Business

IPS sees path ahead for Sri Lanka even as economic challenges mount

by Sanath Nanayakkare

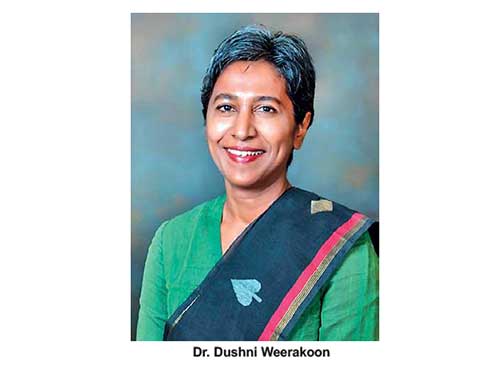

Even though macroeconomic pressures and external challenges are weighing on Sri Lanka’s fiscal situation, the country has a path ahead for growth and sustainability if it puts its fiscal house in order over the next three years, Dr. Dushni Weerakoon, Executive Director of the Institute of Policy Studies of Sri Lanka (IPS) said last week.

She made this remark while speaking at an online seminar after launching the State of the Economy- 2020 Report compiled by the IPS titled “Pandemics and Disruptions: Reviving Sri Lanka’s Economy COVID-19 and Beyond.”

Elaborating further she said, “Policy environment is critical to achieving resilient growth and economic stability in order to position Sri Lanka as a middle income country in the next 2-3 years”.

“Prevailing macroeconomic conditions in Sri Lanka are challenging. The debt overhang is the prime concern. This debt situation didn’t happen overnight, It crept up over the past decade or so. It hasn’t left room for more robust support packages for people and businesses affected by the COVID-19 pandemic. We need to rethink our policies not only to achieve a sustainable growth path, but we need to build a firewall to withstand any external shocks in the future”.

“Sound fiscal policy in order to put the public finances in order should be the focus of the upcoming budget and government policy in the coming years”.

“If a sovereign rating assessment goes against Sri Lanka in the offing, it could cause a sudden devaluation of the rupee and as a result of it, the size of our foreign currency loans will balloon”.

“The pressure on our forex reserves needs to be eased. FDIs need to be attracted to the construction and real estate sector to ease the immediate pressure and thereafter move on to a growth strategy driven by productivity and technology to become a middle-income country”.

“The minimizing of wasteful expenditure in the public sector won’t make much of a difference. The government will have to lead social welfare. We will have to spend more on health, education and social protection in the recovery phase”.

“The debt stock will persist in the next decade albeit a brief break in between. So, we need to shore up our forex buffers – not with borrowed funds but with investments that bring in manufacturing and services with knowledge transfer on technology”.

“The government has decided not to obtain large loans for infrastructure projects in the next 2-3 years to control the debt stock. Fiscal re-balancing and ensuring systematic tax revenue would be vital for medium-term stability”.

“We needed certain monetary policy stances and import restrictions to face the current situation, but we should see them as necessary short term measures only. Beyond recovery, we need a new system which is agile enough to integrate with the global supply chain and be part of that success as they jump start their economies”.

“We need to raise funds through international sovereign bonds, foreign term deposits etc. For the past one and a half decades, Sri Lanka has had experience on foreign funded projects. We have experience on capital spending, converting debt to equity in infrastructure development projects etc. We can learn from them and seek funding on our terms”.

“Wider fiscal space will also assist the government to provide better social welfare support to the poor. Sri Lanka’s budget deficit is estimated to be between 9-11% in 2020, and public revenue streams remain uncertain even in 2021, according to analysts. This together with low debt sustainability was partly why Sri Lanka’s sovereign rating was downgraded earlier this month by international rating agency Moody’s”.”Sri Lanka cannot afford to lose out by holding onto protectionist measures. A seamless tariff regime is needed to join international value chains, and as the world recovers, we must rethink our approach to trade”.

“On the back of Sri Lanka’s political stability, the country can rethink its economic policies and come through its macroeconomic challenges,” Dr. Dushni Weerakoon noted.

Business

Relief measures to assist affected Small and Medium Enterprises

As agreed with the Sri Lanka Banks’ Association (Guarantee) Ltd. (SLBA), to provide relief measures to affected SMEs by licensed commercial banks and licensed specialised banks, Circular No. 04 of 2024 dated 19.12.2024, and its addendum, Circular No. 01 of 2025 dated 01.01.2025 were issued by the Central Bank of Sri Lanka to ensure the effective implementation of the relief measures specified in the cited Circulars in a consistent manner across all licensed banks.

In case of any rejections or disputes, borrowers are requested to contact the respective banks and to appeal to the Director, Financial Consumer Relations Department of CBSL (FCRD), if required through the following channels:

Based on the repayment capacity and the submission of an acceptable business revival plan by the borrower, the relief measures extended to affected SMEs include rescheduling of credit facilities up to a period of 10 years, extending the time to commence repayments based on the capital outstanding, waiving off unpaid interest subject to conditions, and providing new working capital loans. Despite the availability of the above relief measures, limited number of borrowers had approached licensed banks to avail themselves of these benefits to date.

In addition to the above measures, with the gradual recovery of the economy, in order to facilitate the sustainable revival of businesses that were adversely affected during the recent past, several other measures were taken by CBSL together with the banking industry.

Accordingly, inter alia, strengthening the Post Covid 19 revival units of licensed banks, CBSL issued Circular No. 02 of 2024 dated 28.03.2024 on “Guidelines for the Establishment of Business Revival Units of Licensed Banks” mandating banks to establish Business Revival Units (BRUs) to assist viable businesses that are facing financial and operational difficulties.

Under BRUs, banks may provide support to viable businesses, such as restructuring and rescheduling of credit facilities including the adjustment of interest rates, maturity extensions, providing interim financing, advisory services etc., subject to the condition that such borrowers are required to submit acceptable business plans and feasible repayment plans. As reported by banks, by the end of 2024, around 6,000 facilities had been facilitated through these BRUs.

The above cited Circulars and Guidelines can be accessed via https://www.cbsl.gov.lk

Business

Visa commits to support women entrepreneurs in Sri Lanka

Visa (NYSE: V), the global leader in digital payments reiterated its support to women entrepreneurs across Sri Lanka as a part of its International Women’s Month celebrations across the world, by stating a firm commitment towards financial inclusion and digitization of women-led businesses, and hosted women from different walks of life in a specially curated event at Colombo.

Avanthi Colombage, Country Manager for Visa in Sri Lanka and Maldives stated, “At Visa, we believe in being the best way to pay and be paid by uplifting everyone, everywhere. This year, we celebrated International Women’s Month to support the very capable businesswomen in our country, with an event titled ‘Overcoming Barriers to Growth’ along with Square Hub, an incubator and business accelerator.”

The event by Visa brought together 35 upcoming women entrepreneurs across various sectors, including fashion, e-commerce, fintech, technology, manufacturing, and agriculture. While prominent industry experts shared views, learnings and experiences from their own journeys, the event also facilitated open discussions and networking among entrepreneurs, on how they can build and sustain thriving businesses.

Avanthi elaborates that Visa has built a firm foundation in supporting female entrepreneurship and the empowerment of women in Sri Lanka and understands the challenges women-owned businesses face when seeking capital, access, networks and guidance and continues to actively uplift women in Sri Lanka. Globally and in Sri Lanka, Visa believes that the participation of women is key to the growth of an economy. Avanthi adds, “Two years ago, when we celebrated 35 years of Visa in Sri Lanka, we announced a grant for The Asia Foundation to assist women-led small and medium businesses (SMBs) throughout the country. This initiative offered vital seed funding, skills training, and financial inclusion opportunities for women entrepreneurs, helping remove some major barriers to their success,” she recalled.

Business

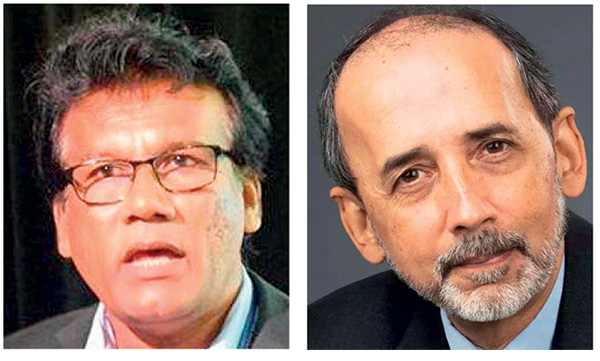

Environmentalists renew concerns over Adani Group’s proposed Mannar wind power project

Environmental groups, including the Wildlife and Nature Protection Society (WNPS), the Centre for Environmental Justice (CEJ) and the Environmental Foundation Ltd. (EFL), are raising renewed concerns about the potential ecological impact of large-scale wind energy development on Mannar Island. Conservationists argue that the island, home to a unique and sensitive ecosystem, faces serious risks from industrial projects that may disrupt biodiversity and endanger local wildlife.

At the heart of the controversy is whether the environmental issues raised by Adani Group’s proposed wind energy project in Mannar were being adequately considered. Critics argue that tariff negotiations and economic interests overshadowed ecological assessments, potentially leading to a project that might compromise the island’s rich natural heritage.

“Can wind energy coexist with Mannar Island’s fragile ecosystem? asked environmental scientist Hemantha Withanage of the CEJ.

He told The Island Financial Review: “We must ensure that our transition to renewable energy does not come at the cost of irreplaceable biodiversity.”

Other conservationists have pointed out that environmentalists are often misrepresented as obstructionists in debates over development. “Are we being painted as enemies of progress, or is the public being misled about the real consequences of such projects? questioned Dr. Rohan Pethiyagoda, a leading environmental advocate.

With Adani’s possible withdrawal from the project, there is now an opportunity to reevaluate Sri Lanka’s approach to sustainable energy. Experts emphasize the need for a smarter, science-driven path that prioritizes both renewable energy and environmental conservation.

A joint media conference, scheduled for today at the Dutch Burgher Union, Colombo, aims to address these concerns. Organized by WNPS, CEJ, EFL and Pethiyagoda, the event will explore questions such as whether the project might resurface under a new guise and who the true beneficiaries of such large-scale energy initiatives are.

By Ifham Nizam

-

Sports3 days ago

Sports3 days agoSri Lanka’s eternal search for the elusive all-rounder

-

News4 days ago

News4 days agoGnanasara Thera urged to reveal masterminds behind Easter Sunday terror attacks

-

Business5 days ago

Business5 days agoAIA Higher Education Scholarships Programme celebrating 30-year journey

-

News2 days ago

News2 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

News3 days ago

News3 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features3 days ago

Features3 days agoSanctions by The Unpunished

-

Latest News1 day ago

Latest News1 day agoIPL 2025: Rookies Ashwani and Rickelton lead Mumbai Indians to first win

-

Features3 days ago

Features3 days agoMore parliamentary giants I was privileged to know