Features

Finance Capital after COVID-19

Kumar David

Hyman Minsky (1919-1996) is celebrated for his thesis that economic recessions seemed to be triggered by shocks to the financial system. Downturns in the last 70 years were prompted by stock-market crashes, financial defaults and in 2008–09 a shock in the banking system. Though the underlying cause may lie in declines in the rate of profit, disruptions in production, surplus value extraction bottlenecks or supply-demand dislocations, the actual breakdown manifests itself in the financial system not in the production systems – the oil crises of the 1970s was an example of an exception. Marx was well aware that the crisis first manifests itself in the “circuit of capital”, vide Kapital Volume II, but it was Minsky who spelt it out most clearly.

The actual instant of free fall inauguration has even earned the name Minsky Moment. The current (2020) recession is different: it was triggered by a global pandemic although the conditions for a recession had been maturing in the womb of global finance capital for several years. Covid was the catalyst, imbalances in global finance capital the cause. I do not need to expand on this remark since it is recognised. Recall the reckless expansion of money-supply as otherwise capital would have gone under the bus globally (quantitative expansion); exploding debt (for example US Federal Debt will reach 100% of GDP at end 2020); income and wealth inequality at grotesque levels; and QUAD a US led group including Japan, India an Australia has commenced, de facto, a strategic and economic cold-war against China which will fracture already dislocated global supply chains.

Nevertheless, the pregnancy remained under wraps until Covid tore off the cover and exposed a wobbly global economy. Covid proved to be more than a catalyst; it has turned into a calamity. Let me quote a few simply unbelievable events. The Australian government has announced that international travel won’t resume until the very end of 2021. “International travel by tourists and foreign students will remain closed until late next year”, said Finance Minister Josh Frydenberg in a statement after the federal budget last week. “Citizens are banned from leaving the country and no international travellers are allowed in except for those on a short list of exemptions”.

The Country has gone into lockdown, literally. What will happen to Australia’s economy? Where are India and Brazil going? It seems that the Modi and Bolsonaro governments have given up; they are unable to cope. With seven and five million cases respectively, they have neither the hospital facilities nor quarantine accommodation. In country after country, the better the less said about the USA and UK, a despondent message is coming through: “It’ll never be the same again; there will be, there has to be transformative change in the global economic and political order”. This short essay will make some comments on the future of global finance capital with brief asides about Sri Lanka.

Livelihood and employment will be the imperatives driving any government and any economic arrangement that hopes to survive. I don’t know if the revolution, anarchy or psychological depression is around the corner, but look down the road a few years and surely it cannot continue like business in the past. The World Bank predicts that the pandemic will force 150 million into extreme poverty globally (less than $1.90 per person per day); and how many more into not so extreme poverty? You have to dig it out of the report but it seems more than a quarter of the world’s population will have to survive well below the $3.20 line. Nope, it’s impossible to prevent that drastic restructuring. Even if capitalism, with finance capital at the helm survives, how will it be transformed by international pressures, domestic class warfare (make no mistakes it’s on the way) and by government actions?

At a minimum a tough new regulatory environment will slot into place in all countries. These will include new health & occupational safety requirements, income protection and environmental regulations. Income protection will be a major concern in the coming years because Covid related disruptions will not go way tomorrow. My guess is that economic disruptions related to Covid are unlikely to abate for three to five years. (Sri Lanka can kiss goodbye to bikini and beach tourism for the next three years but culture and nature related tourism may revive sooner). Income protection is an idea that is catching on. In some places including some Indian states the government will pick up two-thirds of the salary bill when factories are closed due to Covid induced shutdowns. This can be recommended to our two-thirds besotted regime but the problem is that it is of no help to self-employed (think three-wheeler wallahs) and the informal sector (think itinerant journeymen and kerb-side hawkers).

My topic today however is not these small potatoes abut finance capital. Research in the US has shown that contrary to expectations lockdown did not have a much different impact on the three sectors, services & retail, manufacturing and finance. All three sectors, given their heterogeneous exposures to demand and supply factors, suffered similarly, but for different reasons of course. Banks due to curbs on interest rates and limited borrowing, manufacturing due to factory shut down and itinerant workers and the informal sector were killed by curfew. Both the manufacturing and banking sectors witnessed reduced net portfolio inflows. Fiscal and monetary stimulus – that is exertion by the state to save capitalism – played an important role in attenuating the negative impact of the global shock.

A curious factor in the US is that yield on the Treasury Bond has plunged; the ten-year bond for example it is trading at well below 1% and this underpins interest rates in general. The bond yield falls when folks rush into bonds because they have lost confidence in the future of the investment economy and seek a safe haven. When bond prices rise interest rates fall, driving savers, pensioners and banks into difficulty; it should be attractive for investors but in the prevailing post-2010, and now worse, gloomy scenario the well-heeled borrow to invest in stocks (for asset price inflation) and property (a safe haven) exacerbating wealth inequity. Companies in the US and the UK are not investing in manufacturing or the production economy

Finance capital is typified by the big banks, hedge and other funds and investment houses and billion-dollar investors. Banks have felt massive effects from the crisis and are not able to play their usual role in getting the economy back on track— they are fearful of providing loans to businesses that have buckled. Banks are taking massive provisions, and offering negative guidance for coming quarters. If the next three years go badly bank capital will fall below CET1, a capital benchmark used as a precautionary means to protect banks from buckling. If the financial system’s plunges liquidity and assets can evaporate quickly in a plunging market.

Hence a major expectation in the coming period is the introduction of stringent new controls on banks and investment houses, that is on finance capital which is playing Ludo with other people’s, money; viz. market money. But in the wake of these changes will also come politically and socially driven adjustments. Demands for the protection of livelihood, that is provision of decent food and adequate housing even when the virus disrupts employment will soon become a mass demand. No government or economic system that is unable to satisfy these needs is likely to survive. True food riots and civil disobedience are not on the horizon, the infection itself makes collective action of this nature very difficult but there are limits to patience and the example of the USA where mass disregard of sensible protection, beginning with an asinine President Trump, could catch on. But governments all over the world are becoming unpopular; Gotabaya backed out of a referendum on certain clauses of 20A because he knows as sure as night follows day that he will lose. The pendulum has swung halfway back and Covid gets much of the credit.

Deeper and stronger government regulation will curb the freedoms of finance capital and the run of market forces. The writing is on the wall. Even the IMF in its 2020 Global Financial Stability Report praises China for its financial stability during the pandemic and ascribes it to “limited external financial linkages, a strong role of government-owned financial institutions, and proactive efforts by the authorities that helped stabilize market conditions.” Indeed, China’s commercial banks remained healthy and posted profit in the first quarter of 2020, however the banking sector is under challenge. China’s financial opening and reform, would undermine banks though the government remains committed. Majority foreign ownership in securities, futures, insurance and currency brokerage will be allowed. It is possible that some of these trends will now be reversed.

In Sri Lanka traditional economists constantly repeat a call on the government to reduce expenditure and increase revenue. Both may prove impossible; it is untenable for political reasons to cut welfare or raise prices of essentials if the government wants to survive A second wave of Covid will make it utterly impossible. Increasing revenue can only be done by raising taxes on the rich and the super-rich; the government is quite unwilling to do this as it will anger its class and business base and those who financed its election campaigns. Even the Brandix fracas has put the current Administration in a bind because the multimillionaire Brandix is said to have financed its election campaigns.

Features

Following the Money: Tourism’s revenue crisis behind the arrival numbers – PART II

(Article 2 of the 4-part series on Sri Lanka’s tourism stagnation)

If Sri Lanka’s tourism story were a corporate income statement, the top line would satisfy any minister. Arrivals went up 15.1%, targets met, records broke. But walk down the statement and the story darkens. Revenue barely budges. Per-visitor yield collapses. The money that should accompany all those arrivals has quietly vanished, or, more accurately, never materialised.

If Sri Lanka’s tourism story were a corporate income statement, the top line would satisfy any minister. Arrivals went up 15.1%, targets met, records broke. But walk down the statement and the story darkens. Revenue barely budges. Per-visitor yield collapses. The money that should accompany all those arrivals has quietly vanished, or, more accurately, never materialised.

This is not a recovery. It is a volume trap, more tourists generating less wealth, with policymakers either oblivious to the math or unwilling to confront it.

Problem Diagnosis: The Paradox of Plenty:

The numbers tell a brutal story.

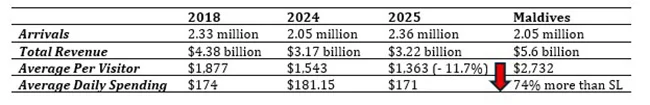

Read that again: arrivals grew 15.1% year-on-year, but revenue grew only 1.6%. The average tourist in 2025 left behind $181 less than in 2024, an 11.7% decline. Compared to 2018, the drop is even sharper. In real terms, adjusting for inflation and currency depreciation, each visitor in 2025 generates approximately 27-30% less revenue than in 2018, despite Sri Lanka being “cheaper” due to the rupee’s collapse. This is not marginal variance. This is structural value destruction. (See Table 1)

The math is simple and damning: Sri Lanka is working harder for less. More tourists, lower yield, thinner margins. Why? Because we have confused accessibility with competitiveness. We have made ourselves “affordable” through currency collapse and discounting, not through value creation.

Root Causes: The Five Mechanisms of Value Destruction

The yield collapse is not random. It is the predictable outcome of specific policy failures and market dynamics.

1. Currency Depreciation as False Competitiveness

The rupee’s collapse post-2022 has made Sri Lanka appear “cheap” to foreigners. A hotel room priced at $100 in 2018 might cost $70-80 in effective purchasing power today due to depreciation. Tour operators have aggressively discounted to fill capacity during the crisis recovery.

This creates the illusion of competitiveness. Arrivals rise because we are a “bargain.” But the bargain is paid for by domestic suppliers, hotels, transport providers, restaurants, staff, whose input costs (energy, food, imported goods) have skyrocketed in rupee terms while room rates lag in dollar terms.

The transfer is explicit: value flows from Sri Lankan workers and businesses to foreign tourists. The tourism “recovery” extracts wealth from the domestic economy rather than injecting it.

2. Market Composition Shift: Trading European Yields for Asian Volumes

SLTDA data shows a deliberate (or accidental—the policy opacity makes it unclear) shift in source markets. (See Table 2)

The problem is not that we attract Indians or Russians, it is that we attract them without strategies to optimise their yield. As the next article in this series will detail, Indian tourists average approximately 5.27 nights compared to the 8-9 night overall average, with lower per-day spending. We have built recovery on volume from price-sensitive segments rather than value from high-yield segments.

This is a choice, though it appears no one consciously made it. Visa-free entry, aggressive India-focused marketing, and price positioning have tilted the market mix without any apparent analysis of revenue implications.

3. Length of Stay Decline and Activity Compression

Average length of stay has compressed. While overall averages hover around 8-9 nights in recent years, the composition matters. High-yield European and North American tourists who historically spent 10-12 nights are now spending 7-9. Indian tourists spend 5-6 nights.

Shorter stays mean less cumulative spending, fewer experiences consumed, less distribution of value across the tourism chain. A 10-night tourist patronises multiple regions, hotels, guides, restaurants. A 5-night tourist concentrates spending in 2-3 locations, typically Colombo, one beach, one cultural site.

The compression is driven partly by global travel trends (shorter, more frequent trips) but also by Sri Lanka’s failure to develop compelling multi-day itineraries, adequate inter-regional connectivity, and differentiated regional experiences. We have not given tourists reasons to stay longer.

4. Infrastructure Decay and Experience Degradation

Tourists pay for experiences, not arrivals. When experiences degrade, airport congestion, poor road conditions, inadequate facilities at cultural sites, safety concerns, spending falls even if arrivals hold.

The 2024-2025 congestion at Bandaranaike International Airport, with reports of tourists nearly missing flights due to bottlenecks, is the visible tip. Beneath are systemic deficits: poor last-mile connectivity to tourism sites, deteriorating heritage assets, unregistered businesses providing sub-standard services, outbound migration of trained staff.

An ADB report notes that tourism authorities face resource shortages and capital expenditure embargoes, preventing even basic facility improvements at major revenue generators like Sigiriya (which charges $36 per visitor and attracts 25% of all tourists). When a site generates substantial revenue but lacks adequate lighting, safety measures, and visitor facilities, the experience suffers, and so does yield.

5. Leakage: The Silent Revenue Drain

Tourism revenue figures are gross. Net foreign exchange contributions after leakages, is rarely calculated or published.

Leakages include:

· Imported food, beverages, amenities in hotels (often 30-40% of operating costs)

· Foreign ownership and profit repatriation

· International tour operators taking commissions upstream (tourists book through foreign platforms that retain substantial margins)

· Unlicensed operators and unregulated businesses evading taxes and formal banking channels

Industry sources estimate leakages can consume 40-60% of gross tourism revenue in developing economies with weak regulatory enforcement. Sri Lanka has not published comprehensive leakage studies, but all indicators, weak licensing enforcement, widespread informal sector activity, foreign ownership concentration in resorts, suggest leakages are substantial and growing.

The result: even the $3.22 billion headline figure overstates actual net contribution to the economy.

The Way Forward: From Volume to Value

Reversing the yield collapse requires

systematic policy reorientation, from arrivals-chasing to value-building.

First

, publish and track yield metrics as primary KPIs. SLTDA should report:

· Revenue per visitor (by source market, by season, by purpose)

· Average daily expenditure (disaggregated by accommodation, activities, food, retail)

· Net foreign exchange contribution after documented leakages

· Revenue per room night (adjusted for real exchange rates)

Make these as visible as arrival numbers. Hold policy-makers accountable for yield, not just volume.

Second

, segment markets explicitly by yield potential. Stop treating all arrivals as equivalent. Conduct market-specific yield analyses:

· Which markets spend most per day?

· Which stays longest?

· Which distributes spending across regions vs. concentrating in Colombo/beach corridors?

· Which book is through formal channels vs. informal operators?

Target marketing and visa policies accordingly. If Western European tourists spend $250/day for 10 nights while another segment spends $120/day for 5 nights, the revenue difference ($2,500 vs. $600) dictates where promotional resources should flow.

Third

, develop multi-day, multi-region itineraries with compelling value propositions. Tourists extend stays when there are reasons to stay. Create integrated experiences:

· Cultural triangle + beach + hill country circuits with seamless connectivity

· Themed tours (wildlife, wellness, culinary, adventure) requiring 10+ days

· Regional spread of accommodation and experiences to distribute economic benefits

This requires infrastructure investment, precisely what has been neglected.

Fourth

, regulations to minimise leakages. Enforce licensing for tourism businesses. Channel bookings through formal operators registered with commercial banks. Tax holiday schemes should prioritise investments that maximise local value retention, staff training, local sourcing, domestic ownership.

Fifth

, stop using currency depreciation as a competitive strategy. A weak rupee makes Sri Lanka “affordable” but destroys margins and transfers wealth outward. Real competitiveness comes from differentiated experiences, quality standards, and strategic positioning, not from being the “cheapest” option.

The Hard Math: What We’re Losing

Let’s make the cost explicit. If Sri Lanka maintained 2018 per-visitor spending levels ($1,877) on 2025 arrivals (2.36 million), revenue would be approximately $4.43 billion, not $3.22 billion. The difference: $1.21 billion in lost revenue, value that should have been generated but wasn’t.

That $1.21 billion is not a theoretical gap. It represents:

· Wages not paid

· Businesses not sustained

· Taxes not collected

· Infrastructure not funded

· Development not achieved

This is the cost of volume-chasing without yield discipline. Every year we continue this model; we lock in value destruction.

The Policy Failure: Why Arrivals Theater Persists

Why do policymakers fixate on arrivals when revenue tells the real story?

Because arrivals are politically legible. A minister can tout “record tourist numbers” in a press conference. Revenue per visitor requires explanation, context, and uncomfortable questions about policy choices.

Arrivals are easy to manipulate upward, visa-free entry, aggressive discounting, currency depreciation. Yield is hard, it requires product development, market curation, infrastructure investment, regulatory enforcement.

Arrivals theater is cheaper and quicker than strategic transformation. But this is governance failure at its most fundamental. Tourism’s contribution to economic recovery is not determined by how many planes land but by how much wealth each visitor creates and retains domestically. Every dollar spent celebrating arrival records while ignoring yield collapse is a waste of dollars.

The Uncomfortable Truth

Sri Lanka’s tourism “boom” is real in volume, but it is a value bust. We are attracting more tourists and generating less wealth. The industry is working harder for lower returns. Margins are compressed, staff are paid less in real terms, infrastructure decays, and the net contribution to national recovery underperforms potential.

This is not sustainable. Eventually, operators will exit. Quality will degrade further. The “affordable” positioning will shift to “cheap and deteriorating.” The volume will follow yield down.

We have two choices: acknowledge the yield crisis and reorient policy toward value creation or continue arrivals theater until the hollowness becomes undeniable.

The money has spoken. The question is whether anyone in power is listening.

Features

Misinterpreting President Dissanayake on National Reconciliation

President Anura Kumara Dissanayake has been investing his political capital in going to the public to explain some of the most politically sensitive and controversial issues. At a time when easier political choices are available, the president is choosing the harder path of confronting ethnic suspicion and communal fears. There are three issues in particular on which the president’s words have generated strong reactions. These are first with regard to Buddhist pilgrims going to the north of the country with nationalist motivations. Second is the controversy relating to the expansion of the Tissa Raja Maha Viharaya, a recently constructed Buddhist temple in Kankesanturai which has become a flashpoint between local Tamil residents and Sinhala nationalist groups. Third is the decision not to give the war victory a central place in the Independence Day celebrations.

Even in the opposition, when his party held only three seats in parliament, Anura Kumara Dissanayake took his role as a public educator seriously. He used to deliver lengthy, well researched and easily digestible speeches in parliament. He continues this practice as president. It can be seen that his statements are primarily meant to elevate the thinking of the people and not to win votes the easy way. The easy way to win votes whether in Sri Lanka or elsewhere in the world is to rouse nationalist and racist sentiments and ride that wave. Sri Lanka’s post independence political history shows that narrow ethnic mobilisation has often produced short term electoral gains but long term national damage.

Sections of the opposition and segments of the general public have been critical of the president for taking these positions. They have claimed that the president is taking these positions in order to obtain more Tamil votes or to appease minority communities. The same may be said in reverse of those others who take contrary positions that they seek the Sinhala votes. These political actors who thrive on nationalist mobilisation have attempted to portray the president’s statements as an abandonment of the majority community. The president’s actions need to be understood within the larger framework of national reconciliation and long term national stability.

Reconciler’s Duty

When the president referred to Buddhist pilgrims from the south going to the north, he was not speaking about pilgrims visiting long established Buddhist heritage sites such as Nagadeepa or Kandarodai. His remarks were directed at a specific and highly contentious development, the recently built Buddhist temple in Kankesanturai and those built elsewhere in the recent past in the north and east. The temple in Kankesanturai did not emerge from the religious needs of a local Buddhist community as there is none in that area. It has been constructed on land that was formerly owned and used by Tamil civilians and which came under military occupation as a high security zone. What has made the issue of the temple particularly controversial is that it was established with the support of the security forces.

The controversy has deepened because the temple authorities have sought to expand the site from approximately one acre to nearly fourteen acres on the basis that there was a historic Buddhist temple in that area up to the colonial period. However, the Tamil residents of the area fear that expansion would further displace surrounding residents and consolidate a permanent Buddhist religious presence in the present period in an area where the local population is overwhelmingly Hindu. For many Tamils in Kankesanturai, the issue is not Buddhism as a religion but the use of religion as a vehicle for territorial assertion and demographic changes in a region that bore the brunt of the war. Likewise, there are other parts of the north and east where other temples or places of worship have been established by the military personnel in their camps during their war-time occupation and questions arise regarding the future when these camps are finally closed.

There are those who have actively organised large scale pilgrimages from the south to make the Tissa temple another important religious site. These pilgrimages are framed publicly as acts of devotion but are widely perceived locally as demonstrations of dominance. Each such visit heightens tension, provokes protest by Tamil residents, and risks confrontation. For communities that experienced mass displacement, military occupation and land loss, the symbolism of a state backed religious structure on contested land with the backing of the security forces is impossible to separate from memories of war and destruction. A president committed to reconciliation cannot remain silent in the face of such provocations, however uncomfortable it may be to challenge sections of the majority community.

High-minded leadership

The controversy regarding the president’s Independence Day speech has also generated strong debate. In that speech the president did not refer to the military victory over the LTTE and also did not use the term “war heroes” to describe soldiers. For many Sinhala nationalist groups, the absence of these references was seen as an attempt to diminish the sacrifices of the armed forces. The reality is that Independence Day means very different things to different communities. In the north and east the same day is marked by protest events and mourning and as a “Black Day”, symbolising the consolidation of a state they continue to experience as excluding them and not empathizing with the full extent of their losses.

By way of contrast, the president’s objective was to ensure that Independence Day could be observed as a day that belonged to all communities in the country. It is not correct to assume that the president takes these positions in order to appease minorities or secure electoral advantage. The president is only one year into his term and does not need to take politically risky positions for short term electoral gains. Indeed, the positions he has taken involve confronting powerful nationalist political forces that can mobilise significant opposition. He risks losing majority support for his statements. This itself indicates that the motivation is not electoral calculation.

President Dissanayake has recognized that Sri Lanka’s long term political stability and economic recovery depend on building trust among communities that once peacefully coexisted and then lived through decades of war. Political leadership is ultimately tested by the willingness to say what is necessary rather than what is politically expedient. The president’s recent interventions demonstrate rare national leadership and constitute an attempt to shift public discourse away from ethnic triumphalism and toward a more inclusive conception of nationhood. Reconciliation cannot take root if national ceremonies reinforce the perception of victory for one community and defeat for another especially in an internal conflict.

BY Jehan Perera

Features

Recovery of LTTE weapons

I have read a newspaper report that the Special Task Force of Sri Lanka Police, with help of Military Intelligence, recovered three buried yet well-preserved 84mm Carl Gustaf recoilless rocket launchers used by the LTTE, in the Kudumbimalai area, Batticaloa.

These deadly weapons were used by the LTTE SEA TIGER WING to attack the Sri Lanka Navy ships and craft in 1990s. The first incident was in February 1997, off Iranativu island, in the Gulf of Mannar.

Admiral Cecil Tissera took over as Commander of the Navy on 27 January, 1997, from Admiral Mohan Samarasekara.

The fight against the LTTE was intensified from 1996 and the SLN was using her Vanguard of the Navy, Fast Attack Craft Squadron, to destroy the LTTE’s littoral fighting capabilities. Frequent confrontations against the LTTE Sea Tiger boats were reported off Mullaitivu, Point Pedro and Velvetiturai areas, where SLN units became victorious in most of these sea battles, except in a few incidents where the SLN lost Fast Attack Craft.

Carl Gustaf recoilless rocket launchers

The intelligence reports confirmed that the LTTE Sea Tigers was using new recoilless rocket launchers against aluminium-hull FACs, and they were deadly at close quarter sea battles, but the exact type of this weapon was not disclosed.

The following incident, which occurred in February 1997, helped confirm the weapon was Carl Gustaf 84 mm Recoilless gun!

DATE: 09TH FEBRUARY, 1997, morning 0600 hrs.

LOCATION: OFF IRANATHIVE.

FACs: P 460 ISRAEL BUILT, COMMANDED BY CDR MANOJ JAYESOORIYA

P 452 CDL BUILT, COMMANDED BY LCDR PM WICKRAMASINGHE (ON TEMPORARY COMMAND. PROPER OIC LCDR N HEENATIGALA)

OPERATED FROM KKS.

CONFRONTED WITH LTTE ATTACK CRAFT POWERED WITH FOUR 250 HP OUT BOARD MOTORS.

TARGET WAS DESTROYED AND ONE LTTE MEMBER WAS CAPTURED.

LEADING MARINE ENGINEERING MECHANIC OF THE FAC CAME UP TO THE BRIDGE CARRYING A PROJECTILE WHICH WAS FIRED BY THE LTTE BOAT, DURING CONFRONTATION, WHICH PENETRATED THROUGH THE FAC’s HULL, AND ENTERED THE OICs CABIN (BETWEEN THE TWO BUNKS) AND HIT THE AUXILIARY ENGINE ROOM DOOR AND HAD FALLEN DOWN WITHOUT EXPLODING. THE ENGINE ROOM DOOR WAS HEAVILY DAMAGED LOOSING THE WATER TIGHT INTEGRITY OF THE FAC.

THE PROJECTILE WAS LATER HANDED OVER TO THE NAVAL WEAPONS EXPERTS WHEN THE FACs RETURNED TO KKS. INVESTIGATIONS REVEALED THE WEAPON USED BY THE ENEMY WAS 84 mm CARL GUSTAF SHOULDER-FIRED RECOILLESS GUN AND THIS PROJECTILE WAS AN ILLUMINATER BOMB OF ONE MILLION CANDLE POWER. BUT THE ATTACKERS HAS FAILED TO REMOVE THE SAFETY PIN, THEREFORE THE BOMB WAS NOT ACTIVATED.

Sea Tigers

Carl Gustaf 84 mm recoilless gun was named after Carl Gustaf Stads Gevärsfaktori, which, initially, produced it. Sweden later developed the 84mm shoulder-fired recoilless gun by the Royal Swedish Army Materiel Administration during the second half of 1940s as a crew served man- portable infantry support gun for close range multi-role anti-armour, anti-personnel, battle field illumination, smoke screening and marking fire.

It is confirmed in Wikipedia that Carl Gustaf Recoilless shoulder-fired guns were used by the only non-state actor in the world – the LTTE – during the final Eelam War.

It is extremely important to check the batch numbers of the recently recovered three launchers to find out where they were produced and other details like how they ended up in Batticaloa, Sri Lanka?

By Admiral Ravindra C. Wijegunaratne

By Admiral Ravindra C. Wijegunaratne

WV, RWP and Bar, RSP, VSV, USP, NI (M) (Pakistan), ndc, psn, Bsc (Hons) (War Studies) (Karachi) MPhil (Madras)

Former Navy Commander and Former Chief of Defence Staff

Former Chairman, Trincomalee Petroleum Terminals Ltd

Former Managing Director Ceylon Petroleum Corporation

Former High Commissioner to Pakistan

-

Features4 days ago

Features4 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business5 days ago

Business5 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business4 days ago

Business4 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business4 days ago

Business4 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business4 days ago

Business4 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business5 days ago

Business5 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Editorial7 days ago

Editorial7 days agoAll’s not well that ends well?

-

Business5 days ago

Business5 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check