Business

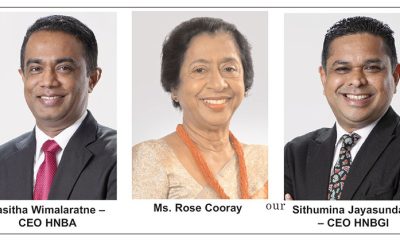

HNB clinches joint victory at ACCA Sustainability Reporting Awards 2023

Joint winner in Banking sector for 2022 Annual Report

Leads industry with sustainable banking practices

Sets benchmark for transparency and accountability

Sri Lanka’s leading private sector bank, HNB PLC, proudly announced its recognition as a joint winner in the banking category for Excellence in Sustainability Reporting at the prestigious Sri Lanka Sustainability Awards, organized by the Association of Chartered Certified Accountants (ACCA) Sri Lanka, a news release from HNB said.

HNB’s Annual Report for 2022 ‘Built for Resilience’ won Gold for its excellence in transparent reporting, accountability, and deploying responsible practices in sustainability, it said.

“This achievement highlights our commitment to not only meeting but exceeding the highest standards of environmental, social, and governance practices. We are immensely proud to be recognized by the ACCA for our efforts in sustainability reporting, as it reinforces our resolve to continue leading the way in sustainable banking practices in Sri Lanka,” said HNB, Managing Director/CEO, Jonathan Alles.

Aligned with the International Reporting Framework and Global Reporting Initiative (GRI) standards, HNB’s Annual Report provides a holistic view into the Bank’s social and environmental impacts. It also underscores HNB’s continuing efforts to integrate sustainable development and responsible banking into HNB’s corporate agenda and operations.

ACCA’s annual awards spotlight businesses excelling in environmental, social, or sustainability reporting. HNB was honored for meeting ACCA’s criteria, showing a deep understanding of its corporate context, outlining key environmental impacts, and demonstrating a strong commitment to environmental policies. The bank’s annual report showcased its environmental targets, objectives, and detailed reporting policies, reflecting a comprehensive approach to sustainability disclosure.

Additionally, HNB was ranked among the World’s Top 1,000 Banks list compiled by the prestigious UK-based Banker Magazine for the sixth consecutive year in 2022, in addition to being crowned the Best Market Leader in Trade Finance Services and Best Service Provider in Trade Finance for the 5th year at the Euromoney Awards 2024.

Business

Sri Lanka Insurance Supports 1000 Families in Flood-Affected Areas

Sri Lanka Insurance Life and Sri Lanka Insurance General, in collaboration with the National Disaster Relief Services Centre (NDRSC), extended vital assistance to 1,000 families affected by the recent ‘Ditwah’ cyclone.

The relief initiative was carried out in two phases on 30th November and 2nd December, reflecting the company’s continued commitment to supporting communities in times of distress. Dry ration packs were distributed through the NDRSC to the Maharagama Urban Council and the Divulapitiya Pradeshiya Sabha, ensuring that aid reached the most affected households swiftly and efficiently. Both distribution programmes were held with the participation of local authorities and the management teams of SLIC Life and SLIC General, further strengthening the company’s close partnership with the communities it serves.

Speaking on the initiative, Chairman of Sri Lanka Insurance, Nusith Kumaaratunga, stated; “Sri Lanka Insurance has always placed community wellbeing at the heart of its purpose. In difficult times such as these, it is our responsibility to stand with the families who have been affected and offer meaningful support. This relief effort reflects our ongoing commitment to uplift communities and reinforces our role as a trusted national insurer focused on protection, care, and compassion.”

In addition to the relief programme, Sri Lanka Insurance has implemented extended operating hours at selected SLIC General branches in the affected areas to ensure uninterrupted service. Claims, customer care teams, and branch staff are working beyond regular hours to provide prompt assistance to policyholders impacted by the severe weather conditions.

Business

Threads of Equity: MAS Holdings’ Journey of Inclusion and Impact

MAS Holdings invited to be Patron of the Diversity & Inclusion Working Group of UN Global Compact Network Sri Lanka

In the quiet hum of production floors and design studios across continents, inclusion is not just spoken of – it is lived. At MAS Holdings, the rhythm of progress beats in unison with purpose, echoing through its 13-country footprint where over 95,000 people come together to create, innovate, and inspire. Seventy percent of them are women – each one a vital thread in a fabric defined not by hierarchy or circumstance, but by shared dignity and opportunity.

In an era when inclusion is too often reduced to aspiration or rhetoric, MAS Holdings has chosen to make it a foundation of how it operates, leads, and grows. Its commitment goes beyond workplace representation or compliance – it is a philosophy that defines every layer of its business, from the boardroom to the production line.

As Patron of the Diversity & Inclusion Working Group of the UN Global Compact Network Sri Lanka (Network Sri Lanka), MAS’ role now extends beyond its own factory walls. It stands as a mentor and catalyst – shaping an ecosystem where inclusion is understood not as charity or obligation, but as a cornerstone of sustainable and ethical enterprises.

“Our diversity and inclusion work is embedded in our sustainability strategy, which forms part of our business strategy,” says Thanuja Jayawardena, Head of Gender Equity & Code of Conduct at MAS Holdings. “Inclusion is not something we do on the side – it’s how we build teams, develop leaders, and contribute to society.”

Embedding Inclusion into Culture and the Way of Work

The company’s Sustainability Strategy – anchored in three pillars: Product, Lives, and Planet – positions people at the heart of progress. At the organizational level, inclusion is safeguarded through a robust Equal Opportunity and Anti-Harassment Policy, which forms part of the MAS Code of Conduct. It ensures all employees -regardless of age, race, nationality, gender, sexual orientation, or language – are treated with equal dignity. Annual awareness sessions and clear consequence management frameworks reinforce that commitment.

While policies lay the foundation for an equitable workplace, MAS has long recognized that policies alone do not create inclusion – people do. To embed equity into its culture, the company has integrated inclusion metrics into management performance evaluations, linking progress on values, behaviour, and representation to leadership accountability. This approach transforms values into measurable action and makes inclusion a shared responsibility.

“We conduct sensitization work continuously – through workshops, training, and communication that help people see why inclusion matters and how each person can model it,” Thanuja says. “These efforts start from the top, because leaders must show the way.”

It is a journey, not a destination. MAS acknowledges that changing mindsets and addressing power imbalances require time, consistency, and persistence. Yet, with strong frameworks, measurable goals, and committed leadership, the company continues to move forward—steadfast even in the face of challenges.

A Legacy of Empowering Women

MAS’ roots in gender equity run deep. Since its founding, the company has been powered by women, with factories and offices where female workers make up the majority. Early on, the company recognized that bridging the gender gap in access to resources, safety, and opportunity wasn’t just a social responsibility – it was critical to long-term business success.

One of the most transformative milestones in their journey was the launch of its flagship Women Go Beyond (WGB) programme in 2003. What began as an initiative to recognize women’s contributions has evolved into a comprehensive empowerment framework, supporting the professional, personal, and social growth of women across the organization.

Since inception, over 5.5 million opportunities have been created under WGB. In 2024 alone, more than 300,000 women benefited through training on career advancement, life skills, entrepreneurship, financial literacy, health and wellbeing, and awareness on Sexual and Reproductive Health and Rights (SRHR) and addressing and preventing Gender-Based Violence (GBV).

“Our founders believed that empowering women was the right thing to do – and it stemmed from our founders’ deeply held personal values,” Thanuja says. “We’re now seeing the business case play out globally: diversity drives innovation, resilience, and performance.”

To sustain progress, MAS has embedded women’s representation targets into its leadership scorecards. Progress is tracked through gender-disaggregated data, ensuring transparency and accountability across recruitment, promotion, and succession planning. Leadership buy-in is strengthened through reward-based incentives that align equity outcomes with strategic goals.

The company’s family-friendly policies – flexible work arrangements, parental and adoption leave, childcare facilities at 36 locations – globally, and lactation rooms across all sites – reflect a tangible commitment to employee wellbeing. Since 2022, MAS has also expanded its inclusion focus to support people of diverse sexual orientations and gender identities, conducting sensitization programmes coupled with infrastructure support to build a culture of respect for all.

Changing Systems and Measuring Success

The company’s inclusive transformation has required both cultural and operational shifts. Long before industry expectations or customer pressure, internal goals for women’s representation in management were established, recognizing that real change had to begin from within.

The integration of these goals into MAS’ social sustainability tool allows for consistent measurement, monitoring, and adaptation of initiatives. The company measures both numbers and narratives – balancing quantitative indicators like promotion rates with qualitative insights from surveys, focus groups, and organizational health assessments.

“The real measure is how we see behaviour changing,” Thanuja reflects. “When someone calls out discrimination, when a mother takes a travel-heavy role, when flexibility becomes normalized – that’s success. Inclusion for us is progress felt, not just reported.”

Defining Inclusion Beyond Gender

While gender equity has been a defining part of MAS’ identity—rooted in its history as a company powered by women—the organization’s commitment today extends far beyond gender, embracing multiple dimensions of identity, experience, and ability. Within the Lives pillar of its Sustainability Strategy, the company focuses on empowering persons with disabilities, strengthening safe and respectful working environments, and expanding sustainability education within the communities where it operates. These commitments are supported by formal policies, leadership accountability mechanisms, and a strong internal culture that upholds equity and dignity for all.

This strong internal foundation enables MAS to extend its values beyond the workplace and into the communities it serves. One of the most recognized examples is the internally developed “Eco Go Beyond” school engagement programme, implemented under the guidance of the Ministry of Education. Through student-led projects, immersive camps, and partnerships, the programme nurtures environmental stewardship, youth leadership, and inclusive innovation – cultivating a generation that understands sustainability and equity as everyday responsibilities. “Both these focus areas are meaningful to us because of the industry we’re in and the communities we touch,” Thanuja notes. “We go deep in every area we take on, and design solutions that respond to real needs.”

By expanding its definition of inclusion, MAS is building systems that recognize and celebrate the diversity of its workforce and the communities connected to it. The company’s efforts—from disability inclusion to youth empowerment—reflect a belief that sustainable progress is only possible when every individual has the opportunity to participate and contribute. As MAS continues to broaden its focus areas and deepen partnerships, it aims to shape environments where inclusion is lived daily, not only within its workplaces but across the ecosystems it touches.

Leadership, Influence, and Industry Impact

At MAS, leadership commitment to inclusion is unwavering. “We’re fortunate to have shareholders and a board that understand the need for diversity of thought, background, and experience,” Thanuja shares. “Without senior-most commitment, this work is almost impossible – but it’s equally crucial to have middle management bought in, because they drive day-to-day change”.

As one of Sri Lanka’s largest employers, MAS’ influence extends across the apparel and manufacturing sectors, both locally and globally. The company actively shares its learnings through public forums, collaborations with universities, partnerships with global brands, and community engagements. “Our influence lies in showing that business excellence and inclusion aren’t separate,” Thanuja explains. “They strengthen each other”.

This philosophy is evident in MAS’ collaboration with the International Trade Centre’s GTEX Programme, a UN-led initiative funded by Switzerland and Sweden. Through this partnership, MAS committed to support nine SMEs in the textile sector by offering education on women’s empowerment, SRHR, and GBV awareness – helping build inclusive capacity beyond its own operations.

Collaboration with Network Sri Lanka and the Power of Collective Progress

The company was among the first Sri Lankan companies to join the UN Global Compact Network Sri Lanka in 2003 and became a signatory to the UN Women’s Empowerment Principles (WEPs) in 2011. Its partnership with Network Sri Lanka has been pivotal in strengthening both accountability and ambition.

“Network Sri Lanka has helped us set realistic yet bold goals and align with global best practices,” Thanuja notes. “Through initiatives like Target Gender Equality and the WEPs Gender Gap Analysis Tool, we’ve been able to benchmark ourselves and structure our frameworks better.”

The network has also enabled MAS to engage with academia, government, and advocacy groups, driving conversations around male allyship, inclusive policies for LGBTIQA+ employees, and addressing gender pay gaps – broadening the reach of its impact and influence.

Looking Ahead: Renewing the Commitment

As MAS looks toward 2030, its Fair-care Responsibility Lighthouse Project under the Lives pillar remains central to its sustainability agenda. The company will continue investing in leadership development, inclusive policy design, and community outreach—while staying committed to listening to its people and evolving in response to their needs. “An inclusive and equitable workplace is not a nice-to-have,” Thanuja asserts. “It’s essential for real economic growth. When businesses overlook childcare, discrimination, or abuse, they ignore the potential of their people – and that’s a cost no economy can afford”.

For MAS Holdings, inclusion is not a chapter – it is the thread that ties every part of its business together. And through their role as Patron of the Diversity & Inclusion Working Group, it continues to weave that thread into the wider fabric of Sri Lanka’s private sector – strengthening collective action and shaping a more equitable future for all.

Business

Growing investor participation fuels unit trust industry performance

The unit trust industry of Sri Lanka reported a 16.5% year-over-year growth of its assets under management (AUM) to Rs. 597 Bn by the end of November 2025. These assets are currently managed across 85 funds by 16 management companies.

Industry AUM continues to be bolstered by strong inflows into equity-related funds, which recorded Rs. 3.4 Bn in new funds during the month. Additionally, the industry saw 2,945 new unit holders invest in the market in November, with a total of 27,720 new investors added year-to-date. This indicates a growing familiarity and acceptance of unit trusts as an alternative investment tool among investors. As of end-November, the total number of unit trust investors in the market stood at 141,252, up approximately 25.0% year-over-year.

Speaking recently of the unit trust industry, Chairman of the Securities and Exchange Commission of Sri Lanka (SEC) Prof. Hareendra Dissabandara spoke of the importance of unit trusts in deepening Sri Lanka’s capital markets by enabling wider public participation through accessible, well-regulated and professionally managed investment options.

“Unit trusts open the door for ordinary citizens — even those with small savings — to become investors. This builds financial inclusion, encourages savings to flow into productive investments, and ultimately strengthens our capital market and national economy,” he stated.

He further reiterated: “Every investment carries some risk, but unit trusts are one of the safest ways to invest in the market. They are regulated by the SEC and held under the custody of independent trustees — often banks — who ensure that your money is not misused. The funds are required to disclose their performance regularly, so investors can see how their money is growing. Transparency and accountability are built into the system.”

Commenting on the industry results, Vice President of the Unit Trust Association of Sri Lanka (UTASL) and CEO of First Capital Asset Management Limited Kavin Karunamoorthy noted: “We are extremely encouraged to see the upward direction the industry has been heading in this past year. However, we believe there is more to be done. With the recent success of our ‘Investor Awareness Initiative’ held in October, we continue to remain focused on strengthening financial literacy and investor participation across the country in unit trusts.”

He further added: “These efforts are carried out in collaboration with the SEC and Colombo Stock Exchange (CSE), and we believe the recently launched ‘A Share for Each – A Unit for Everyone’ national initiative by the SEC to promote the industry will help activate and grow the investor base further.”

The UTASL is the representative body for the country’s licensed fund management companies, dedicated to upholding the highest standards of professionalism, integrity and transparency across the industry. Consisting of 16 member companies regulated by the SEC, the UTASL aims to popularise unit trusts and encourage Sri Lankans to prioritise long-term and professionally guided investing, in addition to short-term savings, whilst contributing to national economic growth.

For more information on unit trusts and to connect with management companies, visit www.utasl.lk.

-

News6 days ago

News6 days agoMembers of Lankan Community in Washington D.C. donates to ‘Rebuilding Sri Lanka’ Flood Relief Fund

-

News4 days ago

News4 days agoBritish MP calls on Foreign Secretary to expand sanction package against ‘Sri Lankan war criminals’

-

News7 days ago

News7 days agoAir quality deteriorating in Sri Lanka

-

News7 days ago

News7 days agoCardinal urges govt. not to weaken key socio-cultural institutions

-

Features6 days ago

Features6 days agoGeneral education reforms: What about language and ethnicity?

-

Opinion7 days ago

Opinion7 days agoRanwala crash: Govt. lays bare its true face

-

News6 days ago

News6 days agoSuspension of Indian drug part of cover-up by NMRA: Academy of Health Professionals

-

News7 days ago

News7 days agoCID probes unauthorised access to PNB’s vessel monitoring system