Business

Inflation increased to 14% in December 2021

NCPI based headline inflation (Y-o-Y) increased to 14.0 per cent in December 2021 from 11.1 per cent in November 2021 due to increases of prices of items in both Food and Non-food categories. Meanwhile, Food inflation (Y-o-Y) and Non-food inflation (Y-o-Y) recorded at 21.5 per cent and 7.6 per cent, respectively, in December 2021, according to the weekly economic indicators of the Central Bank.

The report further said: Furthermore, the NCPI measured on an annual average basis, increased to 7.0 per cent in December 2021 from 6.2 per cent in November 2021.

Sustaining the expansion on a M-o-M basis, the Purchasing Managers’ Indices for both Manufacturing and Services activities increased in December 2021, recording 58.1 and 62.4 index values, respectively.

During the period under review (15.01.2022 to 21.01.2022), crude oil prices showed a mixed performance. The crude oil prices increased to 7-year highs at the beginning of the week as investors were concerned that geopolitical tensions involving major oil producers could worsen the already tight supply outlook. However, prices declined later on data that there was a significant weekly buildup of gasoline inventories in US and on the White House’s statement that there are ‘tools continue to

remain on the table’ to address the commodity price surge. Overall, Brent prices decreased by US dollars 0.92 while WTI prices increased by US dollars 2.33 per barrel, during the period.

On 20th January 2022, the Central Bank decided to increase its Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) by 50 bps each, to 5.50 per cent and 6.50 per cent, respectively. The Bank Rate, which is linked to the SLFR with a margin of +300 bps, automatically adjusted to 9.50 per cent.

Weekly AWPR for the week ending 21st January 2022 increased by 7 bps to 8.65 per cent compared to the previous week.

The reserve money increased compared to the previous week mainly due to the increase in currency in circulation.

The total outstanding market liquidity was a deficit of Rs. 543.367 bn by the end of this week, compared to a deficit of Rs. 459.932 bn by the end of last week.

By 21st January 2022, the All Share Price Index (ASPI) increased by 0.25 per cent to 13,371.61 points and the S&P SL 20 Index increased by 1.10 per cent to 4,604.99 points, compared to the index values of last week.

During the period from January to October 2021, government revenue increased to Rs. 1,154.8 bn compared to Rs. 1,133.6 bn recorded in the corresponding period of 2020.

During the period from January to October 2021, overall budget deficit increased to Rs. 1,575.2 bn compared to Rs. 1,317.2 bn recorded in the corresponding period of the previous year.

During the ten months ending October 2021, total expenditure and net lending increased to Rs. 2,731.7 bn compared to Rs. 2,453.7 bn recorded in the corresponding period of 2020.

During the period from January to October 2021, domestic financing increased to Rs. 1,717.4 bn compared to Rs. 1,669.4 bn in the corresponding period of 2020. Foreign financing recorded a net repayment of Rs. 142.2 bn during the period from January to October 2021 compared to a net repayment of Rs. 352.2 bn recorded in the corresponding period of 2020.

Outstanding central government debt increased to Rs. 17,343.9 bn by end October 2021 from Rs. 15,117.2 bn as at end 2020.

Since end 2020, total outstanding domestic debt increased by 19.4 per cent to Rs. 10,827.5 bn, and the rupee value of total outstanding foreign debt increased by 6.6 per cent to Rs. 6,516.4 bn by end October 2021.

During the year up to 21st January 2022, the Sri Lankan rupee depreciated against the US dollar by 1.1 per cent. Given the cross currency exchange rate movements, the Sri Lankan rupee depreciated against the Japanese yen by 2.2 per cent, the

pound sterling by 1.8 per cent, the Euro by 1.1 per cent and the Indian rupee by 1.1 per cent during this period.

Business

‘Notable drop in SL’s 2025 tourism sector earnings compared to those of 2018’

The revenue that was earned from the tourism sector in 2025 was US $ 3.2 billion, which is a significant drop compared to the 2018 figure , which is US$ 4.3 billion, a top tourism sector specialist said.

‘Comparatively there is a revenue deficit of US $ 1.2 billion, which we cannot be satisfied with at any cost, ‘Island Leisure Lanka’ founder chairman Chandana Amaradasa said.

Amaradasa made these observations at a Rotary Club joint meeting organised by Rotary Club Colombo South, featuring also the Rotary Clubs of Kolonnawa and Sri Jayawardenapura, at the Kingsbury Hotel on Tuesday.

Amaradasa added: ‘To develop the tourism sector the government has to do many things which previous governments comprehensively failed to take up.

‘The revenue that comes from the local tourism sector is four to five percent of the GDP, while in Dubai it is more than 45 percent of the GDP.

‘At present the country has 51000 rooms, out of which not more than 10000 rooms are at the four to five star level. Of that number 6000 rooms are located in Colombo, which is a major issue for tourism promotion in tourism potential areas.

‘Sri Lanka should focus on high quality standards in tourism and also develop the East Coast with the necessary infrastructure; especially having an international airport is absolutely necessary.

‘Colombo could be developed as a MICE tourism hub in the region. But not having an international level conference/convention hall is a another bottle neck in promoting that market as well.’

By Hiran H Senewiratne ✍️

Business

A Record Year for Marketing That Works: SLIM Effie Awards Sri Lanka 2025 crosses 300+ entries

The Sri Lanka Institute of Marketing (SLIM) announces a defining milestone for the country’s marketing, advertising, and creative sectors, as Effie Awards Sri Lanka 2025 records the highest number of entries in its history, crossing 300+ submissions. The unprecedented response reflects a stronger, more confident industry, one that is increasingly committed not only to bold creativity, but to creativity that can prove its value through measurable business and brand outcomes.

Now in its 17th year in Sri Lanka, the Effie Awards remain the most recognised benchmark for marketing effectiveness, honouring campaigns that bring together creative excellence, strategic discipline, and results. As the industry evolves, the Effies have become a space where the agency community, brand teams, media and creative partners are collectively challenged to raise the bar, moving beyond attention and awards, toward work that drives growth, shapes behaviour, and delivers real impact.

The record volume of entries this year also signals a healthy shift in the market: more brands and agencies are willing to be evaluated against rigorous effectiveness criteria, and to put forward work that demonstrates clear thinking, strong execution, and proof of performance. SLIM notes that this momentum highlights the expanding role of marketing and advertising in Sri Lanka, not simply as communication, but as a strategic driver of competitiveness and value creation.

SLIM confirms that the judging process will commence soon, guided by the established Effie evaluation framework that assesses entries on insight, strategy, execution, and measurable outcomes. The Grand Finale is scheduled for end-February 2026, where Sri Lanka’s most effective marketing work will be recognised on a national platform.

For inquiries, entries, and sponsorship opportunities, please contact the SLIM Events Division: +94 70 326 6988 | +94 70 192 2623.

Business

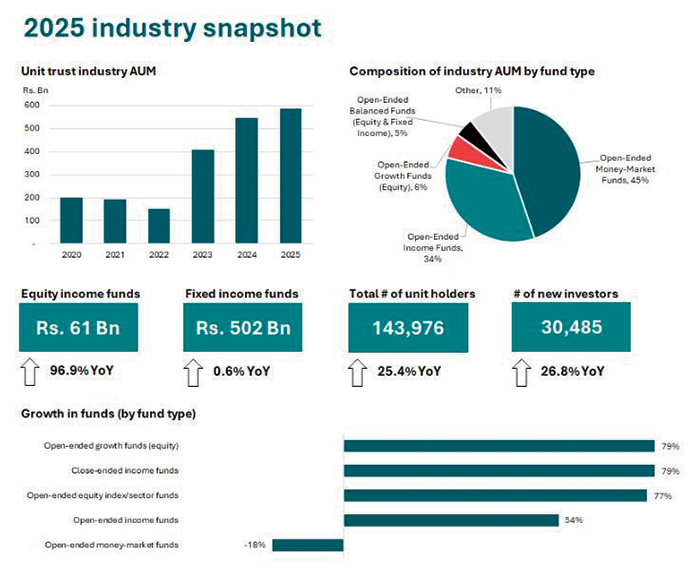

The Unit Trust industry closes 2025 with Rs. 587 Bn assets under management

The Unit Trust industry of Sri Lanka reported a 7.8% year-over-year growth of its assets under management (AUM) to Rs. 587 Bn by the end of 2025. During the year, the AUM reached a high of Rs. 613 Bn, indicating continued interest in the asset category. These assets are currently managed across 86 funds by 16 management companies.

While fixed-income funds accounted for the largest share of AUM, equity-related funds saw strong inflows, increasing by Rs. 30 Bn in 2025 compared to just Rs. 2 Bn for fixed-income funds. This reflects improved investor sentiment, with a clear shift from a capital preservation mindset toward long-term capital growth.

The year also saw a move from ultra-safe short-term instruments to medium-term growth, with strong inflows into open-ended income funds, open-ended equity index/sector funds, and balanced funds, accompanied by a decline in inflows to money-market funds. Additionally, open-ended growth funds (equity) recorded a 79% year-over-year increase, signalling a rising risk appetite among investors.

Commenting on the full-year industry performance, Secretary of the Unit Trust Association of Sri Lanka (UTASL) and Director/CEO of Senfin Asset Management Jeevan Sukumaran noted: “Post-economic crisis, the unit trust industry has been on a strong upward trend with the AUM surpassing Rs. 600 Bn last year.

‘’The steady growth of the unit trust industry in 2025 is a strong indication of increasing investor confidence in professionally managed and well-regulated investment products. Beyond the growth in fund flows, we have also seen encouraging progress in expanding the investor base — not only in terms of unit holder numbers, but also in the broadening of investor demographics — reflecting a gradual shift towards long-term, market-linked investing.”

-

Editorial6 days ago

Editorial6 days agoIllusory rule of law

-

Features6 days ago

Features6 days agoDaydreams on a winter’s day

-

Features6 days ago

Features6 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features5 days ago

Features5 days agoExtended mind thesis:A Buddhist perspective

-

Features6 days ago

Features6 days agoThe Story of Furniture in Sri Lanka

-

Opinion4 days ago

Opinion4 days agoAmerican rulers’ hatred for Venezuela and its leaders

-

Business2 days ago

Business2 days agoCORALL Conservation Trust Fund – a historic first for SL

-

Features6 days ago

Features6 days agoWriting a Sunday Column for the Island in the Sun