Business

CSE and USAID’s SME forum draws considerable interest

“USAID is working with MSMEs to improve their ability to attract private capital. Through enrollment in the MSME Funding Readiness Program, businesses can unlock fresh pathways for growth, capitalize on capital market opportunities, and contribute to the nation’s economic prosperity.” – Mark Peters- Economic Growth Advisor, USAID.

“A listing will not only strengthen your company’s capital and corporate image, but it will also have a significant impact on the company’s growth prospects.” – Rajeeva Bandaranaike, CSE CEO

“Fundraising through the CSE is a feasible option for SMEs to raise funding while maintaining control, enhancing the image and visibility of the SME, as well as creating a platform for future funding and growth.” – Ms. Amani Ranaweera, Acuity Partners (PVT) Ltd.

“Sacrificing cash flows as interest payments to lenders will hamper this opportunity for SMEs; hence, listing on the Colombo Stock Exchange is a great pathway to access equity capital, strengthen the capital structure, and thereby successfully face challenges in the business environment.” – Rohan Senewiratne, Atarah Capital (Pvt) Limited

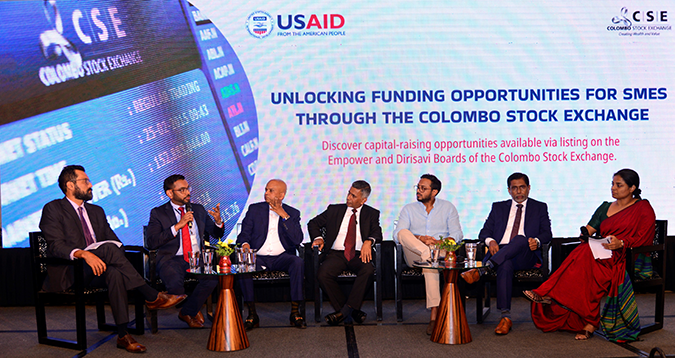

The Colombo Stock Exchange (CSE) conducted an Issuer Relations Forum titled “Unlocking funding opportunities for SMEs through the Colombo Stock Exchange”, in association with the U.S. Agency for International Development (USAID) in Sri Lanka on 15th August 2023 at the Mövenpick Hotel Colombo.

The forum provided insights for small- and medium-sized enterprises in key sectors, such as Agribusiness and Information, Communication & Technology (ICT), to discover capital-raising opportunities available at the CSE via listing on the Empower and Dirisavi Boards of the Exchange.

The forum was attended by the USAID Economic Growth Advisor, Mark Peters, USAID CATALYZE PSD Activity Team Lead Juan Forero, CSE Chief Executive Officer (CEO) Rajeeva Bandaranaike, Chief Regulatory Officer (CRO) Renuke Wijayawardhane, Senior Vice President, Commercial Ms. Punyamali Saparamadu, Atarah Capital (Pvt) Limited Managing Director Rohan Senewiratne, Acuity Partners (Pvt) Ltd Senior Vice President – Corporate Finance, Ms. Amani Ranaweera and representatives from investment banks, SMEs interested in raising capital, USAID, and CSE.

Delivering the opening remarks, USAID Economic Growth Advisor, Mark Peters, said “Sri Lanka’s sustainable development and recovery hinge on bolstering capital markets while creating additional funding avenues for SMEs across the nation. USAID is working with MSMEs to improve their ability to attract private capital. Through enrollment in the MSME Funding Readiness Programme, businesses can unlock fresh pathways for growth, capitalise on capital market opportunities, and contribute to the nation’s economic prosperity.”

Through the USAID CATALYZE Private Sector Development (PSD) Activity, USAID Sri Lanka boosts private capital in vital Sri Lankan sectors. Such programs support the private sector in fostering inclusive economic growth and facilitating affordable financing access.

CSE CEO Rajeeva Bandaranaike, in his remarks, stated, “We are pleased to have received a positive response for this initiative today. Over the years we have seen numerous companies listing on the Colombo Stock Exchange, with both the company and its shareholders benefitting in the process.”

“We have witnessed a dynamic growth in the capital market of Sri Lanka. The Government’s recent Domestic Debt Optimization (DDO) process also had a positive impact on the CSE. We are actively looking at new products to be introduced to the market,” Bandaranaike added.

Encouraging the participants to list on the CSE, he further said, “A listing will not only strengthen your company’s capital and corporate image, but it will have a significant impact on the company’s growth prospects. Therefore, we encourage companies to make use of this opportunity.”

Addressing the gathering, Acuity Partners (PVT) Ltd Senior Vice President – Corporate Finance, Ms. Amani Ranaweera said “We are seeing tangible signs of an economic revival. After several challenging years, now is the time for SMEs to put the appropriate framework and processes in place to take advantage of capital raising opportunities.”

“Fund raising through the CSE is a feasible option for SMEs to raise funding while maintaining control, enhancing the image and visibility of the SME as well as creating a platform for future funding and growth. With USAID’s CATALYZE project gaining access to funding is now more affordable to SMEs,” she added.

Speaking at the forum, under the subject of “Listing on the CSE as a Game Changer”, Mr. Rohan Senewiratne, Managing Director of Atarah Capital (Pvt) Limited stated “SMEs comprise more than 75% of enterprises, account for more than 20% of Sri Lankan exports, 45% of employment and 52% of the GDP.”

“SMEs can play a vital role in the economic recovery of Sri Lanka if they are able to gain access to raise equity capital. Sacrificing cash flows as interest payments to lenders will hamper this opportunity for SMEs hence listing in the Colombo Stock Exchange is a great pathway to access equity capital, strengthen the capital structure and thereby successfully face challenges in the business environment,” Mr. Senewiratne added.

Business

Newly appointed ADB Country Director to Sri Lanka and delegation meet PM

The newly appointed Country Director of the Asian Development Bank for Sri Lanka Ms Shannon Cowlin and the accompanying delegation met with Prime Minister Dr. Harini Amarasuriya on Tuesday [0th of February] at the Prime Minister’s office.

Welcoming the delegation, the Prime Minister extended congratulations to the newly appointed Country Director and acknowledged the long-standing partnership with the Asian Development Bank. The Prime Minister also expressed appreciation for ADB Bank’s continued engagement and support aligned with Sri Lanka’s national development priorities.

The Prime Minister also conveyed gratitude for the timely assistance extended by the ADB in response to Cyclone Ditwah, noting the importance of such support in mitigating the immediate impacts of natural disasters.

The ADB delegation reiterated its readiness to further assist Sri Lanka during the post-cyclone recovery phase, including rebuilding and reconstruction efforts, and emphasized its commitment to the supporting the education sector.

The meeting was attended by OIC / Deputy Director General, SARD Ms. Sona Shrestha, Ms. Cholpon Mambetova Country Operations Head of ADB Sri Lanka Mission Resident, Additional Secretary to the Prime Minister Ms. Sagarika Bogahawatta, Director General of the External Resource Department, Ministry of Finance Samantha Bandara, Director for ADB Division in External Resource Department, Ministry of Finance Ranjith Gurusinghe.

[Prime Minister’s Media Division]

Business

‘Bad Bank,’ Big Stakes: Sri Lanka’s Rs. 300bn gamble on growth

Sri Lanka’s small and medium enterprise (SME) sector—responsible for 52 percent of GDP and employing nearly half the national workforce—has become the next decisive test of the country’s fragile economic recovery.

A proposal to establish a Rs. 300 billion “Bad Bank” to absorb distressed SME loans now places policymakers at a crossroads: act boldly to revive credit and growth, or risk entrenching stagnation in the real economy.

The Sri Lanka Chamber of Small and Medium Industries (SLCSMI) on Tuesday told journalists that they had unveiled a detailed blueprint aimed at restructuring an estimated Rs. 460 billion in non-performing loans (NPLs), much of it concentrated among SMEs battered by successive shocks—from the Easter Sunday attacks and the pandemic to sovereign default and climate-related disruptions such as Cyclone Ditwah.

While headline indicators suggest macroeconomic stabilisation, including lower inflation, improved reserves and a profitable banking sector, credit transmission to smaller enterprises remains severely constrained, Chambers think tank pointed out.

“This is not about rewarding defaulters,” said SLCSMI President Prof. Rohan De Silva. “It is about protecting the productive backbone of the economy. If SMEs collapse, the consequences will extend far beyond individual balance sheets.”

Despite strong liquidity and a return to profitability in the banking system, thousands of SMEs remain blacklisted at the Credit Information Bureau (CRIB), unable to access fresh working capital.

The Chamber argues that unless distressed assets are separated from viable enterprises, banks will remain structurally risk-averse, prolonging the paralysis in private sector credit growth.

The proposed “Bad Bank” would function as a specialised rehabilitation vehicle, purchasing or warehousing toxic SME loans and granting viable firms a five-to-ten-year restructuring window, shielded from parate execution, to rebuild cash flows. Senior Vice President Colvin Fernando described the initiative as an economic circuit-breaker rather than a bailout. “These are not failed enterprises,” Fernando said.

He added:”They are businesses hit by extraordinary external shocks. Unless we ring-fence these distressed loans, credit transmission will remain paralysed.”

The concept draws on international precedents where asset management companies were deployed after systemic crises. Yet such mechanisms succeed only when governed by strict asset valuation discipline, professional management and insulation from political interference. Without these safeguards, they risk becoming vehicles for concealed subsidies or fiscal leakage.

The most contentious element of the Chamber’s proposal lies in its funding model. It calls for a hybrid structure combining low-cost international financing, a levy on commercial bank profits and the utilisation of unutilised balances from the Employees’ Provident Fund (EPF) and Employees’ Trust Fund (ETF).

Prof. De Silva argues that the banking sector, having restored profitability partly through elevated interest margins during the crisis years, has both the capacity and systemic responsibility to contribute. “The banking system has returned to strong profitability,” he said. “A structured contribution toward SME rehabilitation is not punitive—it is an investment in systemic stability.”

The suggested mobilisation of pension fund balances, however, is likely to provoke scrutiny over governance and fiduciary safeguards, while a levy on bank profits may raise investor sensitivity in a sector that has only recently regained confidence.

Fernando acknowledged the risks, emphasising that transparency and strict eligibility criteria would be essential. “This must be professionally managed, transparent and focused strictly on viable enterprises. Without discipline and accountability, the entire purpose would be defeated,” he cautioned.

Adding urgency to the debate is the Government’s decision to lower the VAT registration threshold to Rs. 36 million annually from April 1, 2026, drawing more small firms into the tax net. The Chamber warns that tightening tax compliance while credit remains restricted could create a double squeeze. “You cannot increase tax burdens and restrict financing simultaneously without economic consequences,” Prof. De Silva observed, describing the timing as highly sensitive.

Immediate Past President Mohideen Cader underscored the scale of the stakes. With SMEs contributing 52 percent to GDP and already under severe strain, he warned that inaction would result in irreversible economic scarring.

The macroeconomic logic is clear: without restoring SME balance sheets, private investment and employment growth are unlikely to regain momentum. Yet the countervailing risk is equally apparent. A poorly designed vehicle could create moral hazard, transfer private losses onto public shoulders and introduce new contingent liabilities into an economy still emerging from sovereign default.

Sri Lanka’s IMF-backed reform programme has so far focused on fiscal consolidation and debt sustainability. The SME “Bad Bank” proposal introduces a more complex phase in the recovery narrative—one that shifts attention from stabilisation to growth. The question confronting policymakers is whether the economy can sustain recovery without unclogging the credit arteries that feed its most labour-intensive sector.

The Rs. 300 billion proposal is, in essence, a calculated gamble that repairing SME balance sheets will unlock lending, revive investment and restore economic momentum. If executed with rigour, transparency and independence, it could serve as a bridge from crisis management to expansion. If mishandled, it risks deepening vulnerabilities in a system that has only recently regained its footing. For an economy seeking to move beyond stabilisation, the stakes could hardly be higher.

By Ifham Nizam

Business

The all-new Nissan Almera has arrived

Associated Motorways (Private) Limited (AMW), a stalwart of Sri Lanka’s automotive industry, officially unveiled the all-new Nissan Almera on February 7th, 2026. The launch, held at the Nissan Showroom in Union Place, signaled a bold step forward in providing ‘market-relevant mobility solutions’ to a dicerning local audience.

Addressing the gathering, Jawahar Ganesh, Group Managing Director of AMW, highlighted the strategic engineering behind the new model.

“The all-new Nissan Almera has been thoughtfully engineered to deliver what today’s Sri Lankan customer truly values: efficiency, safety, comfort, and intelligent design,” Ganesh stated.

He further emphasised that AMW’s leadership, backed by the global expertise of the Al-Futtaim Group, remains committed to bringing world-class standards to the local market.

Echoing this sentiment, Atul Aggarwal, Director Aftersales and South Asia Business Unit for Nissan Motor Corporation, noted that the Almera is designed to offer the ‘Nissan Peace of Mind.’ He expressed confidence that the sedan would replicate the massive market success recently seen by the Nissan Magnite.

The Almera is powered by the unique HRA0 1.0-litre Turbo engine, producing 100 hp and 152 Nm of torque. This ‘flat torque’ setup ensures responsive acceleration for city driving and confident overtaking on highways. To bolster fuel economy, it features an Idling Stop system.

Inside, the cabin prioritises the “human element” with:

Quole Modure Seats: Innovative materials that reflect heat, keeping the cabin cool in the tropical sun.

Zero Gravity Seats: Ergonomically designed to reduce fatigue during long commutes.

360-degree Safety Shield: A comprehensive suite including an Around View Monitor, Blind Spot Warning, and Lane Departure Warning.

With immediate stock availability and flexible financing via AMW Capital Leasing, the Almera is positioned as the premier choice for professionals and families seeking a smart, refined, and safe driving experience.

Although AMW did not announce pricing at the event, sources told The Island Financial Review that the new sedan will retail in the LKR 12.5–13 million range. Early birds are in for a win, too, with an encouraging discount reserved for the first 100 buyers.

Notably, the event was a departure from typically lengthy automotive launches, the Almera ceremony was a masterclass in simplicity. The entire event concluded in just twenty minutes – comprising a 15-minute preamble and speeches, followed by a five-minute ceremonial reveal as the Almera glided into the auditorium.

Participants described the event as ‘short and sweet,’ a sentiment that aligned perfectly with the ‘C-word’ emphasised by Jawahar Ganesh, Group Managing Director of AMW about the Nissan brand: Credibility.

By Sanath Nanayakkare

-

Features5 days ago

Features5 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business6 days ago

Business6 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business5 days ago

Business5 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business5 days ago

Business5 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business5 days ago

Business5 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business2 days ago

Business2 days agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Business6 days ago

Business6 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Midweek Review2 days ago

Midweek Review2 days agoA question of national pride