Business

AFC raises LKR 1 bn in subordinate debt to strengthen the Tier II Capital

Alliance Finance Co PLC (AFC) has successfully raised LKR 1 billion in Tier II capital, with the aim of strengthening the regulatory capital of the Company to financially empower and facilitate the development of the Micro, Small and Medium enterprise sector in Sri Lanka. The Tier II Subordinated Debt has a tenure of 5 years and has been structured and arranged by Capital Alliance Ltd (CAL), a leading investment bank in the country.

Commenting on this important milestone, Mr Romani de Silva, Deputy Chairman and Managing Director of AFC stated that “This is a reflection of the confidence our investors have in our sustainable business philosophy. Due to the covid 19 pandemic, Sri Lankan micro, small & medium entrepreneurs need more support than ever before and raising of LKR 1 Bn as Subordinate Debt strengthened our Tier II capital which gives us an enormous capacity to develop micro, small and medium scale entrepreneurs of Sri Lanka using our proven business models. Furthermore, we extend our sincere appreciation for the investor, (CAL) for the trust placed in us. Subsequent to an internal restructure with the technical assistance of IFC (private sector arm of the World Bank Group) in 2019,all of the performance metrics of the Company have improved tremendously outperforming its peers in the industry with a Loan book growth of 1.6% ,Profit growth of 169 % and a highly commendable reduction in NPL’s by 23 % for the financial year ended 2020/21, validating the impact of the restructure. As the oldest finance company in Sri Lanka and as a net lender to the rural economy, AFC is focussing on financial inclusivity and sustainable development of all communities.”.

AFC’s approach to sustainability is holistic and goes beyond economic empowerment with an equal emphasis placed upon social and environmental sustainability as well. AFC has institutionalised the values of its founding fathers by adopting the Triple Bottom Line Approach in 2012, followed by numerous other actions to become the sustainable financial institution it is today. In 2020, AFC became the first financial institution in South Asia to be certified for holistic sustainability under the pioneering Sustainability Standards and Certification Initiative (SSCI). SSCI is governed under the International Council of Sustainability Standards for Value-Driven Financial Institutions, Germany. This has resulted in an even greater focus on this unwavering commitment of the Company and better measurements of the impact created.

AFC is also amongst the highest contributors of net profits towards sustainability initiatives in the industry. The Company has dedicated an annual allocation of 4% of profits for sustainability and CSR initiatives. The Company has many initiatives including the “1 Mn trees for Unity” flagship project that aims to plant one million trees by 2024 whilst meeting social and environmental objectives. To date the Company has contributed over 350,000 plants to the nation. In addition, conserving biodiversity, empowering social entrepreneurs, promoting sustainable products and undertaking CSR practices that ensure social and environmental wellbeing remain as AFC’s key priorities under its sustainability mandate.

The AFC business powered by a dynamic and empowered young team of 1300 visionary individuals will continue to support the global and local sustainable development agenda, with its high impact goals in place to ensure focused value creation in line with the UN SDG’s and National Development Agenda. AFC believes that synergistic partnerships with its foreign financing partners such as IFC, FMO, DWM, Tridos Bank and other impact investors will add further value to its approach and facilitate value distribution to a wider range of stakeholders in the country. AFC is eager to uphold these partnerships and collaborations that facilitate sustainable development in Sri Lanka and have confidence that they will undoubtedly accelerate its journey of “making the world a better place through sustainable finance”.

Business

SriLankan Airlines Resumes Flights to Riyadh and Dubai

09 March 2026; Colombo – SriLankan Airlines would like to inform passengers that it is resuming daily services to Riyadh tonight and Dubai tomorrow, while continuing to closely monitor the situation in the Middle East and prioritising the safety and wellbeing of its passengers and crew.

The following flights are scheduled to operate:

For more information please contact: 1979 (within Sri Lanka); +94 11 777 1979 (international); WhatsApp +94 74 444 1979 (chat only); your travel agent; visit www.srilankan.com; or follow us on social media.

Business

Oil prices jump above $100 for first time in four years

Global oil prices have jumped above $100 (£75.11) a barrel for the first time since 2022 as the escalating US-Israeli war with Iran has fuelled fears of prolonged disruption to shipments through the Strait of Hormuz.

Iran on Sunday named Mojtaba Khamenei to succeed his father Ali Khamenei as Supreme Leader, signalling that a week into the conflict hardliners remain in charge of the country.

The US and Israel launched fresh waves of airstrikes across Iran over the weekend, hitting multiple targets including oil depots.

Major disruption to energy supplies from the region threatens to push up prices for consumers and businesses around the world.

Early on Monday in Asia, Brent crude was around 15.5% higher at $107.16, while Nymex light sweet was up by more than 17% at $106.77.

Stock markets in the Asia-Pacific region fell sharply in early trading on Monday, with Japan’s Nikkei 225 index down by more than 5% and the ASX 200 in Australia more than 3.5% lower.

Many in the markets predicted that oil would hit the $100 a barrel mark this week.

In the event it took about a minute to jump 10%, and then another 15 minutes to rise a further 10% in early Asian trading.

Last week the markets had been relatively relaxed about the seeming nightmare scenario for millions of barrels of crude and liquefied natural gas trapped in the Gulf, unable or unwilling to transit the Strait of Hormuz.

But the escalations over the weekend, alongside scenes of destruction of energy infrastructure both in Iran and across the Gulf, saw the markets take rapid fright.

The question now is where does this go? Some analysts argue that if the shutdown in the strait lasts until the end of March, we could see record oil prices above $150 a barrel.

The existing rise is likely to further increase petrol prices, and those of important derivative products such as jet fuel and vital precursors for fertilisers.

The physical supplies from the Gulf are mainly consumed in Asia.

Already however there are signs that Asian consumers are bidding up prices for US gas, with some tankers originally heading for Europe turning around in the mid-Atlantic.

US President Donald Trump responded to the jump in prices by saying that short term rises were a “small price to pay” for removing Iran’s nuclear threat.

His energy secretary told US broadcasters on Sunday that Israel, not the US, was targeting Iran’s energy infrastructure, amid some concern about rising domestic pump prices caused by the war.

(BBC)

Business

CMTA warns buyers of long-term costs hidden in reconditioned vehicle imports

The Ceylon Motor Traders’ Association (CMTA) has issued a stark cautionary note to prospective vehicle buyers, warning that the initial price advantage of reconditioned imports often masks significant long-term financial risks.

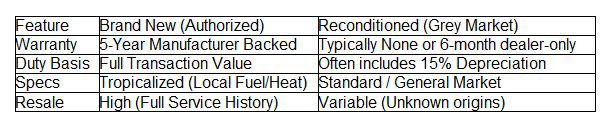

By highlighting a “structural imbalance” in the current duty valuation system – which allows near-identical vehicles to be imported under a 15% automatic depreciation bracket – the CMTA argues that the lack of manufacturer-backed warranties and tropicalised specifications in the grey market could lead to a “reconditioned trap” for unsuspecting consumers. For the savvy buyer, the association suggests that the true cost of ownership is increasingly tilting the scales in favour of brand-new vehicles from authorised agents.

If two identical 2026 models are sitting on different lots, and one is significantly cheaper because it was technically “registered and de-registered” abroad, the frugal buyer’s instinct is to take the discount. But the CMTA argues that this 15% depreciation benefit – intended for genuine used cars – is being leveraged as a loophole for zero-mileage vehicles.

For the savvy buyer, this raises a fundamental question of transparency. If the entry price of a vehicle is built on a “procedural” technicality rather than actual wear and tear, where else is the transparency lacking? Does the lower price reflect a genuine saving passed to the consumer, or does it mask a lack of manufacturer-backed after-sales support?

When a buyer chooses an authorised agent, they are essentially purchasing an insurance policy against the unknown. With a five-year manufacturer warranty, the financial burden of a faulty transmission or a software glitch stays with the global giant that built the car, not the local owner. In an era where vehicles are increasingly “computers on wheels,” the technical specialised tools and genuine parts held by authorised agents are no longer a luxury – they are a necessity for longevity.

The CMTA’s perspective also invites the buyer to look at the “Big Picture.” Every time a vehicle is imported under an under-declared value or an artificial depreciation bracket, it isn’t just a loss for the Treasury; it is a blow to the country’s foreign exchange discipline.

“A savvy buyer today is more informed than ever. They realize that a “cheap” import with no service history and no tropicalised specifications may eventually become a “minus” on the balance sheet. Frequent repairs and lower resale value can quickly evaporate the initial few lakhs saved at the point of purchase. Ultimately, the choice between brand new and used is a choice between certainty and speculation,” the Association says.

The CMTA is advocating for a level playing field where duty is based on true transaction value. Until that day comes, the burden of due diligence rests on the consumer. To be a “savvy buyer” in 2026 means looking past the showroom shine and asking: Who stands behind this car if something goes wrong tomorrow?

In conclusion, CMTA says,” For those seeking long-term peace of mind, the “brand new” path – supported by a transparent duty structure and a solid warranty – remains the gold standard for steering Sri Lanka’s complex automotive landscape.”

Before signing the papers on a reconditioned vehicle, the CMTA suggests buyers evaluate the four “minus” factors against a “brand new” purchase:

By Sanath Nanayakkare

-

News4 days ago

News4 days agoUniversity of Wolverhampton confirms Ranil was officially invited

-

News5 days ago

News5 days agoLegal experts decry move to demolish STC dining hall

-

News4 days ago

News4 days agoFemale lawyer given 12 years RI for preparing forged deeds for Borella land

-

News3 days ago

News3 days agoPeradeniya Uni issues alert over leopards in its premises

-

Business5 days ago

Business5 days agoCabinet nod for the removal of Cess tax imposed on imported good

-

News4 days ago

News4 days agoLibrary crisis hits Pera university

-

News3 days ago

News3 days agoWife raises alarm over Sallay’s detention under PTA

-

Business6 days ago

Business6 days agoWar in Middle East sends shockwaves through Sri Lanka’s export sector