Business

Could the government motivate taxpayers?

Sri Lanka has been struggling with a number of economic complications pertaining to the country’s tax system. However, this characteristic of taxation has been challenging as it does not deliver the potential tax revenue while maintaining a satisfactory level of tax compliance. In recent years, this issue in taxation has been focused on with much debate among politicians, academic researchers, policymakers and practitioners. Yet, every government has been compelled to experience this challenge that is detrimental to the fiscal operation of the government, fairness of income distribution, efficiency, smooth economic stability and transparency.

It’s said that still there are only a few taxpayers registered in Sri Lanka, which is a minimum percentage of the entire population. This is actually a disaster. It indicates the government is now dealing only with a few individual taxpayers whilst imposing and increasing the tax rates to that very limited section. Someone could argue that the problem does not relate to the tax rates whereas it relates to tax administration. Of course, the government is supposed to rescrutinize the composition of the Inland Revenue Department (IRD) and whether they are capable of administering the tax files or whether they have enough resources to accommodate the requirements.

Normally people are reluctant to pay taxes. It’s an inherent limitation in any tax system. Especially with these adverse economic conditions in Sri Lanka, the power of purchasing has dramatically deteriorated. It also doesn’t provide a good sign or indication even for the active taxpayers.

How should the government raise the tax base? The answer for this will not be a popular decision for any government. However as per the provisions of the Inland Revenue Act No. 24 of 2017, every person who has a taxable income shall file a ‘return of income’. Nevertheless, a resident individual who only has income from employment that is subject to PAYE will not be required to file a return for that year of assessment (section 94(1)(a)(ii).

Here the tax law is talking about filling a return of income. Not about registering a person as a taxpayer. The government should focus on registering more people as taxpayers whilst giving them Taxpayer Identification (TIN) numbers the way people are given National Identity Card (NIC) numbers. That’s very important at this juncture where Sri Lanka is at a critical stage. Then only the Inland Revenue Department will be able to keep a track record of the taxpayers and follow them up for getting the expected tax revenue.

At the same time, as we know in the case of a person who is employed either in the private or public sector, it is compulsory for the employer to get their employees registered for the Employee Provident Fund (EPF) and Employee Trust Fund (ETF). As such, the new regulations can be introduced to make it mandatory to register the employees in IRD by granting them Taxpayer Identification Numbers. However, the government has taken a huge step and imposed the rule stating that ‘With effect from January 01, 2024, any individual who is at the age 18 years or more, or who attains the age of 18 years on or after January 01, 2024, it is mandatory to register with the Inland Revenue Department and obtain a TIN (Taxpayer Identification Number)’.

Then again, the government should simultaneously rethink developing the infrastructure for the IRD by providing them with adequate resources to cater to this additional requirement. Of course, Information Technology (IT) plays a major role at this stage. For example; the QR code system has recently been introduced by the government for delivering fuel supply throughout the country in an efficient way. That was indeed successful and many people have been benefited. If so, why cannot the government introduce the same mechanism to the country’s tax system?

During the economic recession if a vehicle was given a QR code then why cannot a person be given a QR code? Just think about it. Through a QR code, the IRD is able to check the tax history of the taxpayers, their assets or liability base, other income sources, tax payment patterns and default amounts, etc. This paves the way for curtailing the cost of printing the returns of income, tax payment slips and other corresponding letters by saving millions of rupees. That’s the next level where the government is supposed to extend its strategies to widen the government income through income tax.

Moreover, in July 2014, to revolutionize the tax culture in Sri Lanka, the Inland Revenue Department introduced a system called ‘RAMIS’ (Revenue Administration Management Information System) as their one-stop tax management platform by addressing the aforementioned facts up to a certain extent. But simultaneously IRD has been sending the printed returns of income and the printed payment slips to the taxpayers via post even though this system provides the same features to do so via online. That’s indeed a waste of government money.

At the inception a proper marketing strategy should have been launched for promoting the newly introduced system among the general public as to how they should get the maximum benefits when they make the tax payments or submit the return of income through this system. Unfortunately, it has been eight years since the induction of RAMIS but there are many people who still don’t know how to get access or operate this system.

Therefore, IRD should introduce continuous awareness programs/training to the general public as to how this system works and the benefits of using it. In fact, what’s the meaning of having a system which was supposed to be utilized by a large section of the people but is actually being utilized by a small number of persons? These problems should be immediately addressed by IRD to increase the tax revenue whilst letting the taxpayers avoid a maze of taxes, forms and filing requirements. A simple and transparent tax system helps taxpayers better understand the system and reduces the costs of compliance while letting them know who is being taxed, how much they are paying, what is being done with the money and who benefits from tax exemptions, deductions, and tax credits, etc.

Motivating taxpayers

The government should introduce strategies, schemes or motivational campaigns and certain monetary and non-monetary encouragements to the taxpayers. It’s obvious that people are making rational decisions when spending their own money such as doing a cost-benefit analysis. So that a person who is liable to pay tax may be thinking of the benefits that are being received in lieu of the tax payment. That’s obvious. The question is; has the government properly introduced such a mechanism or a system for it?

In April 2016, IRD introduced some annual privilege cards for the taxpayers based on the income tax paid in the immediately preceding year of assessment. As per the official website of IRD, ‘the individuals who paid income tax more than Rs. 500,000 and submitted the return on or before the due date are eligible for this scheme’. And it has mentioned certain benefits for having these privilege cards. But the problem here is; this section has not been updated for six years. It was last updated in 2016.

Another thing is; these mentioned benefits are mainly given through the banks. That’s not sufficient at all. The IRD should introduce more benefits for the taxpayers by expanding its relationships with other stakeholders such as food city chains, hospitals, educational institutions, etc. With these comprehensive strategies, IRD can attract more non-tax payers to the tax system and increase the tax base of the country.

Moreover, migration and brain drain are severe issues to any country. At the moment Sri Lanka has come to the top of this issue. Lots of professionals, academics and young generation are leaving Sri Lanka for their future betterment. The core reason behind their decision is this unbearable tax system. In Sri Lanka, most of the salaries are not on par with industry norms compared to the international level. Even from lowest salaries government takes proportionally a huge part. Then the purchasing power will drastically deteriorate. Will that motivate the tax payers?

Due to the recent WHT scandal lots of senior citizens have faced a huge inconvenience. Many of them are waiting in the queues expecting their turn to go in to the bank. Some of them do not have any literacy to fill the required forms and any awareness about these new regulations. Some people are not in a position to travel due to sickness and some are living in areas where banks are located far from the residence. As tax practitioners we have been experiencing these challenges faced by the innocent general public.

Has the Inland Revenue Department demonstrated any comprehensive video or conducted any awareness campaigns or official dialogues for educating people on these new regulations? At least any fruitful conversation on these tax matters in the television media? Is this how they motivate the tax payers? These burning issues must be addressed soon. If not, the repercussions will be unmeasurable.

By Indrajith Karunarathna ✍️

MBA (Sri J’), BSc. Business Administration (Special) Hons,

FCA, FCMA, FMAAT, FIPA (Australia), FFA (UK), ACCA (UK),

ACIM (UK), MCPM, ADCN

Business

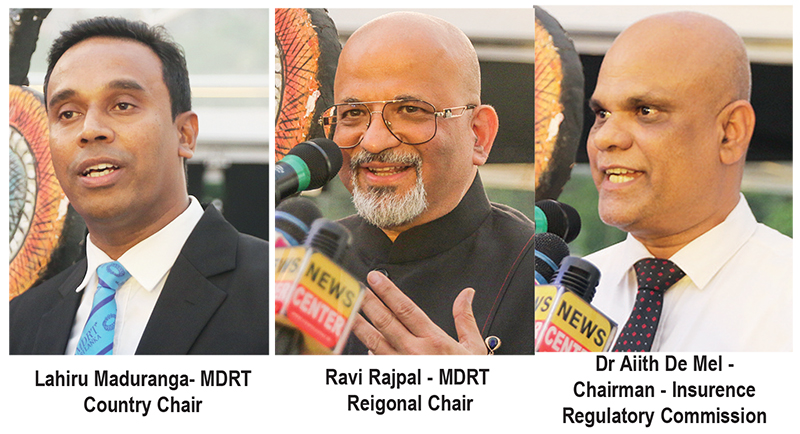

Global Insurance leaders to converge in Colombo for MDRT Sri Lanka Day 2026

In a first for Sri Lanka’s insurance industry, the country will host MDRT Sri Lanka Day 2026, also known as International Insurance Day, bringing together global leaders, professionals and organisations from the international financial services and insurance sectors.

The initiative, organised by the Million Dollar Round Table (MDRT), will mark Sri Lanka’s inaugural MDRT Day and is scheduled to be held on 18 May 2026.

MDRT Country Chair – Sri Lanka, Lahiru Maduranga, said the event would provide a significant opportunity to position Sri Lanka on the global insurance and financial services map.

“This is an excellent opportunity for Sri Lanka to host such a prestigious event and to promote the country’s standing globally,” Maduranga said.

He made these remarks at the official sundown launch announcing the event, held on 26 January at 8 Degrees on the Lake, Cinnamon Lakeside, Colombo.

The launch was attended by the Chairman and Director General of the Insurance Regulatory Commission of Sri Lanka, chief executive officers of insurance companies, and regional and zonal chairs of MDRT, at which the official date of MDRT Sri Lanka Day 2026 was unveiled.

Maduranga said the landmark event aims to bring the spirit and experience of the MDRT Annual Meeting to the Sri Lankan MDRT community. The programme will feature the MDRT President, Executive Committee members and internationally renowned speakers, offering world-class insights, inspiration and professional development aligned with MDRT values.

He noted that many Sri Lankan MDRT members face challenges in attending the Annual Meeting overseas due to foreign exchange constraints and visa limitations. Of more than 1,200 MDRT achievers in Sri Lanka, only around 50 were able to attend the Annual Meeting in the United States.

“This initiative marks a significant step forward in strengthening the MDRT culture in Sri Lanka and in elevating professional standards within the local insurance services sector,” Maduranga said.

The MDRT Membership Communication Committee (MCC) serves as the official liaison between MDRT Headquarters in the United States and the Sri Lankan MDRT community, overseeing communication, engagement and coordination with the local financial services sector.

Founded in 1927 in the United States, the Million Dollar Round Table (MDRT) is the world’s most prestigious association of insurance and financial services professionals. MDRT represents the highest standards of professional excellence, ethics and performance in the industry. Its Annual Meeting, traditionally held in the United States, attracts more than 10,000 top-performing members from around the world each year.

By Hiran H Senewiratne

Business

ESOFT UNI Kandy leads the charge in promoting rugby among private universities

With the aim of fostering a passion for rugby among students in private universities and higher education institutes across Sri Lanka, ESOFT UNI Kandy has launched a special sports development initiative.

As a part of this program, a series of rugby encounters were recently organized between the ESOFT UNI Kandy rugby team and the SLIIT Kandy Uni rugby team. The matches were held at the Peradeniya University Rugby Grounds.

Two highly competitive matches were played during the event. In the first game, the ESOFT UNI Kandy rugby team secured a victory over SLIIT Kandy Uni with a score of 17-07. They maintained their winning streak in the second match as well, defeating their opponents with a final score of 12-07.

This initiative is seen as a significant step toward building a robust sporting culture within the private higher education sector in the hill capital.

The initiation has been started with Rugby and will soon be extended to Cricket, Football, Martial Arts, Badminton, Hockey, Chess, and other areas of sports as well. ESU believes that the development of soft skills, parallel to higher education, will help shape highly capable, industry-ready, and employable students who can confidently face any personal and professional challenges they encounter during their journey.

Dimuthu Thammitage, General Manager, ESU Central Region said: Today’s job market demands highly employable individuals who possess not only educational qualifications but also strong soft skills, which can be effectively developed through sports. Therefore, we warmly invite other educational institutions to join hands with us in producing highly employable students together through sports.

Lakpriya Weerasinghe, Deputy General Manager, ESU Kandy said: At ESOFT Uni, we believe that sports play a vital role in improving students’ personalities through the development of essential soft skills. Therefore, we encourage our students to actively join our clubs and enhance their soft skills alongside their academic education.

Oshara Chamod Bandara, MIC Rugby Club, ESU Kandy said: Sports are iconic to Kandy. As the MIC of the ESU Kandy Rugby Team, I am truly happy to see the enthusiasm of our students towards sports while actively engaging in their studies. I warmly invite other students to join our clubs and further develop their skills alongside their academic journey.

Text and Pix By S.K. Samaranayake

Business

Altair issues over 100+ title deeds post ownership change

Altair Residences have, over the past six months, seen more than 100 individual title deeds being executed by apartment owners, providing owners with a clear, registered, legal title to their apartments in accordance with Sri Lankan property law. This has been a key initiative by the new owners and management of Altair to improve governance and will continue in an orderly manner in the coming months.

With the transition of ownership to Blackstone India, Altair’s Management Council has also been formally constituted, enabling owners to play an active and proactive role in the management of the Altair building. In addition, the management council has appointed Realty Management Services (RMS), a subsidiary of Overseas Realty Ceylon PLC, as the new facility manager of Altair.

Commenting on these milestones, Thilan Wijesinghe, Chairman of TWC Holdings, who, together with a team from TWC, represents Blackstone’s interests in Sri Lanka, said, “The issuance of individual title deeds is a critical step in any professionally developed residential asset. Over the past six months, this process at Altair has moved forward in a structured and transparent manner, alongside the formal establishment of owner-led governance. This, combined with the appointment of experienced facility managers are fundamental building block for long-term value-creation for apartment owners and proper asset stewardship.”

With ongoing improvements to the building being undertaken by Indocean Developers Pvt Ltd (IDPL), the owning company of Altair, the issuance of deeds to owners is expected to accelerate over the coming months.

-

Business7 days ago

Business7 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business4 days ago

Business4 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion3 days ago

Opinion3 days agoSri Lanka, the Stars,and statesmen

-

Business2 days ago

Business2 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Opinion7 days ago

Opinion7 days agoLuck knocks at your door every day

-

Business2 days ago

Business2 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business2 days ago

Business2 days agoArpico NextGen Mattress gains recognition for innovation

-

Business21 hours ago

Business21 hours agoAltair issues over 100+ title deeds post ownership change