Business

Aitken Spence’s Heritance Kandalama takes spotlight at Delhi’s first Bawa archive show in India

Premier hospitality company Aitken Spence Hotels iconic resort Heritance Kandalama is at the centre stage at the National Gallery of Modern Art (NGMA) Delhi at the ‘Geoffrey Bawa: It is Essential to be There’ architectural and photographic installation, in its first of its kind exhibition drawing inspiration from Bawa’s archives and practice.

The world-renowned architect Deshamanya Geoffrey Bawa acknowledged as ‘father of tropical modernism’ was responsible for reviving the Sri Lankan architectural space with suave lines and modern sensibilities whilst encompassing local traditions and its vibrancies. The exhibition hosted at NGMA until 7 May 2023 is a celebration of the 75th anniversary of Indo-Lanka Diplomatic Relations and features over 120 documents from the Bawa archives, most of which have never been shown publicly previously.

The Breathtaking, Heritance Kandalama blending with the environment

On board as a primary sponsor, Aitken Spence Hotels’ Heritance Kandalama will host an exclusive invitees-only event on 7 April at The Claridges featuring an intimate conversation between Indian photographer extraordinaire Dayanita Singh and leading Sri Lankan architect and student of Bawa, Channa Daswatte. Both heavily influenced by the work and practices of Sri Lanka’s most prolific and influential architect, the conversation will take a deep dive into ephemeral yet stoic qualities that make Bawa design what it is revered for today. Daswatte was also heavily involved in the work of Heritance Kandalama and will share first-hand insights into the thought process behind the world’s first LEED certified and Asia’s first Green Globe certified hotel for sustainable design and practices.

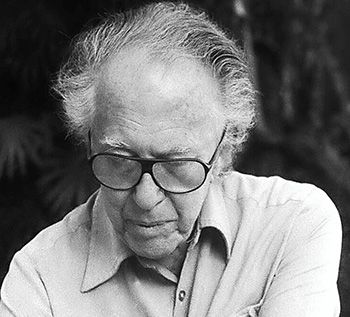

Deshamanya Geoffrey Bawa

“We are honoured to partner with the Bawa Trust in taking the work of our legendary architect Deshamanya Geoffrey Bawa to the world in an exhibition of this caliber. Among his most formidable creations, Heritance Kandalama is an iconic masterpiece given its unique amalgamation of nature and modern comforts. We hope this exhibition will inspire a new generation of architects to think innovatively to address current and future needs of the world, while preserving our inherent traditions and values, symbiotically,” commented Ms. Stasshani Jayawardena – Aitken Spence PLC Director, Head of Tourism and Leisure, and Chairperson of Aitken Spence Hotel Management.

The exhibition is jointly organized by the National Gallery of Modern Art in New Delhi, the High Commission of Sri Lanka in New Delhi and the Geoffrey Bawa Trust.

Among Bawa’s most visionary designs, encompassing eco-aesthetics with operational efficiencies, marrying nature with the need of travellers, Heritance Kandalama resembles the outspread wings of a bird, following the line of the cliff from which it seems to emerge. The hotel is an incredible 1km from end to end, and rises up seven floors, yet appears to be an effortless natural extension of the mountainside. The flat roof and timber pillars provision a screen of vegetation that attracts local wildlife, whilst the entire building is festooned with longwinded plants, blending it further into its natural setting, The nature theme is continued within with a classy ‘eco’ aesthetic with interiors benefiting from Bawa’s signature vast open windows, which let in natural light abundantly and allowing wildlife-watching from wherever you stand.

Heritance Kandalama – the dream sketch by Deshamanya Geoffrey Bawa

Taking centre stage at this unique exhibition, Heritance Kandalama and its story is likely to influence the many international art and design enthusiasts, scholars, journalists and high-profile dignitaries attending the events to further drive the cohabitation of nature and design, whilst exploring the four thematic sections – exploring relationships between ideas, drawings, buildings and places, the exhibition explores the different ways in which images were used in Bawa’s practice.

For more information on Heritance Kandalama, log on to www.heritancehotels.com/kandalama

For more on the exhibition, log on to https://bawaexhibition.com

Business

Sri Lanka’s recovery: A boon for banks, a burden for many

As Sri Lanka’s economy charts a fragile path toward recovery in 2026, the latest corporate earnings data reveals a stark and widening divide. While households and most industries grapple with a slow and arduous healing process, the banking and financial sector is posting windfall profits – a dynamic deepening public concern that the financial system is benefiting disproportionately from an economy still causing widespread hardship.

The Purchasing Managers’ Index hints at tentative stabilisation, with slowing inflation offering some relief. Yet, as an independent analyst cautioned, “The road to recovery is long and full of potholes,” pointing to the enduring burdens of debt and challenging reforms.

“This slow, painful repair is reflected in an 11.9% year-on-year decline in cumulative corporate earnings, driven by sharp falls in the Food, Beverage and Tobacco and Capital Goods sectors. In stark contrast, the Banking and Diversified Financials sectors are not merely recovering; they are accelerating. The Banking sector’s earnings grew by a robust 38.9%, powered by loan book expansion and improved asset quality, with giants like Commercial Bank and Hatton National Bank leading the pack. Similarly, the Diversified Financials sector exploded with 112.6% growth, fueled by a lower interest rate environment and significant fair-value gains in the equity market,” he said.

“This dramatic outperformance underscores a persistent and contentious reality. The financial sector’s role as the economy’s essential intermediary appears to insulate it – and enable it to profit – amidst broader volatility. Its foundational strength is solidifying even as other sectors and the public at large still face grave difficulties,” he said.

“In this context, a growing strand of public opinion questions why the dividends of this pronounced financial resilience are not felt more broadly. The perception is clear: the hardships on the ground – the headwinds on the recovery road – are conspicuously absent from the banking bottom line. Instead, the sector emerges, yet again, as the unambiguous winner in an uneven landscape, leading many to ask when and how this financial success will translate into more tangible, shared gains for the nation at large,” he questioned.

“All in all, the data confirms the banking sector’s fortified foundation. Yet, its social license for such substantial profits may increasingly depend on demonstrating a clearer contribution to a more inclusive and equitable recovery for all Sri Lankans,” he warned.

By Sanath Nanayakkare ✍️

Business

Beyond blame: The systemic crisis in Sri Lanka’s medicine regulation

The recent suspension of ten Indian-manufactured injections by Sri Lanka’s medicines regulator has done more than ignite a fresh “substandard medicines” scare. It has laid bare a chronic, systemic failure in the nation’s pharmaceutical governance – a failure that transcends political parties and individual ministers.

According to Ravi Kumudesh, President of the Academy of Health Professionals (AHP), this episode is not an isolated scandal but the latest symptom of a regulatory regime that operates on personality and discretion rather than transparent, evidence-based science.

The public’s current anxiety, Kumudesh argues, stems from a dangerous confluence: an allegation of microbial contamination in an injectable, the blanket suspension of ten products from one manufacturer, and the opaque controversy surrounding an “Indian Pharmacopoeia” agreement. “When these three collide,” he states, “the outcome is predictable: not clarity, not confidence – but a national regulatory regime that the public is asked to ‘trust’ without being given the evidence required to trust.”

A problem rooted in system, not scapegoats

Kumudesh insists that framing this crisis around former Health Minister Keheliya Rambukwella or the current minister, Dr. Nalinda Jayatissa, misses the fundamental point. The core issue is a system that has remained stubbornly unchanged across administrations. “The public has watched governments change while the internal decision-making circle inside the regulatory system appears to remain remarkably stable,” he observes. This creates a perilous pattern where the same insiders sometimes act as public critics and at other times as ‘story managers’ within the system, leading to public perception of a credibility gap that no mere statement can bridge.

From hospital test to national edict: A question of protocol

The central controversy, Kumudesh explains, is not the precautionary suspension itself but the evidence pathway that led to it. “A hospital laboratory can detect signals. But national regulatory action requires national-level validation,” he emphasises. The critical, uncomfortable questions he raises are: If Sri Lanka’s own national medicine quality laboratory still lacks full public confidence, how can a hospital test justify a nationally consequential suspension? And if subsequent international or confirmatory tests contradict the initial finding, who repairs the shattered trust and clinical disruption?

He warns that Sri Lanka has seen this movie before – products removed amid public alarm only to be reintroduced later, creating clinical chaos and eroding faith. “Regulatory panic creates clinical chaos,” Kumudesh notes. The proper response to a contamination allegation, he outlines, is systematic: isolate temporarily, collect samples under strict chain-of-custody, and verify through recognised reference testing – not “suspend and shout.”

The unanswered questions: Procurement and agreements

Kumudesh points to glaring gaps in public accountability. One key question remains unanswered: were pre-shipment test reports for these injections reviewed? “If yes: where are the reports? If no: how did the system allow high-risk products in?” he asks, stressing that procurement is a patient-safety responsibility, not mere paperwork.

Furthermore, the shadow over the reported “Indian Pharmacopoeia” agreement exemplifies the systemic opacity. “If an agreement exists, the first duty is public disclosure,” he asserts. Without it, the public cannot assess whether Sri Lanka is strengthening its standards or inadvertently weakening its own scrutiny and liability pathways.

The path forward: Evidence over emotion

For Kumudesh, the solution lies in a radical shift from personality-based to evidence-based regulation. “Committees do not fix systems – systems fix systems,” he says, critiquing the cyclical political response of appointing committees after each crisis. His prescription is structural:

= Establish a stable, transparent regulatory protocol immune to political or personal influence.

= Build a credible, independent national medicine quality laboratory with recognised competency.

= Enforce a clear, legally sound evidence pathway for all regulatory decisions.

= Ensure routine publication of key regulatory outcomes and decisions.

“Without a credible national laboratory,” he warns, “Sri Lanka remains permanently dependent on foreign timelines and credibility, while its own decisions are perpetually questioned.”

The ultimate question Kumudesh leaves for policymakers and the public is stark: “Is the fear of substandard medicines being used to protect patients – or to hide the system’s inability to prove the truth quickly, transparently, and credibly?” Until the architecture of regulation is rebuilt on the bedrock of science and transparency, he concludes, this crisis will not be the last. It will simply be the latest in a long line of failures that place patients and professionals in the crossfire of a system they cannot trust.

By Sanath Nanayakkare ✍️

Business

Venezuela’s oil reserves : Investments hinge on politics

Venezuela has more oil than any other country, but it pumps very little of it. Its national oil company is broke, so the country now needs private investment to fix its broken industry. This could let big American oil companies like Chevron return.

For these companies, the advantage is huge oil fields and facilities that could be repaired fairly quickly. But their investment depends entirely on politics and getting a good deal. As one expert put it, “It’s about the politics.”

For everyday gas prices, not much will change right away. Venezuela currently produces so little that it won’t affect the global market much. The U.S. is also producing record amounts of its own oil and has large emergency stockpiles, which help keep prices stable.

In short, American companies see a major opportunity in Venezuela’s vast oil, but they are facing major political risks. The story isn’t about a lack of oil in the ground; it’s about whether the politics will ever be stable enough to safely get it out.

By Sanath Nanayakkare ✍️

-

News2 days ago

News2 days agoHealth Minister sends letter of demand for one billion rupees in damages

-

Features6 days ago

Features6 days agoIt’s all over for Maxi Rozairo

-

News5 days ago

News5 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Opinion4 days ago

Opinion4 days agoRemembering Douglas Devananda on New Year’s Day 2026

-

News10 hours ago

News10 hours agoPrivate airline crew member nabbed with contraband gold

-

News6 days ago

News6 days agoDr. Bellana: “I was removed as NHSL Deputy Director for exposing Rs. 900 mn fraud”

-

News5 days ago

News5 days agoDons on warpath over alleged undue interference in university governance

-

Features6 days ago

Features6 days agoRebuilding Sri Lanka Through Inclusive Governance