Business

HNB re-inks partnership with Ideal Motors with exclusive offers for Mahindra automobiles, generators

Sri Lanka’s leading private sector bank Hatton National Bank (HNB) has once again renewed its partnership with Ideal Motors (Pvt.) Ltd, to promote and offer financing solutions for Mahindra automobiles and generators.

A special ceremony was hosted at HNB Towers, in the presence of HNB Deputy General Manager, Retail & SME Banking Sanjay Wijemanne and Ideal Motors Chairman Nalin Welgama to sign the Memorandum of Understanding (MoU).

The continued partnership between the two leaders in Sri Lanka’s banking and automobile industries will undoubtedly facilitate customers looking to purchase any Mahindra vehicle or generator with guaranteed personalised services in leasing and maintenance.

Customers will be able to receive a full life insurance cover worth up to Rs.4.5 mn together with attractive discounted vehicle insurance premiums. This exclusive collaboration also allows the two corporate giants to share their customer bases, who will in turn receive the lowest interest rates in addition to other benefits.

“Despite the uncertainties we faced over the past two years due to the pandemic, the leasing market has seen a positive incline. This is mainly in due to the value additions we extended to our customers and the hard work and dedication of our staff.

“Most importantly, we are excited to be joining hands with Ideal Motors, who have made an impact in the automobiles and generators market with the Mahindra brand. We hope that our mutual customer base will make use of this great opportunity to obtain the most affordable leasing options available, allowing them a chance to own a vehicle that they want,” commented HNB DGM-Retail & SME Banking Sanjay Wijemanne at the event.

The renewed alliance gives customers the opportunity to take advantage of free registration for all new Mahindra vehicles and generators through Ideal Motors, and attractive leasing opportunities from HNB, in addition to other benefits offered through the partnership. Customers will also receive the benefit of a ‘prestige prime’ credit card from HNB, which will offer unbeatable discounts on various automobile products.

“Our partnership with Mahindra has established us as market leader and household name in Sri Lanka. We look forward to expanding our facilities over the year to carter to the growing demand for Mahindra vehicles and we are certain that our collaboration with HNB to showcase our products will be successful,” said Chairman IDEAL Motors Nalin Welgama.

Customers can obtain further information on this partnership and offers through HNB customer centres and Ideal Motors showrooms, island-wide.

Ideal Motors (Pvt.) Ltd is the local promoter of Mahindra vehicles in Sri Lanka, a well-established and rapidly growing Indian brand that is internationally renowned for its high-performance Jeeps and SUVs. All Mahindra vehicles are now offered at a special discounted price for HNB Leasing customers, along with free registration for all Mahindra vehicles and free insurance for selected vehicles.

With 256 customer centres across the country, HNB is one of Sri Lanka’s largest, most technologically innovative banks, having won local and global recognition for its efforts to drive forward a new paradigm in digital banking. Consolidating its reputation for banking excellence, HNB bagged the Best Retail Bank and Best SME Bank awards in the Banking category at the International Finance Awards 2021. The bank was also ranked among the World Top 1,000 Banks list compiled by the prestigious UK-based Banker Magazine for five consecutive years. HNB was also declared Best Sub-Custodian Bank in Sri Lanka at the Global Finance Awards 2020. HNB has a national rating of AA- (lka) by Fitch Ratings (Lanka) Ltd.

Business

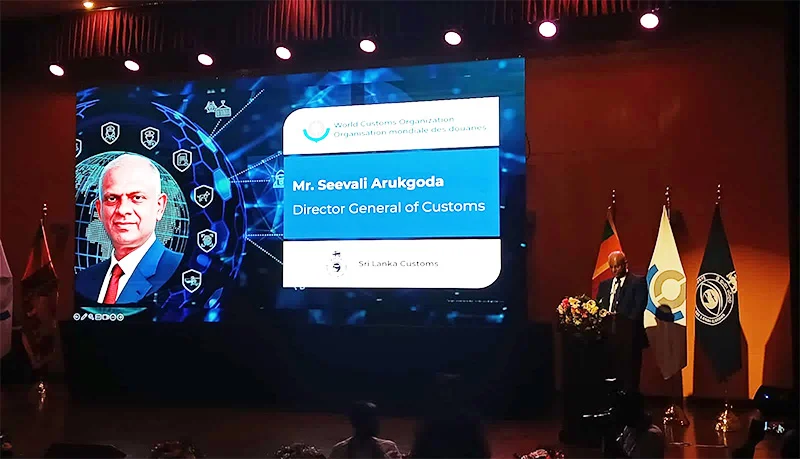

Customs posts record Rs. 2.26 tn revenue, accelerates digital overhaul

Sri Lanka Customs delivered its strongest performance in institutional history in 2025, exceeding national revenue targets while fast-tracking deep structural reforms to protect revenue, secure borders and lower trade friction, Customs Director General Seevali Arukgoda said at the International Customs Day celebrations 2026 in Colombo.

Addressing officials, diplomats and private-sector stakeholders under the global theme “Customs Protecting Society through Vigilance and Commitment,” Arukgoda said Customs collected Rs. 2,257 billion, surpassing the Rs. 2,231 billion target, and demonstrating the Department’s expanding role as both a revenue authority and trade facilitator.

“This is not a one-off outcome. It is the result of sustained reforms, disciplined enforcement and a clear strategic focus on protecting revenue while facilitating legitimate trade,” Arukgoda said.

While motor vehicles remained the single largest contributor, general cargo revenue rose 18 percent, signalling improved compliance and higher trade throughput. Enforcement-driven revenue reached Rs. 32 billion, up 10 percent year-on-year, underscoring the growing impact of intelligence-led controls.

“Every rupee secured through enforcement represents revenue protected for the State and confidence restored in the system,” the Director General said.

Beyond revenue, Arukgoda stressed Customs’ frontline role in protecting society, citing interdictions of narcotics, gold, foreign currency, substandard imports and illegal wildlife movements, coupled with firm penalties on non-compliant traders.

A major institutional breakthrough was the data-sharing MoU signed this month with the Inland Revenue Department, enabling parallel audits and coordinated investigations.

“Undervaluation and overvaluation will no longer be low-risk options. This integration closes a long-standing gap in revenue protection,” Arukgoda said.

On trade facilitation, he said Customs has moved decisively toward digital, rules-based clearance, expanding the Authorized Economic Operator (AEO) programme to MSMEs and rolling out platforms such as ‘Track My CusDec’ and Motor Vehicle Verification.

Advance Rulings have also been expanded to cover classification, valuation and rules of origin, fully aligning Sri Lanka with WTO Trade Facilitation Agreement obligations.

Looking ahead, Arukgoda said Sri Lanka Customs has been assigned a Rs. 2,207 billion revenue target for 2026, which the Department is confident of delivering amid continued reform momentum.

He added:”Our priority for 2026 is total digitalisation of remaining manual processes. This is about speed, transparency and eliminating discretion where it does not belong.”

Among the flagship projects is a state-of-the-art cargo examination yard at Kerawalapitiya, scheduled for completion by 2027, expected to reduce physical examinations from 40 percent to 10 percent, easing congestion and supporting higher trade volumes.

Other 2026 initiatives include Pre-Arrival Clearance, fully paperless cargo processing, an Automated Risk Management System, an Electronic Cargo Tracking System, and an electronic auction platform for goods disposal.

Customs will also expand AEO status to SMEs, freight forwarders and Customs House Agents, reducing compliance costs for trusted operators.

Arukgoda also announced the release of Time Release Study 2025, conducted in line with World Customs Organization guidelines, providing data-driven insights to remove bottlenecks across the clearance chain.

In a major governance reform, Sri Lanka Customs will issue a Code of Ethics and Conduct this week, developed with technical assistance from the IMF, WCO, World Bank, UNDP, Presidential Secretariat and CIABOC, and cleared by the Attorney General.

“Integrity is not optional. This Code institutionalises accountability and sets clear standards for every officer,” Arukgoda said.

The event was attended by Minister of Labour and Deputy Minister of Finance Dr. Anil Jayantha Fernando, Deputy Minister of Economic Development Nishantha Jayaweera, senior government officials, diplomats, development partners and retired senior Customs officers.

By Ifham Nizam

Business

Port City Colombo’s first residential project breaks ground

Sri Lanka’s most ambitious urban development project reached a critical execution milestone, as construction officially commenced on the first residential development within Port City Colombo. The milestone marks the transition of the country’s flagship Special Economic Zone (SEZ) from regulatory readiness to active private-sector delivery.

The project, Bay One Residences Colombo, is being developed by ICC Port City (Private) Limited, an entity established by International Construction Consortium (Private) Ltd. (ICC), one of Sri Lanka’s most established and experienced construction companies with a long track record of delivering complex, large-scale developments to international standards. The development represents one of the earliest major Sri Lankan private-sector residential investments within Port City Colombo and plays a foundational role in activating the city’s mixed-use urban ecosystem.

“Developed on 269 hectares of reclaimed land, Port City Colombo is now transitioning into a modern urban destination, with its first phase of infrastructure successfully completed. At the forefront of this evolution, Bay One Residences presents a rare first-mover opportunity, thoughtfully designed to enable residents to live, work, and unwind in a truly integrated environment, and backed by ICC’s 45 years of trusted expertise in delivering landmark, large-scale developments,” said Namal Peiris, Managing Director/Chief Executive Officer, International Construction Consortium (Pvt) Ltd.

Situated on a 13,945 square metre prime waterfront plot, Bay One Residences Colombo represents a total investment of approximately US$112 million, inclusive of land and development costs. The development will comprise 231 luxury apartment units, designed to international standards and targeted at both local and international buyers seeking premium urban living within a globally benchmarked city environment.

The commencement of the first residential development also marks an important step in the broader evolution of Port City Colombo, which has been purpose-built as a multi-services SEZ with a transparent, rules-based regulatory framework, world-class infrastructure, and a long-term vision to position Sri Lanka as a competitive destination for global capital, talent, and services. (Port City Colombo)

Business

Vibrant public participation in Jaffna International Trade Fair 2026

The Jaffna International Trade Fair (JITF) concluded successfully on January 25, marking its 16th consecutive year at the Muttraweli Grounds, Jaffna. Organised by Lanka Exhibition and Conference Services (LECS) in association with the Chamber of Commerce and Industries of Yarlpanam (CCIY), JITF once again reinforced its position as Northern Sri Lanka’s most influential multi-trade exhibition.

The three-day event attracted over 75,000 visitors, including business leaders, importers, exporters, SMEs, investors, financial institutions, technical professionals, and development agencies. With strong national visibility and extensive promotional outreach, JITF continues to serve as a vital platform for trade, investment, and economic integration in the Northern Province.

This year’s exhibition featured a diverse range of sectors, showcasing innovative products, services, and business opportunities, while facilitating meaningful networking and B2B engagement. Exhibitors reported strong visitor engagement and positive business prospects, reflecting growing confidence in the region’s economic potential.

JITF 2026 once again demonstrated its role as a catalyst for long-term development, fostering partnerships and opening new pathways for sustainable growth in Northern Sri Lanka.

-

Business3 days ago

Business3 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business4 days ago

Business4 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion7 days ago

Opinion7 days agoRemembering Cedric, who helped neutralise LTTE terrorism

-

Business7 days ago

Business7 days agoCORALL Conservation Trust Fund – a historic first for SL

-

Opinion4 days ago

Opinion4 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Opinion6 days ago

Opinion6 days agoA puppet show?

-

Opinion3 days ago

Opinion3 days agoLuck knocks at your door every day

-

Features6 days ago

Features6 days ago‘Building Blocks’ of early childhood education: Some reflections