Business

CSE trading halted due to circuit-breaker in the wake of massive selling pressure

CSE trading was halted yesterday after a sensitive index dropped 5.30-pct 20 minutes after resuming its trading activities following massive selling pressure. This was also mainly due to US President Donald Trump’s tariff increase on imports entering the US market.

The market halted or witnessed a circuit- breaker due to the S&P SL20 index dropping over 5 percent from the previous close. This practice was in accordance with SEC Directive dated April 30, 2020,market analysts said.

Further, Asian markets were sharply down as the impact from Trump tariffs continued to shake investors, with Shanghai’s SSE Composite Index down 8.98 percent, Taiwan’s TAIEX down 9.70 percent, and Singapore’s Straits Times Index down 8.1 percent, reports showed.

“Accordingly, the market had been halted for 16 minutes (from 9.51 a.m to 10.07 a.m) and the CSE will conduct an Auction Session for a duration of 14 minutes (from 10.07a.m to 10.21 a.m). Thereafter, the Regular Trading session was commence at 10.21 a.m., the CSE said.

The more liquid S&P SL20 which tracks the larger companies opened down 264 points, while the All Share Price Index down by 698 points. Turnover stood at Rs 6.74 billion with four crossings. Those crossings were reported in DIMO, which crossed 903,000 shares to the tune of Rs 948 million and its shares traded at Rs 1050, JKH 9.9 million shares crossed for Rs 191 million; its shares traded at Rs 18.8, TJ Lanka 1 million shares crossed for Rs 44 million; its shares traded at Rs 44 and Access Engineering 1 million shares crossed for Rs 37 million; its shares traded at Rs 37.

In the retail market top six companies that mainly contributed to the turnover were; JKH Rs 737 million (39.3 million shares traded), Sampath Bank Rs 625 million (6.1 million shares traded), HNB Rs 605 million (2.2 million shares traded), Commercial Bank Rs 529 million (4.2 million shares traded), Digital Mobility Solutions Rs 230 million (3.2 million shares traded) and Browns Investments Rs 173 million (25 million shares traded). During the day 188 million share volumes changed hands in 35000 transactions.

Top negative contributors to the ASPI were Commercial Bank (down 8.58 percent at Rs 122.50), HNB (down 7.96 percent at Rs 269.00), Sampath Bank (down 5.9 percent at Rs 102.75), Melstacorp (ended 5.7 percent lower at Rs 120.25), and JKH (down 4.6 percent at Rs 18.70 ).

It is said that the manufacturing and banking sectors were the main contributors to the turnover. JKH was the top individual contributor to the turnover, which represents the manufacturing sector, while the banking sector was headed by Sampath Bank, followed by HNB and Commercial Bank.

Yesterday, the rupee opened at Rs 296.90/297.10 to the US dollar in the spot market , weaker from Rs 296.65/75 last Friday, dealers said, while bond yields were up.

A bond maturing on 15.02.2028 was quoted at 10.15/20 percent. A bond maturing on 15.12.2027 was quoted at 10.05/10 percent. A bond maturing on 15.12.2028 was quoted at 10.45/48 percent. A bond maturing on 15.09.2029 was quoted at 10.60/70 percent, up from 10.55/65 percent.

By Hiran H.Senewiratne

Business

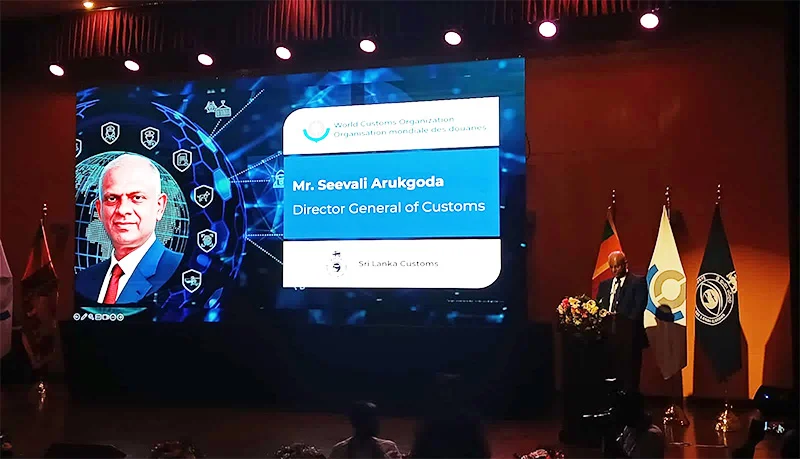

Customs posts record Rs. 2.26 tn revenue, accelerates digital overhaul

Sri Lanka Customs delivered its strongest performance in institutional history in 2025, exceeding national revenue targets while fast-tracking deep structural reforms to protect revenue, secure borders and lower trade friction, Customs Director General Seevali Arukgoda said at the International Customs Day celebrations 2026 in Colombo.

Addressing officials, diplomats and private-sector stakeholders under the global theme “Customs Protecting Society through Vigilance and Commitment,” Arukgoda said Customs collected Rs. 2,257 billion, surpassing the Rs. 2,231 billion target, and demonstrating the Department’s expanding role as both a revenue authority and trade facilitator.

“This is not a one-off outcome. It is the result of sustained reforms, disciplined enforcement and a clear strategic focus on protecting revenue while facilitating legitimate trade,” Arukgoda said.

While motor vehicles remained the single largest contributor, general cargo revenue rose 18 percent, signalling improved compliance and higher trade throughput. Enforcement-driven revenue reached Rs. 32 billion, up 10 percent year-on-year, underscoring the growing impact of intelligence-led controls.

“Every rupee secured through enforcement represents revenue protected for the State and confidence restored in the system,” the Director General said.

Beyond revenue, Arukgoda stressed Customs’ frontline role in protecting society, citing interdictions of narcotics, gold, foreign currency, substandard imports and illegal wildlife movements, coupled with firm penalties on non-compliant traders.

A major institutional breakthrough was the data-sharing MoU signed this month with the Inland Revenue Department, enabling parallel audits and coordinated investigations.

“Undervaluation and overvaluation will no longer be low-risk options. This integration closes a long-standing gap in revenue protection,” Arukgoda said.

On trade facilitation, he said Customs has moved decisively toward digital, rules-based clearance, expanding the Authorized Economic Operator (AEO) programme to MSMEs and rolling out platforms such as ‘Track My CusDec’ and Motor Vehicle Verification.

Advance Rulings have also been expanded to cover classification, valuation and rules of origin, fully aligning Sri Lanka with WTO Trade Facilitation Agreement obligations.

Looking ahead, Arukgoda said Sri Lanka Customs has been assigned a Rs. 2,207 billion revenue target for 2026, which the Department is confident of delivering amid continued reform momentum.

He added:”Our priority for 2026 is total digitalisation of remaining manual processes. This is about speed, transparency and eliminating discretion where it does not belong.”

Among the flagship projects is a state-of-the-art cargo examination yard at Kerawalapitiya, scheduled for completion by 2027, expected to reduce physical examinations from 40 percent to 10 percent, easing congestion and supporting higher trade volumes.

Other 2026 initiatives include Pre-Arrival Clearance, fully paperless cargo processing, an Automated Risk Management System, an Electronic Cargo Tracking System, and an electronic auction platform for goods disposal.

Customs will also expand AEO status to SMEs, freight forwarders and Customs House Agents, reducing compliance costs for trusted operators.

Arukgoda also announced the release of Time Release Study 2025, conducted in line with World Customs Organization guidelines, providing data-driven insights to remove bottlenecks across the clearance chain.

In a major governance reform, Sri Lanka Customs will issue a Code of Ethics and Conduct this week, developed with technical assistance from the IMF, WCO, World Bank, UNDP, Presidential Secretariat and CIABOC, and cleared by the Attorney General.

“Integrity is not optional. This Code institutionalises accountability and sets clear standards for every officer,” Arukgoda said.

The event was attended by Minister of Labour and Deputy Minister of Finance Dr. Anil Jayantha Fernando, Deputy Minister of Economic Development Nishantha Jayaweera, senior government officials, diplomats, development partners and retired senior Customs officers.

By Ifham Nizam

Business

Port City Colombo’s first residential project breaks ground

Sri Lanka’s most ambitious urban development project reached a critical execution milestone, as construction officially commenced on the first residential development within Port City Colombo. The milestone marks the transition of the country’s flagship Special Economic Zone (SEZ) from regulatory readiness to active private-sector delivery.

The project, Bay One Residences Colombo, is being developed by ICC Port City (Private) Limited, an entity established by International Construction Consortium (Private) Ltd. (ICC), one of Sri Lanka’s most established and experienced construction companies with a long track record of delivering complex, large-scale developments to international standards. The development represents one of the earliest major Sri Lankan private-sector residential investments within Port City Colombo and plays a foundational role in activating the city’s mixed-use urban ecosystem.

“Developed on 269 hectares of reclaimed land, Port City Colombo is now transitioning into a modern urban destination, with its first phase of infrastructure successfully completed. At the forefront of this evolution, Bay One Residences presents a rare first-mover opportunity, thoughtfully designed to enable residents to live, work, and unwind in a truly integrated environment, and backed by ICC’s 45 years of trusted expertise in delivering landmark, large-scale developments,” said Namal Peiris, Managing Director/Chief Executive Officer, International Construction Consortium (Pvt) Ltd.

Situated on a 13,945 square metre prime waterfront plot, Bay One Residences Colombo represents a total investment of approximately US$112 million, inclusive of land and development costs. The development will comprise 231 luxury apartment units, designed to international standards and targeted at both local and international buyers seeking premium urban living within a globally benchmarked city environment.

The commencement of the first residential development also marks an important step in the broader evolution of Port City Colombo, which has been purpose-built as a multi-services SEZ with a transparent, rules-based regulatory framework, world-class infrastructure, and a long-term vision to position Sri Lanka as a competitive destination for global capital, talent, and services. (Port City Colombo)

Business

Vibrant public participation in Jaffna International Trade Fair 2026

The Jaffna International Trade Fair (JITF) concluded successfully on January 25, marking its 16th consecutive year at the Muttraweli Grounds, Jaffna. Organised by Lanka Exhibition and Conference Services (LECS) in association with the Chamber of Commerce and Industries of Yarlpanam (CCIY), JITF once again reinforced its position as Northern Sri Lanka’s most influential multi-trade exhibition.

The three-day event attracted over 75,000 visitors, including business leaders, importers, exporters, SMEs, investors, financial institutions, technical professionals, and development agencies. With strong national visibility and extensive promotional outreach, JITF continues to serve as a vital platform for trade, investment, and economic integration in the Northern Province.

This year’s exhibition featured a diverse range of sectors, showcasing innovative products, services, and business opportunities, while facilitating meaningful networking and B2B engagement. Exhibitors reported strong visitor engagement and positive business prospects, reflecting growing confidence in the region’s economic potential.

JITF 2026 once again demonstrated its role as a catalyst for long-term development, fostering partnerships and opening new pathways for sustainable growth in Northern Sri Lanka.

-

Business2 days ago

Business2 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business3 days ago

Business3 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion6 days ago

Opinion6 days agoRemembering Cedric, who helped neutralise LTTE terrorism

-

Business6 days ago

Business6 days agoCORALL Conservation Trust Fund – a historic first for SL

-

Opinion3 days ago

Opinion3 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Opinion5 days ago

Opinion5 days agoA puppet show?

-

Opinion2 days ago

Opinion2 days agoLuck knocks at your door every day

-

Features5 days ago

Features5 days ago‘Building Blocks’ of early childhood education: Some reflections