News

ICC Sri Lanka celebrates the Most Admired Companies of 2022

The highly anticipated annual event celebrating Sri Lanka’s Most Admired Companies (MAC Awards) for 2022 took place recently, captivating an audience of distinguished corporate leaders and esteemed diplomats. The award ceremony, organized by ICC Sri Lanka, AICPA & CIMA and DailyFT unveiled and recognized the exceptional accomplishments of these top-ranking companies in the country.

The companies awarded were recognized, for their exceptional performance, innovation, and overall impact on the economy. The main criteria they were judged for were their financial performance, ability to practice environmentally sustainable governance and ethical business practices for their employees, customers, investors and the community.

The Top Ten Companies of 2022:

Aitken Spence PLC

Bank of Ceylon

CBL Investments Ltd.

Ceylinco Insurance Ltd.

Commercial Bank of Ceylon PLC

Dilmah Ceylon Tea Company PLC

Hatton National Bank PLC

LOLC Holdings PLC

National Savings Bank PLC

Sri Lanka Telecom PLC

The event also paid tribute to five honourable mentions for their commendable contributions to the business landscape:

DFCC Bank PLC

Global Rubber Industries Ltd.

NDB Bank PLC

People’s Bank

Sampath Bank PLC

Shanil Fernando, Chairman of ICC Sri Lanka, said that “MAC awards were started by Dinesh Weerakkody the past ICC Chairman. ICC Sri Lanka, AICPA & CIMA and DailyFT are truly honoured to recognize and celebrate the remarkable achievements of ‘The Most Admired Companies in Sri Lanka’. These organizations have not only demonstrated exceptional business acumen but have also shown their commitment to innovation, sustainability, and societal impact. Their contributions play a pivotal role in driving the nation’s economic growth and shaping a brighter future for us all. The Most Admired Company Awards serve as a testament to their dedication and inspire others to strive for excellence.”

The event was graced by Chief Guest Secretary to the President, Saman Ekanayake, and the keynote speech was delivered by Katsuki Kotaro, Deputy Head of Mission for Japan in Sri Lanka.

The evaluation process was meticulous, involving a Financial Evaluation undertaken by a team of highly qualified CIMA members (CGMAs). Subsequently, the KPMG team ratified the scores and selected the Top 20 organizations for the next round of assessments. The second phase included compelling presentations by the shortlisted companies to the panel of judges. This dynamic element of the competition witnessed the top management of these companies actively engaging with the judges, showcasing their vision and strategies.

The organizing bodies, ICC Sri Lanka and AICPA & CIMA seized the occasion to present their budget proposals for the 2024 National Budget to Mr. Ekanayake, further emphasising the alignment of these institutions with the nation’s economic aspirations.

The MAC Awards is not just a celebration of business excellence but a testament to the innovation, dedication, and resilience that defines Sri Lanka’s corporate landscape. As the spotlight shines on these remarkable companies, it also illuminates the path for future endeavours, inspiring others to reach similar heights of distinction.

News

SLPP MP killing: 12 Aragalaya activists sentenced to death

… ex-Public Security Minister says lives of MP and bodyguard could have been saved

The Gampaha High Court Trial-at-Bar yesterday (11) sentenced 12 persons to death by hanging over the May 9, 2022, killing of former Polonnaruwa District SLPP MP Amarakeerthi Athukorala and his police bodyguard. They were among altogether 39 persons tried by the High Court for the double murder. Of the remaining accused, four persons were handed six-month sentences, suspended for five years, and 23 others acquitted by the Gampaha High Court Trial-at-Bar, consisting of High Court Judges Sahan Mapa Bandara Rashmi Singappuli and A.D. Ruwan Pathirana.

Of the 12 sentenced to death, one continues to evade the law.

The verdict was to be announced on January 14.

Sri Lanka suspended implementation of the death penalty in 1976. The EU has repeatedly warned that resumption of judicial executions would result in consequences.

The new entrant to Parliament, and his bodyguard, were lynched by a ‘Aragalaya’ mob, in broad daylight. They were on their way back to Polonnaruwa when the gang intercepted the MP’s car, in the Nittambuwa town, during violence unleashed in the aftermath of SLPP goons’ attack on those camping at the Gotagohome site at Galle Face.

Footage secured from a nearby CCTV camera showed MP Amarakeerthi Athukorala fleeing the scene with his security officer, who was armed with a gun. Dozens of suspects had been subsequently arrested on several occasions on suspicion of involvement in the MP’s murder. The MP and police officer were killed in a garment store where they took refuge.

Earlier, the case caused major controversy over the Gampaha High Court Trial-at-Bar granting bail to all suspects. The Attorney General appealed to the Supreme Court (SC) to cancel the bail granted by the High Court Trial-at-Bar. The AG argued that releasing the accused on bail would impede a fair trial. The AG asked that the SC cancel the bail order and requested that the accused be placed in remand custody till the conclusion of the trial.

One-time Law and Order Minister Rear Admiral (retd) Sarath Weerasekera told The Island that the lives of the parliamentarian and his police bodyguard could have been saved if the military swiftly responded to the then developing situation. Former Colombo District MP said that he told Parliament that the Army, in spite of having troops at Nittambuwa, didn’t intervene. The powers that be never inquired into the lapses on the part of those responsible for maintaining law and order, the ex-Minister said, alleging that successive governments conveniently neglected that responsibility.

by Shamindra Ferdinando

News

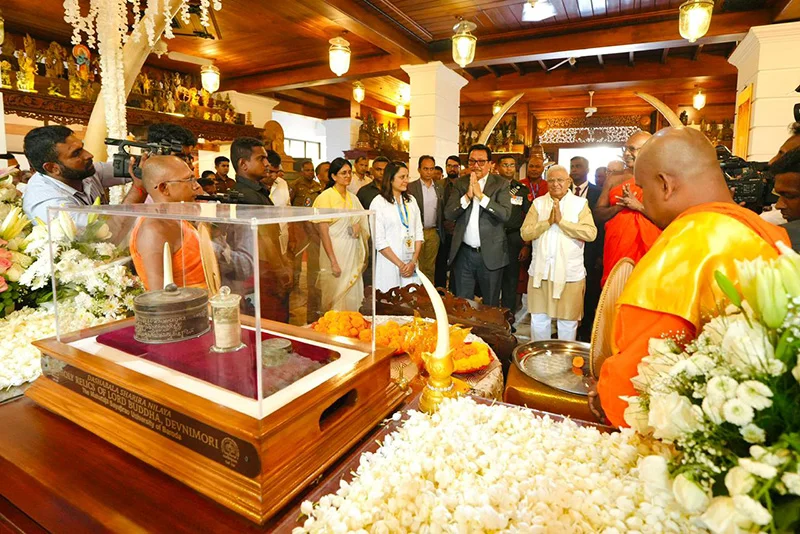

Over one million Lankan devotees venerate sacred relics

The Devnimori Relics of Lord Buddha, brought to Sri Lanka on February 04, 2026, departed for India on February 11, 2026, after the successful conclusion of the Exposition at the Gangaramaya Temple in Colombo. The Relics were accompanied by the Governor of Madhya Pradesh Mangubhai C. Patel, and Deputy Chief Minister of Arunachal Pradesh, Chowna Mein, on their return journey.

At the ceremonial departure, at the Bandaranaike International Airport, Minister of Buddhasasana, Religious and Cultural Affairs (Dr.) Hiniduma Sunil Senevi, Deputy Minister of Buddhasasana, Religious and Cultural Affairs Gamagedara Dissanayake, and High Commissioner of India Santosh Jha, were present to see off the Buddha Relics.

IHC spokesperson: ” During the visit, the delegation led by Governor of Madhya Pradesh, and Deputy Chief Minister of Arunachal Pradesh met Minister of Foreign Affairs, Foreign Employment and Tourism Vijitha Herath, Deputy Minister of Environment Anton Jayakody, and Governor of North Western Province Tissa Kumarasiri Warnasuriya. In addition, the dignitaries interacted with members of the Indian-origin community in Sri Lanka.

The Exposition was inaugurated by President Anura Kumara Dissanayaka from the Sri Lankan side, and Governor of Gujarat Acharya Devvrat, and Deputy Chief Minister of Gujarat Harsh Sanghavi from the Indian side, in the presence of the Chief Incumbent of the Gangaramaya Temple Ven. Dr. Kirinde Assaji Thera at the Gangaramaya Temple, Colombo, on February 04, 2026. The week-long Exposition saw over a million devotees paying their respects. Prime Minister of Sri Lanka (Dr.) Harini Amarasuriya and several Cabinet Ministers, as well as the Speaker, the Leader of Opposition, former Presidents and numerous other Members of Parliament paid their respects during the course of the Exposition.

The Exposition marked the first public veneration of these Holy Relics outside of India. Complementing the exposition, two exhibitions titled “Unearthing the Sacred Piprahwa” and “Sacred Relic and Cultural Engagement of Contemporary India” were also held to showcase the shared Buddhist heritage of India and Sri Lanka.

The Exposition was announced by Prime Minister Narendra Modi during his State Visit to Sri Lanka in April 2025. The Exposition further reinforced the spiritual and cultural linkages between the two civilizational partners. India remains committed to deepening the linkages between both countries through continued bilateral initiatives and regular exchanges between the monastic and scholarly communities.”

News

Flooded Chemmani mass grave cleared amidst persistent rain

Action was taken on Monday (9) to drain rainwater from the Chemmani mass graves as preparations continued for the next phase of excavation, Tamil Guardian has reported.

During the first and second phases of excavation at Chemmani, a total of 240 sets of human skeletal remains were identified. Of these, 239 sets have so far been exhumed under court supervision.

Although funds had already been allocated and preliminary arrangements were in place to begin the third phase of excavation, persistent heavy rainfall, in Jaffna, since November last year, resulted in rainwater stagnating within the burial site, bringing the process to a halt.

In response, steps were taken on Monday to remove the accumulated water with the assistance of the Nallur Pradeshiya Sabha. However, despite the drainage, the site remains heavily waterlogged and muddy, making immediate excavation unsafe, Tamil Guardian reported.

As a result, it has been decided that a determination on when the next phase of excavation can commence will be made on 16 March, when the case is due to be taken up again. The matter has been adjourned to that date.

The drainage operation was inspected on site by a team that included Jaffna Magistrate S. Lenin Kumar, Judicial Medical Officer Sellaiyah Pranavan, and Attorneys-at-Law Niranjan and G. Rajitha.

Tamil Guardian disclosed that funds allocated last year by the Ministry of Justice for the third phase of excavation have lapsed and been returned, as the work could not proceed within the allocated timeframe. As a result, a fresh budget proposal must now be submitted for the current year in order to secure the necessary funding.

The Judicial Medical Officer has taken steps to submit a new cost estimate to the court, so that the excavation process can resume once conditions at the site permit.

-

Features4 days ago

Features4 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business5 days ago

Business5 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business4 days ago

Business4 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business4 days ago

Business4 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business4 days ago

Business4 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business1 day ago

Business1 day agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Business5 days ago

Business5 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Business5 days ago

Business5 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check