Indian Ocean region.”

-

News6 days ago

News6 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

News5 days ago

News5 days agoPeradeniya Uni issues alert over leopards in its premises

-

News6 days ago

News6 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

News3 days ago

News3 days agoRepatriation of Iranian naval personnel Sri Lanka’s call: Washington

-

News6 days ago

News6 days agoLibrary crisis hits Pera university

-

News5 days ago

News5 days agoWife raises alarm over Sallay’s detention under PTA

-

News6 days ago

News6 days ago‘IRIS Dena was Indian Navy guest, hit without warning’, Iran warns US of bitter regret

-

Latest News6 days ago

Latest News6 days agoSri Lanka evacuates crew of second Iranian vessel after US sunk IRIS Dena