Business

ComBank Group navigates devaluation impact in complex Q1 performance

The Commercial Bank Group has posted a balanced financial performance for the first quarter of 2022, highly influenced by the sharp devaluation of the Rupee impacting key performance indicators both positively and negatively.The Group, comprising of the Commercial Bank of Ceylon PLC, its subsidiaries and an associate, reported gross income of Rs 54.573 billion, total operating income of Rs 34.244 billion and net operating income of Rs 28.284 billion for the three months ended 31st March 2022, recording improvements of 33.41%, 41.74% and 66.33% respectively.YOY growth in the loan book coupled with the positive impact of the unprecedented deprecation of the Rupee witnessed in March 2022 on interest income from the foreign currency denominated assets portfolio saw interest income for the three months increasing by 19.41% to Rs 37.847 billion. Interest expenses too increased by 17.30% to Rs 19.024 billion due to the YOY growth in the deposit portfolio as well as a substantial increase in interest expenses booked on deposits and borrowings denominated in foreign currency owing to the sharp depreciation of Rupee. As a result, the Group posted net interest income of Rs 18.823 billion for the quarter, an improvement of 21.62%.

Commenting on the quarter reviewed, Commercial Bank Chairman Prof. Ananda Jayawardane said: “These are extraordinary times for business in Sri Lanka and for banks in particular. It takes a great deal of exceptional financial acumen and maturity to navigate the mercurial challenges that prevail. Our results for the first quarter reflect the depth of the managerial skills at the disposal of the Bank.”The Bank’s newly-appointed Managing Director and CEO Sanath Manatunge said: “The unprecedented depreciation of the Rupee impacts income and profits as well as key balance sheet indicators. This can have a distortionary effect on performance. We have nevertheless posted solid results and are constantly taking swift actions and necessary measures to minimise the negative impacts of the rapid changes taking place in external factors.”

According to interim financial statements filed with the Colombo Stock Exchange (CSE), the Group’s other operating income more than doubled to Rs 11.333 billion in the three months reviewed while net fee and commission income improved by 35.21% to Rs 4.088 billion, and combined with net interest income, contributed to the growth in the total operating income of the Group.

Meanwhile, the growth in the net operating income was helped by impairment charges and other losses reducing by 16.71% to Rs 5.961 billion. The exchange impact on impairment charges on loans and advances and Government Securities denominated in foreign currency was recognised in Net Other Operating Income where the corresponding exchange gains are recognised.

The Group recorded a net gain of Rs 23.542 billion from trading via realized and unrealized exchange profits resulting from the sharp depreciation of the Rupee, offsetting the impact of reduced capital gains from government securities in comparison with the corresponding quarter of 2021, which led to net gains from derecognition of financial assets reducing to Rs 15.143 million during the three months under review from Rs 1.776 billion reported for the corresponding period last year. However, a net loss of Rs 12.223 billion was posted in other operating income due to the exchange losses on the revaluation of foreign currency assets and liabilities and the exchange impact on impairment charges on loans and advances and Government Securities denominated in foreign currency.Consequently, net operating income increased to Rs. 28.284 billion from Rs. 17.005 billion reported for the corresponding quarter of 2021, an improvement of 66.33%.

With operating expenses of Rs 8.721 billion for the three months reflecting a lower rate of increase of 23.66% in comparison to the 66.33% growth achieved in net operating income, the Group reported operating profit before taxes on financial services of Rs 19.563 billion, recording a higher growth of 96.56%.

Business

Sampath Bank’s strong results boost investor confidence

The latest earnings report for Sampath Bank PLC (SAMP), analysed by First Capital Research (FCR), firmly supports a positive outlook among investors. The research firm has stuck with its “MAINTAIN BUY” recommendation , setting optimistic targets: a Fair Value of LKR 165.00 for 2025 and LKR 175.00 for 2026. This signals strong belief that the bank is managing the economy’s recovery successfully.

The key reason for this optimism is the bank’s shift towards aggressive, yet smart, growth. Even as interest rates dropped across the market, which usually makes loan income (Net Interest Income) harder to earn, Sampath Bank saw its total loans jump by a huge 30.2% compared to last year. This means the bank lent out a lot more money, increasing its loan book to LKR 1.1 Trillion. This strong lending, which covers trade finance, leasing, and regular term loans, shows the bank is actively helping businesses and people spend and invest as the economy recovers.

In addition to loans, the bank has found a major new source of income from fees and commissions, which surged by 42.6% year-over-year. This money comes from services like card usage, trade activities, and digital banking transactions. This shift makes the bank less reliant on just interest rates, giving it a more stable and higher-profit way to earn money.

Importantly, this growth hasn’t weakened the bank’s foundations. Sampath Bank is managing its funding costs better, partly by improving its low-cost current and savings account (CASA) ratio to 34.5%. Moreover, the quality of its loans is getting better, with bad loans (Stage 3) dropping to 3.77% and the money set aside to cover potential losses rising to a careful 60.25%.

Even with the new, higher capital requirements for systemically important banks, the bank remains very strong, keeping its capital and cash buffers robust and well above the minimum standards.

In short, while the estimated profit for 2025 was adjusted slightly, the bank’s excellent performance and strong strategy overshadow this minor change. Sampath Bank is viewed as a sound stock with high growth potential , offering investors attractive total returns over the next two years.

By Sanath Nanayakkare

Business

ADB approves $200 million to improve water and food security in North Central Sri Lanka

The Asian Development Bank (ADB) has approved a $200 million loan to support the ongoing Mahaweli Development Program, Sri Lanka’s largest multiuse water resources development initiative.

The program aims to transfer excess water from the Mahaweli River to the drier northern and northwestern parts of Sri Lanka. The Mahaweli Water Security Investment Program Stage 2 Project will directly benefit more than 35,600 farming households in the North Central Province by strengthening agriculture sector resilience and enhancing food security.

ADB leads the joint cofinancing effort for the project, which is expected to mobilize $60 million from the OPEC Fund for International Development and $42 million from the International Fund for Agricultural Development, in addition to the ADB financing.

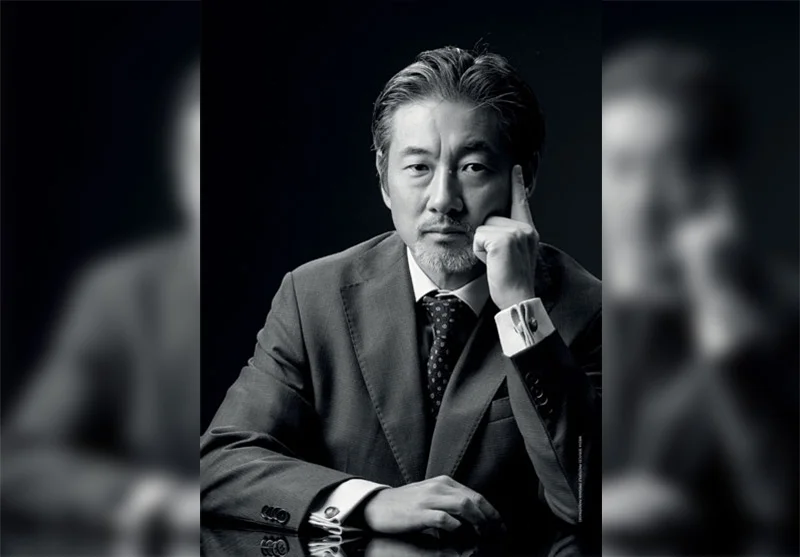

“While Sri Lanka has reduced food insecurity, it remains a development challenge for the country,” said ADB Country Director for Sri Lanka Takafumi Kadono. “Higher agricultural productivity and crop diversification are necessary to achieve food security, and adequate water resources and disaster-resilient irrigation systems are key.”

The project will complete the government’s North Central Province Canal (NCPC) irrigation infrastructure, which is expected to irrigate about 14,912 hectares (ha) of paddy fields and provide reliable irrigated water for commercial agriculture development (CAD). It will help complete the construction of tunnels and open and covered canals. The project will also establish a supervisory control and data acquisition system to improve NCPC operations. Once completed, the NCPC will connect the Moragahakanda Reservoir to the reservoirs of Huruluwewa, Manankattiya, Eruwewa, and Mahakanadarawa.

Sri Lanka was hit by Cyclone Ditwah in late November, resulting in the country’s worst flood in two decades and the deadliest natural hazard since the 2004 tsunami. The disaster damaged over 160,000 ha of paddy fields along with nearly 96,000 ha of other crops and 13,500 ha of vegetables.

Business

ComBank to further empower women-led enterprises with NCGIL

The Commercial Bank of Ceylon has reaffirmed its long-standing commitment to advancing women’s empowerment and financial inclusion, by partnering with the National Credit Guarantee Institution Limited (NCGIL) as a Participating Shareholder Institution (PSI) in the newly introduced ‘Liya Shakthi’ credit guarantee scheme, designed to support women-led enterprises across Sri Lanka.

The operational launch of the scheme was marked by the handover of the first loan registration at Commercial Bank’s Head Office recently, symbolising a key step in broadening access to finance for women entrepreneurs.

Representing Commercial Bank at the event were Mithila Shyamini, Assistant General Manager – Personal Banking, Malika De Silva, Senior Manager – Development Credit Department, and Chathura Dilshan, Executive Officer of the Department. The National Credit Guarantee Institution was represented by Jude Fernando, Chief Executive Officer, and Eranjana Chandradasa, Manager-Guarantee Administration.

‘Liya Shakthi’ is a credit guarantee product introduced by the NCGIL to facilitate greater access to financing for women-led Micro, Small, and Medium Enterprises (MSMEs) that possess viable business models and sound repayment capacity but lack adequate collateral to secure traditional bank loans.

-

Features6 days ago

Features6 days agoFinally, Mahinda Yapa sets the record straight

-

News7 days ago

News7 days agoCyclone Ditwah leaves Sri Lanka’s biodiversity in ruins: Top scientist warns of unseen ecological disaster

-

Features6 days ago

Features6 days agoHandunnetti and Colonial Shackles of English in Sri Lanka

-

Business4 days ago

Business4 days agoCabinet approves establishment of two 50 MW wind power stations in Mullikulum, Mannar region

-

News5 days ago

News5 days agoGota ordered to give court evidence of life threats

-

Features7 days ago

Features7 days agoAn awakening: Revisiting education policy after Cyclone Ditwah

-

Features5 days ago

Features5 days agoCliff and Hank recreate golden era of ‘The Young Ones’

-

Opinion6 days ago

Opinion6 days agoA national post-cyclone reflection period?