Business

ILO ready to work with CBSL to drive economy via MSE power

by Sanath Nanayakkare

The International Labour Organisation (ILO) which has conceptualised and introduced a viable Value Chain Financing (VCF) model for the coconut and coir industry in Sri Lanka said on Tuesday that a similar working capital model can be applied to any micro and small enterprise (MSE) sector where buyers have a strong dependencye on producers for supplies.

Ms Simrin Singh, Country Director for ILO in Sri Lanka and the Maldives said, “This means lending for micro and small enterprises (MSEs) appears to be more feasible now which has often remained outside the target of the commercial banks. The ILO is willing to work with the Central Bank of Sri Lanka to set guidelines and sound practices for Sri Lanka’s commercial banks to undertake value chain financing in a symbiotic relationship with the country’s MSE sector gaining advantages from each other.”

She made these comments at a virtual session organised by the Central Bank of Sri Lanka amid the prevailing situation in the country and its impacts on MSEs.

Speaking further as to how the ILO approached industry members who were willing to advance credit to their MSE raw-husk processing suppliers with the intention of providing inputs they need to continue their exports, she said:

“ILO has had had a number of years of exposure to the industry though collaboration with the Coconut Substrate Exporters Association of Sri Lanka. Four of Sri Lanka’s largest coir and coconut related product exporters partnered with the ILO to move forward with this initiative.The partnership guaranteed that the ILO would cost share an equal amount of any loan that the company would provide to the MSE supplier as a grant, to be used for improving occupational safety and health and working conditions, machinery acquisition or similar capital investment at the suppliers’ level. Accordingly, both MSEs and buyers would benefit from the resulting improved business conditions and quality of the products. Thus far, the ILO has engaged with 93 raw husk processing suppliers which has resulted in benefits to over 1,000 working people out of which approximately 50% are women.”

“The VCF intervention is part of an ILO-led initiative in Sri Lanka to facilitate the healthy socio-economic recovery of the MSE sector from the negative impacts of the COVID-19 pandemic. Vulnerability of this sector should not lead to exploitation and indebtedness at the hands of micro lenders of the informal sector. A significant proportion of MSEs in Sri Lanka struggle to secure working capital through formal channels for a number of reasons, including a lack of credit history or a poor credit rating or an inability to offer collateral. In searching for effective measures to help MSEs re-start or continue their business operations, the ILO introduced value chain financing as an effective and pragmatic approach to providing business owners with access to sufficient working capital.”

“For example, if the small business in question is involved in the apparel value chain, a financial institute would offer credit to the business if a reputed buyer from the apparel industry having commercial transaction with the financial institute vouches for the business. In general, VCF is a tool used to increase returns for all stakeholders and growth and competitiveness along the supply chain. In view of this pragmatic approach, commercial banks of Sri Lanka could look at this lending tool in a more favourable manner as they can rely on a symbiotic relationship with MSEs,” ILO Country Director said.

Business

HNB Assurance Elevates ‘Liya Harasara’ 2026 with Unmatched Benefits to Honor the Spirit of Womanhood

HNB Assurance PLC launched the 2026 edition of Liya Harasara, its flagship annual initiative dedicated to celebrating and empowering women in line with International Women’s Day. Recognized as one of the most anticipated campaigns of the year, Liya Harasara continues to evolve, delivering meaningful protection and exclusive privileges designed to support women in every stage of life.

This year’s edition introduces the most rewarding benefits in the history of the initiative. Women who sign up for eligible Regular Premium Life Insurance policies will receive a Free Life Cover of up to Rs. 2 Million for one year, along with a Free Critical Illness Benefit of up to Rs. 500,000, providing enhanced financial security and reassurance when it matters most. Additionally, female policyholders are also entitled to pregnancy related hospitalization cash benefit for Life Insurance Policies with in-force Hospitalization Benefit, for a maximum of three days per annum.

Commenting on the significance of this year’s campaign, Lasitha Wimalarathne, Executive Director / CEO of HNB Assurance, stated: “As we mark our 25th year as a trusted life insurer, we wanted Liya Harasara 2026 to reflect the strength of the journey that brought us here. For 25 years, women have been at the heart of our story, as leaders, advisors, customers and changemakers. This special edition is our way of honoring that partnership and reaffirming our commitment to protecting their aspirations for the future. When women progress, families prosper and communities thrive and we are proud to stand by them with meaningful protection and lasting assurance.”

Sharing his thoughts, Dinesh Yogaratnam, Chief Marketing and Customer Experience Officer of HNB Assurance, added, “Liya Harasara has grown into more than just an annual campaign, it is a tribute to the Spirit of Womanhood, to resilience, ambition and strength. The 2026 edition has been thoughtfully enhanced to deliver greater value and deeper impact, ensuring women receive protection that truly supports their ambitions and wellbeing. We remain committed to creating solutions that empower confidence and provide peace of mind, enabling women to focus on achieving their goals without compromise.”

Business

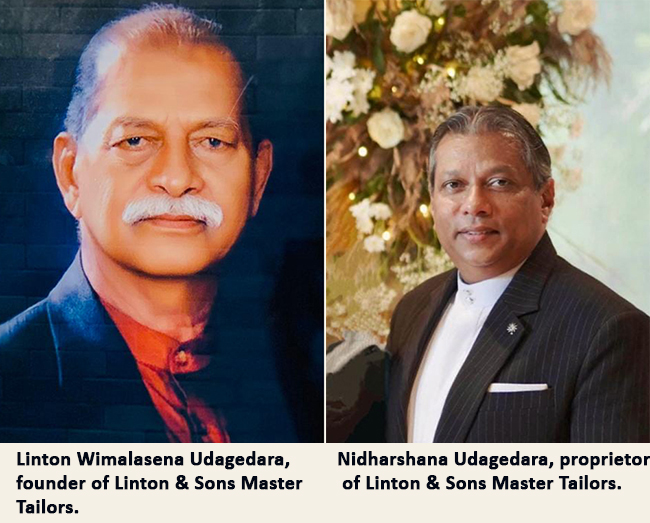

Seven decades of sartorial excellence: The legacy of Linton Master Tailors in Kandy

In the 1950s, Linton Wimalasena Udagagedara served as the tailoring instructor at the rehabilitation unit of the Bogambara Prison. Known affectionately by all as “Linton Master,” he laid the foundation for a legacy that would eventually redefine men’s fashion in the hill capital.

In 1958, Linton Master ventured into private business by renting a small shop in Trincomalee Street, Kandy, under the name “Linton Master Tailors.”

Supported by a handful of employees and the unwavering strength of his wife, Srima Alwala, the business began its humble journey. In those early days, Linton Master would travel from Kandy to Pettah, Colombo, walking miles to handpick high-quality fabrics at affordable prices. Though the initial years were a struggle, he never compromised on quality.

Due to his commitment to superior craftsmanship and impeccable finishing, “Linton Master’s Shop” in Trincomalee Street soon became a household name across the Kandy region. By the 1970s, the thriving business moved to Yatinuwara Veediya. As the enterprise grew, Linton Master eventually purchased the rented building and the adjacent premises. In the 1990s, the brand reached its zenith, becoming a hallmark of excellence.

Following the passing of Linton Master in 2009, the business transitioned into a new era. Today, it stands proud at the same familiar location in Yatinuwara Veediya, rebranded as “Linton & Sons Master Tailors.” His legacy is carried forward by his children; while one son manages a printing press and a daughter runs a bridal wear brand under the Linton name, his son Nidarshana Udagagedara has significantly expanded the core tailoring business.

Today, Kandy is home to three main institutions bearing the prestigious Linton brand. Linton & Sons Master Tailors, now employing around 20 skilled professionals, is a nationally recognized name. Known for their international standards, it is said that anyone who gets a full suit tailored at Linton & Sons invariably returns for their second.

The business that once started with fabric handpicked from Pettah now utilizes world-renowned international brands. Linton & Sons is currently the only tailor shop in Kandy that creates garments using prestigious fabrics such as Raymonds, Pacific Gold, Medici, and Macone.

Current Chairman Nidarshana Udagagedara notes that they serve a loyal customer base, with complete groom’s suit packages ranging from Rs. 30,000 to Rs. 90,000. With a highly experienced team, they now offer an exclusive one-day service, allowing customers to have bespoke designs created to their exact specifications in record time.

Spanning seven decades, the Linton lineage, which has brought fame to Kandy, has now successfully expanded from the second generation to the third, ensuring that the master’s stitch continues to define elegance for years to come.

By S.K. Samaranayake

Business

LANKATILES Captivates Architect 2026 with a Spectacular Celebration of Fine Living

At the prestigious Architect 2026 Exhibition, LANKATILES unveiled an immersive Concept Studio of contemporary design, where every surface spoke in allusive ways of exquisite craftsmanship and architectural vision.

Among a host of outstanding participants, the Concept Studio was recognized with two of the exhibition’s highest accolades: Overall Best Stall and Best Trade Stall Displaying Local Products. This is a resounding testament to five decades of trust, quality, and innovation.

The Concept Studio was thoughtfully zoned to evoke the ambiance of curated interiors and sophisticated entryways, unveiling the latest designs introduced to the market. Visitors were guided through a seamless spatial journey, beginning with the Living Zone, where expansive surfaces harmonized durability with refined design to elevate everyday living. The Kitchen Ambience Zone presented a contemporary culinary environment enriched with elegant finishes, demonstrating how functionality and elevated aesthetics coexist in modern homes.

The experience continued into the Bedroom Zone, an intimate and serene setting curated with soothing palettes and luxurious surfaces to create a tranquil retreat defined by comfort and understated elegance. Complementing this was the Bathware Zone — a sanctuary of calm showcasing precision-crafted porcelain surfaces that seamlessly blended purity of form with superior performance, redefining modern bathroom sophistication.

Extending beyond interiors, the Poolside Zone highlighted elegant outdoor settings framed by resilient, high-performance tiles, where aesthetic excellence met enduring strength in expressive interpretations of contemporary luxury. Featuring the latest Mosaic designs alongside the grand large-format tile series, Majestica, each zone illustrated how LANKATILES transforms raw materials into architectural poetry, reinforcing its leadership in innovation and design excellence.

Another defining feature of the Concept Studio was the AI-powered Tile Visualizer; an advanced digital interface designed to offer architects and homeowners an intelligent and immersive visualization experience that redefines the way interiors are selected and conceptualized. Within minutes, users can upload an image of their dream space and instantly explore precisely matched tile designs and colour palettes tailored to their aesthetic preferences.

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

News2 days ago

News2 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

Business4 days ago

Business4 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News1 day ago

News1 day agoWife raises alarm over Sallay’s detention under PTA