Business

ComBank supports traditional rice producers in Kokkadichcholai

Farmers in Kokkadichcholai, Batticaloa, have received financial and technical support and equipment to facilitate their traditional trade of rice production, as the latest beneficiaries of Commercial Bank of Ceylon’s Dirishakthi Value Chain Development Programme.

The Bank embarked on this exercise to drive financial inclusion among smallholder farmers in this area in partnership with the Women’s Society in Kokkadichcholai. Its ultimate objective is to increase the production capacity in the area and enhance rural livelihoods. To support this mandate, the Bank also donated 30 paddy-boiling aluminum pans to selected farmers in the community. The livelihood of this community revolves around collecting paddy, preparing traditional rice and supplying local markets and individuals in the Batticaloa town.

The Commercial Bank Batticaloa branch along with the Bank’s Bank on Wheels – Eastern arm, the Bank’s corresponding Agriculture and Micro Finance Unit (AMFU) and the Development Credit Department (DCD) collaborated on this ‘Dirishakthi Value Chain Development Programme’ which culminated in a ceremony that was held in Kokkadichcholai, recently.

After donating the cooking utensils to the Women’s Society, Commercial Bank’s officials elaborated on the services offered by the Bank on Wheels operation and the Bank’s products and services available to the community.

Speaking at the ceremony, the President of the Women’s Society, Mrs P. Sakunthaladevi said: “Through the Bank on Wheels operation, Commercial Bank has been providing basic banking services such as account opening, cash deposits and withdrawals, micro loans, agri leases and other banking related services to our farmers on at least four days of the month. We are grateful to receive these services which have been instrumental in expanding our trade, enhancing productivity, and even improving our lifestyle. Of the 80 members in our Society, nearly 45 have obtained Dirishakthi loans from the Commercial Bank Batticaloa branch. This capital inflow boost has not only increased the income of these families but enhanced the livelihoods and quality of life of our community as a whole.”

The Women’s Society in Kokkadichcholai, soon to be registered as the ‘Padayanadavely Women’s Society,’ was established in 2019 with the support of Commercial Bank’s Bank on Wheels operation as a small association comprising 12 farmer members who were engaged in cultivation, traditional rice making, and animal husbandry.

A similar initiative conducted under the Bank’s Dirishakthi Value Chain Development Programme was the provision of assistance to the dairy value chain of the Mullaitivu Livestock Breeders Cooperative Society. This value chain consisting of farmers, milk collectors, producers, product transporters, and retailers to the end consumer were supported with banking services and access via the Bank on Wheels. Members of this community who had lost their assets including livestock during the conflict also had the opportunity to obtain loans to purchase cattle and develop cattle sheds.

The Bank also donated a set of cooler boxes to support a group of dairy farmers in Mulliyawalai. The coolers help preserve the freshness of the products and are essential in the safe transportation of dairy products. Following these measures, community members reported an increase in milk production and their income. They are now able to distribute milk to distant shops, while curd, ghee, milk toffee, and yoghurt produced from the milk is supplied to wholesale outlets in Kilinochchi and Vavuniya.

Commercial Bank’s Dirishakthi Value Chain Development Programme was launched to support micro entrepreneurs with a holistic intervention encompassing financing and empowerment activities that benefit not just individual borrowers but all participants in their value chains to drive success and growth from the grassroot level. Its In-Kind Grants initiative was introduced to support the identified value chains to improve their efficiency and sustainability while overcoming the challenges faced by rural value chains.

Under this programme the Bank identifies all participants in a value chain with the assistance of existing customers or Community Based Organisations (CBOs), provides financial services by reaching vulnerable players in the community such as women entrepreneurs and low-income individuals via coordinators of its Agriculture and Micro Finance Units who approach these members to provide personalised support. They identify obstacles which hinder the efficiency of the value chain and solve cash flow and capacity issues, provide fund transfer facilities to remit sales proceeds and to pay suppliers through the formal banking sector, and improve technical knowledge and entrepreneurship skills of value chain members with the objective of improving the quality of the products and services they offer.

Sri Lanka’s first 100% carbon neutral bank, the first Sri Lankan bank to be listed among the Top 1000 Banks of the World and the only Sri Lankan bank to be so listed for 11 years consecutively, Commercial Bank operates a network of 268 branches and 938 automated machines in Sri Lanka. Commercial Bank is the largest lender to Sri Lanka’s SME sector and is a leader in digital innovation in the country’s Banking sector. The Bank’s overseas operations encompass Bangladesh, where the Bank operates 19 outlets; Myanmar, where it has a Microfinance company in Nay Pyi Taw; and the Maldives, where the Bank has a fully-fledged Tier I Bank with a majority stake.

Business

JICA and JFTC support Sri Lanka’s drive for economic growth through a fair and competitive market

The Japan International Cooperation Agency (JICA) and the Japan Fair Trade Commission (JFTC) have expressed their support for policy reforms and institutional enhancements aimed at ensuring the supply of high-quality goods and services in Sri Lanka while safeguarding both consumers and producers.

This was discussed at a meeting held on Wednesday (12) at the Presidential Secretariat between representatives of these organisations and the Secretary to the President, Dr. Nandika Sanath Kumanayake.

During the discussion, the representatives emphasized that establishing fairness in trade would protect both consumers and producers while fostering a competitive market in the country. They also emphasized how Japan’s competitive trade policies contributed to its economic progress, explaining that such policies not only help to protect consumer rights but also stimulate innovation.

The secretary to the president noted that this year’s budget has placed special emphasis on the required policy adjustments to promote fair trade while elevating Sri Lanka’s market to a higher level. He also briefed the representatives on these planned reforms.

The meeting was attended by Senior Additional Secretary to the President, Russell Aponsu, JICA representatives Tetsuya Yamada, Arisa Inada, Yuri Horrita, and Namal Ralapanawa; and JFTC representatives Y. Sakuma, Y. Asahina, Y. Fukushima, and M. Takeuchi.

[PMD]

Business

World seen to be at crucial juncture as competition mounts for strategic resources

By Ifham Nizam

The intersection of climate change, energy security and global politics has never been more crucial, with geopolitical conflicts increasingly driven by competition over fossil fuels and critical minerals. Mayank Aggarwal, an energy and climate expert from The Reporters’ Collective, highlights this in his work, ‘Geopolitical Energy Chessboard’.

“Climate change and energy security are two of the most pressing global challenges, Aggarwal explains. “Urgent climate action is needed to mitigate its impact, but reducing fossil fuel use and transitioning to cleaner energy is a politically charged issue, he told The Island Financial Review.

His research highlights the complex web of energy politics, particularly in South Asia, where one in four people on earth reside. “South Asia is a major importer of fossil fuels and its energy security is critical. But the region also lacks a comprehensive dialogue framework to address climate and energy challenges collectively, he notes.

Aggarwal emphasizes that energy conflicts are not just national concerns but extend to the global stage. “From Libya and Iraq to Ukraine and Venezuela, conflicts over oil, gas, coal and critical minerals are shaping international relations. These disputes threaten economic stability and development goals worldwide.”

Despite the urgent need for a clean energy transition, political and economic interests delay global cooperation. “Countries are pulling out of climate agreements, favoring bilateral deals that often sideline developing nations. While global clean energy transition is essential, the geopolitical hurdles remain significant, Aggarwal warns.

He calls for a “Just Energy Transition” that ensures energy security and independence while engaging communities in decision-making. “We need regional cooperation, transparent negotiations for resource-rich areas and strong political will to drive climate and energy discussions at all levels, he concludes.

As the world grapples with escalating climate disasters and energy crises, Aggarwal’s insights highlight the urgent need for a balanced, just, and cooperative approach to energy politics.

Business

SEC Sri Lanka engages in interactive knowledge-sharing forum with University of Ruhuna

The Securities and Exchange Commission (SEC) of Sri Lanka recently participated in the Capital Market Forum 2025, organized by the Department of Accountancy and the Department of Finance of the Faculty of Management and Finance at the University of Ruhuna, in collaboration with the Colombo Stock Exchange (CSE). This interactive knowledge-sharing forum aims to enhance financial literacy and promote capital market participation among undergraduates and academics.

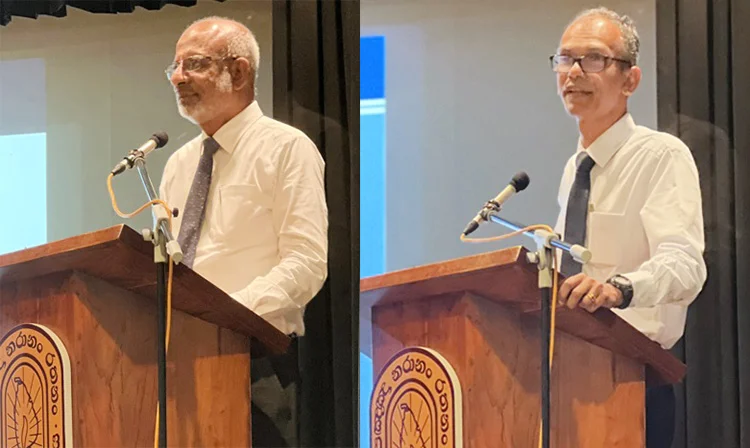

A key highlight of the forum was the workshop on “Nurturing Future Investors: The Role of Capital Markets in Personal and Economic Growth,” which featured distinguished speakers, including Senior Professor Hareendra Dissabandara, Chairman of the SEC, and Tushara Jayaratne, Deputy Director General of the SEC.

Senior Professor Hareendra Dissabandara delivered a compelling lecture on the crucial role of capital markets in fostering economic development. He emphasized how capital markets facilitate efficient capital allocation and contribute to long-term economic stability. A key focus of his discussion was the significance of capital formation as a sustainable alternative to debt financing for government projects. He illustrated this by comparing the market capitalization of a leading Sri Lankan company with the costs of several major government initiatives.

Professor Dissabandara highlighted the historical reliance on borrowing for infrastructure development in Sri Lanka, leading to fiscal imbalances, high-interest burdens, and economic vulnerabilities. He underscored the importance of equity financing in business sustainability, emphasizing that an efficient financial market channels surplus funds from households, institutions, and foreign investors into businesses and government projects. He explained that for over 70 years, successive governments have relied on borrowing to fund infrastructure and development, causing fiscal imbalances, rising interest burdens, high taxation, and economic vulnerabilities. He also noted that corporate professionals often overlook the importance of equity financing for sustainable growth.

-

News6 days ago

News6 days agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

Features7 days ago

Features7 days agoShyam Selvadurai and his exploration of Yasodhara’s story

-

Editorial5 days ago

Editorial5 days agoRanil roasted in London

-

Latest News5 days ago

Latest News5 days agoS. Thomas’ beat Royal by five wickets in the 146th Battle of the Blues

-

News6 days ago

News6 days agoTeachers’ union calls for action against late-night WhatsApp homework

-

Editorial7 days ago

Editorial7 days agoHeroes and villains

-

Features5 days ago

Features5 days agoThe JVP insurrection of 1971 as I saw it as GA Ampara

-

Opinion4 days ago

Opinion4 days agoInsulting SL armed forces