News

Central Bank implements schemes to assist COVID-hit borrowers

The Central Bank has implemented several schemes to assist COVID-19 affected borrowers through Financial Institutions (FIs) supervised by it.

The schemes included extended repayment periods, concessionary rates of interest, working capital loans, debt moratoriums and restructuring/rescheduling of credit facilities for affected borrowers.

These concessions greatly assisted the small and medium enterprises of many affected sectors: tourism, apparel, plantation, information technology, logistic service providers, three-wheeler owners, operators of school vans, lorries, small goods transport vehicles and buses, and private sector employees.

In line with the concessionary schemes implemented by the CB, FIs have approved over 2.9 million requests for concessions amounting to a total of Rs. 4,083.8 billion prioritising the micro, small and medium enterprises (Table1).

These concessions, which were extended until 31 December 2021 by licensed banks and until 31 March 2022 by nonbank financial institutions, have helped to support the above groups who faced financial difficulties due to loss of jobs, reduction of incomes, contraction of business operations, closure of businesses, etc.

Considering that the tourism sector has been affected since 2019, special concessionary schemes for affected borrowers in the tourism sector continued to be granted from time to time and extended until 30.06.2022 by licensed banks and until 31 March 2022 by non-bank financial institutions. Accordingly, FIs have so far approved 24,831 requests for such concessions.

Specific concessions, such as moratoriums for lease facilities, granted to COVID-19 affected businesses and individuals in passenger transportation sector, were initially up to 30 September 2021, and extended further until 31 December 2021 by licensed banks and 31 March 2022 by non-bank financial institutions. FIs have approved 117,085 requests for such concessions.

In addition to debt moratoria, affected borrowers of the NBFI sector have been provided with the option to either restructure existing credit facilities for a longer term (subject to furnishing an agreeable revival plan) or to settle existing credit facilities early, where such requests are to be facilitated by waiving future interest, fees and applicable charges. These options have been made available for borrowers of nonbank FIs up to 31 March 2022.

CBSL has also requested FIs to grant further concessions, including the waiver of accrued penal interest, restructuring of existing credit facilities, provision of interest rebates, waiver of early settlement fees and other charges, suspension of legal action on loan recoveries, extension of the validity period of cheques valued below Rs. 500,000, discontinuation of certain charges usually made by FIs (for cheque returns, stop payment, etc.) and suspension of late payment fees applicable on credit cards during the concessionary period. FIs have also been requested to refrain from declining loan applications from eligible borrowers, solely based on unfavourable Credit Information Bureau (CRIB) records.

CBSL has further facilitated the revival of COVID-19 affected businesses through the introduction of the Saubagya COVID-19 Renaissance Loan Scheme Facility (SCRF) in 3 phases to provide working capital loans at an interest rate of 4% per annum, with a repayment period of 24-months, including a grace period of 6 months. Through this scheme, CBSL processed 62,574 applications leading to the release of Rs. 179,280 million under the SCRF, of which, Licensed Banks have disbursed Rs. 165,513 million among 53,152 affected businesses island-wide. Considering the subsequent waves of COVID-19 pandemic, grace periods and loan repayment periods applicable to SCRF loans have also been extended several times.

Accordingly, a debt moratorium has been granted up to 31 December 2021 while the repayment period has been extended by 12 months to 36 months. In addition, beneficiaries of the other loan schemes implemented by CBSL, such as Saubagya and Swashakthi Loan Schemes, have been provided with further relief at this crucial juncture, by the reduction of the interest rates and the introduction of the debt moratorium.

As announced recently by the CBSL in its six-month Road Map for ensuring macro-economic and financial system stability, a liquidity support grant of Rs. 15 billion is to be provided to FIs supervised by CBSL to compensate a part of the cost of the interest charged by them from affected borrowers during the moratorium, with a view to providing further relief to borrowers.

In the meantime, the CBSL has established the Financial Consumer Relations Department (FCRD) in August 2020 to handle complaints by financial consumers and borrowers who are able to submit complaints to FCRD using the forms available in the CBSL website.

Latest News

Our goal is to build a “Thriving Nation” where a woman can walk without fear or doubt, where her talents are duly recognized, and where she can lead a life of dignity – PM

The PM’s message:

Women are the true pillar of Sri Lankan society and economy. The role they play within the family and in society has today become a decisive factor in shaping the future of our nation. Through the Government’s policy statement, “A Thriving Nation – A Beautiful Life,” we envision going beyond treating women as mere beneficiaries and recognizing them as active partners in national development, ensuring that they receive the dignity and opportunities they rightfully deserve.

Within our policy framework, special focus has been placed on women. We are committed to recognizing the economic contribution extended by women as housewives, promoting women’s entrepreneurship, and expanding access to the technical and financial support necessary for self-employment alongside strengthening the legal framework required to ensure women’s safety in public transport, workplaces, and within the family environment. Further, we are taking steps to create the environment to increase women’s representation in decision-making bodies at national and regional levels. Special attention is also being given to implementing targeted programmes aimed at improving women’s nutrition, reproductive health, and mental well-being.

Women are not a group seeking sympathy; they are vital social partners endowed with intelligence, resilience, and creativity. Our goal is to build a “Thriving Nation” where a woman can walk without fear or doubt, where her talents are duly recognized, and where she can lead a life of dignity

On this International Women’s Day, I sincerely hope that it marks the beginning of a new era in which the aspirations of all women in our country are realized as they shine before the world.

Latest News

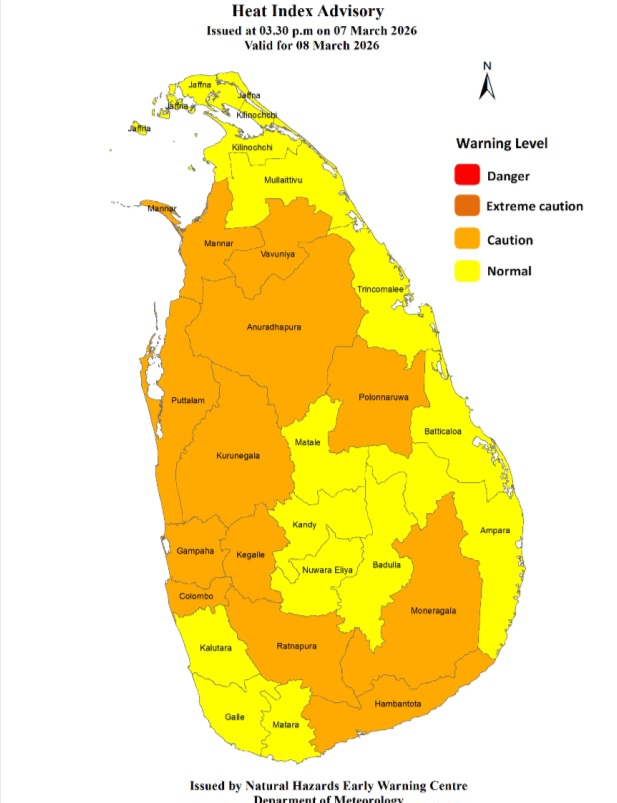

Heat Index at Caution Level in the Sabaragamuwa, North-western and North-central provinces and in Colombo, Gampaha, Vavuniya, Mannar, Hambantota and Monaragala districts

Warm Weather Advisory issued by the Natural Hazards Early Warning Centre of the Department of Meteorology at 3.30 p.m. on 07 March 2026, valid for 08 March 2026.

Heat index, the temperature felt on human body is likely to increase up to ‘Caution level’ at some places in the Sabaragamuwa, North-western and North-central provinces and in Colombo, Gampaha, Vavuniya, Mannar, Hambantota and Monaragala districts

The Heat Index Forecast is calculated by using relative humidity and maximum temperature and this is the condition that is felt on your body. This is not the forecast of maximum temperature. It is generated by the Department of Meteorology for the next day period and prepared by using global numerical weather prediction model data.

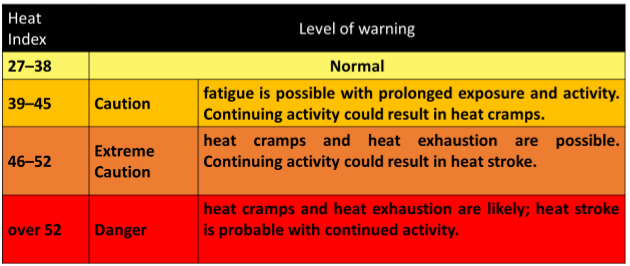

Effect of the heat index on human body is mentioned in the above table and it is prepared on the advice of the Ministry of Health and Indigenous Medical Services.

ACTION REQUIRED

Job sites: Stay hydrated and takes breaks in the shade as often as possible.

Indoors: Check up on the elderly and the sick.

Vehicles: Never leave children unattended.

Outdoors: Limit strenuous outdoor activities, find shade and stay hydrated.

Dress: Wear lightweight and white or light-colored clothing.

Note:

In addition, please refer to advisories issued by the Disaster Preparedness & Response Division, Ministry of Health in this regard as well. For further clarifications please contact 011-7446491.

News

Lanka tea industry may lose $ 10-15 mn per week from ME war

The ongoing military conflict in the Middle East has adversely impacted on the Sri Lankan tea industry as the exporters are unable to supply tea to the region. The exporters estimate the revenue loss at about $ 10-15 million per week. The exporters have orders in hand for supply of tea and it is the logistical issues and war risk preventing them fulfilling such orders, the Tea Exporters Association (TEA) said in a statement.

“In order to mitigate the impact on the industry, the tea industry has jointly requested the government to support it in addressing the cash flow issue and consider absorbing a part of the additional freight and insurance charges. It has also requested government intervention to obtain the balance payment of about $ 50 million due on tea shipments already made to Iran under the barter deal,” TEA said on Friday.

The statement said approximately 52% of Sri Lanka’s tea exports reach the affected region mainly coming from the low grown area of the country dominated by tea smallholder farmers. According to 2025 tea export statistics, about 125 million kilograms of Ceylon tea were exported to the Middle East, with an estimated value of USD 750 million. The major importing countries of Ceylon Tea in the region include Iraq, Iran, Libya, Turkey, Saudi Arabia, Syria, and the United Arab Emirates. Though Libya and Turkey can be reached via Africa, the exorbitant freight charges have prevented the buyers in those countries from importing tea at the moment.

The supply routes to Middle East countries go via Strait of Hormuz and Red sea Suez Canal. Although there is no blockade on Suez Canal, due to the war risk both channels are currently not used by the major shipping lines. The tea exports to the region have almost come to a standstill due to the following reasons:

=All major shipping lines suspended their services to the region immediately after the outbreak of the conflict.

=Several seaports in the region were temporarily closed during the initial stages.

= Although a few shipping lines resumed limited operations from March 4, freight charges have

increased significantly by approximately USD 1,800 for a 20’ container and USD 3,000 for a 40’ container.

= Existing insurance coverage obtained by exporters is no longer valid.

=There is a lack of regular and scheduled vessels operating from Colombo to Middle Eastern destinations.

The tea exporters are experiencing serious cash flow constraints, as payments for shipments already

dispatched have been delayed due to the unsettled situation in the region. This has restricted exporters’

buying capacity and that was evident at this week’s tea auction, where overall prices declined by about Rs. 50/ per kg while low grown tea prices declined by about Rs. 75/ per kg.

If the situation continues for few more weeks it will have a serious impact on the tea auction as buyers may curtail the purchase of tea if the outward movements are restricted. This could directly impact on the income of the tea smallholder farmers.

In January 2026, the country earned $ 121.8 million from tea exports compared to $ 112.7 million in January 2025 (a 5% increase). The figures for February 2026 are not yet available but should be either similar to last year or higher. The disruption to tea exports in March will certainly affect the volume and value of the exports though the exact amounts cannot be estimated at this point.

According to the available data Sri Lanka has settled about 95% of its debt to Iran by supplying tea to Iran under the Tea for Oil mechanism. Even if the military conflict comes to an end, Sri Lanka will find it difficult to continue to supply tea to Iran unless a new mechanism is introduced. Under the prevailing US sanctions on Iran, the exporters may not be able to supply tea to Iran outside the barter system. Iran purchases about 11 million kg of tea from Sri Lanka annually under the barter deal.

The situation was discussed with the Minister of Plantation & Community Infrastructure at a meeting held on March 4, 2026.

-

Features6 days ago

Features6 days agoBrilliant Navy officer no more

-

News2 days ago

News2 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

Opinion6 days ago

Opinion6 days agoSri Lanka – world’s worst facilities for cricket fans

-

News3 days ago

News3 days agoLegal experts decry move to demolish STC dining hall

-

Features6 days ago

Features6 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

-

News2 days ago

News2 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

Business4 days ago

Business4 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News1 day ago

News1 day agoWife raises alarm over Sallay’s detention under PTA