Business

Creating a culture of creativity: Importance of Intellectual Property Rights

By Dilani Hirimuthugodage

On the 26th of April each year, Intellectual Property (IP) Day is celebrated to draw public attention to the importance of IP rights in fostering creativity and innovation.

It is said that oil was the primary fuel of the 20th century economy while creativity is the fuel of the 21st century. Creative industries encompass a broad range of activities such as arts, craft, music, design and media which have their origin in individual creativity, skill and talent, and have a potential for wealth and job creation through the generation and exploitation of intellectual property. Creative industries are vital to many economies, accounting for 7% of the world’s GDP and growing at an annual rate of 8.7% according to the latest available data.

The World Intellectual Property Rights Organization (WIPO) marks IP Day under specific themes, and this year, it focuses on creativity in Small and Medium Enterprises (SMEs) in bringing novel ideas to the market. Intellectual Property Rights (IPRs) including copyrights, trademarks, Geographical Indications (GI), patents, and sui generis systems are important in protecting and fostering creativity. This blog highlights the importance of IPRs for Sri Lanka’s creative industries and offers strategies to build stronger, more competitive and resilient businesses.

Creative Industries in Sri Lanka

Sri Lanka’s creative sector can be broadly divided into three categories: arts and culture, design, and media. A study by the Institute of Policy Studies of Sri Lanka (IPS) commissioned by the British Council, Sri Lanka identified 16 subsectors as creative industries:

Sri Lanka’s creative sector can be broadly divided into three categories: arts and culture, design, and media. A study by the Institute of Policy Studies of Sri Lanka (IPS) commissioned by the British Council, Sri Lanka identified 16 subsectors as creative industries:

According to the available data, Sri Lanka’s creative industry has shown a growth of 95% between 2010 to 2014, rising from USD 433.6 million to USD 845.4 million. An approximate estimate of the GDP share of creative goods and services exports in 2014 was nearly 1.1%. The IPS survey, which sought to capture the current size and scale of the creative industry sector in Sri Lanka, found that only 4.6% of respondents were export-oriented and the balance produced for local consumption. Thus, the 1.1% GDP share is an underestimate, as it only accounts for the exports of creative goods and services.

The IPS survey also found that the number of employees in the sector make-up approximately 3% of the country’s total labour force. Approximately 36% of creative workers are female and 67% of workers in the sector are between the ages of 24 and 55 years, while 71% of workers are in the private sector and the rest is in government and semi-government sectors. Self-employment is high in this sector, with 40% of the workforce identifying themselves as ‘self-employed’. As is the case globally, in Sri Lanka too, the sector consisted mostly of SMEs and sole traders with only a few large businesses.

Most importantly, the creative industries depend on the talents of individuals and the generation of intellectual property. Thus, several IPRs are relevant to the sector. For example, copyrights for literature, music, visual arts, digital creative work, trademarks for advertising and branding, GI for location-specific creativities, and patents for gaming and digital designs. Therefore, IPRs play a major role in driving this sector. Further, IP enforcement is important to protect the creator and/or investors to provide them with incentives to invest and further develop the sector.

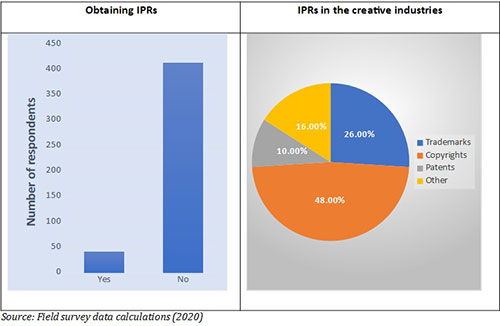

The awareness of IPRs among the survey respondents in the above-mentioned IPS study was poor. Only 8.8% had obtained any form of IP protection, out of which 48% had copyrights, 10% had patents, 26% had trademarks and 16% had others. Copyrights and trademarks were taken up in each sector whereas patents were only adopted in a few subsectors such as visual/performing arts, crafts, advertising, etc. (Figure 1).

IPRs are relevant to the creative industry as it relies on the use of intellectual production to create its goods and services. Following are a few suggestions to enhance the effective utilisation of IPRs for the development of the creative sector: Firstly, it is important to enhance knowledge on access to IPRs in the creative industry sector through awareness programmes at the grassroots levels especially in the craft, music, dance and design sectors. Industry professional associations should take the lead in this regard.

Secondly, many traditional creative industry sectors such as craft, performing arts, and visual arts are location-specific such as Ambalangoda masks, Dumbara mats, and Weweldeniya cane products. Thus, products can use GI to indicate that the goods have a special quality, character or reputation because they originate from a specific place. This will help to protect their rights, increase product value and better visibility. As such, the National Intellectual Property Office (NIPO) must speed up the process of identifying and obtaining GIs for selected sectors while also expanding links with WIPO to protect traditional creative industries.

Secondly, many traditional creative industry sectors such as craft, performing arts, and visual arts are location-specific such as Ambalangoda masks, Dumbara mats, and Weweldeniya cane products. Thus, products can use GI to indicate that the goods have a special quality, character or reputation because they originate from a specific place. This will help to protect their rights, increase product value and better visibility. As such, the National Intellectual Property Office (NIPO) must speed up the process of identifying and obtaining GIs for selected sectors while also expanding links with WIPO to protect traditional creative industries.

Thirdly, at the national level, it is important to adopt a sui generis (a unique system) legal framework for protecting traditional knowledge and cultural expressions, which are ultimately the foundation from which Sri Lanka creates its unique designs. Fourth, laws need to be updated as the existing legal framework does not cater to developments in modern technology. NIPO should also improve its efficiency and capacity to cater to modern creativities especially for IT and design sectors. Finally, Sri Lanka must modernise its IP system, incentivise grassroots innovation and promote homegrown creativity to fuel a culture of creativity.

This blog is based on an IPS study, commissioned by the British Council, Sri Lanka on Creative and Cultural Industries in Sri Lanka (2020).

Dilani Hirimuthugodage is a Research Economist working on Environment, Natural Resources and Agriculture Policy at IPS. Her research interests include agriculture economics, food security, intellectual property rights and innovations. She holds a Masters in Economics (with Distinction) from the University of Colombo. She is part-qualified in Charted Institute of Management (CIMA-UK). (Talk to Dilani: dilani@ips.lk)

Business

Dialog delivers strong growth, stronger national contribution in FY 2025

Dialog Axiata PLC announced, Friday 6th February 2026, its consolidated financial results (Reviewed) for the year ended 31st December 2025. Financial results included those of Dialog Axiata PLC (the “Company”) and of the Dialog Axiata Group (the “Group”).

Group Performance

The Group delivered a strong performance across Mobile, Fixed Line and Digital Pay Television businesses recording a positive Core Revenue growth of 16% Year to Date (“YTD”). Group Headline Revenue reached Rs179.6Bn, up 5% YTD, despite the continued strategic scaling down of low-margin international wholesale business. In Q4 2025, Revenue was recorded at Rs46.5Bn up 2% Quarter-on-Quarter (“QoQ”) and 2% Year-on-Year (“YoY”).

The Group Earnings Before Interest, Tax, Depreciation and Amortisation (“EBITDA”) reached Rs86.0Bn up 30% YTD supported by Core Revenue performance and Cost Rescaling Initiatives. On a QoQ basis Group EBITDA demonstrated a modest growth to record at Rs23.0Bn up 2% QoQ with an EBITDA margin of 49.5% in line with the Revenue performance. Group EBITDA margin reached 47.9% for FY 2025, up 9.2pp.

Group Net Profit After Tax (“NPAT”) reached Rs20.8Bn for FY 2025, up 67% YTD mainly resulting from robust EBITDA growth, despite higher tax and net finance costs. Normalized for forex impact, NPAT growth was recorded at +>100% YTD to reach Rs22.1Bn. On a QoQ basis NPAT grew 3% to reach Rs5.9Bn resulting from strong EBITDA performance.

On the back of strong operational performance, the Group recorded Operating Free Cash Flow (“OFCF”)

of Rs49.3Bn for FY 2025 up >100% YTD.

Dividend Payment to Shareholders

In line with the dividend policy and financial performance of the Group and taking into account the forward investment requirements to serve the nation’s demand for Broadband and Digital services, the Board of Directors of Dialog Axiata PLC at its meeting held on 6th February 2026, resolved to propose for consideration by the Shareholders of the Company, a dividend to ordinary shareholders amounting to Rs1.50 per share. The said dividend, if approved by shareholders, would translate to a Dividend Yield of 5.0% based on share closing price for FY 2025. The dividend so proposed will be considered for approval by the shareholders at the Annual General Meeting (AGM) of the Company, the date pertaining to which would be notified in due course.

Company and Subsidiary Performance

At an entity level, Dialog Axiata PLC (the “Company”) continued to be the primary contributor to Group Revenue (76%) and Group EBITDA (74%). Aided by sustained growth in the Data segment and cost-rescaling initiatives, Company revenue was recorded at Rs135.8Bn for FY 2025, up 18% YTD, EBITDA rose 32% YTD to reach Rs63.6Bn. On a QoQ basis, Q4 2025 Revenue was recorded at Rs34.8Bn, down 1% QoQ due to a reclassification of Hubbing Revenue, while EBITDA decline 1% QoQ to record Rs17.0Bn, largely attributable to network restoration costs and donations made in relation to the Cyclone Ditwah relief efforts. Furthermore, NPAT was recorded at Rs15.6Bn for FY 2025, up 41% YTD. Normalised for forex impacts, the company NPAT was up +>100% YTD to reach Rs17.0Bn. On a QoQ basis, Company NPAT was recorded at Rs4.5Bn, down 6% QoQ.

Business

Ceylinco Life’s Pranama Scholarships reach 25-year milestone

Ceylinco Life has announced the launch of the 25th consecutive edition of its flagship Pranama Scholarships programme, marking a significant milestone in the company’s long-standing commitment to recognising and rewarding excellence among the children of its policyholders.

Under the 2026 programme, the life insurance market leader will present scholarships with a total cumulative value of Rs. 22.7 million, continuing a rewards initiative that has now been conducted without interruption for a quarter of a century. Since its inception, the Ceylinco Life Pranama Scholarships programme has benefitted 3,466 students across the country, representing a total investment of Rs. 240 million in nurturing academic achievement and outstanding performance in sports, arts and other extracurricular pursuits.

Business

Sri Lankans’ artistic genius glowingly manifests at Kala Pola ‘26

The artistic genius of Sri Lankans was amply manifest all over again at ‘Kala Pola ‘26’ which was held on February 8th at Ananda Coomaraswamy Mawatha Colombo 7; the usual, teeming and colourful venue for this annual grand exhibition and celebration of the work of local visual artists.

If there is one thing that has flourished memorably and resplendently in Sri Lanka over the centuries it is the artistic capability or genius of its people. It is something that all Sri Lankans could feel a sense of elation over because from the viewpoint of the arts, Sri Lanka is second to no other nation. With regard to the visual arts a veritable dazzling radiance of this inborn and persisting capability is seen at the annual open air ‘Kala Pola’.

A bird of Sri Lanka created from scraps of iron waste.

All capable visual artists, wherever they hail from in Sri Lanka, enjoy the opportunity of exhibiting their work at the ‘Kala Pola’ and this is a distinctive ‘positive’ of this annual event that draws numberless artists and viewers. There was an abundance of paintings, sketches and sculptures, for instance, and one work was as good as the other. Ample and equal space was afforded each artist. Its widely participatory and open nature enables one to describe the exhibition as exuding a profoundly democratic ethos.

Accordingly, this time around at ‘Kala Pola ‘26’ too Sri Lankans’ creative efforts were there to be viewed, studied and enjoyed in the customary carnival atmosphere where connoisseurs, local and foreign, met in a sprit of camaraderie and good cheer. Many thanks are owed once again to the George Keyt Foundation for the presentation of the event in association with the John Keells Group and the John Keells Foundation, not forgetting the Nations Trust Bank, which was the event’s Official Banking Partner. The exhibition was officially declared open by Chief Guest Marc-Andre Franche, UN Resident Coordinator in Sri Lanka.

By Lynn Ockersz

-

Features3 days ago

Features3 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business4 days ago

Business4 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business3 days ago

Business3 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business3 days ago

Business3 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business3 days ago

Business3 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business4 days ago

Business4 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Business4 days ago

Business4 days agoGREAT 2025–2030: Sri Lanka’s Green ambition meets a grid reality check

-

Editorial6 days ago

Editorial6 days agoAll’s not well that ends well?