Business

Can Overseas Sri Lankans finally have their say?

Voting Beyond Borders:

Dr Bilesha Weeraratne is a Research Fellow and Head of Migration and Urbanisation Research at IPS. Prior to re-joining IPS in 2014, she was a Postdoctoral Research Associate at Princeton University, New Jersey, USA. Her research interests include internal and international migration, climate mobility, urbanisation, the economics of education, labour economics, economic development, econometrics and economic modeling. She holds an MA in Economics from Rutgers University, USA and an MPhil and PhD in Economics from the City University of New York, USA.

Dr Bilesha Weeraratne is a Research Fellow and Head of Migration and Urbanisation Research at IPS. Prior to re-joining IPS in 2014, she was a Postdoctoral Research Associate at Princeton University, New Jersey, USA. Her research interests include internal and international migration, climate mobility, urbanisation, the economics of education, labour economics, economic development, econometrics and economic modeling. She holds an MA in Economics from Rutgers University, USA and an MPhil and PhD in Economics from the City University of New York, USA.

By Dr Bilesha Weeraratne

The recent presidential election in Sri Lanka marked a series of “firsts,” setting it apart from previous elections. It saw a record-low number of 350,516 valid voters per candidate, implementation of the Regulation of Election Expenditure Act of 2023, and a second count of votes. Notably, there was also greater engagement from Overseas Sri Lankans (OSLs) in the country’s electoral process than at any time previously.

Indeed President Anura Kumara Dissanayaka actively engaged with Sri Lankan expatriates during his campaign, visiting countries including South Korea, Australia, the USA, Canada, Sweden, the UK and Japan. Continuing a trend from the previous presidential election in 2019, there was evidence of Sri Lankans returning to vote. However, despite this enthusiasm, the long-standing debate over granting OSLs the right to vote from abroad remains unresolved. Of the OSLs, it also means 1.5 million Sri Lankan workers abroad could not vote in the recent election according to the SLBFE.

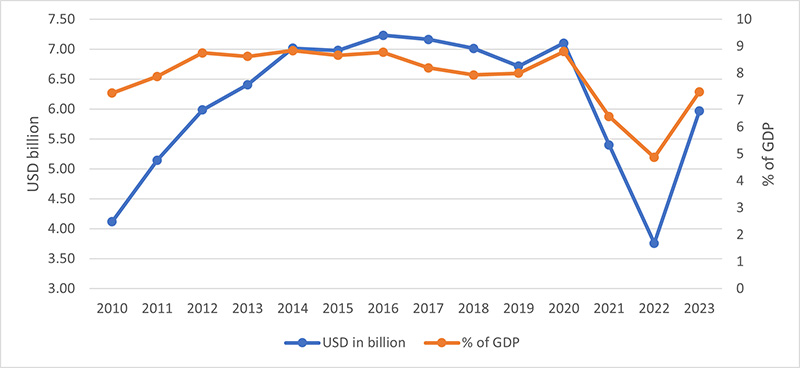

Voting with Their Wallets

While OSLs may not have voting rights yet, those who regularly remit earnings back to Sri Lanka have already demonstrated their influence—by voting with their wallets. In the run-up to the 2022 economic crisis, government efforts to attract more formal remittances by offering higher interest rates failed to convince OSLs, as the formal foreign exchange rate offered was far below the informal rate. As a result, in 2022, remittances to Sri Lanka declined by a record 42%. Compared to the steady 10-year average USD 6.4 billion inflow (from 2010 to 2020), the decline to USD 3.7 billion was the final nail in the coffin that sparked the 2022 sovereign debt default.

Remittance and Voting Rights

The literature identifies three mechanisms for linking the receipt of remittances with political participation.

1) Income Channel: those with greater resources are able to devote more resources (both in terms of material support and time) to political activities;

2) Independence Channel: remittances reduce the dependence of recipients on the government for material prosperity; and

3) Insurance Channel -remittances promote feelings of economic security in recipients that allow them to pay more attention to non-material concerns.

While these mechanisms are for all voters in households receiving remittances, OSLs prefer a say in how the macroeconomy back in Sri Lanka is managed by elected officials, i.e. how does the government spend the foreign exchange OSLs regularly send as remittances? what are the interest rates on their savings? how is inflation feeding into the purchasing power of their remittances? how is the foreign exchange rate affecting the disposable income of their remittances? how are savings and investments of their remittances taxed? and what are the public services available to their families left behind? to name a few. The answers to such questions are linked to election promises and how governments actually perform when in office. Voting rights would allow OSLs a voice in economic policies that impact their remittances and financial interests in Sri Lanka.

Overseas Absentee Voting:

A Long-Awaited Promise

Providing voting rights or Overseas Absentee Voting (OAV) has been in discussion for many years, with various candidates, including the current president, promising to make it a reality. Sri Lanka has also ratified the United Nations Convention on the Rights of All Migrant Workers and Members of their Families, which calls for migrant workers’ voting rights (Article 41). Many previous governments, though keen, have not been successful on this front. Previous efforts include a Parliamentary Select Committee for Electoral Reforms recommending voting rights for OSLs in 2021, and a Special Presidential Commission in 2023 (among other issues) being required to make recommendations on a mechanism for OSL voting rights. In 2023, the Election Commission developed a beta version of an online method for registering OSLs for voting. However, according to the Commissioner General of Elections their hands are tied “until the Parliament passes a law to enable migrant workers to vote from their destination states.”

How to Make Overseas Absentee Voting a Reality

There are many possible and sophisticated ways to implement OAV, including advanced in-person (similar to postal voting in Sri Lanka), voting by mail, facsimile, or internet, as well as proxy voting (where a duly authorised representative or a proxy vote on behalf of the absent voter). Some countries such as the Philippines, for instance, use a combination of in-person and postal voting.

For Sri Lanka, keeping things simple would be one important mindset in transitioning from an eternal election promise to making overseas absentee voting a reality. A manageable starting point could be advanced in-person in-embassy voting, which would function analogous to Sri Lanka’s postal voting system. Embassies could serve as analogous to postal voting centers for expatriates, and OLSs to postal voters.

Hence, learning from the Philippines, a few key steps in the process of allowing in-person in-embassy voting are:

Enshrine in the Constitution the right of qualified OSLs to vote

Enact an Act related to OAV

Define a system and the mechanism for exercising such rights, covering aspects of

Defining qualifications for OAV

Identifying a registration procedure for eligible OSL

Identifying voting and vote counting mechanisms.

Not an Easy Road

Implementing OAV will not be without challenges. For Sri Lankans residing in countries without a local embassy, registration and voting might require travel to the nearest consular post. While critics would highlight that time and financial cost would “deter the diaspora from proactively partaking in voting”, employees such as female domestic workers would have the added challenge of seeking “approval of their masters and traveling a long distance to both register and vote”. Mail voting or assigning longer voting periods, including weekends, could alleviate some of these concerns.

Other concerns of out-of-country voting include potential vote buying and exploitation. Activists also raise concerns about whether politically appointed staff in diplomatic missions would influence, especially the unskilled and voiceless OSLs. Therefore, there is a need for a “mechanism with checks and balances” to “prevent the integrity of the electoral result from being questioned”.

While criticisms of each optional OAV method will likely emerge, it is important to start taking initial steps toward one feasible and practical option. The issues can be ironed out with time, and more sophisticated options can be pursued.

Finally, it is important to realise that achieving this goal in time for the upcoming Parliamentary election on 14 November or the pending provincial or local government elections in 2025 is not easy. Yet, initial steps towards this change are much needed and the time is right for it.

Business

ADB approves support to strengthen power sector reforms in Sri Lanka

The Asian Development Bank (ADB) has approved a $100 million policy-based loan to further support Sri Lanka in strengthening its power sector. This financing builds on earlier initiatives to establish a more stable and financially sustainable power sector.

This second subprogram of ADB’s Power Sector Reforms and Financial Sustainability Program will accelerate the unbundling of the Ceylon Electricity Board (CEB) into independent successor companies for generation, transmission, system operation, and distribution, as mandated by the Electricity Act of 2024 and its 2025 amendment. The phased approach ensures a structured transition, ensuring progress in reform actions and prioritizing financial sustainability.

“Sri Lanka has made important progress in stabilizing its economy and strengthening its fiscal position. A well-functioning power sector is vital for the country’s continued recovery and sustainable growth,” said ADB Country Director for Sri Lanka Takafumi Kadono. “ADB is committed to supporting Sri Lanka’s long-term development and advancing key reforms in the power sector. This initiative will enhance power sector governance, foster private sector participation, and accelerate renewable energy development to drive sustainable recovery, resilience, and inclusive growth.”

To improve financial sustainability, the program will help implement cost-reflective tariffs and a comprehensive debt restructuring plan for the CEB. It will support the new independent successor companies in transparent allocation of existing debts. This will continue to strengthen their financial viability, enhance creditworthiness, and enable these companies to operate on a more sustainable footing.

The program also aims to strengthen renewable energy development and private sector participation by enhancing transparency and supporting power sector entities that are financially sustainable. It will enable competitive procurement for large-scale renewable energy projects and identified priority generation schemes, while upholding strong environmental standards.

Promoting gender equality and social inclusion is integral to the program. Energy sector agencies have implemented annual women’s leadership programs, adopted inclusive policies, and launched feedback mechanisms to ensure equitable participation of female consumers and entrepreneurs. The program includes targeted support for vulnerable groups, such as maintaining lifeline tariffs and implementing measures to soften the impact of tariff adjustments and sector reforms.

ADB will provide an additional $2.5 million technical assistance grant from its Technical Assistance Special Fund to support program implementation, build the capacity of successor companies, and help develop their business plans and power system development plans.

Business

Union Assurance becomes first insurer to earn the YouTube Silver Play Button

Union Assurance, Sri Lanka’s longest-standing private Life Insurer, has achieved a milestone in its digitalisation journey by being awarded the YouTube Silver Play Button, recognising the Company for surpassing 100,000 subscribers on its official channel. This achievement marks a first in Sri Lanka’s Insurance industry, across both Life and General Insurance, and underscores Union Assurance’s pioneering role in digital engagement.

This accomplishment reflects the Company’s unwavering commitment to making Life Insurance accessible, simplified, and engaging for all Sri Lankans. Through innovative content strategies, Union Assurance has successfully transformed complex Insurance concepts into relatable, informative, and inspiring narratives that empower individuals to protect what matters most; health, wealth, family, and future.

Receiving the Silver Play Button is more than a symbolic accolade; it is a testament to the strength and credibility of Union Assurance’s digital presence. In an era where trust and transparency define brand loyalty, this recognition validates the company’s ability to create content that resonates deeply with a growing audience. It enhances the brand’s authority, reinforces its visibility across digital platforms, and further solidifies Union Assurance as a leader in customer engagement.

Celebrating this achievement, Mahen Gunarathna, the Chief Marketing Officer at Union Assurance stated: “This milestone is a testament to the trust and engagement of our audience and reflects our dedication to innovation, transparency, and customer-centric communication.

Business

LOLC Finance Factoring powers business growth

LOLC Finance PLC, the largest non-banking financial institution in Sri Lanka, brings to light the significant role of its Factoring Business Unit in providing indispensable financial solutions to businesses across the country. With a robust network of over 200 branches, LOLC Finance Factoring offers distinctive support to enterprises, ranging from small-scale entrepreneurs to corporate giants.

In light of the recent economic challenges, LOLC Finance Factoring emerged as a lifeline for most businesses, ensuring continuous liquidity to navigate through turbulent times. By facilitating seamless transactions through online platforms and expediting payments, the company played a pivotal role in sustaining essential services, including supermarkets and pharmaceuticals.

Deepamalie Abhaywardane, Head of Factoring at LOLC Finance PLC, emphasized the increasing relevance of factoring in today’s economy. “As economic conditions become more stringent, factoring emerges as the most sought-after financial product for businesses across various sectors. It offers a win-win solution by providing upfront cash up to 85% of the credit sale to suppliers while allowing end-users/buyers better settlement period.”

One of the standout features of LOLC Finance Factoring is its hassle-free application process. Unlike traditional bank loans that require collateral, LOLC Factoring extends credit facilities without such obligations. Furthermore, LOLC Finance Factoring relieves business entities of the burden of receivable management and debt collection. Through nominal service fees, businesses can outsource these tasks, allowing them to focus on core operations while ensuring efficient cash flow management.

For businesses seeking Shariah-compliant factoring solutions, LOLC Al-Falaah’s Wakalah Future-Cash Today offers an efficient and participatory financing model that meets both financial needs and ethical principles. Understanding the diverse challenges faced by businesses, LOLC Finance Factoring deliver tailored solutions that enhance cash flow, reduce credit risk, and support sustainable growth. Working together with LOLC Al-Falaah ensures access to a transparent, well-structured receivable management solution strengthened by the credibility and trust of Sri Lanka’s largest NBFI, LOLC Finance.

The clientele of LOLC Finance Factoring spans into various industries, including manufacturing, trading, transportation, healthcare, textiles, plantations, and other services, all contributing significantly to Sri Lanka’s economic growth. By empowering businesses with accessible and convenient working capital solutions, LOLC Finance’s Factoring arm plays a vital role in fostering economic development and prosperity of the country.

In the upcoming quarter, LOLC Finance Factoring remains committed to delivering innovative financial solutions tailored to meet the evolving needs of businesses. As Sri Lanka’s economic landscape continues to develop, LOLC Finance Factoring stands ready to support enterprises on their journey towards growth and success.

-

News6 days ago

News6 days agoWeather disasters: Sri Lanka flooded by policy blunders, weak enforcement and environmental crime – Climate Expert

-

Latest News7 days ago

Latest News7 days agoLevel I landslide RED warnings issued to the districts of Badulla, Colombo, Gampaha, Kalutara, Kandy, Kegalle, Kurnegala, Natale, Monaragala, Nuwara Eliya and Ratnapura

-

Latest News7 days ago

Latest News7 days agoINS VIKRANT deploys helicopters for disaster relief operations

-

News3 days ago

Lunuwila tragedy not caused by those videoing Bell 212: SLAF

-

Latest News4 days ago

Latest News4 days agoLevel III landslide early warnings issued to the districts of Badulla, Kandy, Kegalle, Kurunegala, Matale and Nuwara-Eliya

-

News2 days ago

News2 days agoLevel III landslide early warning continue to be in force in the districts of Kandy, Kegalle, Kurunegala and Matale

-

Features4 days ago

Features4 days agoDitwah: An unusual cyclone

-

Latest News7 days ago

Latest News7 days agoWarning for Cyclonic storm “Ditwah”