News

Lanka should set up a currency board to stop rupee depreciation: US economist

ECONOMYNEXT – Sri Lanka should set up a currency board to stop further currency falls, US economist Steve Hanke has said as the island’s currency collapsed from 203 to 290 to the US dollar in an attempt to float the currency which has not yet succeeded.

“Since January 1st 2022, the Sri Lankan rupee has depreciated ~26% against the USD. #SriLanka’s severe balance of payments crisis and recent fuel price hikes are sinking LKA,” Hanke, who is professor of Applied Economics at Johns Hopkins University in Baltimore, said in a twitter.com message.

“To ease the crisis, LKA needs to install a currency board, like the one it had from 1884 until 1950.”

Sri Lanka – then Ceylon – set up the currency board after the Ceylon Rupee issued by the Oriental Bank Corporation stopped exchanging silver for rupee notes, technically called a suspension of convertibility.

A modern day central bank attempts a float also in a similar fashion, though the bank is not closed.

A currency board is easy to set up and will end balance of payments trouble for ever, insulating the public and also politicians from Keynesians who print money to manipulate interest rates.

Currency boards have very low interest rates just about 50 basis points higher than the anchor currency by automatic tightening to prevent imbalances from building up.

The anchor currency for the currency board can be the US dollar, Euro, Swiss Franc, Swedish Kroner or Singapore dollar, which is among countries with the best monetary policy in the world.

Hanke has prepared a handbook on how to set up a currency including measures for war torn countries where the monetary authority could be incorporated abroad to prevent any warlord from getting hold of reserves.

In 2018 Sri Lanka was put on the extraordinarily situation of a ruling politician, then-Minister Harsha de Silva, pleading with central bank in public, to raise rates in a bid stop money printing, after giving it full operational independence to inject liquidity.

At the time taxes raised taxes to reduce the deficit and a political costly price formula or fuel was set up, but money was printed to create balance of payments trouble by so-called ‘call money rate targeting’.

Money was also injected through dollar rupee swaps of the style used to bust East Asian pegs during the crisis by speculators (Soros style swaps). Speculators could not break the Hong Kong currency board during the East Asian currency board, but instead mad massive losses on swap costs.

In 2020 the policy was taken several steps ahead by crippling bill and bond auctions with price controls. Now the rupee has been hit by a surrender rule, analysts have warned.

Analysts have called for strict laws to block the ‘domestic operations’ of the central bank through which balance of payments troubles are created, or set up an orthodox currency board.

When the Oriental Bank Corporation shut its doors in 19th century Ceylon, the Mercantile Bank which also issued notes provided convertibility at par.

Oriental Bank Corporation ran out of silver reserves following bad loans. A modern day central bank runs out of dollar reserves due to direct government financing of deficits, re-financed credit schemes and sterilized interventions or giving reserves for imports.

The central bank of Sri Lanka today holds over two trillion in Treasury bills a part of which was taken back from banks in the course of private sector finance to maintain a policy rate or price controls of bond auctions.

Sri Lanka’s currency board, which had kept the island safe through two World Wars and a Great Depression was replaced with a Latin America style central bank under US technical advice in 1950.

Almost all such central bank by Fed experts have led to social unrest and some central banks have collapsed and led to spontaneous dollarization.

Analysts have warned it may happen in Sri Lanka as well if the float is not established.

Currencies are depreciated by Keynesian interventionists for ‘competitive exchange rates’, which critics say is a merciless a zero-sum policy of transferring wealth from the working class to shareholders of export or import substitution companies by destroying real wages.

The advantage remains until workers go on strike demanding higher wages and until utility prices such as electricity, power or water rates are raised.

Knowledge of currency boards have been lost to most post World War II ‘economists’ who relentlessly favour depreciating currency central banks, through which they try to boost growth with ‘stimulus’ create balance of payments trouble, starve the poor, create social unrest, boat people, and bring down governments.

The rising world food and commodity prices hurting the poor around the world while strengthening the hands of authoritarian leaders of natural-resource rich countries after the US and ECB printed vast amount of money is the latest example analysts say.

Steve Hanke was one of the few economists in the world who correctly warned that Fed’s Jerome Powell would set off an inflationary spiral.

Hanke has helped set up several currency boards including in Eastern Europe.

Currency boards have neutral policy and are still in use in East Asia. However most East Asian pegs including Vietnam are tighter than currency boards and collect forex reserves exceeding the monetary base.

Sri Lanka used to have a 1 to 1 currency boar with the Indian rupee (which was originally silver) along with Mauritius and other South Asian nations.

Before the Reserve Bank of India was nationalised to print money for Nehru’s Gosplan style programs, the Indian rupee was also used in the Middle East countries like Dubai.

The only economist who opposed Nehrus economists was a lone classical economist, BR Shenoy who issued a note of dissent on the plans which were to be financed with central bank credit.

Bhutan still retains it one to one peg with the India rupee which has been unbroken for decades. Nepal has also kept a 1.6 peg with the Indian rupee for more around 40 years. The Indian rupee is however a depreciating currency and neither country benefits much except avoiding currency crises.

The IMF supports Maldives peg with the US dollar but encourages stimulus, open market operations and depreciation in larger countries like Sri Lanka which is believed to due to a mis-understanding about pegs held in the US Treasury.

Latest News

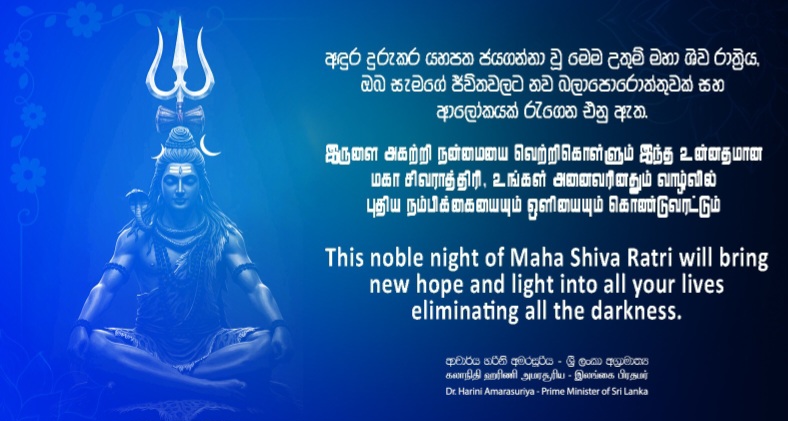

May the blessings of Lord Shiva bring peace, good health, and spiritual fulfillment to your homes and to our beloved country – PM

Prime Minister Dr Harini Amarasinghe in her Maha Shiva Ratri message wished that the blessings of Lord Shiva bring peace, good health and spiritual fulfillment to every home and our beloved country.

The PM’s Maha Shiva Ratri message:

“As we observe the sacred occasion of Maha Shivaratri, I extend my warmest greetings to the Hindu community of Sri Lanka and to devotees across the world.

Maha Shivaratri, the “Great Night of Shiva,” stands as a profound symbol of the triumph of light over darkness and wisdom over ignorance. It is a time for deep reflection, spiritual discipline, and the pursuit of inner peace.

In our multicultural and multireligious society, this festival reminds us of the shared values that unite us — selflessness, compassion, and the strength to overcome challenges through unity and faith. As devotees spend the night in prayer and meditation, may we all reflect on how we can contribute to building a more harmonious, inclusive, and prosperous nation.

May the blessings of Lord Shiva bring peace, good health, and spiritual fulfillment to your homes and to our beloved country”.

Latest News

India vs Pakistan match is a godsend for T20 World Cup hosts Sri Lanka

Almost 30 years ago today, India and Pakistan formed a combined cricket team to take on Sri Lanka ahead of the 1996 Cricket World Cup in an unprecedented moment of unity in the sport’s history.

The two age-old rivals put aside their differences and came together in an act of solidarity to support a fellow South Asian team, who faced the threat of match boycotts in a tournament they had battled hard to host.

India versus Pakistan is the most highly marketed fixture at every multination tournament – the World Cup, Asia Cup or Asian Games – whether it’s a men’s, women’s or Under-19 event.

Few sporting events globally carry the weight and anticipation of an India-Pakistan cricket match. So, when Pakistan’s government ordered its team not to face India at the ongoing T20 World Cup, the tournament was briefly pushed into a state of chaos.

It also left Sri Lanka, the designated host of the fixture, holding its collective breath.

A week of negotiations led to a dramatic late U-turn by the Pakistani government and the match will now take place as scheduled on Sunday at the R Premadasa International Cricket Stadium in Colombo.

But what if the boycott had gone ahead? The impact could have been catastrophic, not just for Pakistan, but also for the International Cricket Council (ICC), as well as Sri Lanka.

With the crisis seemingly averted, the island nation stands poised to reap the benefits in its financial landscape, diplomatic standing and community.

The tourism and hospitality industry was one of the hardest hit during Sri Lanka’s financial meltdown and this match will see an enormous influx of fans from India and Pakistan coming into the country.

Hotels in and around Colombo were fully booked out well ahead of the tournament but the industry braced itself for heavy losses after Pakistan threatened a boycott.

“There’s been a massive impact since the boycott was announced,” Sudarshana Pieris, who works in Sri Lanka’s hospitality sector, told Al Jazeera.

“All major hotels in Colombo were fully booked by Indian travel agencies well ahead of the match and once the boycott was announced, we lost almost all of those bookings,” he said.

“But after Pakistan reversed their decision, hotel room rates shot up by about 300-400 percent at five-star establishments in Colombo.”

It’s not just hotels but several other local businesses – from street vendors to high-end restaurants – who are hoping for an increased footfall and spending over the weekend.

These short trips and the experiences they offer could influence visitors to extend their stay or return to Sri Lanka on holiday, long after the game has ended, in a potential long-term benefit to the industry.

Another relatively underestimated impact of the game would be the employment opportunities it creates, albeit temporarily, in the media, event management, security and transportation industries.

Asanka Hadirampela, a freelance journalist and broadcaster currently working as a Sinhala language commentator for the World Cup, recognises the marquee match as a great opportunity from a personal standpoint.

“This is my first World Cup as a broadcaster,” Hadirampela said.

“The India-Pakistan fixture is the biggest and most-watched game of the tournament. So to get to work on such a match is exciting and I consider it a special achievement.”

The lines are always blurred between sport and politics in South Asia.

So while the financial gains are expected to be significant, the fixture’s impact on the region’s geopolitical environment cannot go amiss.

Pakistan’s boycott, too, was explicitly political, as confirmed by the country’s Prime Minister Shehbaz Sharif when he said that they were offering support to Bangladesh after the Tigers were kicked out of the tournament by the ICC.

The reversal of Pakistan’s decision, which they said came after requests to reconsider the boycott by several regional “friends”, was steeped in politics, too.

Sri Lanka’s President Anura Kumara Dissanayake reportedly had a phone conversation with PM Sharif, urging his government to rethink their decision to boycott the game as the successful staging of this encounter would not only position Sri Lanka as a capable host of global sporting events but also reinforce its standing as a neutral mediator in a region fraught with geopolitical complexities.

Sri Lanka and Pakistan have always maintained strong diplomatic relations, which have extended to the cricket field as well.

Sri Lanka were one of the first teams to travel to Pakistan following their 10-year ostracisation from international cricket, which came as a result of a terrorist attack targeting the Sri Lankan team in March 2009.

When Al Jazeera reached out to Sri Lanka Cricket (SLC), its vice president Ravin Wickramaratne confirmed that SLC did, indeed, reach out to the Pakistan Cricket Board (PCB) after the boycott was announced.

“We asked them to reconsider the decision,” Wickramaratne said.

“It [boycott] would have impacted Sri Lanka economically, whether directly or indirectly.

“We have always had a good relationship with the PCB and we have always supported them, so we’re happy with their decision.”

A little over 24 hours ahead of the match in Colombo, there is a sense of palpable excitement and a growing buzz around the fixture as it returns from the brink of cancellation.

As of Saturday morning, 28,000 tickets had been sold for the game but local organisers expect a capacity crowd of 40,000 to make it into the stands.

Come Sunday, thousands more will line the streets in and around Maligawatte, the bustling Colombo suburb that houses the famous Premadasa Stadium.

Business

“We Are Building a Stable, Transparent and Resilient Sri Lanka Ready for Sustainable Investment Partnerships” – PM

Prime Minister Dr. Harini Amarasuriya addressed members of the Chief Executives Organization (CEO) during a session held on Thursday [3 February 2026] at the Shangri-La Hotel, Colombo, as part of CEO’s Pearl of the Indian Ocean: Sri Lanka programme.

The Chief Executives Organization is a global network of business leaders representing diverse industries across more than 60 countries. The visiting delegation comprised leading entrepreneurs and executives exploring Sri Lanka’s economic prospects, investment climate, and development trajectory.

Addressing the gathering, the Prime Minister emphasized that Sri Lanka’s reform agenda is anchored in structural transformation, transparency, and inclusive growth.

“We are committed not only to ensuring equitable access to education, but equitable access to quality education. Our reforms are designed to create flexible pathways for young people beyond general education and to build a skilled and adaptable workforce for the future.”

She highlighted that the Government is undertaking a fundamental pedagogical shift towards a more student-focused, less examination-driven system as part of a broader national transformation.

Reflecting on Sri Lanka’s recent political transition, the Prime Minister stated:

“The people gave us a mandate to restore accountability, strengthen democratic governance, and ensure that opportunity is not determined by patronage or privilege, but by fairness and merit. Sri Lanka is stabilizing. We have recorded positive growth, restored confidence in key sectors, and are committed to sustaining this momentum. But our objective is not short-term recovery it is long-term resilience.”

Addressing governance reforms aimed at improving the investment climate, she said:

“We are aligning our legislative and regulatory frameworks with international standards to provide predictability, investor protection, and institutional transparency. Sustainable investment requires trust, and trust requires reform.”

Turning to the recent impact of Cyclone Ditwa, which affected all 25 districts of the country, the Prime Minister underscored the urgency of climate resilience.

“Climate change is not a distant threat. It is a lived reality for our people. We are rebuilding not simply to recover, but to build resilience, strengthen disaster mitigation systems, and protect vulnerable communities.”

Inviting CEO members to consider Sri Lanka as a strategic partner in the Indo-Pacific region, she highlighted opportunities in value-added mineral exports, logistics and shipping, agro-processing, renewable energy, pharmaceuticals, and innovation-driven sectors.

“We are not looking for speculative gains. We are seeking long-term partners who share our commitment to transparency, sustainability, and inclusive development.”

She further emphasized collaboration in education, research, vocational training, and innovation as essential pillars for sustained economic growth.

Concluding her address, the Prime Minister expressed appreciation to the Chief Executives Organization for selecting Sri Lanka as part of its 2026 programme and reaffirmed the Government’s readiness to engage constructively with responsible global investors.

The event was attended by the Governor of the Western Province, Hanif Yusoof, and other distinguished guests.

[Prime Minister’s Media Division]

-

Life style24 hours ago

Life style24 hours agoMarriot new GM Suranga

-

Business5 days ago

Business5 days agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Midweek Review5 days ago

Midweek Review5 days agoA question of national pride

-

Opinion4 days ago

Opinion4 days agoWill computers ever be intelligent?

-

Features24 hours ago

Features24 hours agoThe Rise of Takaichi

-

Features24 hours ago

Features24 hours agoWetlands of Sri Lanka:

-

Midweek Review5 days ago

Midweek Review5 days agoTheatre and Anthropocentrism in the age of Climate Emergency

-

Editorial7 days ago

Editorial7 days agoThe JRJ syndrome