Business

Dark side of the energy picture in Sri Lanka

The “rural energy crisis” has been receiving increasing attention from development policy makers because it affects the very survival of the vast majority of the world’s population, who live in the rural areas of the developing countries, and is also deeply inter-linked with the whole concept of sustainable development. The linkages between rural energy and sustainable development, however, need to be understood in the overall context of the energy situation in the developing countries. This also falls extremely well with SDG 7 of Agenda 2030 as an essential and a vital strategy of achieving the same.

The key message for policymakers is: Give wood energy a fair chance in the energy mix of your country in order to make the world a more sustainable and more environmentally friendly place.

Deviating from the conventional classification of energy as fuel sources which hides many development issues ,the Sri Lanka energy demand can be identified as consisting broadly of two major groups of energy (1) Centralized Commercial Energy consisting of electricity, fossil fuels and commercial renewable energy sources (2) Decentralized non commercial energy consisting of mainly biomass and other indigenous energy resources.

According to Sustainable Energy Authority (SEA) data, the largest component of energy demand in Sri Lanka in 2018 is for biomass energy amounting to 46.2.followed by 41% petroleum and 12.3% electricity (energy balance 2018). Biomass is also the main source of energy in household and industry comprising of 64..9% and 74..7 % respectively which highlights its importance as the life blood of the rural sector comprising of 81% of the total population and the industrial sector.

It is evident that burden of meeting the energy needs of group 1 has been carried out not by the government but by the rural people themselves led by the women to secure the sustenance and the livelihoods of the rural people for which government has not shown any appreciation or any interest. The mundane fact is that 191.4 PJ of energy amounting to 46.2% of the energy mix has never been the concern of the energy sector planning. What matters should not be the type of the energy source or fuel but the energy service provided which are the heat, light, mechanical and digital energy requirements.

While the energy sector should be congratulated for achieving 100% electrification in Sri Lanka which is a remarkable achievement, the present portfolios of Ministries in the energy sector focus only on Petroleum, Power and Renewable Energy Solar, Wind and Hydro Power Generation Projects Development . The major source of noncommercial biomass is overlooked . It is also observed that the term energy has been violated by identifying petroleum under the ministry of energy which is a misnomer which can create contradictions in policy matters as the term energy is used to encompass all energy resources.

While the energy sector should be congratulated for achieving 100% electrification in Sri Lanka which is a remarkable achievement, the present portfolios of Ministries in the energy sector focus only on Petroleum, Power and Renewable Energy Solar, Wind and Hydro Power Generation Projects Development . The major source of noncommercial biomass is overlooked . It is also observed that the term energy has been violated by identifying petroleum under the ministry of energy which is a misnomer which can create contradictions in policy matters as the term energy is used to encompass all energy resources.

The energy sector has incurred Rs 699 billion in foreign exchange almost 32% of the export earnings and an enormous expenditure to maintain a strong organizational infrastructure to cater for the commercial energy needs while neglecting the non commercial energy needs of the rural and estate poor.

This trend of depending on biomass has prevailed through out the last four decades and considering the present inequality in income distribution, it is likely to continue since affordability of modern fuels for the poor will not be a reality in the near future. This is evident from the fact that 30% of poorest get nine percent, the middle 40% get 29% and the richest 30% get 62% of the government income(Central Bank 2017 data) . A World Bank study states, at today’s prices that world LPG prices, regular users of LPG would likely need monthly household income in excess of US$350 and require at least 15 USD/month.

The Role of Liquefied Petroleum Gas in Reducing Energy https://openknowledge.worldbank.org › )

Nevertheless, presently there is a lack of focus on biomass energy by the government particularly due to the need for heavy focus on modern fuels for development of the country In contrast the important role played by biomass energy for the subsistence and economic development in the rural sector is not visible due to the decentralized and noncommercial nature of uncoordinated informal activities consisting of large number of stakeholders in the non-energy sector with a multitude of objectives not directly related to energy per se. Biomass energy is really not produced by the energy sector but a by product of activities carried out by the forestry, agriculture and plantation sectors which is not their main objective thus making biomass no one’s baby.

It is observed that this complication of uncoordinated, informal relationships and lack of insensitivity of the government which have contributed towards lack of governance within the energy sector in Sri Lanka have further isolated the low income rural sector to find their own solutions for survival. Non-cognizance on low-cost, improved biomass solutions has led to a scenario where biomass energy is negatively perceived with detrimental effects on sustainable development. It is totally unwelcoming to see that there is no appropriate mechanism devoted to the management of indigenous energy resources which still serves as the energy backbone of Sri Lanka.

The negative image of biomass, tends to be associated with deforestation, climate change under-development, poverty and negative health effects. This image steers policy makers towards the replacement of biomass by other fuels, instead of improving sustainability of the sector with integrated and holistic approaches.

In spite of the focus on alternatives, it is unlikely that biomass use will decrease in absolute terms over the coming decades. There is no evidence to show that firewood use is contributory factor to deforestation. Main four reasons for deforestation in Sri Lanka are encroachments due to agriculture, gem mining and settlements, infrastructure development projects, commercial agriculture ventures and several localized drivers like cattle grazing, cardamom cultivation and forest fires. (Kariyawasam, Ravindra, and Chinthka Rajapakse).

However, despite of the fact that, firewood is underestimated and ridiculed as a primitive fuel, the use of firewood by a majority of the population of Sri Lanka has not deprived but contributed towards the wellbeing of Sri Lanka in achieving many development indicators in moderation compared to many middle income countries. For an example according to world rankings, Sri Lanka’s rankings are Human Development Index 71, health 48, social capital 33, prosperity 84 and education 62. Moreover, a female born in Sri Lanka can expect to live 80.1 years (despite using firewood for cooking ) as oppose to 79 years in America). Infant Deaths/1000 in Sri Lanka is six, where it is six in America and 27 in India .

In the name of good governance and justice it is high time that the Ministry of Power and Renewable Energy (Sustainable Energy Authority) take action to avoid a looming disaster in the near future due to the informal nature of biomass supply and use of biomass is allowed to continue without inputs from the government which not only create social instability also hamper the efforts of achieving sustainable development goals.

The scope for the government is to facilitate the availability of supply, provide low cost technology support for efficient use by improving access to ventilation and efficient use through improved stoves and mitigate negative impacts on health and climate as alleged by the international community. Nearly eight million tons of firewood is required annually for cooking and livelihoods and four million tons of firewood for the industrial sector. Each house would require nearly two tons/year. Meeting this target would require the coordination and integration of the various stakeholder activities already providing informal facilitation in unofficial ways.

Although negative perceptions of biomass energy are widespread, biomass is not necessarily an unsustainable or backward fuel. Sustainability depends on the practices applied in the value chain; for example forest management techniques and the efficiency of conversion and use. These commonly held misconceptions tend to associate biomass fuels with deforestation, indoor air pollution and underdevelopment.(European Union Energy Initiative and GIZ, Germany ). http://www.euei-pdf.org/fr/node/3880.

In the name of governance in the energy sector in Sri Lanka, the objective of this article is to request the Sustainable Energy Authority which has been given the mandate to promote renewable energy (not only commercial energy) to take the leadership and initiative to invite the relevant stakeholders, donors, NGOs for a consultative meeting with a view to identify stakeholders and cross cutting activities, linkages and capacity and make aware the importance of rural sustainable energy interventions which needs the formation of a network of organizations to be established under the local government ministry facilitated by the sustainable energy authority comprising of specially dedicated staff to biomass energy development.

R.M.Amerasekera. Eng

Executive Director, Integrated Development Association (IDEA)

Energy Advisor to Former Minister of Local Government Admiral Sarath Weerasekara

Project Manager, National Fuel Wood Conservation Programme

Electrical Engineer (Alternative Energy Development Unit, CEB)

Retired Director, Sustainable Energy Authority

Short term Consultant to the UNDP(Sudan), World Bank and FAO

Recipient of First Ever Sri Lanka Energy Efficiency Award(2015), Awarded by HE the President

for bringing sustainable energy solutions to people

Recipient of Mohan Munasingha Award (1985) for Energy Conservation Efforts

Nominee for World Clean Energy Award(2007)

Business

HNB Assurance Elevates ‘Liya Harasara’ 2026 with Unmatched Benefits to Honor the Spirit of Womanhood

HNB Assurance PLC launched the 2026 edition of Liya Harasara, its flagship annual initiative dedicated to celebrating and empowering women in line with International Women’s Day. Recognized as one of the most anticipated campaigns of the year, Liya Harasara continues to evolve, delivering meaningful protection and exclusive privileges designed to support women in every stage of life.

This year’s edition introduces the most rewarding benefits in the history of the initiative. Women who sign up for eligible Regular Premium Life Insurance policies will receive a Free Life Cover of up to Rs. 2 Million for one year, along with a Free Critical Illness Benefit of up to Rs. 500,000, providing enhanced financial security and reassurance when it matters most. Additionally, female policyholders are also entitled to pregnancy related hospitalization cash benefit for Life Insurance Policies with in-force Hospitalization Benefit, for a maximum of three days per annum.

Commenting on the significance of this year’s campaign, Lasitha Wimalarathne, Executive Director / CEO of HNB Assurance, stated: “As we mark our 25th year as a trusted life insurer, we wanted Liya Harasara 2026 to reflect the strength of the journey that brought us here. For 25 years, women have been at the heart of our story, as leaders, advisors, customers and changemakers. This special edition is our way of honoring that partnership and reaffirming our commitment to protecting their aspirations for the future. When women progress, families prosper and communities thrive and we are proud to stand by them with meaningful protection and lasting assurance.”

Sharing his thoughts, Dinesh Yogaratnam, Chief Marketing and Customer Experience Officer of HNB Assurance, added, “Liya Harasara has grown into more than just an annual campaign, it is a tribute to the Spirit of Womanhood, to resilience, ambition and strength. The 2026 edition has been thoughtfully enhanced to deliver greater value and deeper impact, ensuring women receive protection that truly supports their ambitions and wellbeing. We remain committed to creating solutions that empower confidence and provide peace of mind, enabling women to focus on achieving their goals without compromise.”

Business

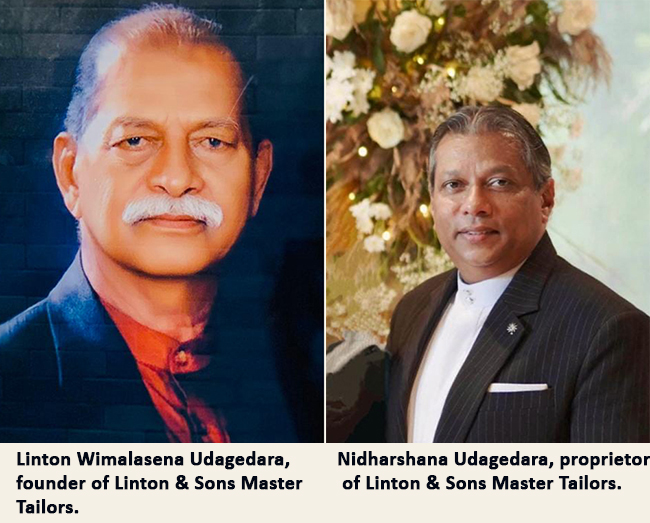

Seven decades of sartorial excellence: The legacy of Linton Master Tailors in Kandy

In the 1950s, Linton Wimalasena Udagagedara served as the tailoring instructor at the rehabilitation unit of the Bogambara Prison. Known affectionately by all as “Linton Master,” he laid the foundation for a legacy that would eventually redefine men’s fashion in the hill capital.

In 1958, Linton Master ventured into private business by renting a small shop in Trincomalee Street, Kandy, under the name “Linton Master Tailors.”

Supported by a handful of employees and the unwavering strength of his wife, Srima Alwala, the business began its humble journey. In those early days, Linton Master would travel from Kandy to Pettah, Colombo, walking miles to handpick high-quality fabrics at affordable prices. Though the initial years were a struggle, he never compromised on quality.

Due to his commitment to superior craftsmanship and impeccable finishing, “Linton Master’s Shop” in Trincomalee Street soon became a household name across the Kandy region. By the 1970s, the thriving business moved to Yatinuwara Veediya. As the enterprise grew, Linton Master eventually purchased the rented building and the adjacent premises. In the 1990s, the brand reached its zenith, becoming a hallmark of excellence.

Following the passing of Linton Master in 2009, the business transitioned into a new era. Today, it stands proud at the same familiar location in Yatinuwara Veediya, rebranded as “Linton & Sons Master Tailors.” His legacy is carried forward by his children; while one son manages a printing press and a daughter runs a bridal wear brand under the Linton name, his son Nidarshana Udagagedara has significantly expanded the core tailoring business.

Today, Kandy is home to three main institutions bearing the prestigious Linton brand. Linton & Sons Master Tailors, now employing around 20 skilled professionals, is a nationally recognized name. Known for their international standards, it is said that anyone who gets a full suit tailored at Linton & Sons invariably returns for their second.

The business that once started with fabric handpicked from Pettah now utilizes world-renowned international brands. Linton & Sons is currently the only tailor shop in Kandy that creates garments using prestigious fabrics such as Raymonds, Pacific Gold, Medici, and Macone.

Current Chairman Nidarshana Udagagedara notes that they serve a loyal customer base, with complete groom’s suit packages ranging from Rs. 30,000 to Rs. 90,000. With a highly experienced team, they now offer an exclusive one-day service, allowing customers to have bespoke designs created to their exact specifications in record time.

Spanning seven decades, the Linton lineage, which has brought fame to Kandy, has now successfully expanded from the second generation to the third, ensuring that the master’s stitch continues to define elegance for years to come.

By S.K. Samaranayake

Business

LANKATILES Captivates Architect 2026 with a Spectacular Celebration of Fine Living

At the prestigious Architect 2026 Exhibition, LANKATILES unveiled an immersive Concept Studio of contemporary design, where every surface spoke in allusive ways of exquisite craftsmanship and architectural vision.

Among a host of outstanding participants, the Concept Studio was recognized with two of the exhibition’s highest accolades: Overall Best Stall and Best Trade Stall Displaying Local Products. This is a resounding testament to five decades of trust, quality, and innovation.

The Concept Studio was thoughtfully zoned to evoke the ambiance of curated interiors and sophisticated entryways, unveiling the latest designs introduced to the market. Visitors were guided through a seamless spatial journey, beginning with the Living Zone, where expansive surfaces harmonized durability with refined design to elevate everyday living. The Kitchen Ambience Zone presented a contemporary culinary environment enriched with elegant finishes, demonstrating how functionality and elevated aesthetics coexist in modern homes.

The experience continued into the Bedroom Zone, an intimate and serene setting curated with soothing palettes and luxurious surfaces to create a tranquil retreat defined by comfort and understated elegance. Complementing this was the Bathware Zone — a sanctuary of calm showcasing precision-crafted porcelain surfaces that seamlessly blended purity of form with superior performance, redefining modern bathroom sophistication.

Extending beyond interiors, the Poolside Zone highlighted elegant outdoor settings framed by resilient, high-performance tiles, where aesthetic excellence met enduring strength in expressive interpretations of contemporary luxury. Featuring the latest Mosaic designs alongside the grand large-format tile series, Majestica, each zone illustrated how LANKATILES transforms raw materials into architectural poetry, reinforcing its leadership in innovation and design excellence.

Another defining feature of the Concept Studio was the AI-powered Tile Visualizer; an advanced digital interface designed to offer architects and homeowners an intelligent and immersive visualization experience that redefines the way interiors are selected and conceptualized. Within minutes, users can upload an image of their dream space and instantly explore precisely matched tile designs and colour palettes tailored to their aesthetic preferences.

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

News2 days ago

News2 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

Business4 days ago

Business4 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News1 day ago

News1 day agoWife raises alarm over Sallay’s detention under PTA