Business

Grow opens new Sri Lanka office to aid the adoption of blockchain and Web 3.0

Sri Lanka is aligning with innovation and accelerating into a new, digital-centric space, with the government working to create an inviting regulatory environment for blockchain use-cases to flourish, offering the country fresh and entirely new economic verticals.

One such enterprise capitalizing on Sri Lanka’s progressive approach to emerging technology markets such as Metaverse and Web 3.0 , is start-up incubator and 360 service provider, Grow. Recognizing the exciting growth potential that Southern Asia has to offer, the company has set up an operating base in Colombo, a move they hope will inspire others to follow.

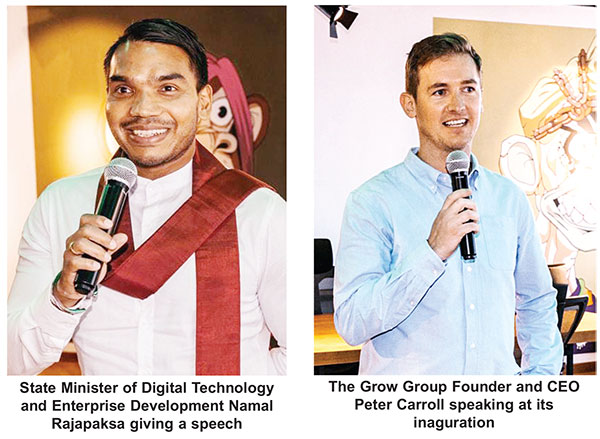

The team’s new office, which is situated in One Galle Face Tower, recently welcomed the Sri Lankan Cabinet Minister for Youth and Sports, Namal Rajapaska to its opening. “We are proud and happy to have you guys here as young entrepreneurs in the blockchain technology sector, and taking Sri Lanka, leading Sri Lanka into the new era. As a government, myself, my secretaries here, the central bank, deputy governors, all of us, are excited to be here today and to welcome you all.”

“I’m sure this is going to be the incubator for many, many start-ups on the blockchain technology opportunities that are coming out in Sri Lanka and also in the region. So, congratulations, and our support is there. So, we want to see you working hard. I can assure that we as a government will support you 100pct. There are certain positive changes that we are looking at to facilitate you more in this part of the industry, and we will look at that in a very positive way and work together going forward,” Rajapaska said.

Speaking from the opening celebration, Founder and CEO, Peter Carroll said, “New technological economies are combining with widespread technological infrastructure and forming the building blocks of our economic future. The ways in which they are utilized and regulated will define social mobility for the youth of today. At Grow we firmly believe these times are part of a shift, from the innovation phase of a technology breakout to the early adoption phase of the blockchain based industries of Web 3.0.”

“As the opportunities unfold, we are seeing huge potential in Blockchain Gaming and the Metaverse, we believe with forward thinking leadership Sri Lanka can take a central role as an ecosystem driver for these fresh and exciting verticals.”

Sri Lanka and Port City Colombo, if developed correctly, could become one of the world’s leading hubs for frontier technologies. If the government can facilitate a “sandbox” environment for Web 3.0’s brightest minds, then the seeds of innovation may have fertile soil on which to grow. The opportunity is clearly one that excites Carroll.

“I mean, think about it, what drives an entrepreneur? Building! We build ideas, products, and businesses, so what could be more exciting than being here in Colombo and helping to build the people, economy, and tech infrastructure of a $120bn state-of-the-art Smart City? For us, the answer is simple: nothing! We want to engage with the Blue Chip companies of Web 3.0 like Animoca Brands, Polygon and encourage them to help us drive opportunity, to educate and build traction because we believe Central and Southern Asia can drive real adoption.”

GROW provide Web3 builders with idea curation, marketing support and an advisory network of leading experts in an effort to facilitate real world impact of blockchain technology. Let’s Grow Together. For more information, visit www.thegrowgroup.com.

Business

Stepped-up bid to attract more young talent to the world of hospitality

The clink of cutlery, youthful laughter and the unmistakable energy of ambition filled the SLIIT Campus in Malabe as the Colombo Academy of Hospitality Management (CAHM) officially unveiled CAHM-7 Star Junior Chef Season 1, a pioneering national culinary competition designed to ignite the dreams of Sri Lanka’s next generation of chefs.

Speaking at the media briefing, CAHM chairman Errol Weerasinghe said the initiative was born out of a pressing need to attract young talent into what he described as the fastest-growing industry in the world of hospitality.

“We really want kids to get involved in this industry. We need the young generation,” Weerasinghe said, noting that this would be Sri Lanka’s first corporate-backed seven-star junior chef competition.

The programme will kick off in the Western Province, with plans to expand islandwide in phases, reaching schools directly and gauging student interest in culinary careers at an early age.

Weerasinghe also took pride in CAHM’s rapid growth over the past 13 years, highlighting that the academy has become Sri Lanka’s largest private hospitality education provider in a remarkably short time.

He added: “We have produced over 3,000 graduates, and I’m proud to say every single one of them is employed.” Adding that’s the key, real opportunities and real careers.

Adding strong corporate backing to the initiative, Vijay Sharma, Chief Executive Officer of Serendib Flour Mills Pvt Ltd, said the programme resonated deeply with the company’s core philosophy of “nourishing the nation.”

“We don’t just produce and sell flour, Sharma said. “Our responsibility is much larger. We want to nourish the body, the mind, the emotions and even traditions.”

He noted that supporting young minds at a formative age was essential for shaping how they perceive their future.

Sharma recalled how traditional career expectations once limited choices. “In those days, you were expected to become either a doctor or a teacher, he said. “Hospitality was rarely seen as a profession. Today, that has changed completely. This industry offers global opportunities, dignity and growth.”

Organisers said CAHM-7 Star Junior Chef is built around a simple but powerful idea, the best dish often starts in the smallest kitchen.

The competition gives young chefs aged 13 to 16 a platform to transform passion into purpose through exposure to real kitchens, professional chefs and structured mentorship.

Nilantha Rupasinghe, Head of the Organising Committee and Assistant Director at CAHM, said while the age group presents challenges, it is also where lasting inspiration begins.

He added:”We want to recognise talent early, motivate them and guide them towards becoming future culinary experts.”

Applications open from January 23, both online and through printed forms, and close on February 15.

Organisers expect more than 1,500 applications. From these, 200 participants will be selected for live cooking competitions scheduled for March 7 and 8 at CAHM’s professional kitchens.

From there, 100 contestants will advance, followed by 30 semi-finalists who will receive hands-on training, demonstration sessions and exposure visits to leading hotels and food production facilities, including flour mills.

The semi-finals on April 4 will lead to a grand finale on May 9, with winners receiving scholarships, cash awards and prestigious recognition.

All ingredients, equipment and utensils will be provided, ensuring every child competes on equal footing.

With the support of the Ministry of Education, media partners and industry leaders, CAHM-7 Star Junior Chef Season 1 is shaping up to be more than a competition — it is a bold investment in Sri Lanka’s culinary future, where young dreams are nurtured, one dish at a time.

By Ifham Nizam

Business

Sri Lanka’s economic comeback faces its first test as debt fears rekindle

First Capital Holdings PLC, a subsidiary of JXG (Janashakthi Group) and a pioneering leader in Sri Lanka’s investment landscape, successfully hosted the highly anticipated 12th Edition of its First Capital Investor Symposium on 22nd January, at Cinnamon Life, Colombo.

During the Symposium, First Capital presented its economic outlook for Sri Lanka in 2026, highlighting both growth prospects and plausible vulnerabilities. A central finding was the anticipated softening of Sri Lanka’s GDP growth, projected to decrease from 5.0% in 2025 to 3.0-4.0% in 2026. The main reason for this expected slowdown is the impact of the recent Cyclone Ditwah. The damage from the storm leads people to spend less, especially in areas beyond the main Western province, which affects the economy. While Sri Lanka’s fiscal resilience and fundamental discipline, a trend since 2023, are anticipated to remain robust, the need for higher capital expenditure in post-Ditwah revitalization efforts creates challenges. The main point of concern is that with slower economic growth, it could become more challenging for Sri Lanka to continue making good progress on managing its national debt.

Concurrently, the symposium’s discussion spanned interest rate movements, exchange rate trends, and bond market developments. The event also provided a unique platform for investors, industry leaders, and experts to engage in critical discussions on the market forces that are shaping Sri Lanka’s economic future. Drawing over 300 invitees and 400 participants online, the event proved to be one of the largest and most influential investor gatherings in the country, further consolidating First Capital Holdings’ leadership in fostering economic discourse and empowering investors with strategic insights.

Business

LOLC Finance launches short-term fixed deposits

LOLC Finance, Sri Lanka announces the launch of its Exclusive Short-Term Fixed Deposits, offering 4-month and 7-month maturity options at some of the most attractive and competitive interest rates in the market. Designed especially for Sri Lankans who work tirelessly to build and protect their savings, this new product delivers a powerful combination of stability, security, and stronger returns, backed by the most trusted financial entity in the industry.

As the country’s leading NBFI, LOLC Finance continues to demonstrate strength, resilience, and proven expertise in managing customer wealth responsibly. For the FY 2024/25, the company recorded a Profit After Tax (PAT) of Rs.25.1 billion and has already achieved Rs.14 billion PAT in the first half of FY 2025/26, a remarkable 72% year-on-year growth, indicating that the company is on track to surpass last year’s performance well before the financial year ends. Reinforcing this exceptional trajectory, LOLC Finance maintains a gross lending portfolio of Rs.360.2 billion, while customer deposits have grown to Rs.238.6 billion as at 30th September 2025.

The company’s financial strength reflects the consistent, unbroken trust and loyalty of its customers, a testament to the strong brand equity LOLC Finance has built over its two decades of leadership within Sri Lanka’s financial services landscape. With 30.3% of total industry equity, 20.6% of industry assets, and 36.3% of total industry profits, LOLC Finance stands firmly at the top of Sri Lanka’s NBFI sector, not just as the largest player, but as the most reliable partner for communities striving to safeguard and grow their hard-earned money. LOLC Finance is rated A+ (Stable) by Lanka Rating Agency, reaffirming its financial stability, robust governance, and its commitment to managing customer funds with integrity and reliability.

-

Business1 day ago

Business1 day agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business2 days ago

Business2 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion5 days ago

Opinion5 days agoRemembering Cedric, who helped neutralise LTTE terrorism

-

Business5 days ago

Business5 days agoCORALL Conservation Trust Fund – a historic first for SL

-

Opinion4 days ago

Opinion4 days agoA puppet show?

-

Opinion2 days ago

Opinion2 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Features6 days ago

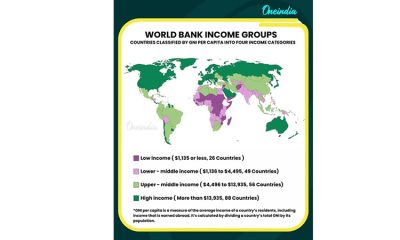

Features6 days agoThe middle-class money trap: Why looking rich keeps Sri Lankans poor

-

Opinion1 day ago

Opinion1 day agoLuck knocks at your door every day